Ellevest: Can machine learning reverse gender biases in investment management?

Ellevest is developing a robo-advisory platform designed to meet women’s unique financial needs.

Over the past ten years the power of machine learning has been harnessed to provide automated investment advice at low costs through robo-advisory platforms. Robo-advisors are digital platforms that use machine learning to guide customers through an automated investment advisory process. Similar to traditional financial advisors, robo-advisors allocate a client’s assets based on risk tolerance and target returns. However, robo-advisors differentiate themselves by using machine learning algorithms to guide customers through an automated investment advisory process with limited human intervention. The market is sizeable and growing; estimates suggest the U.S. market potential for robo-advisors is around $400 billion.

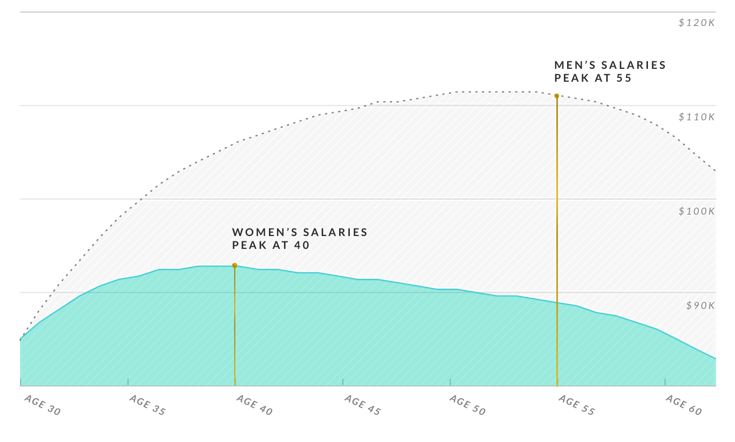

However, traditional investment management services and most robo-advisors have been designed to meet the needs of men. Today, 86% of investment advisors are men, with an average age of above 50 years old. Studies find that 73% of women are unhappy with offerings in the financial services industry, despite women controlling $5 trillion in investable assets. On the whole, investment management tools today fail to account for key differences in the financial lives of women, such as how much women earn and the timing of their earnings. Factors like pregnancy and child raising lead women to take more career breaks, the gender pay gap affects women’s overall earnings, and on average women’s salaries peak earlier in their careers as compared to men’s salaries. In addition, women live six years longer on average, and therefore need to think about investing over a different time horizon.

Figure 1. On average women’s salaries peak earlier in their careers as compared to men’s salaries.

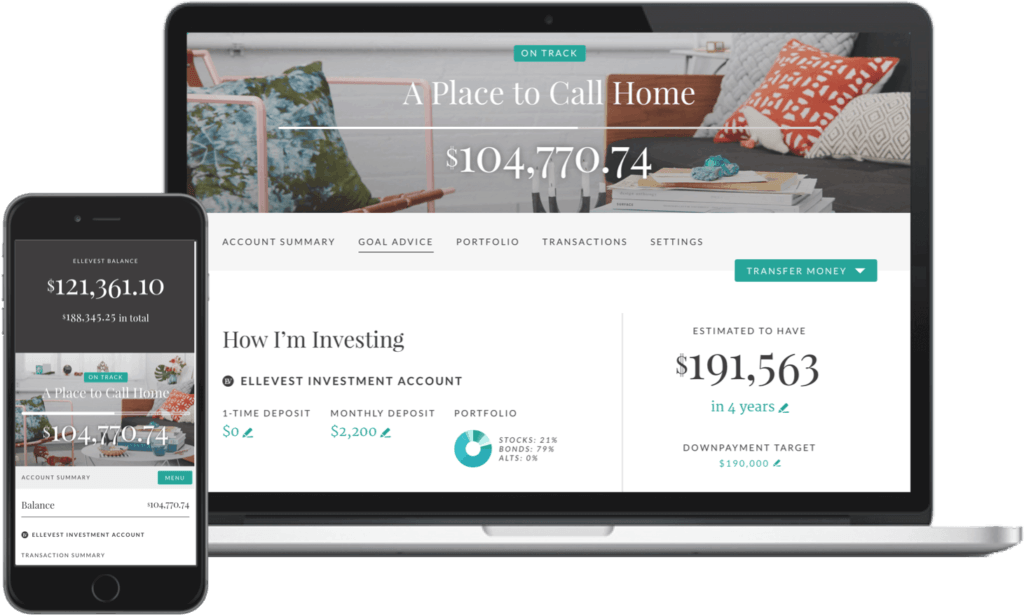

To address these realities, Ellevest’s platform has developed a proprietary algorithm powered by machine learning technology and tailored specifically to women’s incomes and life cycles. The company’s algorithm differs from competitors in that it considers factors such as earnings trajectory and anticipated career breaks. It provides women with an investing strategy based on the life events they indicate as most important such as: starting a business, having a child, buying a home, starting an emergency fund, or retirement. Ellevest’s investment management platform is based on the notion that women fundamentally need to make different investing and saving decisions than men.

Figure 2. Ellevest’s platform provides women with an investing strategy based on the life events they indicate as most important, such as buying a home.

The Ellevest business model is in many ways similar to its “gender neutral” competitors such as Betterment or Wealthfront. It develops investment portfolios for clients using primarily ETFs, with no minimum deposit required. The platform offers multiple options based on fit with age, goals, risk tolerance and other factors. Recently, Ellevest updated its fee structure to be at parity with Wealthfront and Betterment, both of which charge a 0.25 percent fee for digital-only investment services. In addition, Ellevest offers premium services at a higher fee of .50 percent which includes 1:1 executive coaching and personalized financial guidance.

