Ferrari: Innovation on the Road and Track

Racing legacy, engineering talent and scarcity have fueled Ferrari’s winning history and created an iconic automotive brand

Tracing its roots to the prodigious racing team Scuderia Ferrari founded by Enzo Ferrari in 1929, Ferrari is a leading automotive brand focused on the design, production and sale of high-end sports cars. In 1947, Ferrari produced its first race car, the 125 S, and one year later introduced its first road car, the 166 Inter. Since then, Ferrari has continued its racing dominance, winning 222 Grand Prixes making it the most successful company in Formula 1 history. Leveraging its extensive racing heritage, Ferrari focuses exclusively on the niche sports car market targeting high net worth individuals attracted to the brand’s unique styling and unmatched performance. By pursuing a low volume, high price point strategy, Ferrari has positioned itself as a true luxury brand, selling only 7,255 cars in 2014 across eight models that range in price from approximately $200,000 to over $1 million.

Embedded in Ferrari’s DNA, the company’s mission statement is to “win on both road and track” and their symbiotic business and operating models have enabled the company to generate over €2.8 billion in revenue with outsized EBITDA margins of 25% compared to an industry average of only ~8%.

Embedded in Ferrari’s DNA, the company’s mission statement is to “win on both road and track” and their symbiotic business and operating models have enabled the company to generate over €2.8 billion in revenue with outsized EBITDA margins of 25% compared to an industry average of only ~8%.

Scuderia Ferrari’s history of Formula 1 success and relentless focus on racing innovation has cemented the company’s reputation as a top automotive brand. With global viewership of over 425 million people, Ferrari’s business decision to support Formula 1 activities (generating a loss of ~€50-100 million annually) serves two core functions: (i) serves as the company’s main marketing effort, with no other spending on traditional advertising , and (ii) serves as a platform for technological innovation, which is ultimately used in Ferrari’s road cars that are sold to customers. Not only do Ferrari products carry a luxury and high-quality status, but also offer functional performance advantages over many other luxury and non-luxury vehicles. Research and innovation through F-1 racing has allowed the company to develop proprietary engine technologies, lightweight carbon fiber parts, traction control systems, aerodynamic designs and KERS (Kinetic Energy Recovery System) technology that make its vehicles unique and highly sought after compared to the average sports car.

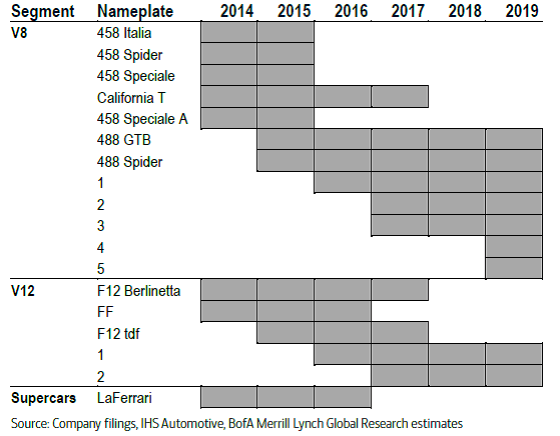

Ferrari’s focus on the upper end of the luxury performance car market and unparalleled skill of their engineers allow the company to design and develop new models exceptionally quickly. Moreover, their racing mindset, which is characterized by an annual design, develop and build schedules, have enabled the company to bring new models from initial development to production and delivery in approximately 40 months, and only ~33 months for modified models. The company typically offers a selection of only a handful of models in a given year, each with a life cycle of ~4-5 years. This rapid product refresh rate entices consumers into buying the next new model and the flexibility of their development process enables the company to continue to modify and adjust a new model’s specifications throughout the development phase up to the scheduled launch. The speed and flexibility of the development process also reduces development costs for new models and allows the newest models to be fully responsive to changes in technology and market demand.

Additionally, the company recently renovated its production facilities in Maranello, Italy, which allows for significant increases in production with limited additional investment. This gives Ferrari greater flexibility to proactively increase unit production to meet growing demand, if needed.

