ExxonMobil: Why consider renewables if my business is already profitable?

Does climate change exist and should we worry about it? The question that crossed the minds of many executives at ExxonMobil. From 1998 to 2008, the company’s scientists were convinced that climate change did not have negative consequences on society[1]. During that time, there were two opposing school of thoughts on the reliability of scientific data that suggested climate change was negatively impacting the world.

But why would climate change matter to ExxonMobil? Because ExxonMobil has built an extremely profitable company from extracting and refining crude oil.

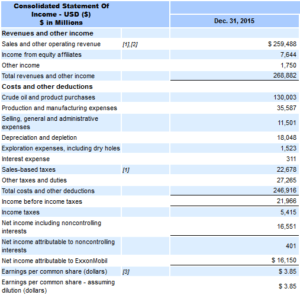

Table 1: ExxonMobil 2015 Income Statement [2]

Table 1: ExxonMobil 2015 Income Statement [2]

Now fast forward to 2016, ExxonMobil’s CEO has publicly admitted to the negative effects of climate change [11].

Video: Rex Tillerson admits Global Warming is real

But again, why should ExxonMobil care about the impact of climate change? To answer this question, we must further investigate the current business model of ExxonMobil.

ExxonMobil Divisions

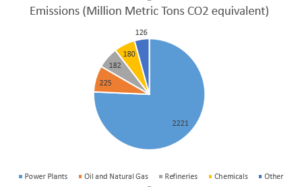

ExxonMobil has three main business units: Upstream (extraction of oil or natural gas from the ground), Downstream, (refining of crude oil to gasoline or other byproducts) and Chemicals (refining of oil into other chemical byproducts, such as plastics and glue). All three industries are big contributors to greenhouse gases: the oil and natural gas industry emits 225 million metric tons CO2 equivalent, the refining industry emits 182 million metric tons CO2 equivalent, and the chemical industry emits 180 million metric tons CO2 equivalent[3].

Chart 1: CO2 Emissions by Industries

Chart 1: CO2 Emissions by Industries

ExxonMobil as a corporation has been responsible for 4.7% to 5.3% of humanity’s industrial greenhouse gas emissions since 1882[4]. Considering the new greenhouse regulations, such as the Environmental Protection Agency (EPA) new standards, that are aiming to reduce global greenhouse gas emissions, ExxonMobil must re-examine its current operating model and consider removing the company’s dependency on crude oil[5]. Moreover, as an employee of an ExxonMobil Chemicals plant, I learned about the multiple fines that were imposed on the company for exceeding its daily allowable emission of greenhouse gases. To try to prevent the fines, management was constantly considering new ways to reduce the amount of emissions. The company built new units that recovered gases that would historically be emitted into the atmosphere. Since these new units do not improve throughput or machine utilization, the cost is completely associated with continued operations and will decrease the company’s margins. Also, with the continued increase of regulations, similar expenditures are expected to be implemented throughout every division of the corporation.

Company Response

Acknowledging the need to move in a new direction, the company has taken the following steps:

- Selling Assets: The company’s new strategy is to sell certain assets, such as refineries. Within the last few years, the company sold the Torrance, CA and the Chalmette, LA refinery. As an employee, it was communicated to the employees that all manufacturing plants, such as refineries and chemical plants, are up for sale, especially in states with very stringent emission regulations, such as California.

- Investing in New Technologies: ExxonMobil has recently made large investments into a Fuel Cell company that focuses on using carbon capture and sequestration (CSS) to remove carbon dioxide from streams in natural gas and power plants[6]. The company also made large investments into producing liquid transportation fuels from algae[7].

Working in the Research and Engineering division of the company, I learned about the large investments that the company made to improve operations and to find ways to reduce the emissions of greenhouse gases. The company has made tremendous strides to change the direction of the company, but why not completely change the business?

Challenges of Changing the Business

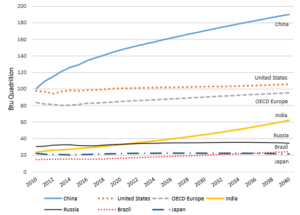

- Increasing Energy Demand: The world’s energy consumption is predicted to continuously increase, and it will be difficult for renewables to meet all of the world’s energy demand.

