Dunkin’ Brands: A Cup of Coffee is a Cup of Coffee

Despite great efforts to increase relationships and product offerings, all customers want at Dunkin’ Donuts is a quick and cheap cup of coffee.

Dunkin’ Brands is the parent company of Dunkin’ Donuts (DD), Baskin-Robbins, and Dunkin’ International. As DD accounts for 75% of the revenues for Dunkin’ Brands, it will be used interchangeably here as the core of both the business and operating models revolve around DD [1].

Business Model: DD focuses on being the everyday stop for coffee and baked goods, offering lower prices than Starbucks and faster wait times than McDonald’s. While Starbucks focuses on being the “third place,” an “affordable luxury” where people can share and enjoy a cup of coffee with friends and colleagues [2], Dunkin’ Donuts focuses on providing a quick cup of coffee and donut for a hard working, cost-conscious customer on the way to work. Unfortunately, with the recent entrance of McDonald’s McCafé, Dunkin’ Donuts has found itself being squeezed by on both sides. The three ways that DD differentiates itself from its competitors is through great tasting coffee, quick service, and cheap prices.

- Great tasting coffee: Dunkin’ Donuts has won many awards for the taste of its coffee. Its website explains how it is ranked #1 for customer loyalty in the coffee category for nine years [1]. Additionally, it has been ranked #1 for both iced and hot coffee by CREST data in 2014 [1].

- Quick service: A Houston based news station did some research into the average wait time at Dunkin’ Donuts, Starbucks, and McDonald’s. The results put Dunkin’ Donuts in a competitive 2nd place at only six seconds slower than Starbucks (2 minutes 56 seconds versus 2 minutes and 50 seconds). McDonalds, on the other hand was quite slow at 3 minutes and 37 seconds [6].

- Cheap Prices: McDonald’s has entered the price-conscious coffee market and in many places sells any sized cup of coffee for $1. This has squeezed sales away from Dunkin’ Donuts. Meanwhile, Starbucks has enjoyed its premium status where customers are happy to pay a little extra for the brand [7].

Operating Model: The operating model is based on an asset-light, franchise strategy [8]. Since Dunkin’ Brands owns very little by way of capital structure, the vast majority of the value lies in the quality of the products, relationships with franchisees, and relationships with customers [9].

- Innovative Products: Dunkin’ Brands maintains a Culinary Dream Team whose role is to work with the R&D team to create new and innovative menu choices [12].

- Building relationships with franchisees: Since nearly 100% of DD locations are franchises, strategic relationships must be maintained with the franchisees. These relationships are grown through a robust training program, general news and trends, and a significant marketing campaign. Additionally, initiatives like maintaining innovative product offerings and the DD Perks program help.

- Building relationships with customers: DD recently introduced the DD Perks loyalty program. While some have argued that this program has been a success, others argue that it has only bolstered an already high customer satisfaction rating. This may indicate the DD Perks program has only made loyal customers that much more loyal [10].

