General Mills UK and the Potential Impact of Brexit on the Dairy Industry

As Brexit looms, the dairy industries of the UK and EU-27 are concerned with potentially huge WTO tariffs, but how might this also affect General Mills's French produced Haagen-Dazs and Yoplait?

On 24 June 2016, the UK woke up to the news that 52% of voters had voted to leave the European Union (EU). A shock to many, this had profound effects on businesses and markets throughout the world: the pound dropped more than 8% against the dollar and markets lost approximately $2T. Almost a year and a half later, the UK still has many unanswered questions about how international trade will be conducted when the UK leaves the EU in 2019.

On top of a weaker and more unstable pound, one of the key implications that businesses are keen to understand is that of potentially leaving the single market and what that means for the import and export of goods. Considering the current lack of progress in negotiations, of concern is whether there will be any trade agreements at all between the EU and the UK when the two-year negotiating period expires. If no trade agreements are in place, the UK will be forced to abide by World Trade Organisation (WTO) tariffs when trading with the EU.

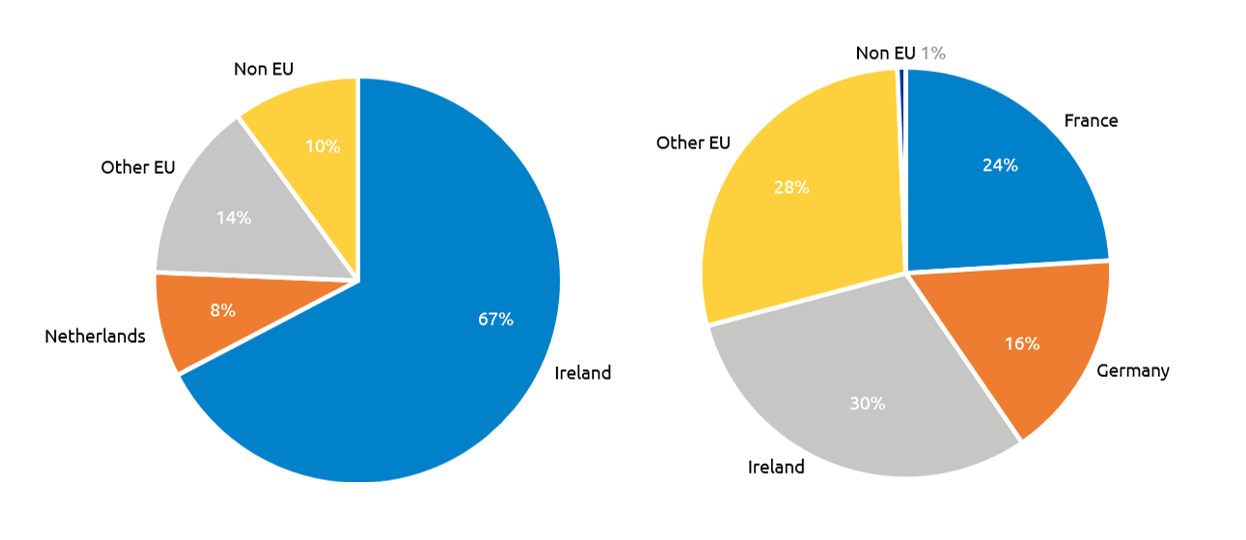

When looking at WTO tariffs, dairy products have some of the greatest tariff rates: 36-50% ad valorem[1]. This is of concern to both the UK and EU. 99% of UK dairy imports come from the EU and 90% of UK dairy exports go to the EU[2] (see Figure 1). The value of EU dairy imports to the UK in 2016 was £2.5B (c.f. £105M from non-EU countries), equating to ~20% of all non-UK EU exports[3], and £900M of dairy products were exported from the UK to the EU (c.f. £386M to non-EU countries)[4]. French food trade association ANIA recognises the risks to the dairy industry: “sectors that could be most affected are naturally those that most significantly contribute to the French trade balance: wines and dairy products in particular”[5] with some analysts suggesting up to €400M could be lost in French exports between 2017-19[6].

