Drummond Company: Will an old industry be able to adapt to new climate regulations?

The coal industry is under pressure to renew and optimize its supply chain as climate regulations get tighter and demand and coal prices shrink every year.

Industry context

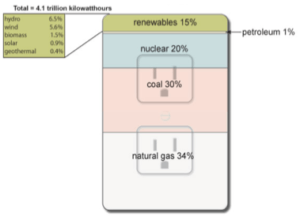

The major energy-producing companies in the world have traditionally relayed in two main sources to supply of electricity to its customers: natural gas and coal [1]. In the US alone, coal is the second most sought source of energy, accounting for the 30.4% of the total energy produced and only surpassed by natural gas as shown in figure 1 [2]. However, due to several factors such as tighter environmental regulations on coal-fired plants [3], disbelief that a coal-based economy reduces poverty [4], and the increasing scrutiny by politicians pushing for carbon taxes [5], coal demand and prices have drastically dropped 70% since 2008 [6]. In addition, the growing use of renewables has aggravated the situation of coal mining companies, forcing them to become more efficient in times of continuous shrinking profit margins.

Figure 1. Sources of U.S. electricity [7]

Figure 1. Sources of U.S. electricity [7]

Continuous changes in environmental laws have pressed power plants to impose extra measures on mining companies such as Drummond. Government officials assure that those measures create incentives for coal-dependent industries to innovate and reduce their coal consumption through the adoption of lean manufacturing practices and developing more efficient processes [8]. In a similar note, coal mining companies are also forced to identify underutilized resources, detect bottlenecks and minimize inefficiencies across their supply chain to reduce their operating expenses [9].

History and operations

Drummond has been operating the most productive open-pit coal mine in Colombia since 1986. The abrupt terrain has made Drummond’s supply chain very complex, which includes extraction of the coal, loading, and transportation in the mine using large loaders and trucks to coal stacks, followed by inter-mine transportation using conveyor belts prior to loading the coal into a cargo train. Once the train arrives at the port, another conveyor belt transports the coal to a locking dock that deposits the coal into a ship as illustrated in figure 2.

Figure 2. Drummond Pribbenow mine value chain [10]

Figure 2. Drummond Pribbenow mine value chain [10]

The major problem faced by the company is the continuous unexpected stops in operation and fines charged by the Colombian government because of the environmental impact that the coal dust causes while it is transported from the mine to the port. Surrounding communities are affected directly when the train passes by their houses spreading hazardous coal dust and indirectly with coal deposited at the bottom of the ocean when it is loaded on ships. Every stop caused downstream creates large upstream disruptions to Drummond’s customers, who expect deliveries on time. Failure to comply with contracts result in fines assumed by the mining company. Also, the variability along the supply chain makes impossible for engineers to organize contingency plans or even schedule maintenances, reducing the labor utilization and capacity of the Pribbenow mine [11].

Short-term plan: Investment Strategy

From internal company-wide meetings and external debates with the surrounding communities and local governments, Drummond’s management decided that stopping the operation was not feasible but reaching operating limits as soon as possible was imperative. To address this critical problem, Drummond’s management invested US$360 Million in building a new direct ship loading system to accomplish several goals [12]:

- Reducing the environmental impact by adding dust suppressors at the loading stage, preventing the spillage of coal when transferred to the ship.

- Increasing the installed capacity of the ship loading operation with two ship loaders of an installed capacity of 60 million tons per year. This extra capacity would allow Drummond to reduce variability and respond better to critical loading times when coal prices are high while avoiding fines for delayed orders.

Suggestions: Global Sustainability Strategy

In order to fully address the interplay between regulations dictated by climate change, low demand and declining prices of coal, it is important to incorporate those factors to create a new global strategy of the company. Starting from modifying the company’s mission from “exploration, mining, transportation and export of coal” to a more inclusive and relevant to today’s changing economic times that affects their business, including sustainability practices and an always-improving mentality.

In another front, leveraging technology to minimize environmental impact as well as increased efficiencies in the extraction and transportation stages will be critical to compensate for the unpredictability in the regulations.

In addition, as already initiated by other governments [13], the coal industry can be transformed into a more responsible, transparent, and profitable business when each member of the supply chain embraces the goal of respect for people and for the environment.

