Dashing into a digital future with the Amazon Dash

The Amazon Dash – joke or supply chain innovation?

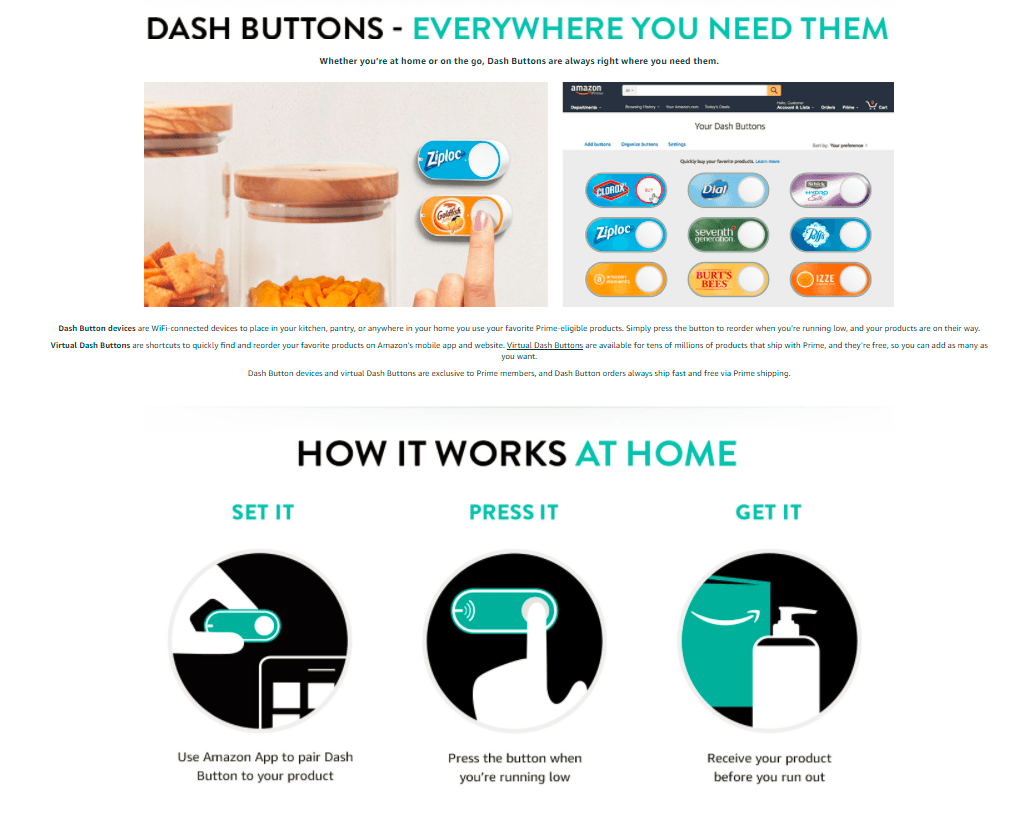

When Amazon launched the Dash button on March 31, 2015, the public was baffled (Exhibit 1). The Dash is a small, WiFi connected, push-button tied to a particular brand and users can press the button at any time to place an Amazon order for the product (Exhibit 2). USA Today published “Amazon’s Dash button–Not an April Fools’ joke” while the New Yorker wrote about “The Horror of Amazon’s New Dash Button.”[1][2] What was the Internet giant doing making physical ‘easy buttons’ to sell products?

In 2015, Amazon was a leader with respect to the digitization of its supply chain.[3] Its technological advancements (Kiva robots automating its factories, routing / shipping algorithms enabling last-minute optimized shipping decisions) and scale allowed the retail to deliver goods faster and more cheaply to consumers than almost any other player.[4] For example, only a few months before the Dash, Amazon launched Prime Now, a one-hour delivery service.[5]

However, while Amazon had control over its own processes, it had yet to automate the customer experience and purchasing process. Today, Amazon, reliant on its retailers, largely delivers ‘dumb’ products. A bottle of Tide dishwashing detergent cannot automatically place a reorder when it is running low. The potential of smart, connected products and of predictive ordering are major concerns and opportunities for Amazon. Every time consumers want to buy a bottle of detergent Amazon needs to compete with existing brick-and-mortar incumbents (e.g., CVS, Walgreens) as well as old and emerging e-Commerce players (e.g., Walmart, Google Shopping Express, Instacart) for mindshare.[6] Moreover, manufacturers have been experimenting with direct-to-consumer models and smart products that can automatically place re-oders (e.g., a washing machine that can reorder detergent when it is running low).[7] While some of these manufacturers (e.g., Whirlpool) have opted to use Amazon’s fulfillment services, Amazon may risk disintermediation from some of these players.[8]

The launch of the Amazon Dash was a phenomenal way to address this concern and create a smarter supply chain, simplifying a customer’s purchasing decision. Amazon has expanded its Dash program. Today, Amazon has over 300 buttons, partners are receiving half their Amazon orders via the Dash and it is available in more than 8 countries.[9] Consumers place orders on Dash buttons more than four times a minute, which is up from once a minute in 2016.[10] The company has gone on to launch virtual Dash buttons on its app (e.g., consumers don’t need to buy the physical button).[11] Finally, the company recently unveiled the Dash Wand, a WiFi connected barcode scanner and voice-enabled device that can order goods.[12] Promoting the Wand is going to be a massive medium-term opportunity for Amazon as it enables a consumer to order virtually anything Amazon delivers.

