Cooling Our Built Environment in a Warming Natural Environment

How real estate developers can pave the way to a sustainable built environment.

From an Inconvenient Truth to a Foreseeable Future

A decade ago, Al Gore released his book, An Inconvenient Truth, in conjunction with a documentary on the same topic: the rapid warming of our planet due to climate change. Gore’s efforts, though controversial, painted a grim future of what he deemed the “climate crisis” in an effort to push the environmental movement into the international foreground. Though there is now general consensus and global awareness regarding climate change, Gore continues to discuss what a warmer planet will look like and how we can prepare. In a recent TED Talk, Gore quantified the risks associated with sea-level rise, calling out cities that stand to lose the most. First on his global list is Miami, which risks losing three and half trillion dollars in real assets in the foreseeable future.[1]

Regulation: How the Real Estate Industry is Responding to Climate Change

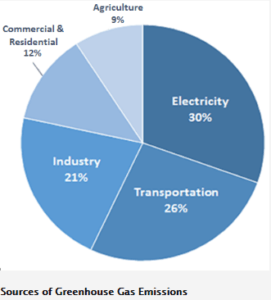

Commercial real estate buildings are responsible for emitting 33% of GHG (incl. commercial, residential and industrial buildings) and consuming 40% of energy used in the United States.[2] While the Obama administration has made strides in the way of cutting GHG, government has failed to pass comprehensive climate change legislation. Accordingly, there are no federal energy efficiency requirements with respect to the design and development of buildings to date. In the absence of federal policy, local governments have begun to impose green (energy efficient) building standards and incentivized energy efficient design through tax credits and expedited approvals. Most municipalities have done so using the codes established by private, standard setting bodies.[3] The most commonly implemented code is that of the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) certification program. LEED offers different levels of certification ranging from the minimum “Certified” for baseline design fulfillments to “Platinum” for top performers. Since its inception in 1994, LEED has certified over 80,000 buildings nationwide. On Harvard’s campus alone, 93 buildings are LEED certified.[4]

Given the uncertain regulatory landscape and disparate code requirements across the U.S., what has always been regarded as a local industry is requiring even more local expertise to be successful. To deliver projects on time and under budget, developers now need to work with design consultants that are experts on regional energy codes.

Hines: A Leader in Sustainable Development

(Pictured above, Hines’ La Jolla Commons is the nation’s largest carbon-neutral office building to date.)

Hines Interests is a privately owned real estate investment, development and management firm based in Houston, Texas that owns real estate in 20 countries. Founded by mechanical engineer Gerald Hines in 1957, Hines has built a reputation for developing trophy assets using premier design consultants and innovative technology. Hines was one of the leaders in green design in the early 1990’s and has developed 84+ million square feet of LEED certified, pre-certified or registered real estate.[5]

As one of the early adopters of green building, Hines built both an understanding of national building codes as well as a reputation for its sustainable focus that has given the firm a competitive advantage when it comes to seamless design and delivery of buildings within the changing regulatory environment. However, now that green building standards are more universally accepted and applied, the playing field is leveling for developers like Hines that were once ahead of the curve.

Looking Ahead

Despite the progress made by the real estate industry to date, the ongoing global climate change conversation will continue, per Al Gore’s Ted Talk reminder, as coastal cities like Miami are forced to plan for a rising sea-level. The federal and local governments will continue to implement regulations and incentives to reduce the carbon footprint of buildings. In order to stay ahead, developers like Hines need to pave the way in energy efficient innovation and design. While leading green building might require heavier capital investment near term, the developers who commit to sustainability will eventually reap the benefits of energy and tax savings longer term as well as a competitive advantage through familiarity with processes of energy efficient design. As the largest emitter of GHG, the real estate industry stands to lose and gain the most as a result of climate change.

Word Count: 775

References:

[1] TED. “Al Gore: The Case for Optimism on Climate Change. https://www.ted.com/talks/al_gore_the_case_for_optimism_on_climate_change?language=en. Accessed November, 2016.

[2] U.S. Environmental Protection Agency, Sources of Greenhouse Gas Emissions: Electricity Sector Emissions, EPA.GOV, http://epa.gov/climatechange/ghgemissions/sources/electricity.htmlhtml (last updated Apr. 17, 2014).

[3] Katherine E. Bachman. “Regulatory Responses to Climate Change,” American College of Real Estate Lawyers. October, 2014.

[4] Charles J. Gilbert. Sustainable Construction: Green Building Design and Delivery. New Jersey: John Wiley and Sons, 2016.

[5] Hines Interests, Sustainability. https://www.hines.com/about/sustainability. Accessed November, 2016.

Very interesting – I hadn’t considered how the private sector has taken the lead on sustainable real estate development in so many cases. One of the most compelling arguments I’ve seen is related to how green buildings allow developers to sell a more cost efficient product to their customers in the form of operating expense savings. The U.S. Green Building Council has published some interesting statistics on this point, summarized by “…owners of green buildings reported that their ROI improved by 19.2% on average for existing building green projects and 9.9% on average for new projects.” [1]

This also seems to be an interesting example of by outpacing regulatory action, the private sector is work with 3rd party certifiers to define what sustainable real estate development means and maximize the efficiency of their investment in innovation (rather than reactionary action following from prescribed federal regulation)

[1] The U.S. Green Building Council, “The Business Case for Green Building”. http://www.usgbc.org/articles/business-case-green-building, accessed November 2016

I am curious if property values have started decreasing in the cities must susceptible to climate change. Does it make sense to invest in Miami at this point when it is unclear that rising sea levels can be stopped and prevent Miami from flooding?

This is a fantastic example of the private sector taking ownership of sustainable real estate development to both “save the world” and maximize profitability. Based on your post, Hines really does appear to be a great role model for other real estate developers to follow. They have even been able to expand their business model to rapidly growing emerging economies, creating Hines Mexico – the firm’s largest property management group outside of the U.S.

I found it very encouraging that Mexico’s real estate market is very sustainably-oriented, with strong year-over-year growth in LEED projects to become the 7th largest market in the world with over 14.5 million square meters of LEED-certified space (http://www.usgbc.org/articles/sustainability-will-reshape-real-estate-development-and-investment-mexico). Mexico has set forth laudable goals to increase green and third-party certified properties and retrain investors to focus on the best green industry practices when valuing real estate opportunities. With such strong buy-in from this large growing market, Hines is well positioned to capitalize on this opportunity and spread green real estate development to economies beyond the U.S.