Digital Banking: Cut the Lines and Human Interaction

In an age where startups rise to the top over outdated incumbents, hundred-year-old banks continue to adapt and thrive

The digital age is about disruption. Our favorite narrative is of the hero entrepreneur who turns an industry on its head, rising to the top amongst old competitors that were too slow to adapt.

And then there’s retail banking, an industry that has largely not been penetrated by new tech startups, and is still dominated by long-standing companies. In fact, the average age of the 10 largest banks in the US is 156 years1. These ancient organizations, such as Bank of America, have proven they can evolve alongside technology, and their ability to do so effectively has kept the dinosaurs not just alive but thriving.

Online banking

![growth in internet use and online banking [12,13]](https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2016/11/Screen-Shot-2016-11-18-at-4.36.50-PM-300x187.png)

Despite this progress, Bank of America may have been threatened in 1999 with the introduction of the US’s first “online only” bank, offering lower fees and high-yield accounts with a lack of physical overhead3. However, “online only” proved to be slow in their growth, likely due to the reduced convenience for withdrawals, deposits, and perceived security threats4,5. By offering online services early, Bank of America was able to hedge the risk posed by these new competitors by offering the same online capability with the added benefit of physical branches when needed.

Mobile Money

There shouldn’t be any surprise that the next wave of innovation in banking has been centered around the smart phone. Bank of America (along with many competitors) offers apps for its customers providing the same services available through traditional online banking, along with additional features such as depositing checks through photos and card-free ATM integration6. Mobile banking has certainly caught on, as 55% of American

![Source: The Financial Brand [10]](https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2016/11/Screen-Shot-2016-11-18-at-4.57.45-PM-300x222.png)

But who cares about these apps and features? Is Bank of America truly adding value and gaining a competitive advantage with this? The answer is absolutely. Satisfaction with a bank’s mobile platform has been shown to be critical overall customer satisfaction as well as customer retention and growth, specifically in the key segments of the “emerging affluent”, millennials, and minority groups. One advantage of Bank of America’s size is their ability to allocate money toward improving their mobile products, giving them an edge over smaller financial institutions10.

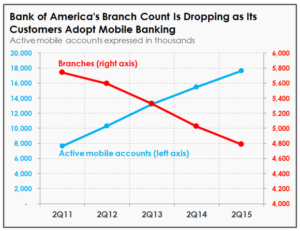

The “Before and After” Picture

OK, so Bank of America has adopted with the times, fostered innovation and all these great things, but how has it affected their bottom line? Unfortunately, the financial crisis of 2008 and subsequently stagnant economy don’t paint a great picture for the banks performance, but there are some signs that this shift toward online banking has had a positive impact. Some indicators are the number of branches operated by the bank, as well as their total deposits and revenue for consumer banking:7,8,9

![Source: [8] [9]](https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2016/11/Screen-Shot-2016-11-18-at-5.07.01-PM-300x185.png)

Moving forward

While Bank of America and its competitors have so far kept pace with technology, there are continually emerging competitors and threats. Venmo is an app targeting millennials that allow consumers to transfer funds to each other at no fee, and to keep a balance in their account. The company has expanded its capability to include limited B2C consumer payments, and is continuing to grow. Robinhood is another app allowing free stock trading based on a mobile platform. Both of these companies are growing in popularity with the millennials and technologically inclined. If these companies continue to widen their services into the banking world, we may soon see another test of our old banks’ ability to adapt and stay on top.

(748 words)

References

- US Bank Locations.com. Banks Rated by Total Deposits. from http://www.usbanklocations.com/bank-rank/total-deposits.html

- The birth of mobile banking. (n.d.). Retrieved November 17, 2016, from http://about.bankofamerica.com/en-us/our-story/the-birth-of-mobile-banking.html#fbid=s1KojACDCgG

- Sarreal, R. (2016). History of Online Banking: How Internet Banking Became Mainstream | GOBankingRates. Retrieved November 18, 2016, from https://www.gobankingrates.com/banking/history-online-banking/

- Couch, Karen, and Donna L. Parker. “’Net Interest’ Grows as Banks Rush Online.” Southwest Economy, Federal Reserve Bank of Dallas no. 2 (2000), 1–5. http://dallasfed.org/assets/documents/research/swe/2000/swe0002.pdf

- Crosman, P. (2016). Consumers Use Mobile Banking But Don’t Trust It, with Reason. Retrieved November 17, 2016, from http://www.americanbanker.com/news/bank-technology/consumers-use-mobile-banking-but-dont-trust-it-with-reason-1078891-1.html

- Bank of America. Cardless ATM promo. From http://promo.bankofamerica.com/cardlessatm/

- 2011 Annual Report. (2012). Retrieved November 17, 2016, from http://media.corporate-ir.net/Media_Files/IROL/71/71595/AR2011.pdf

- 2015 Annual Report. (2016). Retrieved November 17, 2016, from http://media.corporate-ir.net/media_files/IROL/71/71595/AR2015.pdf

- Maxfield, J. (2015). Chart: Bank of America Is Closing Branches as Mobile App Users Grow. Retrieved November 17, 2016, from http://www.fool.com/investing/general/2015/10/07/chart-bank-of-america-is-closing-branches-as-mobil.aspx

