Drugs, Digitized: Merck Leads Pharma’s Delayed Adoption of Supply Chain 4.0

Forget self-driving cars – Merck looks to create a self-driving supply chain with artificial intelligence calling the shots

Suppose Nike rolls out a digital innovation in its warehouse or tests a new predictive demand algorithm: if manufacturing disruptions or algorithm errors mean a few Air Zoom Pegasus sneakers are late or poor quality, the company risks some disgruntled customers. When pharmaceutical companies underestimate demand or adopt unproven new technologies, they risk lives, potentially providing consumers faulty products or disrupting treatment regimens. Given these stringent performance requirements, pharma companies have been slower to adopt supply chain digitalization than their counterparts in consumer goods, less willing to risk the performance lapses that altering information systems and trialing innovations often cause.[1]

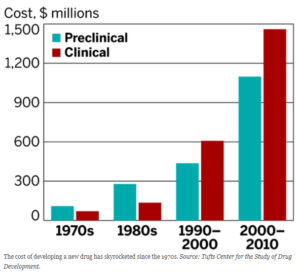

Increasing financial and competitive pressures, however, mean supply chain digitalization is rapidly becoming an imperative for pharma as well. The market shift toward generics is eroding top lines, while increasing development costs erodes margins, pushing companies to look to the supply chain for cost savings.[2] Second, expansion into developing markets in search of higher growth threatens longer supply chains with higher complexity, lead times, and operational expense.[3] Third, increased demand for products derived from biologics (requiring constant cold storage) promises dramatically higher inventory costs unless process changes mitigate the increase.[4] For Merck KGaA, a global pharmaceutical and biotechnology company, to remain a leading player, the company will have to digitalize its supply chain – and quickly.

Exhibit 1: Development costs per drug are rising dramatically[5]

