Drought and Draught – Climate Change’s Impact on Molson Coors

This paper examines how the supply chain and manufacturing process of a key player in the U.S. beer making industry, the Molson Coors Brewing Company, is being (and will be) impacted by climate change, how the company is responding, and additional actions that could be taken to minimize longer-term impacts.

Drought and Draught – Climate Change’s Impact on Molson Coors

The U.S. Beer Industry

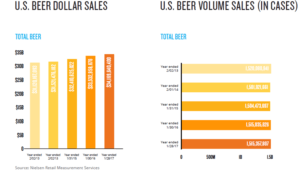

As of December 31, 2016, there were over 5,300 breweries in the U.S.[i] that together generated over $30bn of revenue on the sale of over 1.5bn cases of beer (over six cases per adult).[ii]

With that said, while the U.S. beermaking industry is mammoth both in terms of number of players and size of revenues, the vast majority of sales are concentrated amongst a small collection of brewers, with 11 brewers representing over 90% of sales,[iii] and with two brewers making up 69% of the total market (44% and 25% from AB InBev and Molson Coors Brewing Company (MCBC) respectively).[iv]

This paper will examine how the supply chain and manufacturing process of one of these key players, MCBC, is being (and will be) impacted by climate change, how the company is responding, and additional actions that could be taken to minimize longer-term impacts.

Beer Brewing Process

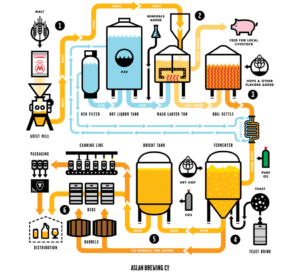

Most beer is produced through a manufacturing process in which a barley-based mixture is mashed, rinsed, boiled (with hops added for flavoring, bitterness, and aroma), cooled, fermented (using yeast as a fermentation agent), carbonated, and bottled (exhibit 1 demonstrates a typical process flow).

The beer brewing process is comparatively simple in terms of inputs, typically requiring only four basic ingredients: water, barley, yeast, and hops. While barley and yeast are widely available commodities, the U.S. production of hops is heavily concentrated geographically. To wit, in 2016, 100% of the 87mm pounds of hops produced in the country came from Washington (76%), Oregon (14%), and Idaho (10%).[v]

The U.S. Department of Agriculture’s annual report notes that the total hops harvest has increased materially over the past five years – from 59mm pounds in 2012 to 87mm in 2016 – however, this has been entirely driven by increases in the amount of land used for growing, which ballooned from 30,000 to 51,000 acres over the period.[vi] Over the same five years, the yield per acre has decreased 15% (from 2,000 pounds to 1,700 pounds), and the price per pound has increased 80% (from $3.17 to $5.72). While several factors have contributed to this decreasing efficiency level, according to Ann George, Executive Director of the Washington Hop Commission, two key factors have been a combination of water stress (each hops plant requires three gallons of water per day) and higher heat levels.[vii]

It is likely that yield problems will continue to be exacerbated as hotter, dryer summers become the norm, and as access to external sources of water presents an increasingly expensive challenge (says NASA climate scientist Joshua Fisher, “We are reaching this kind of tipping point. What we’ve been used to in terms of how much rain we’re going to get and how plants grow is no longer the norm.”).[viii] If this trend continues, we can expect a smaller hops crop in the future, and resultingly, a more expensive product.

MCBC’s Reaction

To its credit, MCBC recognizes that climate change presents a risk to its business. In its most recent 10-K, the company noted that, “A gradual increase in global average temperatures could cause significant changes in global weather patterns… [which] could result in decreased agricultural productivity in certain regions which may limit availability or increase the cost of key agricultural commodities, such as hops, barley and other cereal grains.”[ix]

To combat immediate risks, the company enters into short term commodity options and purchases hops from three regions (the U.S., Europe, and New Zealand). This effectively hedges its exposure to price fluctuations and supply shortages over the short-term. To protect itself from the risk of drought over the medium term, the company owns and leases water rights to provide for and to sustain brewing operations in the regions in which it operates.[x]

While these actions should protect the company’s operations in the near future, additional steps should be taken to further insulate it from downside risks. In particular, the company should seek to either design longer term commodity forwards (even if doing so requires that they pay a premium above current prices) or purchase options that allow for future purchases at reasonable prices.

In addition to these steps, the following open questions relating to the impact of climate change merit further consideration by the company and the industry:

- Could a strain of hops be created that would retain the typical qualities needed for beer brewing (aromatics and bitterness) while increasing its ability to thrive in high, dry temperatures?

- Does MCBC (and/or its peers) have the ability to grow its own hops to combat the potential price increases and supply decreases that could come as a result of drought conditions. If yes, should they do so?

Word count: 800 words.

Exhibit 1 – Beer Brewing Process Flow[xi]

[i] https://www.brewersassociation.org/statistics/number-of-breweries/

[ii] http://www.nielsen.com/us/en/insights/reports/2017/the-state-of-the-us-beer-market.html

[iii] https://www.marketwatch.com/story/these-11-brewers-make-over-90-of-all-us-beer-2015-07-27

[iv] Molson Coors 2016 10-K (http://s21.q4cdn.com/334828327/files/doc_financials/2016/annual/cfbd1a46-0f56-4f1d-8338-bb71d674c943.pdf), page 7

[v] http://usda.mannlib.cornell.edu/usda/current/hops/hops-12-16-2016.pdf

[vi] 2016 data: http://usda.mannlib.cornell.edu/usda/current/hops/hops-12-16-2016.pdf; 2012 data: http://usda.mannlib.cornell.edu/usda/nass/hops//2010s/2014/hops-12-17-2014.pdf

[vii] https://www.cnbc.com/2015/07/24/drought-and-hot-weather-cause-trouble-for-hops-growers.html

[viii] https://www.cbsnews.com/news/climate-change-is-hurting-craft-breweries/

[ix] http://s21.q4cdn.com/334828327/files/doc_financials/2016/annual/cfbd1a46-0f56-4f1d-8338-bb71d674c943.pdf, page 24

[x] http://s21.q4cdn.com/334828327/files/doc_financials/2016/annual/cfbd1a46-0f56-4f1d-8338-bb71d674c943.pdf, page 5

[xi] The Aslan Brewing Company: http://www.aslanbrewing.com/thebrewingprocess/

Very interesting write-up. Having spent a good amount of time within the beer industry, climate change is certainly affecting the production of hops. Production issues are particularly acute within the craft beer segment, which typically utilizes more exotic hops, particularly in “hop-forward” styles like IPAs. As you mentioned at the top of your post, there are now over 5,000 breweries in the U.S., of which most are producing hop-intensive styles and picky about what hops they use. It will be very interesting to see how growing problems in hop production impacts the “long-tail” of brewers that don’t have the operational and financial resources that Molson Coors has.

Great article! It was interesting to read about the issues facing beer manufacturers and learn a bit about the industry. As Moliu pointed out above, there are thousands of breweries across the United States that do not have the financial resources that Molson does. With that in mind, they should consider utilizing some of their resources for the good of the industry overall and for their financial health moving forward. They could provide funding to the scientists researching new kinds of hops. [1] Molson Coors could form a partnership with a research university near their headquarters, or they could provide resources to an internal division and fast track development.

https://www.outsideonline.com/2141991/meet-wild-hop-hunters-saving-your-beer-climate-change