Digitalization of Surgical Intervention

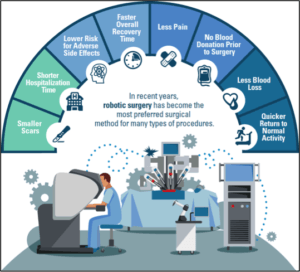

How robotic surgical instruments improve operative supply chains and threaten medical device manufacturers.

Over the next decade, robotic enabled surgical procedures will disrupt and displace market share of the largest surgical instrument producers. As the adoption of medical robotic systems grows due to improved surgical efficacy over manual techniques, their electronic instrumentation will help digitalize the current supply chain of surgical instruments in the hospital. These robotic instruments allow for hospital personnel to track the number of uses, location in the facility, and cleanliness of each surgical device in a way traditional medical device companies have not been able to. Johnson and Johnson (J&J) sold $25.1 billion of medical devices in 2016[i] and commands 13.7% of the medical device market.[ii] If J&J does not respond to the threat of surgical robotics and digitalized surgical instruments, it will lose its foothold in the operating room supply chain and medical device segment which fuels 37% of its total revenue.[iii][iv]

The largest robotic surgery company, Intuitive Surgical, has grown to $43.94 billion in market capitalization since introducing its first robotic platform in 2000.[v] The majority of its revenue comes not from the capital equipment, which can cost upwards of $2.5 million each, but from the instrumentation the system uses to interact with patient tissue. Unlike manual surgical instruments, robotic tools contain RFID chips to track lifecycle depletion, storage in the hospital, and stage of reprocessing between surgeries. If there is contamination to the patient, a robotic tool can quickly be scanned to determine the specifics of its cleaning process and isolate the source of the problem. After a predetermined number of procedures the device no longer allows the system to use it, triggering an alert to surgical staff and a purchase of a new surgical device by hospital inventory managers. [vi]

The largest robotic surgery company, Intuitive Surgical, has grown to $43.94 billion in market capitalization since introducing its first robotic platform in 2000.[v] The majority of its revenue comes not from the capital equipment, which can cost upwards of $2.5 million each, but from the instrumentation the system uses to interact with patient tissue. Unlike manual surgical instruments, robotic tools contain RFID chips to track lifecycle depletion, storage in the hospital, and stage of reprocessing between surgeries. If there is contamination to the patient, a robotic tool can quickly be scanned to determine the specifics of its cleaning process and isolate the source of the problem. After a predetermined number of procedures the device no longer allows the system to use it, triggering an alert to surgical staff and a purchase of a new surgical device by hospital inventory managers. [vi]

As robotic companies have introduced electronically tracked tools, medical device giants J&J, Medtronic and Stryker have had differing approaches to responding to the threat these companies pose to their instrument businesses. Stryker acquired Mako Surgical for $1.65 billion[vii] in 2013 for its total knee replacement robot, which is only compatible with Mako proprietary digitalized instrumentation. Medtronic, in contrast, is attempting to design and launch its own robotic systems to use its surgical instruments in 2018. [viii]

As robotic companies have introduced electronically tracked tools, medical device giants J&J, Medtronic and Stryker have had differing approaches to responding to the threat these companies pose to their instrument businesses. Stryker acquired Mako Surgical for $1.65 billion[vii] in 2013 for its total knee replacement robot, which is only compatible with Mako proprietary digitalized instrumentation. Medtronic, in contrast, is attempting to design and launch its own robotic systems to use its surgical instruments in 2018. [viii]

Recognizing the importance of the robotic surgery sector, Johnson and Johnson has taken steps to enter the space. In the short term, it paired up with Google to create Verb Surgical, a joint venture aimed at digitalizing surgery.[ix] This partnership will combine Google’s expertise in data science with J&J’s advanced instrumentation to create future robotic platforms with traceable tools. As of 2017, Verb announced early prototypes of their system: “The digital surgery platform included all elements of the company’s five technology pillars – robotics, visualization, advanced instrumentation, data analytics, and connectivity.”[x] The platforms that Verb creates will automatically track tool usage and sterilization of the devices as well as integrate with operating room supply chain management software. [xi]

In the long term, J&J has started purchasing companies like Neuwave Medical in 2016[xii], which has developed a minimally invasive soft tissue microwave ablation system with applications in the lung. This acquisition foreshadows robotic intervention in early stage lung cancer, which is the leading cancer killer in the United States.[xiii] Many are betting that this application will be the next focus of the robotic surgery industry. If this is the case, next generation flexible devices built for these robotic platforms will track usage and hospital cleaning to stop defective devices from making it into the surgical suite.

Johnson and Johnson has invested heavily to make up ground in the robotic surgery sector. In addition to the partnerships and acquisitions it has made, J&J should sponsor university affiliated robotics labs and hospital research groups in the field. Supporting research will promote new development in the space and improve visibility into developing technologies giving the company an edge over its competitors.

Additionally, J&J should consider purchasing pre-product instrument tracking companies for their intellectual property (IP). The medical device industry relies heavily on patents to protect businesses and products. Building a robust IP portfolio could prevent market competition and prove useful in the design of its own systems.

Lastly, the medical device giant should start building RFID tracking into its existing instrumentation. Providing information on the supply of manual devices to the operative environment could improve outcomes and provide analytics on current hospital practices.

Two further questions in the context of this organization are as follows:

- How can large companies in traditional industries evolve competitively as digital technologies constantly disrupt their products?

- What concerns should consumers have about these new medical technologies in an age of increasing cyber security complexity?