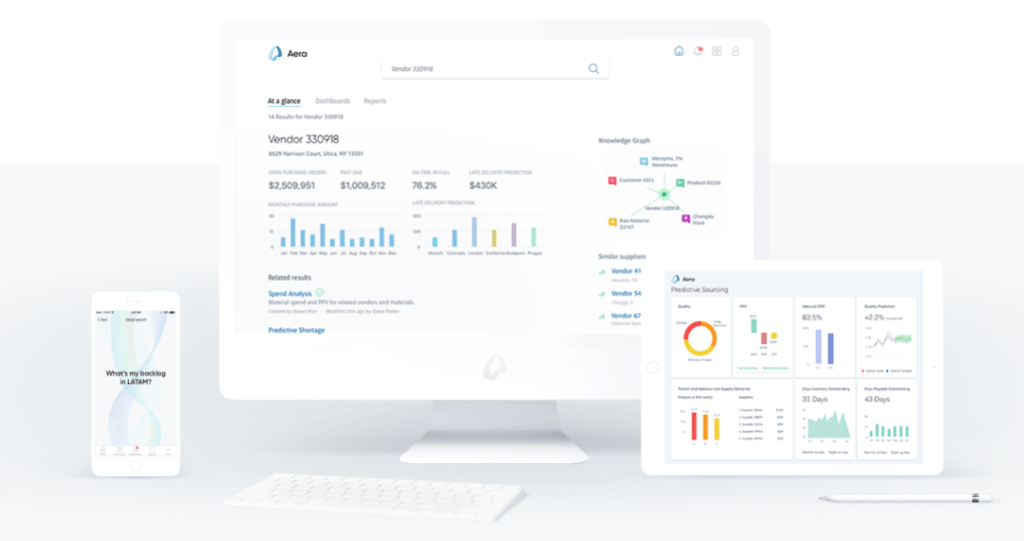

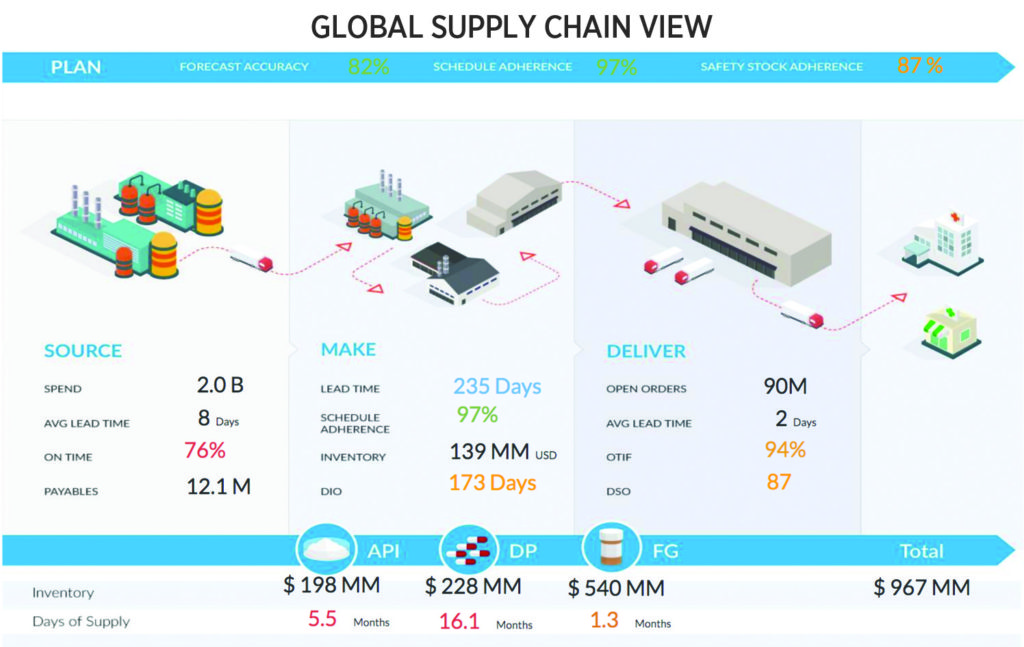

In fact, Merck KGaA, is “at the forefront of digitizing its pharma supply chain.”[6] In 2015, Merck partnered with supply chain analytics firm Aera[7] to create digestible and actionable data visualizations, providing Merck more real-time visibility into supply chain performance but also the ability to grasp more quickly the implications of metrics and to react more effectively.[8] Building on these capabilities, in March 2017 Merck launched a multi-year supply chain automation effort to enhance its ability to predict and satisfy demand as a “first step toward full digitization”[9]: the vision is to move from highly manual, human-driven control to artificial intelligence “that analyzes data continuously and makes decisions on its own about speed and resources.”[10] The effort involves installing sensors throughout Merck’s sourcing, manufacturing, and distribution facilities and implementing predictive demand algorithms that use the data collected to make decisions about production schedules, raw material allocation, and distribution, independent of human operators.[11] The project is intended to help Merck to “process orders in the shortest time possible” and build the company’s ability to react to demand spikes or manufacturing disruptions (e.g., natural disasters).

Exhibit 2: Examples of Aera’s visualization products[12]

Merck has also recently partnered with big data firm Palantir to bolster its ability to leverage predictive data in its supply chain. In the short term, Merck intends the partnership to accelerate the R&D phase of its go-to-market process and reduce drug development costs – critical competitive differentiators – by “us[ing] Palantir’s analytics software to…predict which patients will respond best to certain drugs,” first for cancer treatments and then across Merck’s portfolio.[13] Over the longer term, Merck hopes Palantir’s big data capabilities will bolster its global “forecasting and agility”[14] and further its ultimate aim of building a fully automated, “self-driving supply chain ‘without [human] pilots.’”[15]

To complement these plans, Merck should consider incorporating additional digitalization efforts. In the short term, Merck could use sensors not only to predict demand and optimize production schedules, but also to anticipate and automatically prevent manufacturing failures.[16] Machine sensors can signal when proactive maintenance would enhance output, avoiding costly downtime and reducing lifetime maintenance costs, while testing sensors can signal when manufacturing processes should be adjusted before products begin to fail standards, reducing downtime and waste. Second, Merck could move toward a leaner supply chain while maintaining high service levels by increasing inventory and demand transparency with its procurement partners and direct customers, potentially sharing real-time output from its predictive demand algorithms to give all its partners superior visibility into coming needs. In the longer term, Merck could bolster its feedback loop with end-consumers by tracking individual usage or introducing voluntary internal monitoring devices[17] – real-time data on adherence and efficacy could help anticipate demand and also surface potential product improvements on an on-going basis. Around all these digitalization efforts, however, Merck should prioritize security to ensure its production and monitoring processes are not vulnerable to cyberattacks.