Question for future leaders:

In industries where the economic benefits seem to outweigh the environmental consequences, how should leaders take into account environmental impact when assessing investments that are critical for the viability of a business? Should they incorporate a moral component in the equation when analyzing such projects? If so, how much weight should they allocate to such corporate responsibility factor?

(800 words)

References:

[1] Gadonneix, P., Nadeau, M.-J. et al, “World Energy Resources Report,” World Energy Council” (2013). [online] Available at: https://www.worldenergy.org/wp-content/uploads/2013/09/Complete_WER_2013_Survey.pdf [Accessed 10 Nov. 2017].

[2] Hankey, R., “Monthly Energy Review, “U.S. Energy Information Administration. (Oct 2017) [online] Available at: https://www.eia.gov/electricity/monthly/pdf/epm.pdf. [Accessed 10 Nov. 2017].

[3] Gardner, T., “A year after Trump’s election, coal’s future remains bleak” Reuters (Nov. 13, 2017). [online] Available at: http://www.reuters.com/article/us-trump-effect-coal-revival/a-year-after-trumps-election-coals-future-remains-bleak-idUSKBN1DD0IA. [Accessed 10 Nov. 2017].

[4] Goldenberg, S., “World Bank rejects energy industry notion that coal can cure poverty” The Guardian (July 29, 2015). [online] Available at: https://www.theguardian.com/environment/2015/jul/29/world-bank-coal-cure-poverty-rejects [Accessed 10 Nov. 2017].

[5] Spurr, B., “Alberta to introduce economy-wide carbon tax in new climate change strategy” The Star (Nov. 22, 2015). [online] Available at: https://www.washingtonpost.com/world/alberta-to-introduce-economy-wide-carbon-tax-in-2017/2015/11/22/c83adec4-916d-11e5-8aa0-5d0946560a97_story.html?utm_term=.96cd7de5810b [Accessed 10 Nov. 2017].

[6] Morris, D. “Cheap Solar Power Could Gut the Global Coal Industry by 2040,” Fortune. [online] Available at: http://fortune.com/2017/06/17/cheap-solar-power-coal-industry-crash/ [Accessed 10 Nov. 2017].

[7] U.S. Energy Information Administration. Sources of US Electricity Generation. (2017) [image] Available at: https://www.eia.gov/energyexplained/images/charts/outlet-graph-large.jpg [Accessed 10 Nov. 2017].

[8] Pappis, C. “Climate change, supply chain management, and enterprise adaptation”. Hershey, PA: Information Science Reference (2011).

[9] Barker, K. “Canary in the Coal Mine. New York Times” (2017) [online] Available at: https://www.nytimes.com/2017/08/14/opinion/letters/canary-in-the-coal-mine.html [Accessed 15 Nov. 2017].

[10] Drummond LTD. Colombia. Sustainability Report. (2015) [online] Available at: https://issuu.com/drummondltd/docs/drumond_ingles_16nov?e=19253911/41384915 [Accessed 15 Nov. 2017].

[11] Meneses, F. Sr. Electrical Maintenance Supervisor – Programming & Automation. “Challenges and Opportunities at Pribbenow Mine” (2017) [Interview].

[12] Drummond Company Inc. Drummond Restarts Port Operations with an Investment of US$360 Million in a Modern Direct Ship Loading System. (2014) [online] Available at: http://www.drummondco.com/drummond-restarts-port-operations-with-an-investment-of-us360-million-in-a-modern-direct-ship-loading-system/ [Accessed 10 Nov. 2017].

[13] Foreign Trade and Development Cooperation. “2017 Coal Supply Chain Responsibility”. Amsterdam (2017) Available at: https://www.government.nl/binaries/government/documents/reports/2017/10/12/progress-report-on-corporate-responsibility-in-the-coal-supply-chain-2017/Progress+report+on+the+voluntary+agreement+2017.pdf [Accessed 10 Nov. 2017].

I think it would be helpful to understand the impact coal has on the general health of the people who live close to the mines. If we are able to understand the number of people affected and how they are affected i.e. the extent of new asthma cases, black lung e.t.c we shall be in a better position to quantify the environmental impact coal has on society. In this case for example it would help us understand how much more Colombia has to spend on healthcare due to an operational mine. We can then compare that to the benefits of coal.