______________________________

(Word Count: 765)

[i] Johnson and Johnson, “2016 Annual Report”, https://jnj.brightspotcdn.com/88/3f/b666368546bcab9fd520594a6016/2017-0310-ar-bookmarked.pdf, accessed November 13, 2017.

[ii] CSIMarket “JNJ’s Competition by Segment and its Market Share.” Johnson & Johnson Competition Market share by Company’s Segment, accessed November 13, 2017. www.csimarket.com/stocks/competitionSEG2.php?code=JNJ, accessed November 13, 2017.

[iii] Mike Benson | Mar 11, 2015 4:30 pm EST. “Johnson & Johnson’s Medical Devices and Diagnostics Segment.” Johnson & Johnson’s Medical Devices and Diagnostics Segment – Market Realist, marketrealist.com/2015/03/johnson-johnsons-medical-devices-diagnostics-segment/. accessed November 13, 2017.

[iv] http://laser-prostate-robot.co.uk/wp-content/uploads/2017/05/intuitive-Davinci-version-Xi-e1494102525831.png, accessed November 14, 2017

[v] “ISRG : Summary for Intuitive Surgical, Inc.” Yahoo! Finance. November 14, 2017. Accessed November 14, 2017. https://finance.yahoo.com/quote/isrg?ltr=1.

[vi] http://www.belimed.com/BelimedASPX/media/Media- Library/Equipment%20Planning/schema_EN_with_text.png Accessed November 14, 2017.

[vii] Gelles, David. “Stryker to Buy MAKO Surgical for $1.65 Billion.” The New York Times. September 25, 2013. Accessed November 14, 2017. https://dealbook.nytimes.com/2013/09/25/stryker-to-buy-mako-surgical-for-1-65-billion/.

[viii] https://surgical-hospital.lomalindahealth.org/robotic-surgery/faqs-about-da-vinci%C2%AE, accessed November 13, 2017.

[ix] “Johnson & Johnson Announces Formation Of Verb Surgical Inc., In Collaboration With Verily | Johnson & Johnson.” Johnson & Johnson Homepage. Accessed November 14, 2017. https://www.jnj.com/media-center/press-releases/johnson-johnson-announces-formation-of-verb-surgical-inc-in-collaboration-with-verily.

[x] Verb Surgical Delivers Digital Surgery Prototype Demonstration to Collaboration Partners.” Verb Surgical. Accessed November 14, 2017. http://www.verbsurgical.com/media/archived-press-releases/verb-surgical-demonstrates-digital-surgery-prototype-to-partners/.

[xi] http://www.complianceteaminc.com/why-jj-and-google-are-teaming-up-to-make-surgical-robots/ Accessed November 14, 2017.

[xii] “Ethicon Announces Agreement To Acquire NeuWave Medical, Inc. | Johnson & Johnson.” Johnson & Johnson Homepage. Accessed November 14, 2017. https://www.jnj.com/media-center/press-releases/ethicon-announces-agreement-to-acquire-neuwave-medical-inc.

[xiii] “Key Statistics for Lung Cancer.” American Cancer Society. Accessed November 14, 2017. https://www.cancer.org/cancer/non-small-cell-lung-cancer/about/key-statistics.html.

Symptomatic of many digital technologies, the second question in the essay alludes to a key implementation challenge: Why might patients have concerns to undergo robotic-assisted surgery (RAS)?

Broadly speaking, four areas need to be addressed by Intuitive Surgical and other industry players:

* Responsibility for outcomes: Who is ultimately accountable and liable for adverse outcomes? Unlike traditional surgeries, RAS depends on multiple contributors, including the robotic manufacturer, healthcare professionals, and maintenance specialists.

* Ad-hoc interventions during surgeries: Similar to pilots disconnecting the autopilot in emergency situations, how can surgeons effectively step in if unforeseen complications arise during surgeries? Some cases of mechanical problems during RAS procedures have attracted much attention over the last years (e.g., [1]).

* Cyber-security threats: How can robotic systems be protected from cyber-attacks? Earlier this year, the WannaCry malware has shut down large parts of the National Health Service in the U.K., leading to thousands of canceled operations [2]. In addition, security experts have successfully hacked surgical robots in the past [3]. These instances might only be a foretaste of what is to come, which underlines the importance of cyber-security defense mechanisms.

* Omission of the “human element”: From a psychological perspective, many patients might be hesitant to undergo surgery performed by a robot. Even though this behavior might not be fully rationale, patients value personal interactions with surgeons before and after operations, which instills trust and confidence.

Without doubt, RAS is about to revolutionize the healthcare. However, RAS proponents would be wise to address the above concerns with a clear allocation of accountabilities, extensive training protocols for health-care professionals, close collaborations with top-notch IT security specialists, and patient education campaigns.

______

[1] https://psnet.ahrq.gov/webmm/case/368/robotic-surgery-risks-vs-rewards-

[2] https://www.nbcnews.com/news/world/why-wannacry-malware-caused-chaos-national-health-service-u-k-n760126

[3] https://www.technologyreview.com/s/537001/security-experts-hack-teleoperated-surgical-robot/

(all accessed on Nov 20, 2017)

Reading this description of using robots for surgery makes me wonder two things: who is the decision making unit in this purchasing process, and how does this change the education process for surgeons? Currently to operate on a patient, a doctor needs years and years of practice and education across all an incredibly wide medical spectrum. In the future, will this knowledge still be required to operate on a patient? Will a decades long education be a fast enough turnaround to produce doctors capable of using newer and rapidly changing tools? Finally, do these doctors have a misaligned personal incentive if robotic surgeons start to remove a need for doctors?