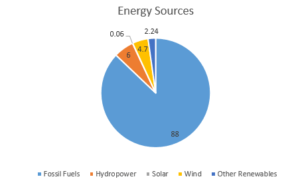

- Reliance on Fossil Fuels: Currently, Fossil Fuels supply 88% of the global energy demand, so the transition from fossil fuels to renewables will require large investments in the current energy grid and world infrastructure.

Chart 2: Energy Demand by Country [8] Chart 3: Energy Sources for the World [9]

The Solution

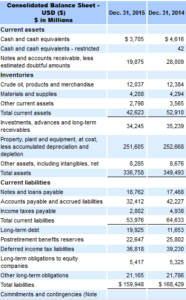

So, what should the company do? The answer lies on the balance sheet. ExxonMobil has $3.705 Billion of cash, so ExxonMobil should acquire a renewable energy company or build an in-house renewable energy division[10]. Diversifying into renewable technology not only allows ExxonMobil to reduce greenhouse emission, but it also makes financial sense to invest into renewable technology. By 2020, some experts predict solar will be the cheapest electricity on the planet and will become a competitive alternative to fossil fuels[8]. Additionally, with the additions of stringent industry regulations for the oil industry and tax incentives for renewable energy, the margins in the renewable energy industry will continue to increase while the margins for the oil industry will continue to decrease.

Table 2: ExxonMobil 2015 Balance Sheet [2]

Table 2: ExxonMobil 2015 Balance Sheet [2]

Word Count: 799

End Notes

[1] Greenpeace Org, “Infographic: Exxon’s Long History of Climate Change Denial,” Greenpeace Organization, http://www.greenpeace.org/usa/global-warming/exxon-and-the-oil-industry-knew-about-climate-change/infographic-exxons-long-history-of-climate-change-denial/, accessed November 2016.

[2] SEC, “ExxonMobil Corp: Consolidated Statement of Income – USD ($) in Millions,” U.S. Securities and Exchange Commission, https://www.sec.gov/cgi-bin/viewer?action=view&cik=34088&accession_number=0000034088-16-000065&xbrl_type=v#, access November 2016.

[3] Sofia Plagakis, “Oil and Gas Production a Major Source of Greenhouse Gas Emissions, EPA Data Reveals,” Center for Effective Government, February 12, 2013, http://www.foreffectivegov.org/oil-and-gas-production-major-source-of-greenhouse-gas-emissions-epa-data-reveals, accessed November 2016.

[4] Douglas Starr, “Just 90 companies are to blame for most climate change, this ‘carbon accountant’ says,” Science, August 25, 2016, http://www.sciencemag.org/news/2016/08/just-90-companies-are-blame-most-climate-change-carbon-accountant-says, accessed November 2016.

[5] Enesta Jones, “EPA Releases First-Ever Standards to Cut Methane Emissions from the Oil and Gas Sector,” US Environmental Protection Agency, May 12, 2016, https://www.epa.gov/newsreleases/epa-releases-first-ever-standards-cut-methane-emissions-oil-and-gas-sector, accessed November 2016.

[6] Maria Gallucci, “Exxon Mobil Corp. (XOM) Backing Fuel Cell Technology to Clean Up Carbon Emissions In Power Plants,” International Business Times, May 5, 2016, http://www.ibtimes.com/exxon-mobil-corp-xom-backing-fuel-cell-technology-clean-carbon-emissions-power-plants-2364598, accessed November 2016.

[7] Jad Mouawad, “Exxon to Invest Millions to Make Fuel From Algae,” The New York Times, July 13, 2009, http://www.nytimes.com/2009/07/14/business/energy-environment/14fuel.html, accessed November 2016.

[8] Rebecca Henderson, Sophus Reinert, Polina Dekhtyar, Amram Migdal, “Climate Change in 2016: Implications for Business,” Harvard Business School, October 14, 2016.

[9] EIA, “What is U.S. electricity generation by energy source?” U.S. Energy Information Administration, April 1, 2016, https://www.eia.gov/tools/faqs/faq.cfm?id=427&t=3, accessed November 2016.

[10] SEC, “ExxonMobil Corp: Consolidated Balance Sheet – USD ($) in Millions,” U.S. Securities and Exchange Commission, https://www.sec.gov/cgi-bin/viewer?action=view&cik=34088&accession_number=0000034088-16-000065&xbrl_type=v#, access November 2016.

