Education Content in a Digital Age

Book publishing to educational technology – yay or nay?

When was the last time you stepped inside a K-12 school? Did you notice anything there that didn’t exist when you were growing up? Perhaps it’s a Chromebook on each student’s desk, a SMART board on which the teacher projects her computer screen, or the fact that there are very few papers anywhere.

Earlier this year, EdTechXGlobal, a leading education technology-focused conference, released a forecast that the global edtech market is expected to reach $252 billion by 2020[1]. The education market is currently a $5 trillion opportunity, yet only 2% is digitized (~$100 billion). As the edtech market is expected to more than double in the next five years, traditional education companies must also evolve to take advantage of the growth, especially as young people’s consumption habits and preferred modes of research shift (Exhibit 1).

Exhibit 1

Although most companies are capitalizing on the technology trend, one major public company has decided to position its growth strategy in a subtler way. Houghton Mifflin Harcourt (“HMH”) is a leading provider of pre-K12 education content whose core business for over the past 150 years was in education and trade publishing. However, in its most recent investor presentation, HMH, who has traditionally published textbooks, instructional technology materials, assessments, reference works, and fiction and non-fiction books, has chosen to frame its new content as a design improvement rather than a technological improvement: “improving design will have a greater effect on learning outcomes than adding features or increasing the use of technology[2].” Why? I believe that because educational software advancements in the modern age requires relatively low capital investment, HMH needs to find a new way to stand out amongst all of the other applications. In order to do this, HMH needs to signal to its customer that the true value proposition of the products is the functionality of its platform, rather than being the fastest or most tech-enabled software (Exhibit 2).

Exhibit 2

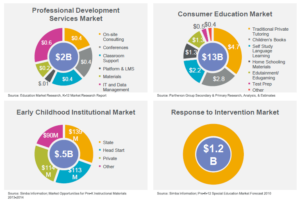

Furthermore, a key component of HMH’s strategy is to expand into adjacent education areas, primarily services such as professional development, consumer education, early childhood institutional, and response to intervention. While these markets are small (~$17 billion altogether (Exhibit 3)), the nature of these services are more stable and represent recurring revenue as once business is won, customers are less likely to switch as costs of changing instructional material year to year is high.

Exhibit 3

One example of this is a recent acquisition that HMH made. In August 2015, HMH announced that it had acquired Scholastic’s Education Technology and Services business for $575 million[3]. Scholastic’s EdTech (“EdTech”) segment provides digital intervention curriculum, products and services to schools in the U.S., as well as various assessment and other consulting services. With this acquisition, HMH expects EdTech to help craft a market leading position in intervention and enhance its offerings and capabilities in growth areas such as consumer business platforms and marketplaces[4]. By acquiring these services and relationships that Scholastic has built, HMH can more quickly scale its intervention services as the acquisition enhances its ability to cross-sell various products, such as literacy and mathematics intervention.

While I believe it’s a smart move on HMH’s part to invest into these high growth areas and play defensive on its educational content, I don’t believe that HMH should completely focus its strategy on responding to the changing technological aspects of education. In its own Educator Confidence Report (conducted by a third party market research agency), two-thirds of educators cited infrequent use of digital tools for various learning purposes, and 71% of those who do use some type of digital material in their classrooms use free / open-educational resources. This implies that the adoption curve is slow, especially as in the education market it’s the administrators who are the key decision makers in selecting paid instruction content and products. I argue that instead, HMH should focus on enhancing the privacy and security of its products instead, as 58% of educators are either “very” or “somewhat” concerned about student data privacy. (675 words)

[1] http://www.marketwatch.com/story/global-report-predicts-edtech-spend-to-reach-252bn-by-2020-2016-05-25-4203228

[2] Investor presentation.

[3] http://www.hmhco.com/media-center/press-releases/2015/april/scholastic-acquisition

[4] 2015 Investor Presentation.

Completely agreed with your point above – HMH should not completely shift its strategy to digitizing education. I think the adoption curve is slow not only because administrators are the ones selecting educational products, but also because many hard-copy textbooks used in schools have a long life cycle and the replacement of such books is often over a 5-10 year time span. Furthermore, schools (particularly public schools) have very tight budget constraints, so I would imagine them to be very price sensitive and hesitant to switch to digital (presumably this would mean that iPads / some mobile device would have to be purchased for each student, along with the digital book).

