Diamonds Are Forever…But Their Supply Chains Are Not

This post explores how blockchain technology is being used to digitalize the procurement of diamonds and enhance industry transparency through the lens of major Asian jeweler Chow Tai Fook.

“A diamond is forever.”

This ubiquitous marketing slogan is a nod to the everlasting emotional connection between consumers and their diamonds, and to the deep tradition within which the diamond industry is steeped. Fittingly, the industry’s supply chain has not strayed far from its traditional dynamic. Paper records are still used to track diamonds from their rough to polished state and there exists no centralized database for such certification records, leaving retailers vulnerable to reputational and financial risks – for example, when war or synthetic diamonds are misrepresented[1].

An advancement in the sourcing of diamonds, in which blockchain technology openly marks and tracks individual diamonds, provides a compelling solution to the lack of transparency in diamond procurement[2]. Based on my prior diligence on the diamond industry as an investor, the digitalization of diamond procurement should be of concern to managers of diamond retailers because of the following strategic opportunities that this new technology could unlock:

- Enhanced supply chain efficiency due to greater transparency and more reliable data tracking along each step of the supply chain (see below for a discussion on the re-shaping of the supply chain)

- Decreased threat of substitutes (e.g., blood diamonds or synthetic diamonds) due to a decreased reliance on forgeable paper certificates[3]

- Decreased threat of new entrants due to higher fixed costs associated with blockchain technology and barriers generated by first-mover advantage/network effects[4]

- Decreased consumer bargaining power as a more transparent procurement system introduces opportunities to enhance and leverage customer loyalty and trust[5]

A major Asian diamond retailer, Chow Tai Fook (“CTF”), offers a glimpse of what managers are doing – and could be doing – to address transparency concerns. In August 2017, CTF introduced its T-MARK campaign, which assesses diamonds according to four T’s (traceable, truthful, thoughtful, transparent) and promises “a thorough and accurate account of each diamond’s life” through the use of proprietary engraving technology that will allow CTF customers to track the diamond throughout its life[6]. Though this near-term step is symbolic of management’s commitment to enhance sourcing transparency, it appears to be primarily a branding campaign and product enhancement tool rather than true supply chain digitalization. As the T-MARK diamond’s information is not published within a public forum, its certification remains connected to the stone itself, and only visible through CTF’s “Diamond Viewer”[7]. Therefore, if T-MARK diamonds were to be sold or re-sold outside of CTF’s purview, they would remain vulnerable to sourcing fraud. The firm remains tight-lipped surrounding how it plans to digitalize its supply chain over the medium-term, however a Company spokesperson suggested that although “[CTF doesn’t] yet use blockchain,” it is “under consideration” and “[CTF is] reviewing the technology in the marketplace.”[8]

As a major diamond retailer, CTF is uniquely positioned to be a first-mover in “Procurement 4.0” – the digitization of procurement – in the diamond industry over the medium-term by leveraging blockchain technology[9]. I recommend that CTF invest in building out in-house capabilities similar to those of the U.K.-based start-up Everledger, which has created a global digital diamond registry by generating unique identification codes for over one million diamonds (called diamonds’ “digital twins”), and then storing these digital twins in a permanent, publicly accessible blockchain ledger[10]. Such a record-keeping system would build on CTF’s T-MARK campaign by eradicating the supply chain’s reliability on privately-held certificates that are easily lost or forged, thereby further enhancing the credibility and authenticity of the diamonds.

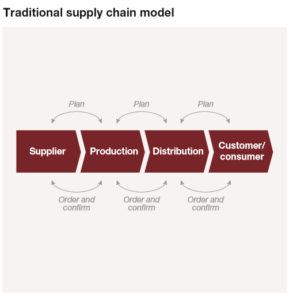

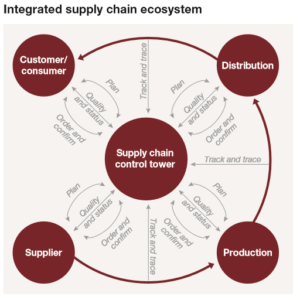

Importantly, such a technology would enhance the diamond industry’s supply chain by fundamentally re-shaping it. Consider Exhibit 1, which demonstrates a traditional supply chain model in which the diamond’s quality, status and origin are unknown by the production function (cutters/polishers), distributers (retailers), and consumers[11]. Migrating to a blockchain system would re-shape the supply chain into what we see in Exhibit 2, a hub-and-spoke model in which information regarding the diamond’s quality, status and origin is reported on the blockchain ledger (e.g., “supply chain control tower”), visible to all parties and comprising the heart of a more efficient supply chain[12].

In sum, though it promises to unleash significant strategic opportunities, the digitalization of diamond procurement elicits questions for further consideration. For example, what are the tradeoffs of developing a blockchain platform in-house, versus at a consolidated industry level? Who along the diamond value chain (upstream diamond mines, midstream cutters/polishers, or downstream retailers) should be responsible for implementing and monitoring this technology? More fundamentally, how could the greater transparency and the public cataloging of diamonds impact their value and utility?

(737 words)

Exhibit 1

Source: Stefan Schrauf and Philipp Berttram, “Industry 4.0: How Digitization Makes the Supply Chain More Efficient, Agile, and Customer Focused,” Strategy& (2016), PWC, accessed November 2017.

