General Electric’s Future with Additive Manufacturing

General Electric is utilizing additive manufacturing to reshape its products. What does the future hold for the company and its additive division?

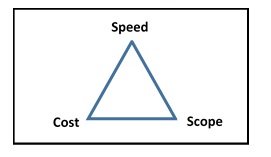

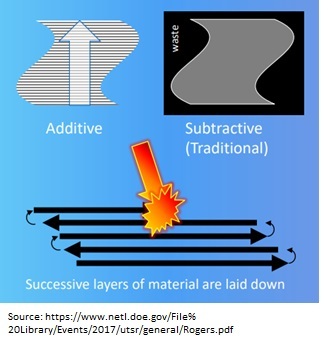

The figure above shows the tradeoffs between speed, cost, and scope that operations managers have to grapple with when launching new products, but what if they could have it all? Additive manufacturing enables that by fundamentally changing the way products are made. Traditional manufacturing is subtractive—a larger piece of raw material is shaped into a smaller finished product while 3-D printing is additive—layers build on top of one another until the final product is complete. For complex products this saves time, reduces raw material costs, and allows for innovative designs.[1]

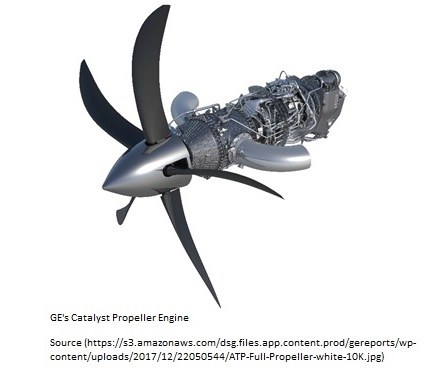

The trend of additive manufacturing is especially important for the industrial conglomerate of GE. GE has turned to 3D printing to accelerate product releases, improve performance, and reduce development spend. For example, in the aviation division, GE has developed as many commercial engines in the past 15 years as the previous 50 years. In addition, GE’s engines continue to lead the industry in performance, reliability and cost of ownership [2] and its most recent three engines have all incorporated components produced with additive manufacturing.[3] GE’s latest propeller engine, the product with the highest usage of additive, consolidated 855 parts into 12 components which cut weight by 5%, improved fuel efficiency by 20%, and reduced production and assembly costs.[4] Additive manufacturing’s benefits for GE go beyond the completed engine. The large size of engine components leads to expensive tooling that have a long manufacturing lead time. 3-D printing provides to ability to cut those costs by 10X and reduce lead time by 4X.[5]

GE values additive manufacturing and vertically integrated by spending over 1 billion USD on acquiring OEM manufactures.[6] After the acquisitions, the management team created a separate additive division to address the short term goals of developing next-gen technology, integrating with other GE businesses, and selling with the GE brand. GE noticed a gap in printing large parts and designed ATLAS, a novel machine with the largest build envelope ever offered.[7] The ability to print bigger parts enables GE to access previously untapped customers. GE is also incorporating complementary technologies such as industrial analytics and uninterrupted power supplies.[8] These features were originally designed for other businesses and allows GE Additive to further differentiate its machines. Lastly, GE has utilized its sales expertise and created customer experience centers to showcase additive manufacturing’s potential.[9] It also created AddWorks, a consultant service designed to drive value creation from design to full volume production.[10] These offerings provide the opportunity to capture more customers and gain a revenue stream beyond printers. It also solves a knowledge gap challenge within the industry. Cost advantages of additive come from novel designs that the technology enables. By providing the engineering horsepower, GE will allow customers to unlock the full potential of the technology. Overall, GE is working towards its medium term goal of consolidation to be a one stop shop for any application of additive manufacturing in advanced manufacturing.

Despite the progress GE is making, there remain gaps. First is the intense capital investment required to purchase printers. GE is trying to address this issue by emphasizing the savings in production costs and highlighting financing through its capital business, but that does not solve the underlying issue.[11] The company is developing more capable machines and not focused affordable alternatives. GE risks losing market share to those who started with a lower price point and advanced capabilities from there. I would recommend that GE work on a low cost machine adapted for small to medium size business that is easy to setup and use. I would also bundle the machine with a low cost consulting services that will help the business develop applications. The second gap is the usage of additive within all of GE. GE is forcing each business unit to develop an adoption strategy for additive manufacturing in order to generate sales for its additive business.[12] This will require the additive branch to tailor incremental improvements for various GE application instead of working on breakthrough R&D. This leads to risk in being disrupted by others more focused on the latter. To alleviate this risk, I would allocate a set percentage of the additive team’s R&D budget on long term technological innovations.