I think it would be helpful to understand the impact coal has on the general health of the people who live close to the mines. If we are able to understand the number of people affected and how they are affected i.e. the extent of new asthma cases, black lung e.t.c we shall be in a better position to quantify the environmental impact coal has on society. In this case for example it would help us understand how much more Colombia has to spend on healthcare due to an operational coal mine. We can then compare that to the benefits of coal.

Miguel, thank you for this interesting post!

Actually I believe that even if coal mining companies manage to become more efficient/environment-friendly, coal itself should not have any future. In my opinion it is highly hypocritical if countries such as Germany, shut down nuclear plants but still heavily rely on coal due to its availability. The U.K. leads by a great example having reduces coal consumption by more than 50% and having closed three coal power plants. On April 21 the U.K. celebrated its first coal-free day for almost 200 years.

I hope many other countries will follow this example and rather invest in renewable energies than try to incrementally improve efficiencies in the coal mining process or its supply chain.

Link: https://gwdforestry.com/news/2017/06/15/global-demand-for-coal-declines-as-dirtiest-fossil-fuel-continues-to-fall-out-of-favor/

Pascal raised the point that developed countries have the capability (and potentially the responsibility) to implement many of the emerging renewable technologies on a broader scale. However, investing in these new projects can be capital intensive and some companies may hesitate to fully shift their power generation to solar, wind, etc. In the interim, conversion from coal to natural gas fuel in power plants add another risk to Drummond’s operation. The global supply of natural gas has reduced prices on the gaseous commodity, thereby lowering the transition barrier for energy companies. Coupled with the fact that natural gas burns cleaner than coal, coal’s utility may eventually be limited to areas where natural gas supply isn’t readily accessible. At a minimum, this alternative represents a moderate risk to the short-term demand for Coal

Thanks Miguel! Your article highlighted an interesting short-term response of reducing the impact of coal dust bycinvesting in dust suppressors as well as increasing production capacity by investing in additional ship loader machinery at the loading ports, downstream of extraction. Further downstream, I’d be curious whether Drummond is addressing climate change with its power generation customers who could invest in technologies like scrubbers and/or carbon capture systems (CCS) to reduce their own output of carbon in the environment. Drummond’s mine is in Colombia, a country that is continuing to develop its economy; another interesting issue in climate change is the debate over whether or not it is equitable for all countries to adhere to the same clean energy standards. Should those who were allowed to develop using dirty-energy go penalty-free; should those who are developing now be forced to adhere to higher standards?

Miguel, that is a very interesting article that highlights one of the major problems of an industry that is in my opinion in a fast decline trend. Taking into account the increasing concern from all nations and governments for renewable energy sources and low environmental impact, it is just a matter of time until this industry falls into a complete latency stage. I mean latency because renewable sources are highly dependent on external weather/climate factors that might influence their output rate. I believe that coal mines and this whole industry will still exist for a while to supply energy during severe droughts or times times where the amount of sunlight or wind is not able to generate energy from other renewable sources. It is also of paramount importance to highlight that coal is a raw material used in other major industries (60% of the steel manufactured today uses coal – https://www.worldcoal.org/coal/uses-coal/how-steel-produced) and for this reason a market for this element will continue to exist on the foreseable future.

I was surprised to read that one of the main concerns in Colombia is regarding the dust and pollution generated during the transportation process. In Brazil, I was able to follow the implementation of an strategy used to reduce the amount of dust dispersed in the air during the transportation of iron ore throughout the railways and the port. The mining company installed portals that would spray a special polymer on the iron ore as the containers were moving through the railways to bond the molecules and make them heavier, preventing the material to be carried out by the wind. I don´t know if this solution could be implemented by Drummond but at least it is used by iron ore mining companies.

I would be curious to see what will be the outcome of this industry in Colombia.

Thiago

Hi Miguel,

Thanks for you article. My response to your final question is that morality and corporate responsibility needs to be woven into the cloth of how our world’s management makes business decisions, period. I understand that often times industries like coal mining that have had established infrastructures and processes in place for quite some time require capital intensive investments in order to improve – but I personally consider this an easy decision to make for the long term sustainability of an organization. I would like for industries such as these to shift their focus from short term profit gains/losses to the long-term viability of their business model as well as their impact on local communities. This shift would provide a greater sense of clarity when it comes to making tough investment and strategy decisions.