Fujifilm: Outlasting the “Kodak Moment”

How two camera film companies saw the dawn of the digital age, but only one survived.

Eastman Kodak was once the leading film producer in the world, with 80% market share compared to its next closest competitor, Japanese owned Fujifilm, whom trailed with a mere 17%. [8] In the 1980’s, “both Fujifilm and Kodak knew the digital age was surging towards [them], but the question was, what to do about it.” [2] Each company took a different approach to addressing digital transformation and the results were significant: in 2012, Kodak filed for bankruptcy, sold its patents, and exited its legacy businesses while Fujifilm grew into a $20.8 billion revenue company. [1] [4] While Kodak has become a classic example of failed innovation in the digital age, the keys to Fujifilm’s survival are lesser known. This piece will focus on how Fujifilm changed an element of its business model to adapt to and ultimately leverage the digital revolution.

Business Model. A business model consists of four essential elements that together define how a business creates value for the customer: (1) customer value proposition, (2) profit formula, (3) key resources, and (4) key processes. [5] Fujifilm’s adaptation will be explored using the first element of this framework: customer value proposition.

Customer Value Proposition. “It’s not the product that creates value but the value proposition.” [6]

Fujifilm originally created value for customers by delivering quality photography film at a fair price via convenient retailer locations. Compared to Kodak, Fujifilm differentiated itself by offering comparable film products at a significantly cheaper price to consumers. But in the 1980’s, Fujifilm realized photography would be going digital and faced a decision regarding what strategy to pursue. [3] How did Fujifilm approach this problem and what did they decide?

Scott Anthony, author of The Little Black Book of Innovation, recently published three questions businesses should ask themselves when considering a digital transformation. Though written 20+ years after Fujifilm’s dilemma, they provide an excellent lens for understanding how Fujifilm adapted its value proposition:

- “What business are we in today?

- What new opportunities does the disruption open up?

- What capabilities do we need to realize these opportunities?” [1]

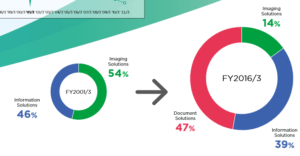

What business are we in today? Where Kodak remained focused on the film industry, Fujifilm questioned what business it was in. Was it in the camera film business or the imaging business? [1] After recognizing it could leverage prior expertise in other industries, Fujifilm redefined itself as both an imaging and information technology company. As early as 1983, Fujifilm demonstrated this expanded position when it produced the world’s first digital x-ray imaging diagnostic machine, the FCR. [9] Fujifilm’s experience led it to pursue three lines of effort: Imaging, Information, and Document Solutions. [9] Figure 1 clearly depicts Fujifilm’s accelerated transition from a company dependent on revenue from photo film to an imaging and information technology company.

Figure 1. Fujifilm Portfolio Mix

(Note: “Imaging Solutions” in the figure above refers to Fujifilm’s camera and photographic film segment)

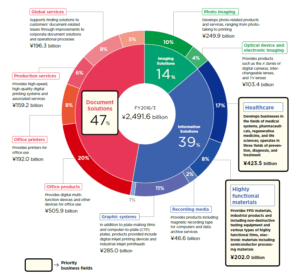

What new opportunities does the disruption open up? As it entered new industries and material/ computer technology advanced, Fujifilm’s opportunities grew. For example, what began as innovation in x-ray technology, transformed into a $3.8 billion business segment, with advancements in endoscopes, medical-use picture systems, and pharmaceuticals. [9] Figure 2 depicts Fujifilm’s industry mix as of its 2016 Annual Report.

Figure 2. Fujifilm Portfolio Diversification

What capabilities do we need to realize these opportunities? As Fujifilm expanded its value proposition and identified new customer problems, the company recognized certain capability and knowledge gaps. In the 2012, for example, Fujifilm acquired SonoSite, an American ultrasound equipment maker, and went on to develop leading point of care imaging products which have garnered top awards. [3]

Recommendations. Innovation is an ongoing and iterative process that will quickly stagnate in the absence of a long-term strategy and investment. As Fujifilm continues to compete in the post-digital age, the company should consider the following recommendations.