As 2018 draws to a close, additive manufacturing at GE is facing two big questions. Does GE have enough cash to keep investing in additive before seeing returns? Is GE sacrificing too much of its competitive advantage as it begins to roll out machines and consulting services to the industry?

(753 words)

[1] Choon Wee Joel Lim, Kim Quy Le, Qingyang Lu, and Chee How Wong, “An Overview of 3-D Printing in Manufacturing, Aerospace, and Automotive Industries,” IEEE Potentials, July 2016, 19, https://ieeexplore-ieee-org.ezp-prod1.hul.harvard.edu/document/7517429/, accessed November 2018

[2] https://www.geaviation.com/commercial/engines, accessed November 2018

[3] https://www.netl.doe.gov/File%20Library/Events/2017/utsr/general/Rogers.pdf, accessed November 2018

[4] Alan Brown, “CHAIN REACTION: WHY ADDITIVE MANUFACTURING IS ABOUT TO TRANSFORM THE SUPPLY CHAIN,” Mechanical Engineering, Oct 2018, p. 33, http://web.a.ebscohost.com.ezp-prod1.hul.harvard.edu/ehost/pdfviewer/pdfviewer?vid=5&sid=a268be3f-7ee3-48fb-9f56-e40ae271d99c%40sdc-v-sessmgr05, accessed November 2018

[5] https://www.netl.doe.gov/File%20Library/Events/2017/utsr/general/Rogers.pdf, accessed November 2018

[6] Kelly O’Brien, “GE looks to complete acquisition of Swedish 3D-printing company”, Bizjournals, December 27, 2017, https://www.bizjournals.com/boston/news/2017/12/27/ge-looks-to-complete-acquisition-of-swedish-3d.html, accessed November 2018

[7] https://www.ge.com/additive/additive-manufacturing/machines/project-atlas, accessed November 2018

[8] https://www.ge.com/additive/ge-technology, accessed November 2018

[9] https://www.ge.com/additive/customer-experience/customer-experience-centers, accessed November 2018

[10] https://www.ge.com/additive/additive-manufacturing/addworks, accessed November 2018

[11] https://www.ge.com/additive/ge-technology, accessed November 2018

[12] “GE 2017 Annual Report”, p3, https://www.ge.com/investor-relations/sites/default/files/GE_AR17.pdf, accessed November 2018

As you mentioned in your analysis, I believe that a good alternative for GE would be to commercialize affordable solutions for small and medium companies but at the same time to maintain its positioning in the more complex and higher-end segment. The first segment would generate the cash needed to develop new solutions for the higher-end market and to reduce the switching costs barriers for the penetration of premium technologies. In the mid-term, the higher-end products would be able to generate cash, differentiate the brand and build technologies that could be later incorporated into the low-end solutions. Also, I think that the GE brand is a competitive advantage itself that would foster the commercialization of the different products and services.

I think GE is smart to commercialize its expertise in additive manufacturing. As an industrial conglomerate, these machines and services are a growing market that the company is well suited to serve since all of their business lines will benefit from any R&D used to develop new products. I agree with your assertion that it is risky for GE to focus solely on the largest most technologically advanced. The pursuit of the “high and right” customer leaves the company vulnerable to disruption as new players enter the field with smaller less costly designs that technological advances then enable them to compete against the large capital-intensive project created by GE. Because of this I think that GE would benefit by also being dominate in the mid-size company market as well as large scale manufactures.

Your final thoughts around incremental vs transformational changes in AM for GE and the trade-offs associated with both is an important one. Especially since AM is receiving so much mind-share, it is not ludicrous to think that we could see another transformation in the way we think about AM. Even more concerning is that GE might miss out on it if it is focused too much on just small incremental changes to business processes.

In your suggestion to allocate a portion of R&D’s budget to long term technological innovations however, I couldn’t help but draw parallels to the IBM Watson case. In particular, is R&D for the sake of R&D (i.e., innovation without a particular business case or end state in mind) a good use of cash or would the organization be better suited to improve their current processes, keeping an out to make sure that the industry doesn’t side step them while they focus on incremental changes internally. Perhaps a better use of their cash might be to strategically identify advances in AM that could be transformational and bring those in house (i.e., acquire) on a opportunistic basis?

Curious to hear your thoughts!

Thanks David. I found it really interesting that GE wants to be the go to additive manufacturer in advanced manufacturing. My guess is at this time time it is not the best use of capital at GE. Instead I would think they would want to truly understand what the customer values more about additive manufactuing, is it the lead time or the cost? I wonder if GE should differentiate themselves from their competitors by leveraging their name brand and QA/QC process to sell additive manufacuting products to industries where delivery time and reliability higare valued the most (within a reasonable cost difference), such as in short cycle higher risk industries?