Comcast combats cord-cutting

As digital streaming options become more popular, cable companies scramble to prevent customers from "cutting the cord".

With the rise of digital streaming options for consuming video content, customers are opting for alternative platforms compared to traditional cable television. The trend of cord-cutting—or foregoing a traditional cable subscription in favor of an alternative internet-based option—is posing a threat to cable companies.

The value created by cable companies is being diminished as customers increasingly prefer on demand to linear programming, and desire the mobility that alternative devices—laptops, tablets, smartphones—provide.

Factors driving cord-cutting:

Price dissatisfaction and unnecessary content in cable services: In 2015, the average monthly cable bill in the U.S. was $99.10 with the average household receiving over 150 channels, of which less than 20 were actually watched. [1] The cable industry practice of “bundling” channels into packages often means that customers are forced to pay for channels that they do not want.

Technological developments in digital streaming: The availability of digital streaming services and on demand viewing across multiple platforms and devices is disrupting the business model that has sustained the cable industry for decades. Digital streaming companies such as Netflix, Hulu, and Amazon provide on demand viewing at far lower price points, available across a range of devices.

Alternatives for original content: Digital streaming companies have begun to enter the business of content creation, which poses an additional threat to cable companies. In 2011, Netflix began producing original content with its highly successful House of Cards, available only through subscription. By 2015 Netflix was streaming 16 original shows, and announced plans to have 31 original shows by the end of 2016. [2]

Premium cable networks have begun offering “over-the-top” (OTT) content, or standalone access to content without requiring a traditional cable subscription. In April 2015, HBO launched HBO Now, with Showtime launching a similar OTT option in July of that year. [3] [4]

Millennials driving the trend:

According to Deloitte’s Digital Democracy Survey, millennials spend nearly 50% of their time watching tv shows and movies on devices other than their television, compared to about 33% for total respondents. [5]

Comcast vulnerable:

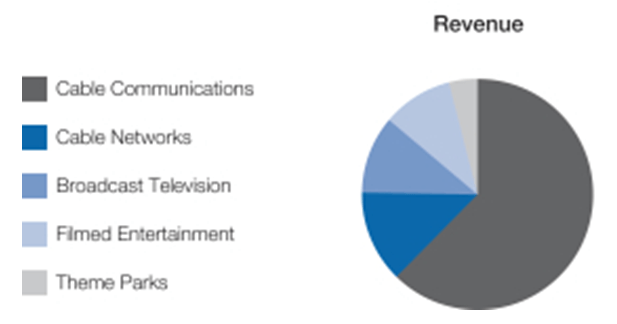

Comcast is the largest broadcasting and cable television company in the world by revenue. [6] In 2015, Comcast had total consolidated revenues of $74.5 billion, of which about 60% was from its Cable Communications segment—consisting of video, high-speed internet and voice services to residential customers. [7]

Comcast 2015 Consolidated Revenue by Segment

Comcast strikes back:

