From Oil to Carbon: How Global Energy Trader Moved Into Carbon Emissions Trading

Mercuria Energy Group is one of the world’s largest commodity trading companies which trades a vast portfolio of commodities ranging from coal to crude oil. Founded in 2004, Mercuria had expanded into five continents with over 30 trading offices transacting billions of dollars’ worth of commodities each year [1]. Despite its rapid growth over the past years, the company’s trading activities have been primarily focused in hyper-competitive markets of crude oil and refined petroleum products where it competes head on with some of the world’s largest corporations like Shell and BP. With its ambitious growth plan in 2010, Mercuria eyed an expansion into one of most newly-developed commodity market: carbon emissions.

http://www.mercuria.com/trading/middle-distillates

What creates the market for carbon emissions?

Upon signing of the Kyoto Protocol in 1997, over 190 countries agreed to adhere to carbon emissions reduction target over the 2008-2012 commitment period [2]. Further, the protocol permits countries with surplus emission credits to sell their credits to another country, thereby creating an international market for carbon emissions credit [3]. This creates a new and attractive carbon emissions market, but why would a traditional oil trading company like Mercuria enter into carbon emissions market?

There were a few reasons that perhaps drive Mercuria’s decision to enter carbon emissions trading. First, the Kyoto Protocol’s cap on carbon emission has serious monetary implications on most businesses operating in both developed and developing countries. The cap and trade program allows for trading of carbon emissions which will likely result in a multibillion-dollar carbon emissions market. This represents a relatively untapped and potentially lucrative market for Mercuria who has faced intense competition for market share in the petroleum commodities market.

http://www.mercuria.com/trading/power

Second, Mercuria’s operating model and global commodity trading infrastructure can readily support trading activities for more or less any commoditized products, including carbon emissions, regardless of its primary focus in petroleum commodities markets. Mercuria’s existing trading infrastructure and risk management system allows Mercuria to conveniently accommodate carbon emissions trading, giving the company considerable competitive advantage to enter into carbon emissions trading at a considerably low cost of entrance.

Third, as climate change become a major area of concern in many jurisdictions, Mercuria as well as other oil trading companies likely acknowledges the pressure from regulators and the community to take part in reducing the global carbon footprint. Interestingly, Switzerland, which is home to Mercuria and other top commodity trading companies, has committed to achieving a 50% reduction in greenhouse gas emissions by 2030 [4]. This is an ambitious national goal that would inevitably require cooperation from Swiss industrial and energy companies, including Geneva-based Mercuria.

From oil trader to global leader in carbon emission trading

“Our target is to be one of the world’s largest and most active carbon emissions traders,” said Mercuria Energy President Marco Dunand”. [5]

In 2010, Mercuria started pursuing its goal to become the world’s leader in carbon emissions market by acquiring from Morgan Stanley the Miami-based global leader in carbon offset project development and one of the pioneers in carbon trading, MGM International. The acquisition of MGM allowed Mercuria to quickly increased its carbon offset project origination capacity and to immediate ramp up its supply of tradable carbon emissions credit [6].

In November 2011, Mercuria continued to expand its carbon emissions portfolio in Asia by teaming up with a Chinese energy company to form a joint venture company which focuses on China’s carbon trading and emissions market [7]. In April 2012, Mercuria took further steps to underscore its position as the global leader in the carbon emissions market when it participated in the forward sale of over 1.6 tonnes CO2-equivalent greenhouse emission credit to an affiliate of SIFCA, a leading company in West Africa [8].

Changing market landscape for carbon emissions

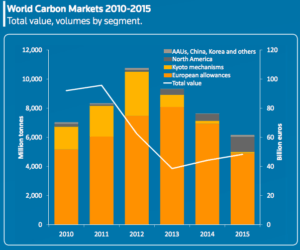

As Mercuria and other commodity trading companies expanded their presence in carbon emissions market, the global carbon market peaked in 2012 with over 10 gigatonnes of CO2-equivalent traded. However, the market unexpectedly declined from 2013 through 2015 due to the oversupply of carbon credits generated by carbon offset projects globally [9].

http://climateobserver.org/wp-content/uploads/2016/01/Carbon-Market-Review-2016.pdf

As the carbon market continued to decline as a result of the oversupply of carbon credit and the falling carbon credit prices, Mercuria decided to shut down its London-based carbon trading desk in January 2016, let go of two senior traders and move the head of carbon trading to the crude oil desk [10]. Nonetheless, the company claims that it is in the process of adjusting its strategy and resources in response to changing supply and demand dynamics, and remains committed maintain its position as the leader in the carbon emissions market.

