Do or Die? Walmart’s foray into Machine-Learning and the implications for Its competitiveness amidst the Amazonian squeeze

Will machine-learning be the tie-breaker in this new dawn of consumer retail?

Adapting in the Face of Adversity

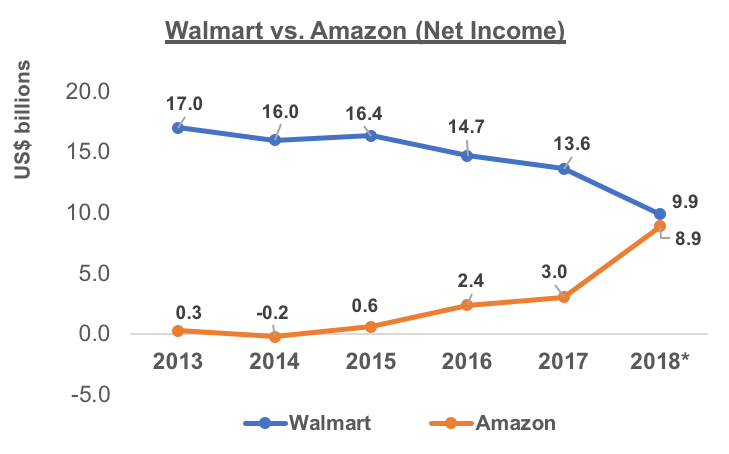

Over the past decade, a fierce battle has been brewing globally within the consumer retail space. Internet giants like Amazon have continued to amass market share at the expense of established brick-and-mortar players, as the marketplace has evolved to become increasingly digital [1]. Walmart, by virtue of its vast financial resources, strong e-commerce presence, and extensive retail logistics infrastructure, is in the process of mounting its own digital challenge by employing various leading-edge technology analytics applications to court the affections of consumers and try to reverse the recent trend of declining net income [2]. One of the ways in which Walmart is looking to re-position itself for the future is by establishing its subsidiary, Sam’s Club, as an innovation driver to help boost customer acquisition through transformational technology [3]. In mid-2018, Sam’s Club welcomed about 100 new technology employees to support its technology innovation operations out of a new Dallas HQ [4]. Perhaps Walmart’s hand was forced in this respect, considering that the giant had just closed over 60 Sam’s Club stores in early 2018, impacting over 9,000 jobs, signaling the precipitous decline of the existing Sam’s Club business model [5].

Source: S&P Capital IQ

(*Q3 2018 financials quoted for Amazon)

Walmart’s CEO has in recent months made investors aware of the company’s transition into more technology intensive infrastructure investments and encouraged investors to revise their short-term earnings projections for the company downwards [6]. Sam’s Club’s new smartphone app-powered innovation lab in Dallas, called the Sam’s Club Now store, is expected to serve as a trial ground for new technologies aimed at improving customer experience; applications will include predictive shopping lists compiled using machine-learning algorithms to better capture customer shopping preferences [7]. Walmart, by investing heavily in technology is looking to keep pace with Amazon, and perhaps take the lead as the future innovation leader in consumer retail globally.

The use of machine-learning within the scope of anticipating demand has been explored by various academics over the past few years; the predictive capabilities of machine-learning are quite vast, given ample amounts of reference data [8]. Through the Sam’s Club Now model, Walmart will look to harness the predictive power of machine-learning by iterating through customer transaction outcomes and generating vast pools of data which will help to develop key customer behavior insights that Walmart can feed directly into its business strategy going forward to gain a competitive edge in the consumer retail market. It appears that Walmart is willing to endure short-term knocks to its earnings growth in order to secure its future within the consumer retail space [6]; such is the level of competition within the segment that even giants such as Walmart are being forced to fundamentally reconstruct their strategies going forward.

Will Machine-Learning Solve Walmart’s Amazon Problem?

After Walmart’s $16 billion acquisition of India’s FlipKart in mid 2018, it became clear to all that Walmart was in fact serious about its renewed push towards digital [9]. However, Amazon has not lost much steam either after its own $13.7 billion acquisition of Whole Foods a year before Walmart’s FlipKart acquisition [10]. Amazon’s acquisition of Whole Foods placed Walmart’s hallowed food retail business within Amazon’s cross-hairs, something that certainly sent chills down a spine or two at Walmart’s HQ. Furthermore, Amazon is no slouch in the machine-learning space; through its wildly successful Amazon Web Service (AWS) platform, and machine-learning breakthroughs such as Alexa, Amazon Go, and a suite of other landmark products, Amazon has gained a level of proficiency in machine-learning that perhaps rivals the biggest global names in Artificial Intelligence [11].