The next critical step for Ellevest is to demonstrate that its algorithm can indeed generate superior financial and investment outcomes for women. In order to do so, customer acquisition should be a primary focus in the short to medium term. The Ellevest platform will need to continue to grow its user base such that it can draw conclusions as to whether or not its algorithms’ factors are indeed the right ones to optimize financial outcomes for women.

Over the long term, Ellevest may need to refine its product offerings. Studies suggest that women prefer to receive interactive financial advice with the ability to ask questions with personal interactions. However, Ellevest’s premium services are more expensive that those of competitors. For example, Betterment’s Premium option, which includes a team of financial advisors available via phone and email, costs only 0.40 percent compared to Ellevest’s 0.50 percent fee. Over time, the 0.10 percent difference can make a huge difference in the wealth accumulation of women, who already face the gender pay gap earing 0.70 percent of what male counterparts earn.

Looking ahead, critical questions remains unanswered. Can updated algorithms truly provide superior investment advice and outcomes for women? More broadly, is it possible to use machine learning to reverse gender biases in investment management?

(790 words)

Sources:

1. Wallace, Charles. (2017) Machine Learning in Finance: Is a Robo-Advisor Smart Enough to Invest Your Savings? Samsung Insights: Wealth Management. [https://insights.samsung.com/2017/06/08/machine-learning-in-finance-is-a-robo-advisor-smart-enough-to-invest-your-savings/] Accessed November 2018.

2. Jung, Dominik & Dorner, Verena & Glaser, Florian & Morana, Stefan. (2018). “Robo-Advisory: Digitalization and Automation of Financial Advisory.” Business & Information Systems Engineering. [https://www.researchgate.net/publication/322643071_Robo-Advisory_Digitalization_and_Automation_of_Financial_Advisory] Accessed November 2018.

3. Citi GPS. (2016). “Digital Disruption: How FinTech is Forcing Banking to a Tipping Point.” [https://www.nist.gov/sites/default/files/documents/2016/09/15/citi_rfi_response.pdf] Accessed November 2018.

4. Boston Consulting Group. (2009). “Women Want More in Financial Services.” [http://image-src.bcg.com/Images/BCG_Women_Want_More_in_Financial_Services_Oct_2009_tcm81-125088.pdf] Accessed November 2018.

5. Ernest & Young. (2017). “Women and wealth: the case for a customized approach.” [https://www.ey.com/Publication/vwLUAssets/EY-women-investors/$FILE/EY-women-and-wealth.pdf] Accessed November 2018.

6. Fast Company (2017) “Gender-Neutral Investing Is A Fallacy, And Ellevest Knows Why.” [https://www.fastcompany.com/40489502/gender-neutral-investing-is-a-fallacy-and-ellevest-knows-why] Accessed November 2018.

I would be interested to understand why women are unsatisfied with the financial service offerings currently available. Is it related to the way that women consume financial services or that women include other factors outside of traditional return-risk analysis into their investment decisions? Do women consider the social-impact of their investments more important than men? It seems like Ellevest’s challenge will be to sustain differentiation of its offering, since at its core it is identical to other robo-advisors, seeking to generate high returns, while minimizing risk. I also think that Ellevest is uniquely positioned as family composition in the U.S. and globally changes. As divorce rates and single-parent households increase, more women will be making their household investment decisions and will look for an investment advisor that provides them with more flexibility to address their unique life events.

It seems that many consumers, and women in particular seem to prefer a hybrid solution (financial advisors available via phone and email). Do you think that the same technology used in the digital-only option should be the same technology used in the premium option? Since the premium option is combined with a team of live advisors should it allow for greater customization?

I had not heard of robo financial advisors and found the concept interesting. It is interesting to think about how robo advisors could be deployed to better serve female investors. I like the idea of a women-centric product. I am skeptical that machine learning alone will reverse gender biases, but if thoughtful humans are creating the training, perhaps it is possible.

While I am not a user, I have followed ElleVest for a while. While working at Fidelity, I –along with a few woman in my floor– started a group called “Invest Like a Girl” to help each other out with our personal investments. We felt that the investing world has a huge barrier to entry. We wanted more support in the process of making our first investment and a community feel. Thus, I think that the mission ElleVest is after is very important. That said, I am not sure that they should limit the target population to woman. To me, it is just a more human approach to investing. One that understands is users and is welcoming to all the situations in your life. When thinking about AI and your question of can AI deliver better results, I really don’t know. Like Prof. Loveman said, never say anything stupid about the stock market. Getting Alpha some would argue is impossible. What I do think is possible is using the technology to better understand patters in our lives and account for them.

I would like to know why women are unsatisfied with current financial offerings?

Also, from personal experience, I worked both for male and female partners at an investment advisor and we had both male and female clients of different ages and points in their lives. I would really like to understand how this platform is actually individualizing its investment strategies towards women that the other robo-advisors or actual advisors couldn’t/don’t do? (other than marketing themselves as a platform for woman investments?)

This is an interesting read. As you mentioned, the gender gap remains a critical issue in society, and any solution that helps bridge that gap and drive greater inclusion of women in the workplace undoubtedly serves a very important need. Similar to what others have mentioned above, it would be very helpful to understand what exactly women do not like in the current offerings to ensure that the Ellevest solution is delivering on these specific needs and differentiating itself in the right way to serve its target market. Furthermore, it is most critical that the offering is at least as good as the others on the market from a functionality perspective to ensure that it does not in anyway disadvantage the women who choose to use it. To address your question on using machine learning to reverse gender biases, I am not quite sure that machine learning alone can be the solution, as most of the challenge lies in changing the fundamental perceptions and constructs of society as a whole. However, I do feel that if such digital solutions are implemented in the right way they can help get us there faster!