C&S Wholesale Grocers – Innovating to Protect an Incumbancy

Manifestations of climate change are driving C&S Wholesale Grocers to innovate. The real question is, are they doing enough?

Companies that rely extensively on trucking – such as C&S Wholesale Grocers – are acutely aware of the impacts that climate change poses to their businesses. Fuel price increases and more severe weather patterns are two climate change manifestations that could adversely impact the business and operating models for C&S, the largest wholesale grocery supply company in the U.S.

Increasing Fuel Prices

Although the United States has been in a low-cost gasoline holiday for the past two years, fuel prices are not expected to remain low indefinitely [1]. An OPEC mandated reduction in oil production or U.S. legislation of a carbon tax could ignite an increase in diesel fuel prices.

The concept of a carbon tax on gasoline is foreign to most Americans. Other progressive countries, however, have enacted carbon taxes on fuel to decrease consumption. In 2008, British Columbia instituted a carbon tax on diesel gasoline [2] and both Sweden and Finland followed suit soon after [3]. Although C&S could pass small gasoline price increases onto their customers, their fleet of almost 1000 trucks means that small price increases greatly impact their business expenses [4]. In addition, an increase in gas prices is an innovation catalyst for the trucking industry, creating an opportunity to disrupt companies who are hedging against potential climate change policies. Fortunately, C&S is already implementing innovations to minimize their environmental footprint…and drive profits.

Back in 2009, C&S made significant investments in their “network optimization technology “to reduce the total number of miles that trucks drove, resulting in an estimated reduction of 400,00 gallons of diesel fuel used between 2008 and 2009. In addition, they adopted aerodynamically efficient trucks to further reduce fuel consumption [5]. A final innovation they’ve employed is to install onboard sensor systems to monitor truck idle time and inefficient driving behavior. The effects of rising fuel prices are tangible; the effects of rising tides and increasingly unpredictable weather patterns, however, is a much more difficult proposition.

Storms Ahead

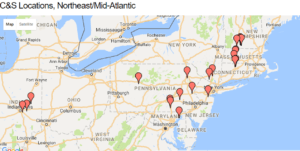

According to a recent publication by the National Research Council, “potentially, the greatest impact of climate change for North America’s transportation systems will be flooding of coastal roads, railways, transit systems, and runways because of global rising sea levels, coupled with storm surges and exacerbated in some locations by land subsidence” [6]. The urbanization of coastal cities will further increase C&S’s demand in the very regions most susceptible to coastal flooding and hurricanes. Because C&S cannot control the weather, the algorithms used locate distribution centers and accommodate storm uncertainties while planning deliveries will need to be bolstered.

Investments to Retain Incumbency

C&S is not unique in facing these challenges, and has already made investments to secure its future. But, further tangible steps should be considered to prepare for climate change. First, C&S should implement incentives for truck drivers who driving in environmentally conscious ways. In other words, turn efficient driving into a positive environmental initiative instead of a monitored statistic. In addition, they should explore the trade-space between transport costs under increased fuel prices compared to the number of regional distribution centers. The additional distance driven between retailers and distribution centers may warrant constructing additional smaller distribution centers to reduce total miles driven. A final strategy to remain competitive may be to switch the revenue generation model from weight or quantity of goods delivered to a weight-per-mile pricing structure. This will increase C&S’s competitiveness in the future regions of growth – cities. Although adopting this metric may increase costs for rural retailers, the realignment of distribution centers may help offset the cost.

Regarding the increasing storm uncertainty, C&S should consider systems to buffer retailer inventory before and after storms. Since retailers have limited internal inventory space, one method to avoid stockouts is to develop environmentally controlled containers, for example 20-40ft in length, that can be delivered to a retailer prior to a storm. Since the container can be loaded and unloaded without the truck cab being present, C&S can increase the number of deliveries prior to a storm and leave the containers behind with select retailers until they are retrieved at a later date. Retailers shouldn’t have stockouts just after a storm when the local community need’s food the most. This solution would provide C&S a buffer to recover from order backlogs after a storm and the retailer product to support their community.

Climate Change is a given. The jury is still out, though, on the pace of change. C&S has taken steps to create certainty in this period of increasing uncertainty. The real question is, is it enough?