Mercuria’s decisive entrance into carbon emissions market despite its expertise in petroleum trading illustrates the company’s ability to leverage its existing operating model to create additional value from changing market landscape driven by climate change.

(word count: 800)

Sources:

[1] Mercuria Energy Trading, “About Us” 2016. http://www.mercuria.com/about-us. Accessed 4 November 2016.

[2] United Nations Framework Convention on Climate Change, “Parties to the Convention and Observer States” 2014. http://unfccc.int/parties_and_observers/parties/items/2352.php. Accessed 4 November 2016.

[3] United Nations Framework Convention on Climate Change, “Emissions Trading” 2014. http://unfccc.int/kyoto_protocol/mechanisms/emissions_trading/items/2731.php. Accessed 4 November 2016.

[4] Swissinfo, “How will energy trading respond to climate change target” 2015. http://www.swissinfo.ch/eng/the-big-players_how-will-energy-trading-respond-to-climate-change-targets-/41335764. Accessed 4 November 2016.

[5] PRNewswire, “Mercuria Energy Expands Activities In Carbon Trading” 2016. http://www.prnewswire.com/news-releases/mercuria-energy-expands-activities-in-carbon-trading-62164257.html Accessed 4 November 2016.

[6] Mercuria Energy Trading, “Mercuria Energy Group Makes Strategic Carbon Business Acquisition” 2016. http://www.mercuria.com/media-room/business-news/mercuria-energy-group-makes-strategic-carbon-business-acquisition. Accessed 4 November 2016.

[7] Reuters, “Mercuria, China’s Datang form carbon JV” 2016. http://www.mercuria.com/media-room/business-news/mercuria-energy-group-makes-strategic-carbon-business-acquisition. Accessed 4 November 2016.

[8] Mercuria Energy Trading, “Certified Emission Reductions: Mercuria Participated in Record Transaction” 2016. http://www.mercuria.com/media-room/business-news/certified-emission-reductions-mercuria-participated-record-transaction. Accessed 4 November 2016.

[9] Thomson Reuters, “Carbon Market Monitor” 2016. http://climateobserver.org/wp-content/uploads/2016/01/Carbon-Market-Review-2016.pdf. Accessed 4 November 2016.

[10] Carbon Pulse, “Mercuria shutters London-based emissions trading desk –sources” 2016. https://carbon-pulse.com/14648/. Accessed 4 November 2016.

[11] Mercuria Energy Trading, “Environmental Markets” 2016. http://www.mercuria.com/trading/environmental-markets. Accessed 4 November 2016.

Featured Image Source: http://www.mercuria.com/trading/gasoline-and-naphtha

Despite the recent decline in the carbon emissions market and Mercuria’s exit from large-scale emissions trading earlier this year, Mercuria’s experiment with carbon emissions trading successfully shows that green house gas reduction can be commoditized and traded on open exchanges. This is an important proof of concept, and model for future government and international regulation to prevent climate change. By allowing the trading of reduction credits, governing bodies essentially minimize the so-called “dead-weight loss” that occurs when inefficient companies and efficient companies are required to reduce emissions by the same amount. Instead, those companies that can reduce emissions cheaply will reduce more, and sell credits to those who cannot. Importantly, a system such as this minimizes the burden on the total economy, minimizing the economic loss that will accompany efforts to reduce emissions.

Trading carbon credits is an interesting way that government regulations and the free market work together to decrease the externality of carbon emissions. The issue I see is that carbon emissions have an international effect, but governments can only regulate within their governing bodies. How can we expect some nations to regulate carbon emissions when others don’t? How can governments best spread the regulations over the globe?

Trading carbon credits is an interesting part of the industry, but how do these companies deal with the volatility of the market? Further, do these companies trade their credits directly with each other or through broking firms? Would be interesting to study one of the middlemen and how their business is affected by the changes in demand, supply and carbon protocols.

Interesting post. I am curious as to the mix of participants in carbon trading markets, and what role they all play. Do large corporations rely on firms like Mercurial to provide liquidity for these types of transactions? Or are carbon trading firms more of an obstruction, extracting value from a system that is intended to facilitate business-to-business transactions? My guess would be the former–the presence of market makers like Mercurial serves to incentivize firms to reduce their emissions by signaling to the market that there are buyers willing to consume their credits, which is a good thing for the world. However, the thought of high-frequency traders profiting from international carbon emissions arbitrage admittedly has a slightly predatory feel. Would be interested to read more about the role and effects of these market participants.