Figure 1. Source: HMRC.

For companies like General Mills (GM), the UK moving to WTO tariff rates and continuing adverse currency fluctuations could cause substantial damage to their European operations. Of the nine brands that GM UK maintain (see Figure 2), two are dairy products produced in France: Yoplait (including Liberté) and Häagen-Dazs. Furthermore, the UK is GM’s second largest global ice cream market in retail channels. However, overall operating profits in the year since the EU referendum were down $13M (18%)[7] for the segment “driven by significant raw material inflation, especially dairy, which impacted both Häagen-Dazs and Yoplait, as well as currency-driven inflation on products imported into the UK”[8]. Overall net sales for the segment declined 9% “primarily reflecting unfavourable foreign currency exchange”.[9]

Figure 2. Source: General Mills UK.

With such uncertainty, it is hard to suggest what General Mills should do. After all, there are still many that hope the UK will be able to remain within the single market for some time and therefore continue as they did before the vote, however currency fluctuations are likely to remain for several years.

It appears GM are continuing to innovate and invest in building the Häagen-Dazs brand, but Yoplait is struggling throughout Europe as local yoghurt producers take market share[10]. It remains to be seen whether the isolationist feelings that led to a vote to leave the EU will extend to a ‘British is Best’ mentality for ice cream and yoghurts when consumers could be hit with price hikes on foreign dairy. The most common British yoghurts to be found in supermarkets tend to be high quality (e.g., Yeo Valley) and can compete with French produce, however there appear to be no direct competitors to the super premium Häagen-Dazs except for a few small brands that could put GM under some pressure if they achieved significant growth (e.g., Kelly’s of Cornwall).

Should it become likely that the UK will move to WTO tariffs for dairy, GM will be faced with a question of what to do with their UK distribution. If the political climate is such that WTO tariffs may only be temporary, then there could be good reason to continue distribution. If GM were able to absorb the tariffs (and not pass on to consumers), this could be economically viable for a short period. However, if the period on WTO rates is longer term, they may need to contemplate ceasing distribution in the UK.

Open questions

- If unfavourable tariffs are imposed, should companies such as General Mills UK absorb the costs (vice passing onto consumers), and if so, for how long should they wait for more favourable tariffs to be established before ceasing distribution?

- How much of a threat are local dairy products to imported brands given potential increases in tariffs?

(Word count: 790)

[1] World Trade Organisation, “World Tariff Profiles”, https://www.wto.org/english/res_e/reser_e/tariff_profiles_e.htm, accessed November 2017.

[2] HM Revenues & Customs, “Overseas Trade Statistics – Archive”, https://www.uktradeinfo.com/Statistics/OverseasTradeStatistics/Pages/ArchiveOTS.aspx, accessed November 2017.

[3] AHDB Dairy, “UK is largest dairy customer for EU-27”, https://dairy.ahdb.org.uk/news/news-articles/february-2017/uk-is-largest-dairy-customer-for-eu-27/, accessed November 2017.

[4] HM Revenues & Customs, “Overseas Trade Statistics – Archive”.

[5] ANIA, “Quel impact pour le secteur agroalimentaire?”, https://www.ania.net/economie-export/brexit, accessed November 2017.

[6] Food ingredients First, “SPECIAL REPORT: Brexit – The Food Industry Impact”, http://www.foodingredientsfirst.com/news/special-report-brexit-the-food-industry-impact.html, accessed November 2017.

[7] General Mills, 2017 Annual Report, p. 4.

[8] Food Navigator, “General Mills gaining traction in European ice cream, snacks: Group performance still down”, https://www.foodnavigator.com/Article/2017/09/21/General-Mills-gaining-traction-in-European-ice-cream-snacks#, accessed November 2017.

[9] General Mills, 2017 Annual Report, p. 4.

[10] Ibid.

Thanks for the perspectives Luke, here are my thoughts:

Firstly, looks like there are delays and trade offs to be made in the greater scheme of things: https://www.wsj.com/articles/eu-reward-to-britain-for-brexit-concessions-may-prove-meager-1511464102

With respect to your question, I don’t think GM should pass on the costs. Instead, given the global nature of the company, GM could do one or all of the following:

1. Increase investments in the UK: Given how the pound has plummeted, it could make certain local businesses attractive to buy. A giant like GM could use this opportunity to increase its influence in UK.