Ferrari key ingredient for success is its strategy of producing and distributing vehicles in extremely limited quantities, which creates a unique relationship where end-user demand becomes a function of supply. With extensive waiting lists and long lead-time delivery schedules, supply of Ferrari cars is greatly outstripped by customer demand. This selling model provides management with significant visibility and control over sales, while also allowing for considerable pricing power due to the exclusivity and scarcity of the vehicles. This strategy has served the company well, as evidenced by its performance through the Great Recession where unit volumes declined ~4% and revenue declined ~7%, while the company maintained profitability. In contrast, automotive giants like General Motors and Chrysler were forced into bankruptcy and other luxury automakers suffered significant declines. Thus, Ferrari’s business structure is uniquely more resilient to fluctuations in the business cycle.

Lastly, Ferrari’s low volume strategy and tight control over the allocation of cars allows the company to adjust the distribution of unit sales across its 60 worldwide markets and network of 182 dealers. Thus, the company can better respond to economic changes and focus on regions where demand for luxury cars is highest. To this point, the company has allocated a higher proportion of shipments to the Middle East and China and, to a lesser extent, the Americas and Europe, reflecting changes in relative demand as part of an overall strategy to manage waiting lists and maintain product exclusivity.

While Ferrari benefits from being one of the world’s most recognized luxury performance car makers, the company’s alignment of business and operating models has enabled it to achieve top-tier financial performance driven by innovative research and development from the racetrack and a limited distribution strategy that rewards its production capabilities.

Sources:

Ferrari corporate website <http://corporate.ferrari.com/en/about-us>

“Ferrari IPO Prices at Top of Range”. Wall Street Journal, Corrie Driebusch. October 20, 2015. <www.wsj.com/articles/ferrari-ipo-prices-at-high-end-of-range-1445375676>

New Business Netherlands N.V., Form F-1 Registration Statement. July 23, 2015. <https://www.sec.gov/Archives/edgar/data/1648416/000164841615000004/newbusinessnetherlands.htm>

“Protect the brand at almost any cost, but capacity to do more – initiating at Buy”. BofA Merrill Lynch Global Research, John Murphy. November 15, 2015

Nice post! Love the company… have worked with them before and they are pretty interesting. THey really do spend zero on marketing. THeir engineering/design process is also super interesting and completely different from more traditional auto manufacturers. Fascinating to see how they will evolve in a world of electric and driverless cars… Will the company continue to grow?

Thank you for the comments. I think Ferrari will continue to push the envelope with innovative technology as evidenced by its hybrid LaFerrari which uses a traditional V12 engine supplemented by a HY-KERS electric motor giving it 950+ bhp. I think it, along with other hypercar competitors like the McLaren P1 and Porsche 918 which use similar powerplants will remain at the cutting edge and companies like Tesla will find ways to bring similar commercial solutions to the mass market. I agree that if we ever get evolve to fully driverless car world, Ferrari will likely have no place, but as a purist, I hope that isn’t anytime soon.

Thank you for such a well-written and informative post. I’m amazed by Ferarri’s ability to seamlessly evolve its unique and timeless design with advances in technology and engineering. Ferrari truly is a model for blending art and science, and its EBITDA margin compared to the industry is truly impressive.

My concern for the company, however, is whether it is too reliant on remaining a niche, ultra high-end luxury product and if this business model can grow and evolve with the millennial generation. Ferrari will always have a cult following in pockets around the globe, but I wonder if it will be able to adapt if the extremely wealthy in emerging economies like China and the Middle East do not prove to be sticky customers. Ferrari is certainly a status symbol, but among our generation, I wonder how many people care.

Raj – thanks for sharing! I really didn’t know anything about Ferrari’s racing heritage and the fact that they spend almost nothing on marketing beyond the Formula 1 infusion is fascinating. In terms of value creation, it’s just so clear that quality stands behind the luxury brand, which seems to have been essential to their success all these years. I also think you really hit the nail on the head with your points about the “rapid refresh” 4-5 life cycle… if I’m someone considering buying a Ferrari, I don’t want a bunch of other people out there driving the same thing. Do you see this as counter to what Porsche has done? By iterating on the same models year after year? (I could be totally wrong on that, but it’s my understanding they have released the same models: Carrera, Boxster, etc. since their beginning).

Really cool post, Raj. With a business model designed around exclusivity and luxury, I wonder if Ferrari has any interest in controlling the secondary market for their vehicles. Perhaps some sort of buy-back program could be used to keep older (but not yet vintage), rundown models off the streets. With that in mind, I wonder if the company has a strong opinion about short term rentals and/or leases.