Sarah Me – Thanks for the great post on the digitization trends in K-12 education. The same tensions are evident at the university level with Barnes and Noble Education (“BNED”) and Follett, the two largest third-party college bookstore operators in the U.S. BNED, for example, had been investing ~$26mm per year over the last three years in its Yuzu educational technology platform to position itself for the eventual digital transition in educational content delivery. Due to slow adoption rates at the university level, BNED recently wrote off its Yuzu investment and decided to partner with a third-party developer instead. In fact, it appears that both students and teachers are slow to change, making the timing of the digital transformation difficult to predict (according to a recent study, 90% of college students prefer reading paper books over e-book). [1]

How do you decide how much to invest in an uncertain digital future? As we saw with BNED, investment timing really matters: start too soon and you waste shareholder capital but start too late and you could lose relevance in a fast-changing market. Given the dynamic education market, how do you know?

[1] http://www.techtimes.com/articles/131055/20160205/more-than-90-percent-of-college-students-prefer-reading-paper-books-over-e-books.htm

I totally agree with your comment that “HMH needs to signal to its customer that the true value proposition of the products is the functionality of its platform, rather than being the fastest or most tech-enabled software”. There are a couple of major challenges that education companies face during the transition into the digital world: (1) teachers don’t feel comfortable using the solutions and don’t understand how to use it in the most effective way (other than simply substituting physical textbooks for digital equivalents) (2) fears that the beginning of the digital age marks the end of the teaching profession. As you say, it will be important for HMH to solve these problems rather than focusing on rapidly digitizing. One important piece of the puzzle is to coach teachers on how to use the material effectively and to increase awareness that these tools will be a fantastic supplement, rather than replacement for teachers.

The digitization of education is very interesting. I believe many schools look to technology as a one-size fits all problem that will solve all the issues that American classrooms are facing. However, many educators have voiced concerns with the shift towards technology. Scientists have determined that the brain interprets digital and printed text differently, and that in fact comprehension is diminished when reading via a digital screen. Scientists have used fMRI while students read to see how the brain works when a subject is reading. The research showed that when reading print different neural pathways are used than when reading digital. This suggests that digital may not be a one to one switch for students. While I think digitization can serve a great purpose in the administrative tasks of a classroom, I worry that the world has too readily accepted technology as an easy panacea for all the problems that are faced in the classroom. I would hope that before schools completely eliminate paper in the classroom that they spend time assessing the negative externalities that come with going digital.

Sarah, excellent article on the state of the edtech industry.

I actually wonder more broadly whether edtech is articulating the right value proposition to a consumer-base of predominantly public institutions with ever-shrinking budgets and ever-soaring mandates to improve. While I believe many of us appreciate the convenience and additional functions available through digitizing our learning materials, many less prosperous school districts can likely only justify these purchases through their proven ability to improve student performance on exams. Calling for an industry to perpetuate an imperfect system is of course not the objective, but may be necessary to continue its growth.

syu

Sarah – I really enjoyed this post. I actually spent a fair bit of time researching edtech companies in my prior job. We found them to be highly defensive companies to invest in, due to the ways in which they provide cost savings to the educational industry. I wonder how much HMH uses cost savings in its pitch to schools. I agree, costs to switching are incredibly high in this industry and therefore it is paramount to have a service with proven results. Cost savings matched with results is an unbeatable combination for a company. Also, I wondering if HMH is planning to move into any other adjacent categories such as dropout recovery.The state will actually pay edtech companies to find highschool dropouts and educate them via online platforms so that they can pass their GED tests.

Very interesting post. I would love to hear what you think about recent forays into education technology by higher education, like Harvard. As Pooch mentioned, edtech companies can offer substantial cost savings to schools. Edtech also has the potential to offer significant cost savings to students, however that is not always the case. Many RCs took Harvard’s HBx CORE before starting business school instead of the traditional bootcamp that HBS usually offers. For many this was an easier way to take classes, for many it was not as effective. Do you think that higher education has a responsibility to experiment with edtech advancements or, conversely, do they have an obligation to continue to offer students traditional education approaches?