2. Create two isolated markets while keeping its supply chain largely the same: Rebrand the products as separate offerings for EU and UK and isolate the distributions to keep the ingredients locally sourced avoiding any import/export tariff.

3. Observe how other firms are safeguarding themselves and use it to its benefit: GM should be proactive in its approach. For example – certain firms are hiring more locals in the fear of having to let go of foreign workers. GM doesn’t have to reinvent the wheel, but could start positioning itself to be nimble for all possible outcomes. GM’s competitor Unilever owns Magnum ice-cream and their CEO has warned about increase in prices: https://www.theguardian.com/business/2016/jul/21/unilever-shoppers-rising-prices-brexit-vote-sterling

Not raising prices short term could help GM gain more market share.

4. Alternatives for product: Could it create alternatives like sorbets that could be marketed to make them more attractive and keep sales up?

If however, everyone in the industry is, it could consider passing on partial costs and not all of it to reduce the hit to its top line. I don’t think in any case it should entirely pass the costs on as it could be detrimental to the business.

5. Absorb costs in global product offerings: GM could leverage its global positioning to absorb the costs for a few years in other unrelated higher margin products it offers to the rest of the world while gradually raising the prices to encourage adoption by the customers.

In addition to the comments above, I worry about the effects within the UK itself with a rise in raw materials costs.

http://www.telegraph.co.uk/business/2017/10/24/dairy-farmers-warn-no-deal-brexit-could-push-price-milk/

I don’t see an immediate solution to the rising price of milk. I think they should push the price onto consumers while increasing production of other products in the UK (ex. nut-based milks and icecreams) to diversify the raw materials used for similar lines.

Thanks for the article, Luke! If the UK has to revert to WTO tariffs with the EU, I think General Mills will be forced to raise prices on their dairy products in the UK. They could try to transfer production to the UK, but the costs associated with doing so may be substantial. I think they can offset some of the necessary price increases by decreasing the size of their dairy products. Many companies in the UK have moved toward this style of ‘shrinkflation.’ Already, Toblerone bars are smaller and the new shape of the candy bars has become a popular meme to represent the impacts of Brexit on the UK. Although it’s not preferable for consumers, given the context it might be unavoidable for GM to sell less for a little bit more.

As you suggest, the tariff threat to General Mills should not be taken lightly. Brexit and isolationism more broadly will undoubtedly create competitive pressure for global companies, specifically (as you describe) via the potential rise of domestic players. While such competition may not arise immediately, new entrants are likely to identify the arbitrage opportunity and attempt to seize it. Assuming that is the case, my initial sense is that General Mills should not absorb the tariff cost absent a viable path to tariff elimination / reduction. To do so would only delay an unavoidable outcome.

Another potential path for General Mills is to actively engage with other food manufacturers in lobbying the U.K. government to craft favorable trade policies as it negotiates Brexit. While potentially expensive, this path could preserve long-term profitability / cash generation in the British market for General Mills.

Thanks for sharing this interesting perspective on the impact of Brexit on UK’s dairy industry. I was intrigued to learn from the article that Brexit’s potential increases in import tariffs may make local dairy products more competitive as compared to imported brands that in turn may result in food and beverage conglomerates such as General Mills actually ceasing distribution of their products in UK. While I agree that Brexit is most likely going to result in increase in import tariffs, I believe there is also a possibility that the UK government decides to reduce or remove import tariffs post Brexit. This could open up the domestic dairy industry to competition from outside the EU. The most likely products involved would be butter and cheese. New Zealand is the main global exporter of cheese. It currently has access to the UK market via EU quotas but may seek to increase shipments, providing competition for UK supplies. For cheese, there is a wider variety of potential suppliers, including Australia, New Zealand, the US and Canada. These suppliers could provide increased competition for domestic cheese, potentially driving down prices throughout the supply chain.