As pharma continues to digitalize, are there technologies CPG has successfully adopted that pharma will have to avoid given the risks to the consumer? Will supply chain digitalization in pharma be fundamentally different somehow than in other industries?

(Word count: 796)

Endnotes

1 Peter Behner and Dr. Marcus Ehrhardt. “Digitization in pharma: Gaining an edge in operations,” Strategy&, October 19, 2016, https://www.strategyand.pwc.com/reports/digitization-in-pharma, accessed November 2017.

Julian Upton, “Setting Sights on the Smart Supply Chain,” Pharmaceutical Executive vol. 37, no. 3 (2017), accessed November 2017.

2 Rick Mullin. “Cost to Develop New Pharmaceutical Drug Now Exceeds $2.5B,” Scientific American, November 24, 2014, https://www.scientificamerican.com/article/cost-to-develop-new-pharmaceutical-drug-now-exceeds-2-5b/, accessed November 2017.

Allen Jacques. “2017 Trends & Transformations in the Pharma Supply Chain,” Pharmaceutical Processing, December 29, 2016, https://www.pharmpro.com/article/2016/12/2017-trends-transformations-pharma-supply-chain, accessed November 2017.

3 Behner and Ehrhardt, “Digitization in pharma: Gaining an edge in operations.” Jacques, “2017 Trends & Transformations in the Pharma Supply Chain.”

4 Jacques, “2017 Trends & Transformations in the Pharma Supply Chain.”

5 Mullin, “Cost to Develop New Pharmaceutical Drug Now Exceeds $2.5B.”

6 Upton, “Setting Sights on the Smart Supply Chain.”

7 Aera was known at the time as FusionOps.

8 “FusionOps brings enhanced supply chain visibility to pharma with new analytics capabilities,” July 13, 2015, Pharmaceutical Commerce, http://pharmaceuticalcommerce.com/latest-news/fusionops-brings-enhanced-supply-chain-visibility-to-pharma-with-new-analytics-capabilities/, accessed November 2017.

9 Upton, “Setting Sights on the Smart Supply Chain.”

10 Kim S. Nash. “Merck Deploys AI For ‘Self-Driving’ Supply Chain,” Wall Street Journal, December 20, 2016, https://blogs.wsj.com/cio/2016/12/20/merck-deploys-ai-for-self-driving-supply-chain/, accessed November 2017.

12 Aera company website (https://www.aeratechnology.com/technology).

13 Michal Lev-Ram. “Palantir’s Bet on Big Pharma,” Fortune, January 12, 2017, http://fortune.com/2017/01/12/palantir-merck-pharma/, accessed November 2017.

“Merck seals collaborations in Silicon Valley,” ENP Newswire, March 1, 2017, via Factiva, accessed November 2017.

“Merck KGaA, Darmstadt, Germany, and Palantir Launch New Healthcare Acceleration Partnership,” PR Newswire, January 12, 2017, https://www.prnewswire.com/news-releases/merck-kgaa-darmstadt-germany-and-palantir-launch-new-healthcare-acceleration-partnership-300390579.html, accessed November 2017.

14 Upton, “Setting Sights on the Smart Supply Chain.”

15 Upton, “Setting Sights on the Smart Supply Chain.”

16 Upton, “Setting Sights on the Smart Supply Chain.”

Knut Alicke, Daniel Rexhausen, and Andreas Seyfert. “Supply Chain 4.0 in consumer goods,” McKinsey & Company, April 2017.

17 Pam Belluck. “First Digital Pill Approved to Worries About Biomedical ‘Big Brother,’” New York Times, November 13, 2017, https://www.nytimes.com/2017/11/13/health/digital-pill-fda.html, accessed November 2017.

Banner photo source: https://eyeforpharmadrupalfs.s3.amazonaws.com/istock-615087156.jpg

Great read! While I agree that digitization can help with upstream supply chain issues, it’s also worth considering what (if any) control Merck has on downstream supply chain, particularly demand and delivery. As you mention, emerging markets are becoming more relevant consumers for pharma companies, but their needs and basic infrastructure are often not sophisticated and lag in terms of readiness for digitization. For example, stockouts, wasteage, and temperature sensitivity are all issues that can effect potency of medication. Digitization can mitigate many of these risks, but would require investments beyond Merck’s “core.”