This level of proficiency, combined with Amazon’s as yet unmatched access to consumer behavior data via its online marketplace [12], means that Amazon is likely to remain a step ahead of Walmart over the near future when it comes to the effective application of machine-learning to gain competitive advantage. What does this mean for Walmart? I believe that although Walmart should seek to modernize its technological infrastructure to keep pace with industry trends, it is important for Walmart to maintain its own core digital identity, as opposed to mimicking Amazon’s innovations, such as the cashierless Amazon Go concept [13], which appears to have been an inspiration behind Walmart’s Sam’s Club Now concept store. Furthermore, in order to achieve this unique digital identity, Walmart needs to revisit its roots and understand deeply what drives its existing and potential customer base in this evolving market environment, and somehow effectively take its cost-saving ethos digital, by leveraging machine learning and sound business strategy.

Question 1: To what extent should Walmart sideline its brick-and-mortar model in favor of online sales growth going forward?

Question 2: Can Walmart compete with Amazon on the basis of cutting-edge technology applications such as machine learning and cashierless stores?

(793 words)

[1] Lauren Thomas, “This chart shows how quickly Amazon is ‘eating the retail world’,” CNBC, July 7, 2017, https://www.cnbc.com/2017/07/07/amazon-is-eating-the-retail-world.html, accessed November 2018.

[2] Walmart Inc Investment Community Meeting – Final, via Factiva, accessed November 2018.

[3] Sam’s Club Now – Reimagining the Future of Retail, via Factiva, accessed November 2018.

[4] Mariah Halkias, “Sam’s Club to open a technology office separate from Walmart in downtown Dallas,” Dallas News, July 25, 2018, https://www.dallasnews.com/business/retail/2018/07/26/sams-club-open-technology-office-separate-walmart-downtown-dallas, accessed November 2018.

[5] Hayley Peterson, “Walmart is abruptly closing 63 Sam’s Club stores and laying off thousands of workers,” Business Insider, January 11, 2018, https://www.businessinsider.com/walmart-suddenly-closes-sams-club-stores-2018-1, accessed November 2018.

[6] Nandita Bose, “Walmart CEO points to new company culture, cuts profit forecast,” Reuters, October 16, 2018, https://www.reuters.com/article/us-walmart-outlook/walmart-ceo-points-to-new-company-culture-cuts-profit-forecast-idUSKCN1MQ1G0, accessed November 2018

[7] Sark Clark, “Sam’s Club unveils mobile-first store that showcases the latest payments and retail technologies,” NFC World, November 7, 2018, https://www.nfcworld.com/2018/11/07/358478/sams-club-mobile-first-store-showcases-latest-payments-and-retail-technologies/, accessed November 2018.

[8] Bajari, Patrick, Denis Nekipelov, Stephen P. Ryan, and Miaoyu Yang. “Machine Learning Methods for Demand Estimation.” The American Economic Review 105, no. 5 (2015): 481-85. http://www.jstor.org.ezp-prod1.hul.harvard.edu/stable/43821932.

[9] Rishi Iyengar & Sherisse Pham, “Walmart is buying India’s Flipkart,” CNN Money, May 9, 2018, https://money.cnn.com/2018/05/09/investing/walmart-flipkart-india-softbank/, accessed November 2018.

[10] Greg Petro, “Amazon’s Acquisition Of Whole Foods Is About Two Things: Data And Product,” Forbes, August 2, 2017, https://www.forbes.com/sites/gregpetro/2017/08/02/amazons-acquisition-of-whole-foods-is-about-two-things-data-and-product/#5fad6cf9a808, accessed November 2018.

[11] Daniel Terdiman, “How AI is helping Amazon become a trillion-dollar company,” Fast Company, October 5, 2018, https://www.fastcompany.com/90246028/how-ai-is-helping-amazon-become-a-trillion-dollar-company, accessed November 2018.

[12] Mike Duff, “Study: Amazon Gaining E-Commerce Market Share,” HomeWorld Business, July 16, 2018, https://www.homeworldbusiness.com/study-amazon-gaining-e-commerce-market-share/, accessed November 2018.

[13] Dennis Green, “Amazon reportedly wants to open up to 3,000 cashierless stores to become one of the largest convenience chains in America,” Business Insider, September 19, 2018, https://www.businessinsider.com/report-amazon-wants-3000-amazon-go-stores-by-2021-2018-9, accessed November 2018.

Very well written article! Having spoken to friends who worked at Walmart, I don’t think brick-and-mortar business is being sidelined by the company, as much as it is being augmented with online (Amazon did the same in the reverse order). Walmart’s USP remains large physical stores, and they should continue with it, but add an element of experience to the stores. Walmart Labs (its research division) is working on a lot of technologies and ML algorithms to improve checkout experience, reducing waiting times in lines, etc. In regard to Q2, Amazon is quite invested and ahead in the competition and it is going to be hard for Walmart to continue competing at this pace (unless they acquire tech companies)

This is going to be a tough battle for Walmart! No doubt that strengthening it’s digit presence via Sam’s Club and acquisitions such as Flipkart will help the company stride forward. However in this battle for data-driven retail marketing, Amazon has the advantage of understanding and predicting consumer wide trends well outside it’s immediate customer-base, due to AWS’s far reach! While Walmart should continue down the path of having a strong omni-channel strategy, should it be seeking an alternative USP, such as best in class in-store experience?