From Idea to 3-D in a Day: UPS and Fast Radius

Logistics behemoth UPS and high-flying 3-D printing startup Fast Radius have partnered to make 3-D printing accessible to the masses

A Fast-Growing Startup Partners with a Behemoth

The halls of the newly-opened, Chicago headquarters of Fast Radius are abuzz with optimism for the additive manufacturing company’s future. Fast Radius, a leading 3-D printing and manufacturing technology startup, has quickly become one of the leading firms offering what they call “manufacturing solutions for an increasingly digital supply chain”. [1] On-top of its technological prowess – backed by over $15MM in venture funding [2] – the firm also has an interesting partner as it moves forward to not only produce effectively for customers, but also provide unparalleled speed in delivery. That partner is logistics and supply chain behemoth UPS.

Through this partnership, the two companies, with third partner SAP, are trying to make additive manufacturing more mainstream than ever before by taking a concept from idea to the customer’s doorstep in as quick as a day. [3]

Why 3-D?

UPS has teamed-up with Fast Radius because of the great potential they see in additive manufacturing. UPS sees the industry growing over 50% to $21B in 2020 and wants to be a part of this transformation in manufacturing activity [4]. As it views its unique global position as a leader in supply chain logistics, UPS sees this foray into additive manufacturing through partnership with Fast Radius as a way to offer an additional service to its customers and potential opportunity to become the primary shipping firm for a number of innovative companies early on the adoption curve of additive manufacturing.

This megatrend of additive manufacturing is important to UPS and Fast Radius because it allows them to differentiate their partnership by bringing their respective expertise to the table to serve customers. Fast Radius provides the technological edge to additive manufacturing, and UPS provides unparalleled logistics and quick delivery to companies looking to prototype or get product quickly.

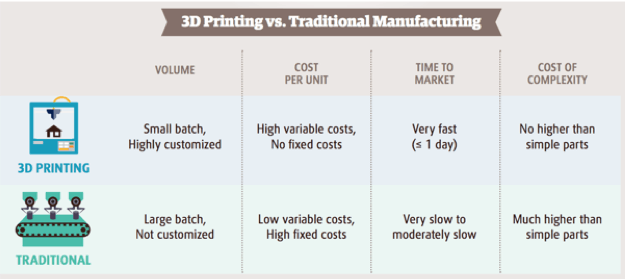

As is seen below, firms leveraging additive manufacturing tend to prioritize getting to market quickly or prototyping.

[4]

This partnership between UPS and Fast Radius is allowing companies to prototype without having to put-out significant initial capital outlays for machinery, which is a common issue with adoption of additive manufacturing in firms. [5]

While the initial capital outlays are an issue for these companies trying to use additive manufacturing, there also is an inherent issue in being able to get a quick turnaround from concept-to-production if they were planning to traditionally outsource their production. The real power of this partnership, and what UPS and Fast Radius are working on in the shorter-term, is to mimic a system of “distributed production on-demand” by leveraging UPS’s shipping and logistics expertise. This will allow for companies to produce inventory and get it to locations in a more just-in-time fashion than ever before. [6]

While a larger firm flush with resources may be able to set-up 3-D printing facilities, UPS and Fast Radius are making a bet that they can produce and ship prototypes, parts, or other inventory quickly and efficiently to solve this issue of distributed production on demand. We see below the cycle of supply chain challenges companies face that UPS and Fast Radius are trying to tackle:

[4]

Longer term challenges for UPS and Fast Radius will primarily revolve around building up technical capacity and being able to produce at larger scale. To tackle this, Fast Radius has partnered with leading 3-D printing technology company Carbon to use their Speedcell technology [7]. This technology will allow them to produce more quickly than ever and at greater volume than ever, with Fast Radius co-founder Rick Smith stating “Fast Radius and UPS believe that the introduction of Carbon’s technologies marks a historic point when additive manufacturing truly becomes a production alternative.” [8]

What’s Next?

With their budding partnership and early adoption of Carbon’s Speedcell technology, UPS and Fast Radius appear poised for success in bringing additive manufacturing to small/mid-size companies and making it more mainstream today than it has ever been in the past. One recommendation to the management team responsible for this partnership would be to consider further co-location of 3-D printing facilities. Currently, sites are located in the Midwest (Chicago and Louisville) which provide a central location in the US, but may also prove costlier to ship to the coasts than if there were sites in, say, California and North Carolina as well.

In researching these firms, I’m very excited about the value proposition they present in the short and medium term to small companies looking for efficient, quick-feedback loop on prototypes and other small-batch part production. The question that remains in my mind is, will companies ever use a service like this to produce at scale or are the benefits to additive manufacturing, like the MIT Management review suggests in its “three myths about 3-D printing” [9], likely to stay in their current nice-role for the foreseeable future?

Word Count (800)

Citations

[1] Jackson, Beau. “Fast Radius Scales up its 3D Printing Production in Chicago.” 3D Printing Industry, 28 Aug. 2018, 3dprintingindustry.com/news/ fast-radius-scales-up-3d-printing-production-in-chicago-138944/. Accessed 12 Nov. 2018.

[2] https://www.crunchbase.com/organization/cloudddm. Accessed 12 Nov. 2018.

[3] Zhang, Benjamin. “UPS pact gives companies access to large-scale 3D printing and virtual warehousing.” Business Insider, 10 Nov. 2016, www.businessinsider.com/ups-sap-fast-radius-on-demand-3d-printing-2016-11. Accessed 12 Nov. 2018.

