Digitization: Amazon’s competitive advantage?

How will digitization affect Amazon's e-commerce website + logistics operations? Where and how can Amazon earn even more $?

Digitization can enhance Amazon’s profitability. In the near-term and medium-term, digitization can reduce costs by streamlining its fulfillment costs and shipping costs. In the long-run, it can affect sales by better integrating, predicting, and molding user demands – perhaps better so than any competitor.

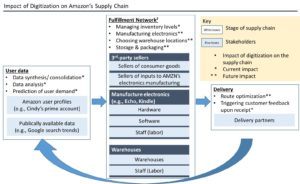

This essay focuses on digitization’s effect on cost-minimization in the supply chain. Figure A breaks down the impact of digitization on its supply chain, from Amazon’s user data to Fulfillment Network[1] to delivery.

Figure A: Impact of Digitization on Amazon’s Supply Chain

Digitization’s potential to address Amazon’s growing operating expenses

Amazon’s operating expenses – particularly its fulfillment costs and shipping costs – have outpaced its sales. Fulfillment costs have risen from 2014 to 2016 from $10.8B to $17.6B. Relative to the growth in sales, the increase in fulfillment costs is a 1 percentage point increase (12.1% of sales to 13% of sales) – roughly $852M. While this may seem marginal, $852M represents 36% of Amazon’s 2016 net income of $2.4B.[2]

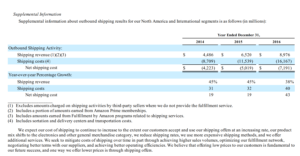

Similarly, Amazon’s shipping costs have outstripped its growth in sales – particularly its growth in shipping revenue. Figure B highlights Amazon’s growth in shipping costs. Net shipping costs have increased from $4.2B in 2014 to $7.2B in 2016, representing 43% and 19% year-over-year growth. To decrease these costs, Amazon will have to create greater efficiencies in its Fulfillment Network.

Figure B: Amazon’s accelerated growth in Net Shipping Cost[3]

Current digitization efforts

To lower operating expenses, Amazon has already started to integrate its supply chain, by harnessing its vast treasure-trove of data through machine learning. [4]

In a supply chain context, Amazon has primarily used digitization for demand forecasting – an effort that impacts vendor-management and inventory management. [5] For example, Amazon is collecting user engagement data on its website to analyze and predict user demand. Based on the forecasted user demand, Amazon’s Fulfillment Network may improve its management of inventory – either by reducing excess orders and/or by giving greater lead-times to vendors for future orders (thereby reducing the probability of back-orders). Similarly, Amazon has integrated with its delivery partners to prompt user feedback and confirmation of receipt. With better customer feedback, Amazon can infer whether the user is likely to repeat purchase or return an item. In either case, faster user-feedback will better inform Amazon’s marketplace development team of a need to onboard more vendors of a certain category, or onboard more delivery partners (or increase their operating capacity).

Future/ Potential recommendations

Beyond the digitization efforts Amazon has publically acknowledged, Amazon can pursue at least 3 additional initiatives.

First, digitization can better inform where to build Amazon’s next fulfillment centers. Digitization will provide improved forecasting on where demand will grow –geographically and by category (e.g., produce vs electronics). These forecasts will help determine which location(s) are cheapest, across renting/ ownership, implied shipping costs, and labor.

Second, digitization can enhance productivity of Amazon’s warehouses and manufacturing plants. Amazon can embrace products like Google X’s Glass. They free workers’ hands of paper, by providing real-time picking/ manufacturing instructions from headquarters’ R&D teams in workers’ line of vision. Companies like DHL and GE have partnered with Glass for 15% greater operational efficiency and 34% greater productivity[6], respectively.

Finally, Amazon can use digitization for route and inventory optimizations with delivery partners. It can integrate data (and forecasts) from partners like Waze, to change its driving routes on a real-time basis, as opposed to following prescribed ‘optimizations’ like UPS’ commonly-known “no left turns” rule. Moreover, Amazon can harness its internal forecasts of very-near-term customer orders, to better stock its trucks – enabling a world where consumers get their orders within minutes because delivery trucks have already predicted and stocked their goods on the truck.