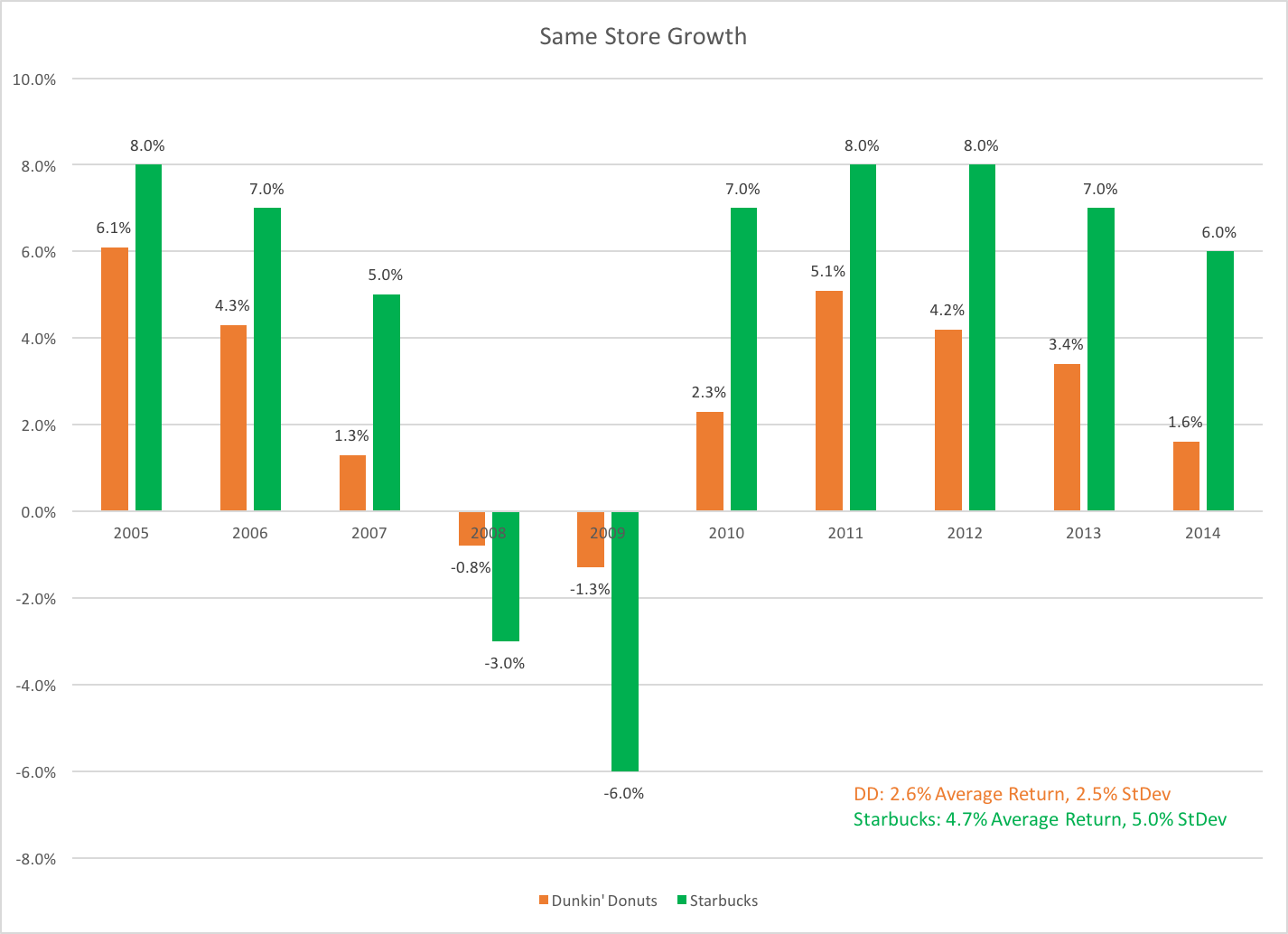

Ultimately, the intersection of the Business Model and Operating Model can be represented by same store sales growth, shown below. While the general market trend over the past four years has been a decline in same store sales growth, DD has declined at a much faster rate than Starbucks.

Conclusion: A cup of coffee is a cup of coffee, which is what the majority of customers want when they walk into Dunkin’ Donuts. DD has great coffee that many prefer over other brands, but needs to drive same store sales by leveraging its innovative products, franchisee relationships, and customer relationships. Meanwhile, DD does not lead the segment in wait time or price, two of its customer promises. Unfortunately, by competing in the price-conscious coffee segment, Dunkin’ Donuts is squaring off with and losing market share to competitors like McDonald’s. It is also failing to get customers to purchase much more than the average cup of coffee and perhaps a bakery item. This has ultimately led to a steady decline in same store growth as shown above. A lot of work needs to be done to convince customers that the brand deserves a premium price.

[3] http://www.dunkinbrands.com/about/donuts

[4] Starbucks Corporation Fiscal 2009 Annual Report accessed: http://media.corporate-ir.net/media_files/irol/99/99518/SBUX_AR.pdf

[5] Starbucks Fiscal 2014 Form 10-K accessed: http://investor.starbucks.com/phoenix.zhtml?c=99518&p=irol-reportsAnnual

[7] http://time.com/money/3028578/dunkin-donuts-mcdonalds-starbucks-coffee-wars/

[8] http://www.dunkinbrands.com/about

Thanks for writing about the Dunkin. “Its website explains how it is ranked #1 for customer loyalty in the coffee category for nine years” – I can vouch for this statement. While attending UF, once or twice a month my brother, girlfriend at the time (now wife) and I would often drive 40 minutes to get a cup of Dunkin coffee. Unfortunately, Gainesville built their first Dunkin only 3 months before we left, but we made the most of it until we graduated!

Two questions I have always had about Dunkins strategy is what’s the point of owning the Baskin brand and how do they deal with market saturation, particularly in the Northeast? Baskin seems to have overpriced ice cream treats and a weak brand name so I am curious how much value it is adding to the Enterprise Value (see what I did there – pulled a lil Fin on ya). Also, all of the Dunkin stores that I know, that used to have Baskins within them, have since been remodeled to solely be Dunkin restaurants. Drive a mile on any stretch of road in the Northeast and you are pretty much guaranteed to past 17 Dunkins. How is this even possible? How do franchisees maintain their stores with such intrabrand competition?

I think that most of the growth with Baskin has actually been overseas. I have also noticed that most of the combination stores have been remodeled into just DDs. Perhaps part of that is the fact that the location for a coffee shop is not necessarily the best spot for an ice cream shop. Those are more my intuitions than anything.

As far as the intrabrand competition, I am not sure how much actual business they are stealing from each other. I think that most people stop at a convenient location to get their coffee quickly. I imagine most people have a routine that they follow and they prefer not to drive out of their way to get their coffee. This is why two DDs on opposite sides of the road only a half mile away from each other may still do well. I am not sure how much help or conversation there is between HQ and a franchisee regarding location if there is even any at all.

Glad someone covered DD! As a long-time resident of the northeast, Dunkin’ is my coffee spot.

I was surprised to see that Dunkin’ is actually slower than Starbucks! I would have expected Starbucks to be much slower given the higher percentage of labor intensive and/or customized drinks (e.g., skinny pumpkin spice lattes) that are ordered at Starbucks. I wonder if DD’s decision to introduce innovative products (operating mode) has actually come at the expense of its service time (business model). On the other hand, this might be necessary to stem the decline in same store sales.

Given the squeeze between service/experience (Starbucks) and cost/food options (McDonalds) that the company is experiencing, I’d be curious to hear where you think Dunkin’ is best positioned to play? Will great coffee be enough, or does the company need to spike on cost or speed as well?

So, the time difference was for the exact same drink (a latte) ordered in each store. I think that one of the factors that was left out of the research was the product mix at Starbucks vs DD. My experience just from observing while waiting in line at both coffee shops is that most people at DD order coffee while people in Starbucks usually order other types of coffee drinks like lattes, fraps, or other drinks along those lines.

I personally feel like DD has always tried to cater to being great tasting coffee for hard working people. Given that vision, I would prefer to see DD try to lower prices but that may just spark a price war with the much bigger McDonald’s.

Interesting that you mention that DD is increasing its product offerings, yet customers still just want coffee from there. Starbucks and DD both struggle to increase sales of food despite selling products on the opposite ends of the price spectrum. McDonald’s on the other hand is a fast food establishment that is (successfully) attempting to enter coffee. I wonder what Starbucks and DD need to do to become a serious player in food.