Foxconn in the Age of Isolationism

Foxconn’s global supply chains are under siege by growing isolationist forces.

“NAFTA is the worst trade deal maybe ever signed anywhere, but certainly ever signed in this country,” President Trump.

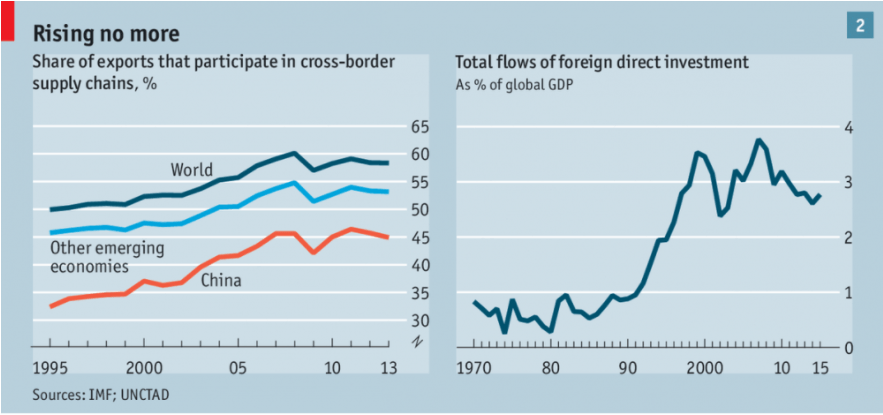

In an unexpected turn of events, China, historically known for its protectionist policies, is now arguably the guardian of globalization and free trade. As labor arbitrage has continued to remove unskilled jobs from the United States and shifted them to lower income areas, the populist voices in U.S. society have begun speaking up. Each industry is being affected by the rise of isolationist and nationalist policies, but manufacturing seems to be in the forefront of the world’s focus. The rate of global trade is cooling faster than global growth which is signaling the rise of isolationist policies around the world.[1] As firms continue to compete against one another, governments around the world are taking a more engaged role in deterring or promoting global firms from operating.[2] Government interaction is ultimately bad for the consumer, because it awards firms based on relationships and bureaucratic acumen rather than competitive advantage.

Source: “The Retreat of the Global Company; Multinationals.” The Economist (US), January 28, 2017.

Foxconn Technology is a multinational corporation that manufactures electronics in Asia, South America, Europe and Mexico with a $10-billion factory in the works for Wisconsin.[3] The electronics they produce or assemble are present in forty percent of all electronics worldwide.[4] Sixty percent of Foxconn’s business is conducted within China, suggesting that the firm may be overly reliant on one specific country for both their supply and demand for products.[5] Foxconn is especially susceptible to isolationist policies because Foxconn specializes in manufacturing parts for other technology companies. Foxconn’s near-term strategy appears to be centered around strengthening relationships with existing governments[6], diversifying global demand through mergers and acquisitions[7], and optimizing existing supply chains. The long-term plan of Foxconn is much more difficult to ascertain due to numerous and countervailing global trends. The rise of isolationist policies is a considerable threat to Foxconn’s long-term profitability. Their supply chains span a multitude of countries and relies heavily on speedy and efficient transitions over borders. Their proposed investment in the United States, mentioned above, is a move to further diversify their manufacturing, but fails to address their overreliance on cross-border trade along long and complex supply chains.

Global demand for electronics continues to increase so Foxconn needs to remain proactive by incrementally increasing supply to keep pace. The challenge is that manufacturing is a highly capital-intensive business, especially with respect to the rise of advanced robotics, so the payback periods for factory investments can be long[8]. The rise of populist movements in the West threaten Foxconn’s ability to seamlessly move supplies across borders. Their competitive advantage comes from their ability to produce different parts in different locations based on cost. Due to the decentralized nature of their current global operations, they would not be successful without full access to their Chinese manufacturing sites. As the tides of globalization recede and isolationist walls are built, Foxconn needs to prepare for potentially damaging effects to their supply chain.

