Even Goldman Sachs Cares About Climate Change

Climate change brings massive uncertainty that threatens global financial stability.

“It’s a matter of business, it’s a matter of economics, it’s a matter of growth…and it’s a matter of the health and wellbeing of all of our stakeholders, including our children and our grandchildren.” –Lloyd Blankfein, Nov 2, 2015 (1)

Why care?

Goldman Sachs is one of the largest banks in the world, generating over $35 billion in revenue and providing a wide range of investment banking, securities and investment management services to its clients, who include corporations, governments, institutions and individuals.(2) Goldman Sachs’ prominent position on the global financial stage means that it plays a crucial role in allocating and providing capital to thousands of institutions in almost every region in the world. Whether it is short-term asset damage resulting from a violent storm, or determining the proper methodology to account for climate change in asset prices, environmental change presents a remarkable challenge to all banks, including Goldman Sachs.(3)

How will this play out?

The evidence for climate change is quite clear, with the past three decades each being warmer than any decade since 1850 and the level of greenhouse gas at its highest than at any other point during the past 800,000 years. The main driver of this change is emission from the combustion of fossil fuels such as coal and oil, which is only further accelerated by humans’ poor management of environmental resources. Most scientists agree that humans are likely the main contributor to climate change.(4) No single issue is more global than climate change.

Banks have become truly global institutions, allocating capital to institutions on every corner of the planet. Given the nature of their business, banks are tied to the fortunes of their clients in an intimate way. Putting some numbers to this scenario, we find that nearly 83% of the world’s Fortune 500 companies view climate change as a business risk.(4) The view is even more dim when looking on an industry by industry basis, where we observe the following:

- Many consumer goods retailers have started measuring the impact of climate change on their supply chains

- Raw material and agricultural companies are facing the risk of water scarcity

- Two thirds of utility companies believe extreme weather are a significant risk for their production

- Insurance premiums may rise exponentially in some regions where weather extremes are particularly severe and unpredictable (4)

Every business in the world, regardless of size, faces exposure to the weather and climate, either directly or indirectly. This exposure will translate directly into increased costs for businesses, which will reduce earnings and increase the risk that these businesses pose to their creditors and stakeholders. Climate change costs could manifest themselves in a variety of ways, for example a devastating weather event might lead to an abrupt bankruptcy or increased costs could reduce a business’ ability to repay interest on a loan.

Measuring the Risk

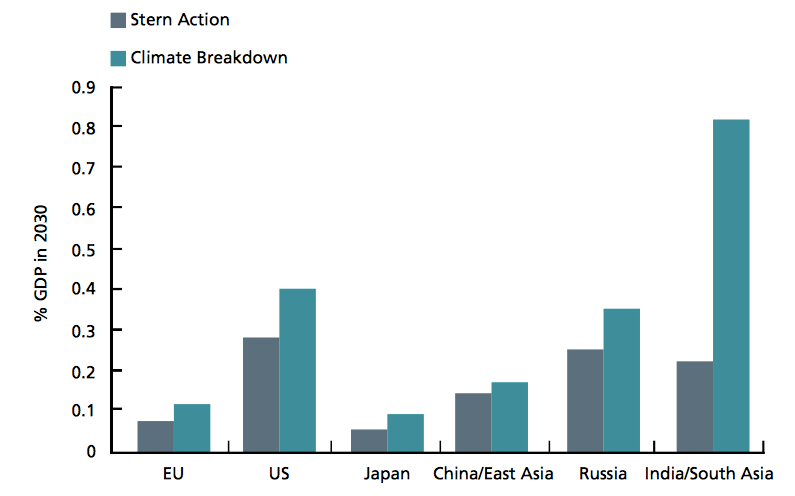

Examining the physical impact costs of climate change is one of the most practical methods to measure the near-term cost of environmental change. The chart listed below shows the cost as a percentage of regional GDP based on two scenarios (gray representing emissions reduction and green representing the current course of emissions growth). The data below shows the cumulative cost to changes to environment, food and health security, estimated to be in the range of $1.5 tr to $3.7 tr to 2030, representing $70 billion to $180 billion annually to 2030. (5)

Source: “Climate Change Scenarios – Implications for Strategic Asset Allocation”. Page 31.

What is Goldman Doing?

Faced with the scenario laid out above, Goldman Sachs has taken a strong stance to combat climate change that involves not only its internal operations but also how it interacts with clients. Specifically, Goldman has made several pledges and launched a number of initiatives, with a few examples of these programs listed below:

- Goldman has pledged to expand its clean energy target to $150 billion in financings and investments by 2025 to facilitate the transition to a low-carbon economy in addition to being active in the development of carbon markets

- Goldman is assisting clients in managing risks related to climate change by developing innovative capital market solutions, including weather-related catastrophe bonds

- Goldman will conduct a carbon footprint analysis within the Goldman Sachs Asset Management portfolio and work with clients to help them understand the impacts of their portfolios on the overall environment

- Goldman achieved carbon neutrality across its operations in 2015 and is targeting the use of 100% renewable energy to meet its global electricity requirements by 2020 (6)

Climate change is an issue that transcends beyond business into every community in the world and threatens to directly impact each person on our planet. All companies must take steps to reduce emissions and become better stewards of their environment — the global economy literally depends on it.