[11] Ken Mataya, “Rex Tillerson admits Global Warming is real,” Youtube, July 22, 2016, https://www.youtube.com/watch?v=TkuyY2FFR7c, accessed November 2016.

I strongly agree that it will be critical for oil and gas (O&G) companies to diversity into additional revenue streams over the coming decades. In the past as when the upstream O&G industry was being negatively impacted by a downturn in the oil commodity prices the super major oil companies relied on their downstream and midstream operations, which were relatively counter cyclical, to reduce the impact of the prices on overall profitability. As Exxon sells more of its downstream operations it will need to diversify its portfolio and their ability to manage large scale capital intensive projects will be an asset if they transition into renewable power generation.

I definitely agree with your view that Exxon, and O&G companies in general, need to begin shifting their future strategy toward renewables, for both environmental and financial diversification reasons. One big challenge I see these companies needing to overcome though, is deciding how best to diversify. Is Exxon better off acquiring other renewable companies, or should it focus primarily on building in-house capability? If it focuses on acquisition, the challenges I see are whether renewable companies will want to be acquired by an O&G firm, and if they are, will customers’ view of the renewable company change now that its brand image is associated with oil and gas? On the other hand, if Exxon chooses to build up an in-house renewable division, will it have enough existing capabilities/experience to compete with other renewable companies? And finally, how will Exxon manage any potential culture clashes between an in-house renewable division and its current traditional segments? I believe this shift towards renewables is vital for O&G companies, but as they consider their new strategy, it will be just as important to select the right design choices and understand how to overcome the hurdles above.

Following up on Mary’s comment, as much as I can understand the strong interest your proposed solution sparks, I remain very dubious as to how such an endeavor could be achieved.

Let me draw a comparison with a similar company, for instance french TOTAL. Over the last couple of years, Total acquired stakes in solar energy and energy storage services. It also showed some strong interest in a battery company. The idea was that, eventually, this approach would create a vertically integrated renewable energy giant of the future, replacing big oil. But that’s just it, the emphasis is on “replacing”. Total is initiating a radical shift for its future. It decided to change its core business over time. The company brings to the table what most renewable energy companies lack : capital. By doing so, it establishes itself not anymore as an O&G company, but as a broader energy provider.

Going from black to green, is a long, arduous process. But it seems to me highly to be able to mix the two under the same roof indefinitely. At the end of the day, the company needs to know where it stands and which “path” it chooses to follow.

I agree with your view that Exxon should consider diversifying away from its fossil fuel business as there is a potential for a systemic risk, should carbon price be introduced worldwide. I would however challenge your assumption that “the margins in the renewable energy industry will continue to increase”, which makes Exxon decision harder than how you describe it. Developing a Renewable Energy business at scale is inherently a low margin business, and hard to make a profit from: “First Solar is a rarity in the green-energy industry. It is profitable”

(http://www.nytimes.com/2016/04/24/business/energy-environment/renewable-energy-stumbles-toward-the-future.html). Exxon Mobil is the best at what it does, even in a low oil price environment, Exxon still manages to be part of the top 10 most profitable fortune 500 companies (http://fortune.com/2016/06/08/fortune-500-most-profitable-companies-2016/). So should the company stick to a very well executed and profitable business, or risk moving into a low margin, commoditized business?

Thank you Franklin – great article. I am quite surprised by the numbers. Mankind’s reliance on fossil fuels is still quite significant. As you mentioned, Solar is truly an opportunity. Particularly in remote places all over the developing world, solar will make a difference in the lives of millions.

Although Exxon continues to make investments in environmental efforts, I don’t believe there is anything sustainable which is structurally part of their business. It might be a matter of time or changes in the demand for energy. Furthermore, I look forward to the day in which Exxon has an Upstream business, a Downstream business, a Chemicals business and a Renewables business unit.

This is a tough topic to tackle and I appreciate the thoroughness of your article; the charts and graphs were great. I was most intrigued by your observation that the world’s energy needs will continue to grow and renewable energy sources will not be able to keep pace at the current trajectory. Given Exxon’s scale and available assets, I agree that they are well positioned to became a major player in the renewable energies space. It would be great to investigate which type of renewable energy they should invest in. Did you see any research or hear of anything while you worked at Exxon as to the likelihood of your recommendations.