With respect to my own recommendations, in the short-term, I believe Amazon should further its rollout, adding more partner brands and mass-advertising the Dash to consumers. Amazon could even automatically deliver a Dash with any product that is frequently reordered or have an ‘add a Dash’ option in the checkout flow. In the medium term, Amazon could go significantly further to digitize the consumer layer of its supply chain, by predicting a consumer’s orders and placing those orders automatically. Through the data it collects from the Dash and its online channel, Amazon can paint a relatively complete picture of a consumer’s purchasing behavior and start prompting the customer with suggested re-orders. Further down the road, Amazon could ask consumers if they want to opt-in to an automatic reordering program and effectively remove the consumer decision from the purchase entirely, making shopping seamless.

Despite the early success of the Dash and the potential opportunity, there are many open questions. The first is around Amazon’s partnership strategy. A consumer with a Tide dash button, will almost always purchase Tide. How should Amazon craft its partnerships such that it successfully continues to scale its Dash ecosystem for both small and large brands? Moreover, how should Amazon position its own private label brands in this strategy? Second, while the Dash has seen success with frequently ordered products, should the program be scaled to more infrequent purchases? Finally, as Amazon moves into predictive ordering, are there any lines the company should draw with consumer data?

I believe the Dash represents a significant innovation in building a supply chain not just catered to consumer demand, but catered to real-time consumer needs. It will be fascinating to watch Amazon answer these questions as it seeks to become the ‘everything store.’[13]

(741 words, excludes footnotes)

Exhibit 1:

Exhibit 2

[1] Elizabeth Weise, “Amazon’s Dash button–Not an April Fools’ joke,” USA Today, March 31, 2015, https://www.usatoday.com/story/tech/2015/03/31/amazon-dash-ordering-button/70747342/, accessed November 2016.

[2] Ian Crouch, “The Horror of Amazon’s New Dash Button,” New Yorker, April 2, 2015, https://www.newyorker.com/culture/culture-desk/the-horror-of-amazons-new-dash-button, accessed November 2016.

[3] Jefferies, “Fulfillment Revisited: A Deep Dive on Amazon’s Evolving Fulfillment Strategy,” April 14, 2015, via CapitalIQ, accessed November 2016.

[4] Ibid.

[5] Ben Geier, “Amazon launches one-hour deliveries with Prime Now,” December 18, 2014, http://fortune.com/2014/12/18/amazon-launches-one-hour-deliveries-with-prime-now/, accessed November 2016.

[6] Jefferies, “Fulfillment Revisited: A Deep Dive on Amazon’s Evolving Fulfillment Strategy,” April 14, 2015, via CapitalIQ, accessed November 2016.

[7] Kif Leswing, “This Smart Washing Machine Will Order More Detergent From Amazon,” January 4, 2016, http://fortune.com/2016/01/04/whirlpool-amazon-washer-dryer/, accessed November 2016.

[8] Ibid.

[9] Brett Williams, “There are now Amazon Dash buttons for Colgate, KY, Emergen-C and more,” Mashable, January 25, 2017, http://mashable.com/2017/01/25/amazon-dash-adds-more-partners/#XScTpHdjmaqP, accessed November 2016.

[10] Leena Rao, “Two Years After Launching, Amazon Dash Shows Promise,” Fortune, April 25, 2017, http://fortune.com/2017/04/25/amazon-dash-button-growth/, accessed November 2016.

[11] Jason Del Rey, “Amazon just launched virtual ‘Dash’ buttons for one-click buying from the homepage,” January 20, 2017, https://www.recode.net/2017/1/20/14333220/amazon-virtual-dash-buttons-one-click-purchase, accessed November 2016.

[12] Minda Zetlin, “Amazon’s Latest Product Will Try to Manipulate You, but You Should Still Buy One (It’s Basically Free),” June 16, 2017, https://www.inc.com/minda-zetlin/amazons-latest-product-will-try-to-manipulate-you-but-you-should-still-buy-one-i.html, accessed November 2016.