Exhibit 2

Source: Stefan Schrauf and Philipp Berttram, “Industry 4.0: How Digitization Makes the Supply Chain More Efficient, Agile, and Customer Focused,” Strategy& (2016), PWC, accessed November 2017.

[1] Pamela Ambler, “Diamonds Are The Latest Industry To Benefit From Blockchain Technology,” Forbes, September 10, 2017, https://www.forbes.com/sites/pamelaambler/2017/09/10/how-blockchain-is-fixing-the-diamond-industrys-rampant-ethical-issues/, accessed November 2017.

[2] Ibid.

[3] Andrew Barclay, “Blockchain is transforming one of the worlds oldest professions,” via Factiva, accessed November 2017.

[4] Michael E. Porter and James E. Heppelmann, “How Smart, Connected Products Are Transforming Competition,” Harvard Business Review (November 2014), 13.

[5] Ibid, 11-12.

[6] Chow Tai Fook, “Chow Tai Fook T MARK,” https://www.chowtaifooktmark.com/#landing, accessed November 2017.

[7] Ibid.

[8] Pamela Ambler, “Diamonds Are The Latest Industry To Benefit From Blockchain Technology,” Forbes, September 10, 2017, https://www.forbes.com/sites/pamelaambler/2017/09/10/how-blockchain-is-fixing-the-diamond-industrys-rampant-ethical-issues/, accessed November 2017.

[9] Stefan Schrauf and Philipp Berttram, “Industry 4.0: How Digitization Makes the Supply Chain More Efficient, Agile, and Customer Focused,” Strategy& (2016), PWC, accessed November 2017.

[10] Gian Volpicelli, “How the blockchain is helping stop the spread of conflict diamonds,” Wired, February 15, 2017, http://www.wired.co.uk/article/blockchain-conflict-diamonds-everledger, accessed November 2017.

[11] Stefan Schrauf and Philipp Berttram, “Industry 4.0: How Digitization Makes the Supply Chain More Efficient, Agile, and Customer Focused,” Strategy& (2016), PWC, accessed November 2017.

[12] Ibid.

Very interesting piece, quite insightful analysis of potential benefit of blockchain on diamond industry. I have one question for the author: do you think that implementation of blockchain may actually jeopardize diamond sellers (consumer-facing) as it would provide radical transparency on pricing?

In a past life, I spent time investing in gold mines, understanding the supply chain. My main takeaway after that experience is that the cost of extraction from mines, the spot price of gold, and the smoldered end-product price are three disparate prices – with the spread between the first and last often being quite large. If, as a consumer, I can suddenly notice that there is a sizable spread, wouldn’t this put a downward pressure on pricing? Why is it in Chow Tai Fook’s interest to introduce such radical transparency if this underscores that diamonds, like other precious stones, are ultimately commodities that should trade at extraction cost?

I assume that this transparency allows Chow Tai Fook to distinguish itself from less-authentic competitors (or seemingly less authentic) but how does it differentiate itself from synethic diamonds? Wouldn’t a consumer that fully follows the supply chain of a diamond through a blockchain likely be more willing to buy a synthetic? I would assume synthetics and Chow Tai Fook are fighting for the same type of consumer.

The blockchain platform will allow efficiencies at every step of the process and it could show the largest impact/savings if managing at an industry level.

However, this could pose some challenges:

Decreased threat of new entrants: risk of monopolization (regulated environment)

Decreased consumer bargaining power: differentiation between brands (price and quality will be assured). If the extraction/producer cost is fixed and there is a competitive % margin at the retailer level, customer service and personnel at the retailer could do the difference. However, considering that e-commerce will increase in the following years, this differentiation point could be eroded too.

The advantages are undeniable (lower price/assured quality) but the companies will have to pay attention to the investment in blockchain and the challenges that rise when there are only a bunch of players that can work with this technology and how they are going to attract customers.

I believe the trade-off question of developing a blockchain in-house or via some kind of shared effort is a critical one, and suggest that a “shared effort” system built on top of a large, existing public blockchain (e.g. Ethereum) makes the most sense for participants in the diamond industry.

Building and monitoring a new, independent blockchain can be expensive and time consuming, especially for companies that lack the requisite technical expertise and have to rely on third-parties (almost a certainty for companies in the diamond business).

Implementing a system on top of a large, public blockchain, such as Ethereum, will be cheaper because companies can leverage existing development standards and infrastructure. But perhaps most importantly, it will also increase the blockchain’s security, which is key for a blockchain whose purpose is to reflect the legitimate exchange of assets that have a high monetary value, such as diamonds. This blockchain would be a likely target for bad actors. The Ethereum network’s enormous scale and computational mining power makes it virtually impossible (too expensive) to hack (at the network level – endpoint security and credential management are still the responsibility of the client). This means the transaction immutability property of its blockchain is stronger than that of smaller alternatives.

The original Bitcoin whitepaper provides further explanation of proof-of-work, or how computational power enforces public blockchains’ immutability. https://bitcoin.org/bitcoin.pdf

To create the highest impact and to reach the highest adoption, I think we should develop a block-chain tracking system at an industry level. The initiation of the platform should involve all related parties of the diamond industry. Big companies can lead in setting up an organization to collect all concerns and needs of all players in the industry to create the platform and to encourage everyone to adopt it.

With increased transparency of diamond source tracking, the value of diamond from clean source will increase the value of blood diamond will significantly decrease since the blood diamond will be harder to sell. This is the price trend that we want. Once the price is down, there will be less incentive selling and consequently less incentive for unethical mining.