Generating change: A California utility copes with state regulation

Regulatory mandates in California create a massive shift toward renewable energy sources for PG&E, the state’s second largest utility. As renewable energy technologies mature, new innovations may challenge its capital intensive model.

Climate change is one of the most pressing issues facing global business in the 21st century. While this phenomenon will create threats and opportunities to many industries, some of the most near-term and pressing changes will come to the Energy and Utilities space. Fully 25% of all greenhouse gas emissions coming from electricity and heat production which has led many governments to target it heavily for major reductions2. One company in this space is Pacific Gas and Electric Company (PG&E).

PG&E was founded in 1905 in San Francisco. Like most traditional utilities, PG&E took advantage of economies of scale in generation, distribution and transmission of electricity to grow throughout the state, resulting in a large capital intensive business. Today PG&E is the second largest utility in California that delivers electricity and gas to both residential and commercial customers throughout the state1.

Key Challenges

The most immediate challenge to PG&E’s business model comes from a series of Senate bills passed in California which sets a plan for meeting minimum thresholds for renewable shares of electricity generation in the state. According to the California Energy Commission,

“The new Renewable Portfolio Standard [applies] to all electricity retailers in the state including publicly owned utilities (POUs), investor-owned utilities, electricity service providers, and community choice aggregators. All of these entities had to adopt the new RPS goals of 20 percent of retails sales from renewables by the end of 2013, 25 percent by the end of 2016, and 33 percent requirement being met by the end of 2020”3.

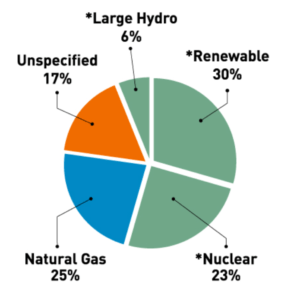

In October 2015, Gov. Jerry Brown extended this legislation to require utilities to procure 50 percent of electricity from renewables by 2030. To meet these ambitious goals PG&E has embarked on a plan to dramatically increase investment in energy efficiency, renewables and storage. Ironically, these plans coincide with its plans to retire its two nuclear reactors at Diablo Canyon which currently represent over 20% of its current electricity production. See Exhibit 1 for a breakdown of PG&E’s current electricity generation portfolio:

Exhibit 1: PG&E electric power mix as of 20154

Despite providing the state with GHG-free energy, the plant has been deemed incompatible with future energy models. According to the company,

“there are several contributing factors, including…the challenge of managing overgeneration and intermittency conditions under a resource portfolio increasingly influenced by solar and wind production, the growth rate of distributed energy resources, and the potential increases in the departure of PG&E’s retail load customers to Community Choice Aggregation.”5

To make up this gap in energy production, the company is investing in utility scale solar production as well as supporting residential and commercial customers who purchase their own solar panels to integrate them into the grid. Finally, PG&E is investing in utility scale energy storage projects to complement its renewables portfolio6.

Opportunities

Although the new targets set by the state of California create strains on PG&E – largely in the form of necessary capital investment – there are also many opportunities for PG&E to offer new products and services to its customers. Particularly, PG&E is incentivized by the California Public Utilities Commission (CPUC) to engage its customers in energy efficiency programs, a practice that dates to the early 2000s. Some examples of new products and services that it has introduced include:

- Energy Savings Assistance Program, which provides free evaluations of homes to suggest opportunities for improvement

- Broad efficiency rebates which incentivize businesses and individuals to purchase energy efficient appliances and systems (e.g., water heating, HVAC, and IT systems)

- Smart Meters and Smart AC products which drive its Smart Grid and demand response initiatives4

In addition to providing PG&E with new sources of revenue, these energy efficiency products and services also provide the company with an important chance to partner with its customers to improve its image in an industry with notoriously low rates of customer satisfaction.

Path Forward

The major shift in electricity generation from carbon-rich sources such as coal, oil and natural gas will require big investments in renewables energy infrastructure and technologies. Some of these new technologies will complement traditional utility models, such as demand response software and other elements of “smart grid” design7. Others, such as distributed generation and “micro grid” technologies, will diverge PG&E’s capital intensive transmission and distribution networks and challenge its underlying business economics. Whatever the outcome, it is imperative that the company prepare itself for these technological changes in industry necessitated by changing industry conditions. In the absence of internal innovation units capable to cope with impending disruption, it should consider either establishing a corporate venture capital arm or partnering with promising independent firms. In addition, PG&E should determine a strategy for partnering with existing companies in the distributed generation space – such as SolarCity and other players – to make sure that it retains market share in the event that alternate grid models take significant share from traditional models.