[13] Michiko Kakutani, “Selling as Hard as He Can ‘The Everything Store: Jeff Bezos and the Age of Amazon,’” http://www.nytimes.com/2013/10/29/books/the-everything-store-jeff-bezos-and-the-age-of-amazon.html, accessed November 2016.

avaswani,

Great article! I am particularly intrigued by the predictive ordering capabilities that you raise. I imagine that Amazon will soon be able to (if it cannot already) predict consumer buying needs on a day-by-day basis, eliminating friction in consumers’ decision making and purchase processes. However, my question is: does Amazon really need Dash to achieve this level of predictability? Furthermore, is the marginal value of a Dash button versus, say, a user friendly mobile app, really worth it to consumers? More and more consumers are buying exclusively on mobile. In fact, the recent Black Friday holiday generated over $5 billion in online sales, with $2 billion on mobile alone [1]. If the convenience factor of Dash ordering can be replicated with a mobile app, why wouldn’t consumers be inclined to press a button they already have, avoiding the added technology of yet another button (either physical or virtual)? From Amazon’s perspective, too, the Dash button might quickly become superfluous. The data collected through Amazon’s online channel is likely already robust enough to replicate the predictive features of the Dash button. I fear that the additional infrastructure costs and R&D expenses of the Dash button will not generate enough user demand to be a worthwhile pursuit for Amazon long term.

[1] Ingrid Lunden, “Black Friday racks up $5.03B in online sales, $2B on mobile alone,” TechCrunch, November 24, 2017, https://techcrunch.com/2017/11/24/black-friday-deals-net-640m-in-sales-so-far-mobile-60-of-all-traffic, accessed November 2017.

Super intriguing!

When Amazon dash came out, I must admit I thought it was silly and I dismissed the idea. Part of the value proposition for the customer of Amazon’s online marketplace is order customization. Customers can compare prices of product substitutes, add multiple products to their cart, and then adjust product quantity and delivery preferences. The Amazon dash reduces the user’s options to one product, one price, one price, and one quantity. The Amazon dash also seemed to me to be bad for Amazon. As you said, Amazon wins on the scale of its supply chain. Online Amazon won’t ship some items alone because they are too small to justify the delivery cost, so it forces an order minimum. Yet, the Amazon dash encourages a lot more small orders instead of more big orders. Lastly, the button just looks cheesy. Who needs this tiny, branded, easy to lose device when people are more than happy to order on their mobile phones?

Your article convinced me of some of the merits of the Amazon dash, especially if they move to the digital Dash app and the Dash wand that can scan barcodes, because now I see how the Amazon dash can encourage more frequent purchases and eventually unlock more predictive ordering capabilities.

To your question about partnerships, I believe Amazon has to offer the customer the choice between small, large, and private label brands. Their customers value brand choices and the expectation of choice has already been set with Amazon’s online marketplace. Competition between brands is good for Amazon because it gives them leverage when negotiating their margins.

To your final question regarding predictive ordering with customer data, generally online customers have become more comfortable with the idea that Amazon knows their ordering history and what items have browsed through but not purchased. It is OK if it recommends these products to the customer, but it would be nice to offer the customer the opportunity to clear order and search history. What I would be less comfortable with is if Amazon brought in recommended purchases of products that I viewed on non-Amazon websites, meaning Amazon is tracking my online activity across non-Amazon websites. Finally, auto-purchases should always require consent, even if it is just a small online checkbox that ensures the user is ok with auto-purchases at some pre-determined interval.

Thanks for writing this article! Super insightful. The most interesting part for me is where you raise the question of how Amazon will choose the suppliers that gives the Dash device buttons to. In my previous life, we spent a lot of time negotiating contracts with suppliers for large retailers (think Walmart, Target etc.) and as a part of this, auctioned off certain store positions to vendors for large amounts of money. Amazon has positioned itself well to leverage Dash buttons as ways to get additional funding from suppliers to even have the right to have a button. This raises the question: will smaller suppliers have similar access to instant ordering like larger manufacturers?

Great article! Like Monica, I’ve always been a little confused by Amazon’s Dash. While I appreciate the value of the data and potentially learning more about the exact moment someone runs out of an essential good, I’m still skeptical about the potential usefulness of Dash for Amazon. I don’t believe the data from Dash reveals much more than what Amazon already has through the huge amounts of data it gets from it’s existing apps. From an ease-of-ordering standpoint, they already track orders closely and offer subscription pricing discounts on basic products and make it as easy as possible to order from your phone. I’m also not sure consumers actually will press the dash button exactly when they run out and so the data they get may not be very reliable. Finally, I’m not sure how a separate voice-enabled tool adds value given the growth and push for users to utilize Amazon’s Alexa devices. People can already order through Alexa so why would they need the Wand?

I do appreciate that Dash buttons may help groom people to remember to shop at Amazon first and also remind them how easy it is to order from Amazon. People may enjoy the technology behind it and brands like the constant exposure to their converted customers. I’ll be curious to see future Dash iterations and hopefully understand whether there are additional end product goals for Dash. Amazon seems to be doubling down on Dash products and it will be interesting to see if they ultimately can develop technology that would actually imitate ‘smart’ products.