[4] https://www.ups.com/assets/resources/media/en_US/3D_Printing_executive_summary.pdf. Accessed 12 Nov. 2018.

[5] Pooler, Michael. “3D printing starts to gain traction in industrial tool kits.” Financial Times, 23 Apr. 2017.

[6] Marchese, Kelly, et al. “3D opportunity for the supply chain: Additive manufacturing delivers.” Deloitte Insights, 2 Sept. 2015, www2.deloitte.com/insights/us/en/focus/3d-opportunity/additive-manufacturing-3d-printing-supply-chain-transformation.html. Accessed 12 Nov. 2018.

[7] Carbon, Inc. “SpeedCell Changes How Products are Designed, Engineered, Made and Delivered with the Introduction of the M2 Printer and Smart Part Washer.” Carbon, Inc., 16 Mar. 2017, www.carbon3d.com/news/carbon-speedcell-additive-manufacturing-reinvented/. Accessed 12 Nov. 2018.

[8] Fast Radius, Inc. “Fast Radius Takes Significant Step Towards High Volume 3D Printing Manufacturing as Launch Partner for Carbon’s Revolutionary SpeedCell™.” Business Wire, 16 Mar. 2017, www.businesswire.com/news/home/20170316006334/en/Fast-Radius-Takes-Significant-Step-High-Volume. Accessed 12 Nov. 2018.

[9] Bonnín-Roca, Jaime; Vaishnav, Parth; Mendonça, Joana; Morgan, Granger.MIT Sloan Management Review; Cambridge Vol. 58, Iss. 3, (Spring 2017): 57-62. Accessed 12 Nov. 2018

Well-written piece. As I think about what UPS is doing, it very much reminds me of Amazon. While Amazon has started its business in the retail space, it really is a platform building machine. Marketplace – was an extension of the retail platform. AWS has become a computing platform for others once Amazon realized how good they actually were at it. Fulfill-by-Amazon is a 3PL platform. Once they build out their delivery network, nothing will stop them from offering last-mile to outside world. In this case, UPS is actually building a platform that will give small-scale manufacturers ability to compete with big guys – not on cost, of course (naturally, 3D printing will likely never be as efficient as running large batches through automated plants), but on design – UPS will simply help these small-scale manufacturers to complete the final steps. The piece doesn’t mention, but UPS has built out a number of 3D printing facilities globally (one in Louisville – UPS’s core hub, one in Singapore – to serve Asia and more is coming in EU). UPS doesn’t aspire to compete with large manufacturers, but having a very strong penetration with small and mid-size businesses, it’s a natural extension of their business relationship.

Mike – I really enjoyed this article on the UPS-Fast Radius partnership. It is certainly an interesting venture that will hopefully enable companies without the capital to afford 3D printers an opportunity to quickly develop and test design prototypes. As you mentioned in the article, I also worry about the scalability of moving from a prototype manufacturer to a full fledged production operation. I assume as the price of 3D printing drops this will become possible, but it also feels like a different model as they move into becoming a company people go to for outsourced production. It will be interesting to see how this partnership manages that transition if indeed it does occur. I am also interested who their competitors are in this space. I am aware of many local players who offer something along these lines, but it would be interesting to know if there are other national level competitors. Thanks!

This is really well written and an informative view on additive manufacturing. It’s interesting how a small startup like Fast Radius can partner with an established behemoth like UPS to deliver 3-D printing to the masses. I too am concerned about the ability to scale 3-D printing from a prototype development tool to a full scale manufacturing. Perhaps Fast Radius could explore a partnership with an established manufacturer with expertise in designing efficient large scale manufacturing processes. The company has already shown the ability to effectively partner with a large global partner, perhaps doing so again could help them expand further.

Initially, I thought a solution to the scaling problem could be the sharing of prototypes or basic models to streamline the production. Upon further reflection, it could pose some challenges with respect to proprietary knowledge, since firms are using them for rapid prototyping, which is likely confidential as a part of product development. That being said, its might be possible to gain more market traction by making the process easier or appealing to the masses in an accessible way. It sure would be nice to be able to replace the chess piece I lost.

Mike – thank you for this thoughtful article. Like Yury, I see significant similarities with Amazon. In terms of market potential, I currently see two potential paths forward for this partnership to achieve growth. First, there may be a market opportunity to manufacture at “scale” highly complex and customized products which are uniquely suited to the advantages of 3D printing. Second, there may be value in serving as a highly flexible overflow manufacturing facility, 3D printing products at slower speeds than a client’s factory during times when the client’s factory cannot meet all of the demand. It will be interesting to see how they end up developing their offering and if 3D printing is able to scale sufficiently to move out of the prototyping niche.

Thank you for a very interesting article, super interesting to read about how a small company managed to partner with a behemoth like UPS! I do share your concerns about 3D printing never really reaching “mass production” status, with the main issue being that printing will (most likely) always be a slower process than batch manufacturing through casting which offers less precision, but also a lower ability to customize products. I think that where 3D printing will first come into the mass market is where there is a need for customization, or where there is large variation in the type of products being manufactured, e.g. “unique” spare parts for cars that have been out of production for a while.

I enjoyed reading about this topic and share many of your thoughts and concerns. I also wonder whether they offer enough value proposition for the long term. As costs comes down over time, UPS and Fast Radius should also consider other value-add services to differentiate themselves from potential competitors and also keep their customers from bringing the technology in-house once they have enough scale and cash flow.