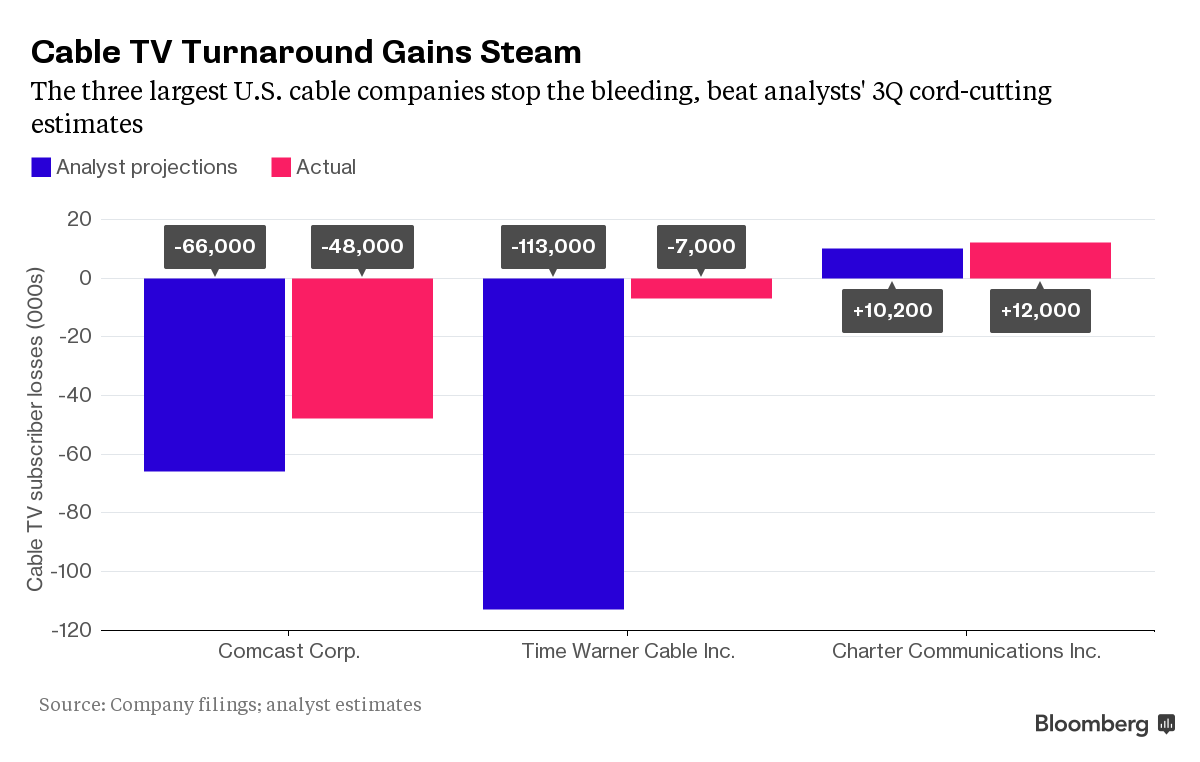

To adapt to changing technology and consumer behaviors, Comcast has taken a number of actions to hedge against cord-cutting. These efforts have allowed Comcast to beat analyst projections in one of the worst performance periods for cable networks (3Q2015, see graph below) and work towards reducing the number of cord-cutters. And in 2Q2016, Comcast actually increased the number of subscribers by 53,000. [8]

Acquisition of content producers: With the acquisition of NBCUniversal in 2011 and DreamWorks Animation in April 2016, Comcast has become a content producer as well as a content distributor. [9] This has allowed Comcast to diversify its revenue streams—shown in the “Cable Networks” segment of chart above—and hedge against decreasing demand for traditional cable services.

“Cord-shaving”, or offering cheaper bundles of cable: Comcast has started to offer discounted packages with fewer channels in order to prevent cord-cutters. [10] While these more customized, a-la-carte programing packages may be less profitable—most basic cable packages run between $10 and $50 a month—at least Comcast is not losing out entirely on these customers. [11]

Anchoring with internet and phone services: Through offering a combination of video, internet and voice services through “Comcast triple play”, the company has been able to maintain customers by making the incremental video subscription relatively low in price. Comcast continues to invest in its internet capabilities and fight for residential market penetration as an internet provider. [12]

New X1 platform and cloud DVR technology: To keep up with both competitors and the changing technological landscape, Comcast has invested in new technology that allows customers to access services on as many devices as possible. In its new cloud-based X1 platform, subscribers can access and store content on multiple devices. [13] This is perhaps the most meaningful step that Comcast has taken to address changing customer needs, embrace technological advances and sustain customers to its cable services.

What’s next for Comcast?

In order to combat cord-cutting, Comcast needs to shift from a product-oriented business towards one that serves consumer needs. Developing its X1 platform is a step towards delivering value based on customers’ changing usage of technology. However, Comcast has a long way to go in terms of perception as a customer-centric business. Focusing on making its products and services more convenient and providing higher value to customers instead of trying to make them difficult to switch away from would be a good place to start. Investing in customer service could also go a long way in building brand equity with consumers.

[Word count: 797]

[1] http://finance.yahoo.com/news/average-cable-bill-hits–99-but-can-it-last-153936942.html

[3] https://en.wikipedia.org/wiki/HBO_Now

[4] https://en.wikipedia.org/wiki/Showtime_(TV_network)

[6] https://en.wikipedia.org/wiki/Comcast

[7] http://www.cmcsa.com/secfiling.cfm?filingID=1193125-16-452423

[8] http://fortune.com/2016/04/27/comcast-cord-cutting/

[9] http://money.cnn.com/2016/04/28/media/comcast-dreamworks-nbcuniversal/

[10] http://fortune.com/2016/04/27/comcast-cord-cutting/

[11] http://finance.yahoo.com/news/cord-%E2%80%9Cshaving%E2%80%9D-is-the-new-cord-cutting-193752756.html

[12] http://realmoney.thestreet.com/articles/09/05/2016/comcast-hangs-more-cut-cable

Comcast has a huge store / service center footprint, which makes sense if everyone has an actual cable line connecting to a TV (and therefore need service technicians and actual hardware). What happens as a bigger share of distribution moves online? Netflix needs significantly fewer employees and, more generally, fixed assets to deliver its content. What will happen to Comcast as more users cut the cord completely?