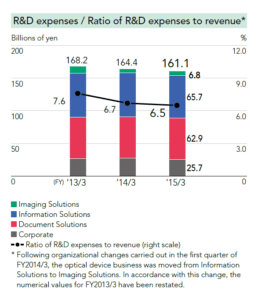

- Increase investment in research and development (R&D). Since 2009, Fujifilm has decreased its investment in innovation from $1.73 to $1.48 Billion or from 7.6% to 6.5% of revenues (see Figure 3). [4] The decline in R&D spending has yielded an improvement in operating margins, but could slow innovation in the long term, counter to Fujifilm’s strategy.

Figure 3. R&D Expenses

- Expand partnerships, like that of its biomolecular imaging alliance with General Electric, to help fund R&D, create value for new customers, and further establish the brand as a leading imaging technology innovator. [7]

- Slow the rate of industry diversification and focus on deepening expertise, pursuing innovation, and growing market share in healthcare and materials technology. Diversification across several industries with a variety of imaging products was essential to Fujifilm’s initial survival in the digital age, but expansion into additional industries could spread its R&D funding too thin.

- Maintain a lean operating model and a robust employee skills re-training program. By retraining current employees to adapt to new technologies, Fujifilm will continue to deepen its expertise and deliver on its customer promise.

Wordcount: 797 without citations or figures.

Citations:

[1] Anthony, Scott. “Kodak’s Downfall Wasn’t About Technology,” Harvard Business Review, July 15, 2016, https://hbr.org/2016/07/kodaks-downfall-wasnt-about-technology, accessed November 2016.

[2] Inagaki, Kana and Osawa, Juro, “Fujifilm Thrived by Changing Focus,” The Wall Street Journal, January 20, 2012, http://www.wsj.com/articles/SB10001424052970203750404577170481473958516, accessed November 2016.

[3] K.N.C., “Sharper Focus,” The Economist, January 18, 2012, http://www.economist.com/blogs/schumpeter/2012/01/how-fujifilm-survived, accessed November 2016.

[4] “Annual Report 2015,” Fujifilm Holdings Corporation, 2015, http://www.fujifilmholdings.com/en/investors/annual_reports/2015/pack/pdf/Financial-Section.pdf, accessed November 2016.

[5] Johnson, Mark W., “A New Framework for Business Models,” Harvard Business Review, January 21, 2010, https://hbr.org/2010/01/is-your-business-model-a-myste-1, accessed November 2016.

[6] Stähler, Patrick, “The offer is only one building block to fulfill the value proposition,” June, 16, 2015, http://blog.business-model-innovation.com/2015/06/product-is-not-the-value-proposition/, accessed November 2016.

[7] Kohn, Stefan, “Disruptive Innovations applied: A review of the imaging industry,” http://www.innovation-portal.info/wp-content/uploads/StefanKohnDisruptiveInnovationsFujiFilm.pdf, accessed November 2016.

[8] Cohan, Peter, “How Success Killed Eastman Kodak,” Forbes, October 1, 2011, http://www.forbes.com/sites/petercohan/2011/10/01/how-success-killed-eastman-kodak/#6944c9bc4d86, accessed November 2016.

[9] “Annual Report 2016,” Fujifilm Holdings Corporation, 2016, http://www.fujifilmholdings.com/en/investors/annual_reports/2016/pack/pdf_TOP/Annual-Report-2016.pdf, accessed November 2016.

I assumed Fujifilm was on its way to being an obsolete company due to camera phones. It is interesting o see how they have diversified into the health space.

Thanks for the article A.J. – fascinating to hear the lesser known Fuji story. This reminds me a bit of the Goodyear case we did in Finance, however, clearly Fuji was extremely strategic in choosing what markets to enter and how to diversify. Leveraging internal capability to expand beyond film into other forms of imagery and making acquisitions to build capability have paid off.

Thanks for sharing! Kodak’s failure in adapting to a changing environment highlights an issue that many companies face in dealing with disruption: willingness to invest for long-term sustainability. Kodak had a huge film business with high margins and to properly adapt to the digital transformation would have had to shift its focus (people, time, resources) to the lower margin digital side. Even if Kodak’s management team had recognized the threat earlier, it would have had to commit to years of investment and reorganization to equip the company for future success. As you pointed out above, Fujifilm will need to continue to invest in R&D to ensure that it does not meet the same fate sometime down the road.

Sarah Yu abides. I had no idea Fuji Film was getting into the healthcare sectors while focusing on its document solutions. This is similar to how some great companies like Pepsi & Coca Cola had to diversify its product base to keep up with shifting consumer demand.