Word Count: 800

- 150 Years of Energy: History of the PG&E Corporation. Retrieved Nov 03, 2016 from PG&E website, http://www.pgecorp.com/150_non_flash/index.html

- Adapting to Climate Change: A Guide for the Energy and Utility Industry. Retrieved Nov 03, 2016 from BSR Website, https://www.bsr.org/reports/BSR_Climate_Adaptation_Issue_Brief_Energy_Utilities.pdf

- Renewables Portfolio Standard (RPS). Retrieved Nov 03, 2016 from California Energy Commission website, http://www.energy.ca.gov/portfolio/

- Clean Energy solutions. Retrieved Nov 03, 2016 from PG&E website, https://www.pge.com/en_US/about-pge/environment/what-we-are-doing/clean-energy-solutions/clean-energy-solutions.page

- In Step With California’s Evolving Energy Policy, PG&E, Labor and Environmental Groups Announce Proposal to Increase Energy Efficiency, Renewables and Storage While Phasing Out Nuclear Power Over the Next Decade. Retrieved Nov 03, 2016 from PG&E website, https://www.pge.com/en/about/newsroom/newsdetails/index.page?title=20160621_in_step_with_californias_evolving_energy_policy_pge_labor_and_environmental_groups_announce_proposal_to_increase_energy_efficiency_renewables_and_storage_while_phasing_out_nuclear_power_over_the_next_decade

- PG&E Presents Innovative Energy Storage Agreements. Retrieved Nov 03, 2016 from Business Wire website, http://www.businesswire.com/news/home/20151202006403/en/PGE-Presents-Innovative-Energy-Storage-Agreements

- Smart Grid. Retrieved Nov 03, 2016 from Office of Electricity and Energy Reliability (OE) website, http://energy.gov/oe/services/technology-development/smart-grid

Great Article. I was interested to learn that California has pleased such significant demands on the reduction of emissions and percent of renewable energy sources on that timeline. In the article, you mentioned the closure of two nuclear plants constituting 20% of their current production and primarily replacing that with solar. With this replacement and the opportunities you outlined, is there any indication on the success of influencing their customers to place solar panels on their houses to offset their production requirements? One tactic they could try which was used in Hawaii, is that the energy provider paid to install the solar panels on the customer’s house. This program provided a 20 year lease of the equipment to the homeowner at no cost and allowed Hawaii’s electric company to reduce its capital expenditures by not having to buy land to place solar panels.

Andrew – I’m glad that you raised the state-mandated shift towards renewables in California in the context of PG&E. I think it’s a fascinating topic and certainly one that could set (or, at least, change and influence) policy for other power markets. As I understand it, the California Independent System Operator (CAISO) manages the flow of electricity for ~80% of California (and a bit of Nevada). You can track their progress in renewables generation, even (see here: http://www.energy.ca.gov/renewables/tracking_progress/documents/renewable.pdf).

Some of the equity analysts I’ve read have indicated that CA appears on course to meet a target of generating 33% of its energy needs from renewable sources by 2020. But I’m curious your perspective on whether there are risks to this transition in addition to the capital intensity. One risk that I’ve seen highlighted is the “Duck Curve.” During the afternoon, as all of the solar generation in the state ramps up steeply, the net load required of other power generators drops significantly. This net load then ramps steeply as solar turns off and people go home to turn on their TVs and air conditioning. This, as the analysts suggests, requires new power generation that can respond quickly to the change in load.

What do you think PG&E’s role in all of this is? Should they continue investing in utility-scale solar? Do they need new ‘responsive’ non-renewable power generation in addition to renewables to successfully transition the grid? Or are there other ways to overcome the Duck Curve through storage?

Great article! As a former San Francisco resident, it is interesting to read about the steps PG&E is taking to move towards more renewable energy.

One downfall of renewable energy is the need to store energy. Since renewable energy sources do not produce most of their energy at peak times of consumption (i.e. early evening hours), companies must store energy. I’d be interested to learn more about the effects of pumped storage on PG&E’s operating model as it is usually a costly endeavor. Pumped storage consists of pushing large amounts of water uphill during excess energy periods and then producing energy as the water moves back down the hill through turbines. It takes both a large upfront investment to create the storage facilities and then their is often a net loss of energy through this process. PG&E anticipates using the Diablo facility for pumped storage from renewable energy, which would have a significant impact on their operating model. Do you think it is feasible and cost-effective for PG&E to use pumped storage at the Diablo facility? Would the use of pumped storage increase the efficiency of their operating model? Are there any other solutions besides pumped storage?

A few interesting articles are below!

http://www.wsj.com/articles/pumped-up-renewables-growth-revives-old-energy-storage-method-1469179801

http://www.wsj.com/articles/pacific-gas-electric-to-close-californias-last-nuclear-plant-by-2025-1466521057