Word count: 758

References

[1] Krauss, Clifford. “Oil Prices: What’s Behind the Volatility? Simple Economics.” The New York Times. The New York Times, 01 Jan. 2016. Web. 04 Nov. 2016. <http://www.nytimes.com/interactive/2016/business/energy-environment/oil-prices.html?_r=0>

[2] “British Columbia’s Carbon Tax – the Evidence Mounts.” The Economist. The Economist Newspaper, 31 July 2014. Web. 04 Nov. 2016. <http://www.economist.com/blogs/americasview/2014/07/british-columbias-carbon-tax>

[3] “Where Carbon Is Taxed.” Carbon Tax Center. N.p., n.d. Web. 04 Nov. 2016. <https://www.carbontax.org/where-carbon-is-taxed/>

[4] Feb 1, 2009 Fleet Owner. “500 America’s Top Private Fleets.” America’s Top 500 Private Fleets. Fleet Owner, 2009. Web. 04 Nov. 2016. < http://fleetowner.com/top-fleets/top-private-fleets-0209>

[5] “C&S Taking Steps to Reduce Carbon Footprint.” C&S Wholesale Grocers. N.p., n.d. Web. 04 Nov. 2016. <http://www.cswg.com/news/cs-taking-steps-reduce-carbon-footprint>

[6] “Potential Impacts of Climate Change on U.S. Transportation Potential Impacts of CLIMATE CHANGE on U.S. Transportation. Rep. N.p.: National Research Council, 2008. Print.” <http://onlinepubs.trb.org/onlinepubs/sr/sr290.pdf>

One of the benefits of being such a big incumbent in this space (in the face of climate change) is the access to real-time data about how the logistics of the operation are working and/or breaking down (due to weather issues). It will be important for C&S to continue to leverage its unique culture to problem solve – whether that be through finding new routes or identifying where to add smaller distribution hubs to ensure consistent supply. As for reducing the overall greenhouse gas emissions of the business, adopting electric vehicle technology for the trucks may be an option in the future as this technology becomes more mature. Of course C&S would then need to consider electric vehicle charging technology and timing its deliveries to include enough time to recharge their fleet.

Great post, Carl. I especially liked your suggestion of C&S dropping off refrigerated food containers prior to a major storm in order to reduce the likelihood of stock outs for disaster-stricken communities. While the other suggestions seem to address a long term reduction in the C&S carbon footprint, the food containers are a great direct response to climate change. I wonder if C&S could leverage data analytics of the storm track and intensity with consumer shopping behavior just prior to the storm to better predict exactly what groceries might be needed for delivery to individual stores to prevent stock outs.

Thanks for the great post, Carl!

I found the re-design of trucks which are more aerodynamic to be particularly interesting as this decreases total demand for fuel without any corresponding trade-offs on distribution center locations or pricing model adjustments. One additional area that I think C&S could pursue is looking to invest in technology to continue improving the overall fuel efficiency of their trucks by looking at how engines are designed or what types of fuel can be consumed (can they transition away from diesel fuel?).

We also looked at whether uncertainty often at Frito Lay as our business was highly transportation-intensive. One additional idea that your post sparked was looking at a dynamic inventory model, in partnership with retailers, where, given a certain likelihood of a weather event, C&S could temporarily increase shipment levels to retailers as an insurance against difficulty in delivering. If the weather event didn’t occur, shipments could subsequently decrease and revert back to average levels.

I agree with Joanna’s comment on your post, Carl. Based on current trends, it seems that the next generation of trucks may not be far off on the horizon. [1] Of course, Elon is referring to autonomous trucks in his assertion here, but once Tesla’s Gigafactory is operating at maximum capacity and new product innovation is spurred, it is highly likely that electric trucks will be on the scene sooner rather than later. For C&S Grocers, this represents an opportunity to greatly reduce costs in the long term. Imagine a network of autonomous trucks that is engineered to operate in the most efficient way, responding to customer demand fluctuations in real time and self-managing their routing to circumvent the impact of storms and other outside factors. I sense that big changes are coming in this industry, and thankfully these are changes that are likely to benefit C&S.

[1] https://electrek.co/2016/11/07/tesla-semi-truck-drivers-will-still-be-needed-for-a-few-years-says-ceo-elon-musk/