Digital Disruption in the Mining Industry. Will innovation save declining productivity?

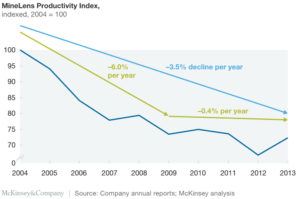

Mining productivity has been declining by 3.5% annually since 2010, reaching 30-year low. Will digitali solutions help change the industry future? Is the Polish biggest mining company a trendsetter or rather just a follower of global copetitors’ strategy?

Digitization as cure for decreasing mining productivity?

Mining productivity has been in a decline. Since early 2000 to 2013 it has been dropping by 3.5% annually, reaching 30-year low. In the World of the unprecendently high commodity prices, the miners have been focused on output at any cost, almost neglecting technology-enabled productivity improvements and chasing easily accessible ore bodies. Mining used to be very slow technology adopter – will it be fast enough to adopt new IoT solutions, predictive modelling and other technological tools, to increase its productivity and save many sites from closure?

What are the improvement levers?

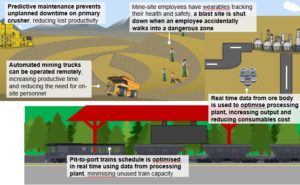

Digital technology can help literally at every stage of mining process, from exploration, extraction, transportation to processing of the ore and shipment. Big data and analytics might improve the geological modelling and mine planning (especially 3D technologies). Improved ore body insights could drive more targeted blast strategies, reducing cost and improving safety. Use of robotics may improve the performance of load and haul (IoT-enabled fleet management). In open pit mines, self driving ore trucks could reduce human cost, improve safety and increase efficiency (no breaks and driver changes), whereas GPS enabled systems might allow for route optimization. Similarly, in underground mines tele-remote and autonomous equipment could reduce, if not eliminate the human factor involvement, especially in dangerous extraction zones. Optimised mine and logistics scheduling would maximise the utilisation of equipment. In processing, big data and advanced analytics could also increase assets productivity and grow the yields (input ore grade optimization allowing for waste reduction, using advanced throughput modelling). Data collection and analysis could also allow for predictive maintenance, improving equipment reliability and reducing unplanned downtime. Dynamic modelling of supply chain from mine site to distribution points (for example ports) could allow to diagnose bottlenecks and improve system efficiency.

KGHM and its Business Strategy

KGHM is a state-owned, biggest polish copper and silver producer. It’s ranked correspondingly 6th and 1st worldwide in copper and silver production and hires over 28 thousand employees, mostly in Poland, Chile and Canada. In 2015 KGHM announced a new business strategy, based on four main goals: maximizing value of the production (1), increasing competitiveness (2), strengthening company’s international position (3) and ensuring Poland’s resource security in the context of technological needs (4). Innovation has been named as a major tool which will allow for the strategy realization.

Operational strategy – Intelligent Mine Program

In regards to goals 3 and 4, the company has intensified the resources (ore bodies) acquisition both in Poland and abroad and is also developing its Chilean operations (mine is Sierra Gorda). Regarding the competitiveness and production value maximization, KGHM decided to implement a new operational transformation program called “Intelligent Mine”. This program will enable the creation of a fully integrated Intelligent Production Process, that will ensure safety, technological effectiveness and efficient and flexible management of all production operations. The program is currently piloted in one of the company’s mines in Poland. Major operational initiatives include:

-IoT-enabled automization of mining and transportation (wireless underground connectivity between self-driving mining equipment), which will allow for removal of employees from high-risk deep mining areas;

– Copper concentrate yield optimization and metal recovery improvement through advanced data modelling (biohydrometallurgical process modelling aimed at ensuring higher recovery of metals while minimizing the environmental impact of smelting operations);

Company wide, KGHM is using big data and analytics to forecast the copper prices worldwide, so as to enhance its hedging strategy and optimize the production output in time.

Self-driving ore truck

Piloting fast enough?

It is of no doubt that all the initiatives undertaken by KGHM make economic and environmental sense. The question is however, weather the company is not introducing the digital tools in a too slow and too localized way. Rio Tinto, world’s third largest mining company, introduced its digitalization program “Mine of the Future” yet in 2008, compared to 2015 by KGHM. Also, KGHM is yet in digitalization program piloting phase in Poland, which will delay the full-scale implementation of the program in all the mines. This is especially worrying, as the polish mines are underground mines, whereas the international KGHM operations are mostly open pit and will therefore require a different set of operational changes, to adopt the digital improvements. Finally, it seems that while KGHM is improving its mining operations, the tech-enabled administrative improvements have not yet been addressed, which might lead to lower overall competitiveness in the future.

Self-driving underground digger

It is great to read about this outside of the Australian mining company context I am used to. I tend to agree that they are moving far too slow relative to Rio Tinto and BHP Billiton. And then again, even those companies are considered to be moving very slow relative to other industries such as banking or telecommunication. I can’t help but wonder what it will take to speed things up – perhaps a competitor moving into this space and reducing costs to well below that of the existing miners. However, given the commodity price is set by the costs of the marginal producer, this is not really likely to have an impact on the mining giant’s profitability.

Given the difference between KGHM’s underground mines in Poland vs. open pit operations worldwide, why do you think the company decided to pilot in the former vs. the latter? Very interesting article about the mining industry and steps they’ve taken to improve technology in the field. Am curious to understand what the timeline would look like to implement a full-chain digitalization program. In an industry that may already be considered slow to adopt new technology, is there any risk in implementing too late?