I assume they’ll have to cut costs (i.e. reduce staffing in service centers), but will still have higher costs than the online content providers that emerge. Comcast will have to pass these costs through in rates, so unless they retain the best content, their users will jump ship for prospects of high-quality content at lower costs.

Two fun facts:

1. ESPN is the highest-cost channel to subscribers, at ~$7 per month. They’re also taking a HUGE hit from subscriber losses, will be interesting to see where they end up.

2. There’s a startup that has created a bot that argues with Comcast’s customer service for you. What a world: http://thehustle.co/trim-comcast-bot

Interesting stuff Lena. Do you think Comcast and other CableCos will be able to fend off cord cutters going forward? It seems like in the long-run, consumers will be successful in pressuring providers for more and more unbundled service. The Triple Play packages are becoming more obsolete for our generation who cannot conceive of the need for a landline. I think CableCos are going to see increasing downward pricing pressure as consumers choose between subscribing to Netflix and HBOGo for ~$20 total per month versus springing for the $100 cable package. The one defensible advantage CableCos have is live programming, specifically sports and special events (I think NBC’s biggest viewing totals last year came from Sunday night NFL games and their live production of Sound of Music with Carrie Underwood). It will be interesting to see if the CableCos try to increase the amount/value of live content, since this is the one area that content producers can’t easily disrupt

Great article, Lena. I think that ultimately, as people shift away from cable to online streaming services for television content, they’ll still need a broadband subscription, which will be provided by the cable companies. So on the margin, cable companies may care whether you are buying TV and internet, or just one large internet package from them, but as streaming services like Netflix, Amazon Video, and even “skinny bundles” like Sling TV and Direct TV’s over-the-top offering drive your internet consumption up, the cable company will still make quite a lot of money from you.

Lena – Thanks for the interesting post on Comcast! This is certainly an important trend in both telecom and media; managing through it will be a key source of value for companies such as Comcast (but also including the likes of AT&T, Disney, Verizon, and others).

You mentioned that Comcast increased subs in 2Q16. They added 32,000 video subscribers in 3Q16, also (see here: http://www.cmcsa.com/releasedetail.cfm?ReleaseID=995492). Moreover, they added 330,000 High-Speed Internet subscribers in that quarter. Cord-cutters still need Internet access (which they’re likely to get through Comcast; albeit at lower prices than if Comcast also sells video). It’s also worth noting that Comcast, through their NBC Universal business unit, is one of the owners of Hulu.

I think you’re right that part of the “solution” to cord-cutting is offering something that consumers want. To that end, almost half of residential video customers have X1. I count myself as one of them. It’s a great product. Today, I found that SyFy (an NBC Universal network, by the way) was playing the original 1970s Westworld.

But I wonder if there’s more that could be done than to just deliver a better user interface. What if, for example, Comcast rented Verizon’s mobile network and sold you cell phone service bundled with your X1 video? (see here: http://www.theverge.com/2016/9/20/12986872/comcast-mobile-network-verizon-mvno-2017) That’d be really interesting to me. We’re starting to see something similar following AT&T acquisition of DirecTV. Maybe “the bundle” isn’t dead, yet?

Interesting post – I’ve been a cord cutter for 4 years, and don’t see myself ever subscribing again. As Mike mentioned, live events, specifically the NFL, are one of the few remaining draws to cable. Its interesting to note that the NFL’s overall TV ratings down about 11 percent from last season. If this trend continues, it would be less of an advantage for CableCos. This year, the NFL began streaming its games live on Twitter for free, and over 2 million people chose to watch this way. I agree that investing in the X1 platform and cloud DVR technology is vital to future success.

Thanks for the interesting post Lena. The tides are definitely turning against Comcast and all other cable companies which are slowly becoming obsolete. In the short term Comcast can mitigate this effect by diversifying their revenue streams as you mentioned, or by bundling it with internet and landline services. The crux of the issue though is that the product itself is inferior to the rising platforms like Netflix and HBO Go that offer full episodes, on-demand, without ads, for fractions of the cable bill. In terms of actually improving the cable product itself, I think Comcast has done a phenomenal job with the X1 making the user interface as smooth as their online competitors, and allowing content to be saved on the cloud and viewed from any device through an authenticated login. Cable also has the edge of having the latest content and live content. Though I imagine these to eventually shift to an online space, Comcast will have to fight hard to hold on to the exclusivity of that type of content that online players cannot offer.