The success of multinational firms derives from a number of economic drivers. Some claim that the recent stagnation of multinational firms, to include Foxconn, is solely a byproduct of isolationist policies. In recent years, wages across China have been increasing, the cost of robotics has been decreasing[9], and host nations have been less hospitable to multinational firms. Foxconn should continue to diversify their global operations to deal with their potential overreliance on China. They need to take a regional approach to their global operations and seek to create sustainability on a national scale. Though it seems counterintuitive, as a multinational firm they need to hedge their business against the possibility of a trade war. When times are good, each of their national businesses will collaborate and achieve synergies through economies of scale and specialization, but during periods dominated by isolationist polices, they will still have sustainable business units.

Foxconn is a bellwether for globalization because of its involvement in so many products across the world. In recent years, multinational firms have stalled, leaving many unsure whether they have a place in the future global economy. Is isolationism, or the threat thereof, truly the cause of this recent trend? Assuming global labor prices continue on current trends and the development of AI and robotics continues, does the world need multinational supply chains? Will Foxconn’s current distributed production model allow it to compete in the future with highly automated, nimble, local competitors in the future?

(Word Count: 771)

[1] “The Retreat of the Global Company; Multinationals.” The Economist (US), January 28, 2017.

[2] Nougayrède, Natalie. “France’s Gamble: As America Retreats, Macron Steps Up.” Foreign Affairs 96, no. 5: 2-8. Business Source Complete, EBSCOhost, accessed November 2017.

[3] Starner, Ron. “Bagging the Big One: How Wisconsin Landed Foxconn”, Site Selection, 62, 5, pp. 117-123, Business Source Complete, EBSCOhost, accessed November 2017.

[4] Bradsher, K, & Duhigg, C. 2012. “How the U.S. Lost out on iPhone Work.” The New York Times, January 21, 2012, [http://www.nytimes.com/2012/01/22/business/apple-america-and-a-squeezed-middle-class.html], accessed November 2017.

[5] TIMETRIC. “Foxconn Technology Co LTD: Company Profile and SWOT Analysis.”, Thomson One, October 9, 2017, accessed November 2017.

[6] Barboza, David. “How China Built ‘iPhone City’ With Billions in Perks for Apple’s Partner.” The New York Times, December 29, 2016, [https://www.nytimes.com/2016/12/29/technology/apple-iphone-china-foxconn.html], accessed November 2017.

[7] TIMETRIC. “Foxconn Technology Co LTD: Company Profile and SWOT Analysis.”, Thomson One, October 9, 2017, accessed November 2017.

[8] Bennett, R, & Hendricks, J, “Justifying the acquisition of automated equipment [manufacturing]”, Management Accounting, 69, 1, pp. 39-43, 1987, EBSCOhost, accessed November 2017.

[9] Statt, Nick. “iPhone manufacturer Foxconn plans to replace almost every human worker with robots”, The Verge, December 30, 2016, [https://www.theverge.com/2016/12/30/14128870/foxconn-robots-automation-apple-iphone-china-manufacturing], accessed November 2017.

Interesting read!

I would disagree with the notion that the benefit of multinational supply chains is eliminated with higher global labor prices and increased penetration of automation. If the only purpose of multinational supply chains was to access the cheapest labor, then wouldn’t all companies just operate in the country with the cheapest labor? Rather, I think that lengthy supply chains take advantage of technological specialization from different regions (i.e. LED screens from Korea) [1] that is independent of labor cost.

Additionally, there are two reasons that I believe that Foxconn will be able to compete with highly automated, local competitors. First, Foxconn understands the importance of automation and seems to be actively pursuing an automation strategy, with the goal of 30% automation by 2020 [2]. Second, much of Foxconn’s business comes from absolutely enormous customers, such as Apple, that require a partner that is able to handle the manufacturing of hundreds of millions of Apple products. While local job shops could handle small runs, larger customers require the scale that Foxconn provides in order to meet their customer demand.

I would be curious to learn whether Foxconn’s move is truly part of a strategy to localize their supply chains, or part of a greater strategy to build positive publicity and goodwill towards themselves.