- Marous, J. (2016). Mobile Banking Drives Satisfaction and Growth. Retrieved November 17, 2016, from https://thefinancialbrand.com/58703/mobile-banking-satisfaction-growth/

- Maxfield, J. (1970). Bank of America’s $7 Billion Question. Retrieved November 18, 2016, from http://www.fool.com/investing/general/2016/05/19/bank-of-americas-7-billion-question.aspx

- United States Internet Users. (n.d.). Retrieved November 18, 2016, from http://www.internetlivestats.com/internet-users/us/

- Online/Mobile Banking Adoption Trends & Demographic Profiles. (2013). Retrieved November 17, 2016, from https://thefinancialbrand.com/32428/pew-research-online-banking-users-demographic-trends/

BAH,

Thanks for the write-up. I’m a (reasonably satisfied) BofA customer. I agree with many of the points you made in your write-up. I think BofA and other large U.S. banks will always have a role to play in the everyday life of the consumer, for the simple reason that we all need a safe place to park our cash. Incremental improvements such as contactless cards will further lock us into keeping our cash deposits at our banks. However, what about the loan side of the equation? Here, I am not so sure. 10 years ago, consumers and SMBs looking for a loan had few realistic options other than asking their bank for one. Today, the situation is different and the number of options is multiplying thanks to fintech – look at LendingClub, LendingTree, Prosper, etc. This trend is gradually eroding BofA’s loan pricing power; the rules of microeconomics tell us that all else being equal, BofA will have to lower the rates they charge on their loans. If BofA does not find a way to properly respond to fintech on the loan side, their net interest margins will compress, and the business of banking then becomes a decidedly less attractive place to be in.

BAH,

It is interesting to see that technology might become a key differential in BAML’s customer promise. If competition arises as mentioned in the text and by BudFox, they will need to understand how to a) add differentiated value – and in this sense, leveraging their financial position may favor them on technology investments, b) how to create competitive products and services to match substitutive solutions arising (i.e. Venmo, Robinhood etd) and c) how to leverage its current scale to expand market share before the arrival of new competitors. It is crucial that BAML keeps its market share and technology seems to not be a differential anymore; it is a ‘must have’ that will benefit whoever understands how to use it first.

Thanks BAH! I also wrote a post regarding digital banking, this is a topic that I find very interesting. Regarding the future of banking in the midst of disruptive startups, I think the answer lies in successfully partnering with them! These startups can be seen as outsourced R&D, and incorporated into current services – if you can’t beat them, join them!

https://cfi-blog.org/2016/09/08/the-new-wave-of-partnership-models-between-banks-and-fintech-startups/

These partnerships are hard though, especially due to internal compliance in major banks.

A question crops up from your assertion stating “you still need to get cash somehow”. Do you indeed?

Is it possible that the entire cash economy could be replaced with digital payments and banking. Apps such as Venmo and Paypal could replace the use of cash, thereby eliminating the need for ATMs and other cash dispensing facilities in banks. Or is cash something so central to human behavior that it can never be eliminated. Either way, this could completely change the business model of banks such as BofA, and I wonder how they are thinking about it.

BAH, thank you for your post. Like Josue I also wrote a post regarding digital banking, which I think is something that banks will need to invest in order to remain in the market. Recently, McKinsey has published an article (link below for reference) stating that banks have three to five years to become digitally proficient, and if they fail to take action, they will probably enter into a spiral of decline. I personally agree with these statement and also with your conclusion that BofA needs to be alert with the threat imposed by new emerging apps.

Itau, for example, which is the bank I analyzed, created an app to enable consumers to directly transfer money to each other, which is very similar to what Venmo does. Maybe due to that, Venmo is not yet in Brazil and is not competing against Itau. This strategy of anticipating the competition is veru important and, as Siddhart mentioned in his post, can also have other advantages, like the elimination of the need for branches. So, in fact, there is still a lot of room for innovation in banking and BofA should look for that.

http://www.mckinsey.com/industries/financial-services/our-insights/strategic-choices-for-banks-in-the-digital-age

Thanks BAH for the great post! As many have commented above, I’m curious to see what they do going forward to differentiate themselves. The money transfer apps that have become popular (venmo, google wallet, etc.) have made my life so much easier and am curious to see if they attempt to partner or create their own version. I find it particularly frustrating that money transfers to different banks are so difficult using the sponsored apps and would imagine they’ll try to improve on that in the future. Additionally many of the online only banks offer benefits such as reimbursement of atm fees, higher interest rates, and lower fees. I’m curious to see if Bank of America attempts to match or improve upon those features.

Thanks for the post BAH! Being a BoA account holder myself, I have been reasonably satisfied with their online banking system, except for the fact that making money transfers to different accounts costs money…

It seems banks try to make money off of any little thing they can think of, but this results in apps like Venmo being widely used because of its convenience and no-fee transactions. As the trend towards cashless payments continue to spread globally, banks need to figure out a way to either compete or acquire these payment apps in order try and find ways to become more convenient – and differentiate themselves from others. The idea of having both physical stores and an internet banking platform is appealing, but can be costly. From a consumer perspective, if being able to make payments or transfer payments for free means eliminating physical stores, I wouldn’t mind. If BoA embarks on as bold a step as this one, it would surely gain popularity and send a strong message of “customer first” to the public.