Foodora – A digital revolution of the food delivery industry

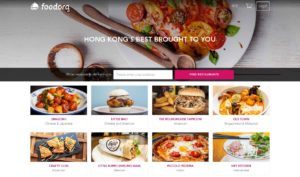

Have your favorite food delivered in 30 minutes! Foodora matches hungry customers and popular restaurants, by taking care of the delivery process and providing full transparency along the supply chain

It’s hard to imagine, but only three years ago in Munich, if it was one of those rainy days and you only wanted to stay in and order food, you had the overwhelming choice between an overly greasy, lukewarm pizza or Chinese food drenched in sweet-sour sauce. Foodora revolutionized the food delivery industry in Germany, by acting as an intermediary, delivering food from the most popular restaurants within 30 minutes. Since it was founded in 2014, Foodora has expanded to ~50 cities in 10 countries, employing more than 5,000 employees (excluding delivery boys).

How does Foodora work?

https://www.youtube.com/watch?v=RNoqeIxtv8A

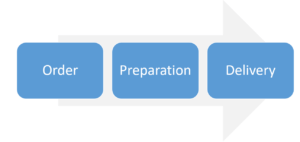

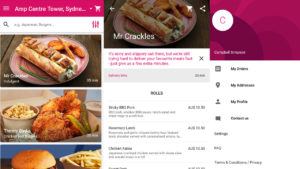

Order: The customer logs on to the App or website to choose their favorite restaurant and then selects their desired meals, pays online and completes the order. Foodora is responsible for all the content on the app/website, it has a professional photographer taking pictures for its best-selling restaurants.

Preparation: Once the customer has completed the order, the restaurant receives a notification and starts preparing the dishes. It also immediately receives the ETA of the delivery person and their name, so that it knows by when the food has to be ready and packed up in a Foodora bag.

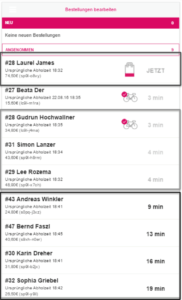

Delivery: Once the restaurant has prepared the food, it is handed over to a delivery person. Food is only delivered on bikes, in order to be environmentally friendly and faster. The delivery zones are very small (1.1 miles) in comparison to its competitors, in order to ensure fast delivery times (max. 30 min) and high utilization of the riders.

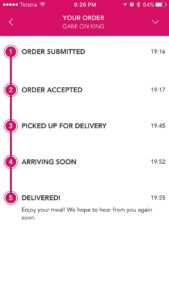

Both the customer and the restaurant have full transparency over the supply chain during the order. Customers get an ETA of their food before submitting the order, after submitting they can closely track each step along the supply chain. Once the food has been picked up at the restaurant, the location of the delivery person can be tracked to see the exact location of the rider.

How do Foodora, the restaurants and the riders make money?

There are two main ways: Each customer pays a delivery fee, depending on the city. In Munich it is currently 2.90€ (~$3.1) per delivery. The restaurants pay 30% of the order price to Foodora (e.g. of a 100€ order they pay 30€ to Foodora). Yet, the restaurant benefits of a tax difference of 12%. In Germany the VAT for a restaurant meal is 19%, yet for take-out it’s only 7%. The difference of 12% (which the consumer usually doesn’t know about) is kept by the restaurant.

For restaurants it is a very lucrative way to generate additional revenues/profits, since they mostly only accrue variable costs. Everything is in place already: the cooks, the infrastructure, the food etc. Foodora takes care of the entire delivery, so that the restaurants reduce idle capacity by preparing food for delivery. When restaurants realize that they cannot cope with high levels of demand, they can go offline until things have calmed down. Some restaurants in Munich are extremely sought after and popular (also due to the fact that it is almost impossible to get a reservation), so they have hired an additional cook to ensure smooth processes.

The majority of the delivery people are students, who deliver food as a side job. Similar to the UBER model, Foodora does not own any bikes. Foodora provides the pink delivery boxes, a helmet and jackets for the riders. The riders must have a smartphone and a bike to deliver the food. Some of the riders have assigned shifts and times, others can log on when they feel like getting some exercise done and earning 12€ (~$14) an hour, plus tip.

How does Foodora promote?

Scale is absolutely crucial in the food delivery industry due to rather low variable costs (only the riders), this is why Foodora has been very aggressive in terms of marketing. They have covered cities with printed ads, pink bicycles, pink balloons and graffiti.

Foodora also set up corporate accounts, where employees of big companies can log on after a certain hour and can order food from their desired restaurant. The companies set a budget per person, if an employee decides to order more, (s)he can simply use his/her credit card to pay for the difference. The amount is immediately deducted from the corporate account and employees no longer have to worry about expensing their meals.

What can Foodora do going forward?

Foodora should consider using its data in a better manner, they have accumulated extremely valuable information about eating patterns, restaurant choices, demographics, etc… Foodora can better leverage this information and e.g. sell it to research firms or to people interested in opening a restaurant/improving their operations. Although outside their core expertise, they could also help restaurants improving their inventory management and supply chain, using the data.

(795 words)

http://www.zeit.de/wirtschaft/2016-06/foodora-lieferdienst-essen-geschaeftsmodell

http://www.gruenderszene.de/allgemein/foodora-vs-deliveroo-test

http://www.sueddeutsche.de/muenchen/lieferdienste-fuenf-minuten-laufen-fuer-ein-essen-wirklich-nicht-1.3100473

http://www.wiwo.de/unternehmen/dienstleister/lieferando-lieferheld-foodora-beissen-lieferdienste-die-hand-die-sie-fuettert/14625238.html

http://www.spiegel.de/spiegel/lieferdienste-foodora-und-deliveroo-a-1098935.html

http://www.horizont.net/marketing/nachrichten/Lieferdienst-Studie-Nur-13-Prozent-der-Deutschen-kennen-Foodora-und-Deliveroo-143527

http://www1.wdr.de/verbraucher/ernaehrung/lieferdienste-essen-100.html

https://www.foodora.de/en/

Investor presentation

I was very interested to read this post because of the proliferation of recently launched food delivery services. Having read this post, I am not quite sure what Foodora does to differentiate itself from its competitors like Seamless, Postmates and DoorDash. In fact, it seems to me like, Foodora is more limiting than its competitors given the small delivery zones that the company has set up. In my opinion, like the market for on demand rides, the winner of the on demand food delivery service will be the company that can deliver the most meals reliably in the shortest amount of time for the lowest price. I agree that Foodora can leverage the data it collects to help optimize its operations, but I fail to see any competitive advantages that the company has in the marketplace.

They don’t exist in Europe!

There are two differences I noticed between Foodera and Silicon Valley delivery startups that I found really interesting – the first is your explanation of the VAT difference, and how restaurants can pocket the 12% that consumers are not aware of. That is a substantial boost to margins for the restaurant, which seems to allow Foodera to charge a higher cost of using the service (30% of order value) than US startups. I also thought that their network of “freelance bikers”, where Foodera only provides the delivery gear was smart – because it minimizes their liability and any capex. The only downside might be managing the ebb and flow of biker supply and demand – to which maybe ‘surge pricing’ for food delivery might be a next step.

I really enjoyed reading about Foodora. It sounds like they are doing everything right to position themselves against competition that might soon enter the European markets. I believe their first mover advantage will give them a boost and insulate them as long as they continue to be price competitive and partner with the right restaurants. I especially think their corporate partnerships are a means of true competitive differentiation. I believe that if their corporate partners are happy with their service, they will not switch away if competitors enter the market. Great company. Great idea. The founder must be a genius 😉