Questions

- What are the implications of a world where user convenience trumps user privacy? How might Amazon respect each user’s varying desire for privacy/ anonymity?

- How will the acquisition of Whole Foods change Amazon’s ability to swiftly change to user demand – either because it has more distribution centers (via Whole Food stores) or because it has to carry more inventory (by nature of a grocery store)? What is the net effect?

Conclusion

This is only the start of Amazon’s digitization. In the future, digitization may not only impact each stage of the supply chain – it may create new feedback loops between stages. For example, in the future, manufacturing and input vendors may have automated 2-way communications: (a) manufacturing software immediately notify sellers of inputs of shortages or defects, while (b) input vendors transmit information about backlogs real-time, helping Amazon re-prioritize its manufacturing. This inventory management can then inform Amazon’s online product placements – shaping sales to match inventory. Amazon’s digitization will give it a competitive advantage few other retailers can match.

Word count: 777

[1] “Fulfillment Network” as described in Amazon’s 2016 10K & 3Q2016 10Q (http://services.corporate-ir.net/SEC.Enhanced/SecCapsule.aspx?c=97664&fid=14806946 & http://services.corporate-ir.net/SEC.Enhanced/SecCapsule.aspx?c=97664&fid=15260225).

[2] Financials per Amazon’s 2016 10K (http://services.corporate-ir.net/SEC.Enhanced/SecCapsule.aspx?c=97664&fid=14806946).

[3] Ibid.

[4] As described in Amazon’s 2016 Letter to Shareholders (https://www.amazon.com/p/feature/z6o9g6sysxur57t).

[5] Ibid.

[6] Per partner testimonials, on Glass website (http://www.x.company/glass/) as of Nov. 15, 2017.

This was a really interesting read, and I agree that digitalization would certainly allow (and hopefully is already allowing) Amazon to optimize their operations. However, I wonder if the increase in fulfilment and shipping costs are net of this progress already occurring and are driven by consumer behavior/demand for faster shipping and delivery, rather than inefficiencies in Amazon’s logistics network. Normal Amazon prime is presumably getting cheaper, but customer demand for next and same day delivery may be rising.

Hi Cay, great article! I agree with your 3 additional digitalisation initiatives but I would actually add a 4th one that I think we’re underestimating: through “Amazon Business”, Amazon’s digitalisation efforts have the potential to impact a lot of small and medium businesses, which don’t have the cash/time to invest in that field. By leveraging their digitalisation knowledge, Amazon might be able to extract more value in the supply chains from its business customers (especially on the procurement side) and even attract new customers because of this competitive advantage.

I’m curious to what extent Amazon is willing to sell and share this data in the future. I see the ability to provide additional services to the third-party sellers by providing similar data and potentially even Amazon’s analyses and recommendations for stocking warehouses and preemptively preparing orders to sellers at a fee. I’m also curious how Amazon may sell this data to outside parties for marketing efforts and wonder how users will respond to this. Will they enjoy the customized experience and benefits of quick on-demand delivery and service? Or view it as an invasion of privacy?

Thank you Clay for choosing a company that is an exemplar to showing the world how one can leverage digitization.

I think the future is much brighter for Amazon using digitalization to reduce its supply chain costs.

One major development that is currently undergoing is Prime Air- amazons’ drone delivery project. Amazon is hoping to bypass the tracks and traffic by sending drones to the air that will carry our delivery to our doorstep, thus eliminating expensive human resources and reducing lead times for customers.

Amazon had already wrote a patent called “airborne fulfillment center” and is communicating with the FAA (Federal Aviation Administration) in order to align the regulations to its new drone delivery.

more information on: https://www.digitaltrends.com/cool-tech/amazon-prime-air-delivery-drones-history-progress/