[1] Shih, W. (2016). What You Won’t Hear About Trade and Manufacturing on the Campaign Trail. [online] Available at: https://hbr.org/2016/05/what-you-wont-hear-about-trade-and-manufacturing-on-the-campaign-trail [Accessed 26 Nov. 2017].

[2] The Verge. (2016). iPhone manufacturer Foxconn plans to replace almost every human worker with robots. [online] Available at: https://www.theverge.com/2016/12/30/14128870/foxconn-robots-automation-apple-iphone-china-manufacturing [Accessed 26 Nov. 2017].

It will be interesting to see how companies like Foxconn deal with these isolationist policies. In particular, I wonder if these policies are just directed at forcing companies to manufacture where they sell, or if they are also looking to promote national companies over international companies. If the latter it could be difficult for Foxconn to operate anywhere a local competitor exists (e.g., United States), however if the former it seems much easier of a hurdle to overcome depending on the capex involved.

Very interesting essay! Although I am not in favor of isolationist policies, I think they can be seen as (forced) opportunities to restore some manufacturing competitiveness in the US [1]. And because plant automation is a more transferable asset than qualified workforce, introducing AI and robots in plants could be thought as a way to bring knowledge and know-how back in the US. If Foxconn were to relocalize their manufacturing bases in the US, the losses that would be generated by imposing tarif on imported raw material in the US could be alleviated by the gain on shipping locally-produced finished goods.

[1] Willy Shih, Restoring American competitiveness, 2009, HBR

Interesting article – I think one thing that’s often missed discussion isolationist policies is the range of benefits from foreign production beyond just cost. For example, Apple executives (see article linked below) claim that “overseas production facilities offer scale, flexibility, diligence and skilled workers that U.S. factories are no longer able to match”. In other words, when companies are forced or encouraged to produce locally, they give up not just lower costs, but also expertise and flexibility, so the costs to local production are higher than most think.

http://www.nytimes.com/2012/01/22/business/apple-america-and-a-squeezed-middle-class.html?pagewanted=all

I believe you are correct to be worried about the impact of isolationism on Foxconn’s supply chain strategy. Since they capitalize on their economies of scale by producing specific parts in different countries, it would be a large shift in production strategy and require large capital investment to produce all products for customers at domestic factories. This also begs the question of whether automated machinery can be easily programmed to produce a wide range of electronic components? If not and specialization is inherent in the machinery, then Foxconn’s supply chain strategy is further threatened and even more capital investment would be required.

Additionally, access to affordable raw materials varies between countries. Isolationism will drive up the cost of acquiring these raw materials which will further diminish margins for Foxconn. For multinational companies, isolationism certainly drives up costs.

There are two separate issues here. One is rising labor cost. The other is isolationism. On isolationism, in the short-term, Foxconn has some flexibility to avoid import tariff should it increase. Foxconn has a factory in Harrisburg, Pennsylvania, which can be used for final assembly for its handset business. Longer-term, I actually see Trump’s move to bring jobs back to the US as an unprecedented opportunity for Foxconn to make inroads in the US. The reason is that while Foxconn is a big supplier for Apple, it also owns a 65% stake in Sharp, a Japanese display/white goods/solar company (acquired in 2016), who sells products directly to US customers under the “Sharp” brand. On July 23, 2017, Foxconn/Sharp announced its $10mm investment in Wisconsin, with the White House signing a memorandum of understanding with the Wisconsin state government [1]. With that, Foxconn receives an incentive package of $3mm [2]. Essentially, with the government incentives to bring jobs back to the US, Foxconn/Sharp is able to bring manufacturing closer to its US customers. So net net, Foxconn has a balanced combination of businesses that helps weather through potential policy changes.

[1]https://walker.wi.gov/sites/default/files/Foxconn%20MOU.pdf

[2]https://www.reuters.com/article/us-foxconn-wisconsin/wisconsin-bill-giving-3-billion-incentives-to-foxconn-advances-idUSKCN1AX101