(Word Count: 797 Words)

Sources:

- Goldman Sachs Website. Multimedia. Accessed November 2, 2016. http://www.goldmansachs.com/citizenship/environmental-stewardship/index.html

- Goldman Sacks Website. “At A Glance”. Accessed November 2, 2016. http://www.goldmansachs.com/who-we-are/at-a-glance/index.html

- “Are Banks Prepared For Climate Change?”. Boston Common Asset Management. 2015. Accessed November 2, 2016. https://bostoncommonasset.com/Membership/Apps/ICCMSViewReport_Input_App.ashx?IX_OB=None&IX_mId=18&IX_RD=Y&ObjectId=731308

- “Would you drive a motorcycle without a helmet?” Interview with Sabine Miltner. October 15, 2013. Accessed November 2, 2016. https://www.db.com/cr/en/concrete-the-impacts-and-risk-of-climate-change.htm

- “Climate Change Scenarios – Implications for Strategic Asset Allocation.” International Finance Corporation. Accessed November 2, 2016. Page 31. http://www.ifc.org/wps/wcm/connect/6b85a6804885569fba64fa6a6515bb18/ClimateChangeSurvey_Report.pdf?MOD=AJPERES

- Goldman Sachs Environmental Policy Framework. Accessed November 2, 2016. http://www.goldmansachs.com/s/environmental-policy-framework/index.html

Hi Phil,

Super interesting analysis and not something I had considered before. The concepts Goldman Sachs + Climate Change did not overlap in my head at all. Uniquely – as you pointed out nicely – it does seem like Goldman Sachs is widely exposed to the risks of climate change. What’s most interesting here is that it seems to me that the investment banks (in general) interests are aligned with the planet’s interests. In other words, the planet’s best advocates would be those organizations that incur costs in a 100000000:1 ratio with the planet whereas the planet’s worst advocates are more likely to be those organizations that incur costs in a 1:1000000000 ratio with the planet. Thus, if the investment banks are broadly exposed to many industries (as you argue they are) then they are in a position to be strong advocates for climate change mitigation roles.

Given that their business is primarily B2B, do you see them as able to influence their customers at all? My guess would be this is very difficult to do given how competitive the investment banking world is but this would seem to be where a major opportunity would be to exert subtle pressure given the number of customers they interact with and provide value for.

Taki

Phil, you are very right to point out that, “Every business in the world, regardless of size, faces exposure to the weather and climate, either directly or indirectly. This exposure will translate directly into increased costs for businesses, which will reduce earnings and increase the risk that these businesses pose to their creditors and stakeholders.” One key question that global policymakers are currently considering is whether companies should be required to estimate and disclose their “climate change exposure” as part of their financial filings. This work has attracted a lot of attention, including from Mike Bloomberg (for more info on what Bloomberg is doing, see: https://www.fsb-tcfd.org/). However, as you might expect, this work is still controversial, and policymakers and private-sector stakeholders are in the early stages of figuring out exactly how to do this type of disclosure. If an effective standard for disclosing “climate change exposure” could be developed, it would help markets do a better job of pricing in climate risk and drive private sector-led solutions to address climate change. GS might want to consider lending its considerable financial acumen to this important effort – to better understand the risks in its own portfolio, to better understand the risks facing clients, and to help markets play a critical role in fighting climate change.

Phil–I’m having a hard time seeing the connection between Goldman’s initiatives and the reduced earnings/increased risk in businesses more broadly (presumably Goldman’s clients) due to climate change. Even if climate change costs companies billions (or trillions), why does that impact Goldman’s business lines directly? M&A activity will continue (or maybe even increase as the need to consolidate increases in face of rising costs), a loan default doesn’t really impact Goldman as most of their financing fees are made on close, restructurings will result in fees to financial advisors, and sales and trading is a spread business that in theory should not depend on whether a company’s stock rises or falls.

More broadly, energy-inefficient business models will be replaced by clean energy ones, so the total $ value of businesses in the US is not going to decline. While there certainly are other reasons for GS to have these energy initiatives (PR/CSR, etc.), I don’t think they personally care if the earnings of certain companies decline because of climate change costs.

Phil, thank you for your post. In response to Frank’s struggle to see the connection between the initiatives and impact on GS’ business, as someone who worked at the firm for 5 years, I can confirm that an impact on GS’ business exists and likely will become more pronounced over time. Two examples that pop into my mind are the firm’s situation post Hurricane Sandy and winning business mandates from clean energy firms that want their partners to be like minded. While most of downtown Manhattan (and the major US stock exchanges) were shut down for at least several days post Hurricane Sandy, GS’ downtown headquarters never lost electricity and was fully operational the day following the hurricane. GS’ employees that were able to commute into the office were able to work and our clients appreciated our availability. For example, we were in the middle of marketing Restoration Hardware’s IPO during the hurricane and were able to price the offering on the expected pricing day, which was greatly appreciated by the client. And, as mentioned above, the firm has won a number of mandates from clean tech clients such as Tesla, partially due to the firm’s sustainability practices.

Further to Mary’s point, in addition to the second- or third-order effects of climate change on investment banks through their clients, first order effects have also come to the fore due to natural disasters in the past few years. In my previous job, I advised most of the major US investment banks in designing their annual stress tests. Part of this exercise requires a bank to design a crisis scenario tailored to their own organization (encompassing macro and firm-specific risks) and then forecast impacts on income and capital under this scenario. Over the past few years, every single major bank has incorporated a natural disaster scenario into their stress test. For one of my clients, this was not just a hypothetical – a major East Coast hurricane wiped out a critical data center located in Virginia, which, shockingly, was the first time that senior management realized that the data center was not backed up / redundant with any thing else. The ensuing days-long lack of accessibility to client data nearly triggered a bank run and a liquidity crisis. It may seem outlandish, but banks are including things like, giant-tsunami-wipes-out-entire-NYC-operation into their stress testing scenario as the risks of climate change grow and they realize their own exposure to geographic concentration risk.

Great post Phil!