Climate Change May Present Opportunities for Vail Resorts, Inc.

While the ski resort industry faces climate change challenges, Vail Resorts is uniquely positioned to succeed.

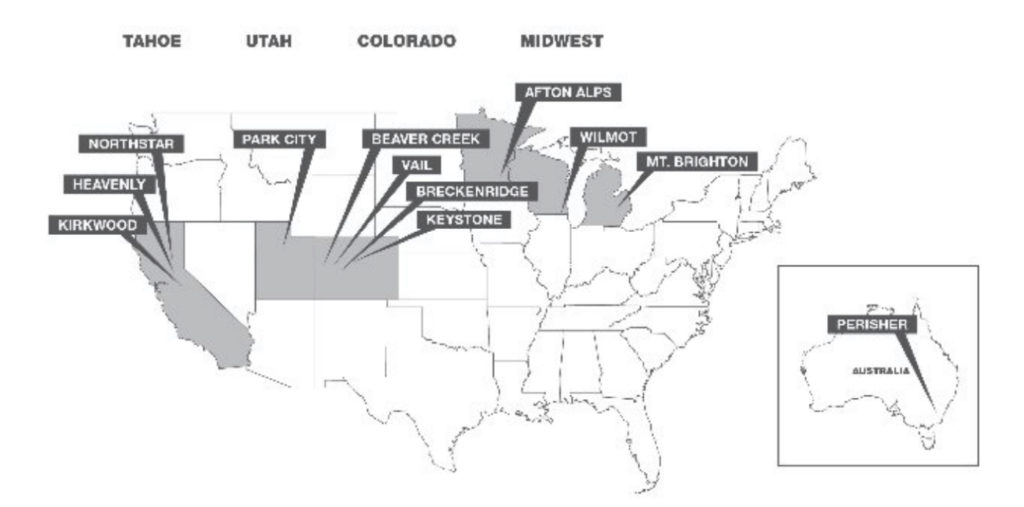

Vail Resorts (NYSE: MTN), based in Broomfield, Colorado, is a $6.2B owner and operator of mountain resorts. MTN’s business is split into three operating segments: Mountain, Lodging, and Real Estate, with its Mountain segment accounting for 82% of net revenues in fiscal year 2016[1]. The Company operates ten mountain resorts and three urban ski areas (shown in Exhibit 1 below)[2], and is the largest ski mountain operator in the United States with approximately 38% market share[3].

Exhibit 1: MTN’s mountain resorts and urban ski areas (excluding recent acquisition of Whistler) [4]

Climate change has already had an outsized impact on the winter sports industry, with warmer weather, droughts, and seasonal changes causing a decline in snowfall. Warmer weather has led to declining snowfall across the U.S. by causing more winter precipitation to fall as rain rather than snow[5]. Regional droughts brought on by climate change have also adversely impacted snowfall at some of MTN’s mountains. From 2012 through 2014, MTN’s California resorts experienced annual snowfall totals that were less than 60% of average, with the 2013-14 ski season producing snowfall of just 29% of average[6]. Warmer weather has additionally shortened the ski season, as it takes longer for sufficient snowfall to amass.

Operators such as MTN can use snowmaking equipment to offset lower snowfall, but snowmaking carries its own problems. Snowmaking is highly energy intensive; energy costs are typically a ski resort’s second highest cost, after labor[7]. MTN’s snowmaking operations accounted for approximately 24% of its total energy use in 2013[8].

Snowmaking also involves tremendous amounts of water. A 200 foot wide ski run with a drop of 1,500 feet would require 400,000 gallons of water to make one foot of snow[9]. Climate change could curtail MTN’s access to water by increasing the severity and frequency of droughts, which would limit its ability to make snow.

Despite these challenges MTN has taken a number of steps to mitigate the impacts of climate change, and is likely better positioned than its competitors to address ongoing concerns.

As the largest player in the sector MTN has more capital to invest in cost-saving sustainability initiatives, and more ability to drive non-ski revenue. MTN also benefits from geographic diversity and the ability to market across resorts. As climate change continues to threaten the industry, MTN can act as a consolidator and look for opportunities to acquire struggling resorts.

MTN has a track record of trying to reduce its own footprint. In 2008 MTN launched its “Target 10” initiative to reduce the company’s overall energy consumption by 10%[10]. Just three years later MTN exceeded its goal, primarily by altering employee behaviors such as turning off lights and not idling vehicles.[11] MTN has also made capital investments over the years to lower its ongoing energy costs, for instance investing $1 million at two of its resorts to replace air compressors (used in snowmaking operations) with high-powered energy efficient compressors[12].

MTN has been expanding its non-ski offering by adding summer resort activities such as mountain biking, hiking, and horse-back riding[13]. By continuing to improve its year-round offerings, MTN can mitigate the impact of lower winter revenues.

MTN is also geographically diversified and has avoided the Northeast. Five of MTN’s resorts are in Utah and Colorado, which have so far seen a smaller decline in snowfall than other states[14]. Costumers may be driven to MTN’s resorts by declining ski conditions in the Northeast. One study of Northeastern U.S. ski resorts estimated that only four out of fourteen would remain profitable by 2100 under a higher-emissions scenario[15]. In addition to being outside the Northeast, MTN’s multiple locations allow it to market the “Epic Pass,” which provides unlimited seasonal access to all resorts, and accounts for ~40% of lift ticket revenue[16].

In addition to the mitigation steps noted above, MTN should consider becoming even more of an industry consolidator. As smaller resorts with fewer resources begin to struggle with the effects of climate change, it will create opportunities for MTN to acquire them at depressed prices. By instituting best practices at these resorts, such as utilizing energy efficient snowmaking equipment and driving summer revenues, MTN should be able to engage in accretive acquisitions. Acquiring new resorts will also increase MTN’s diversification and boost the value of their Epic Pass tickets.

(Word Count: 723)

[1] Vail Resorts, Inc. (Nov 2016). 2016 Form 10-K. Retrieved from www.capitaliq.com

[2] Vail Resorts. Investor Relations. Vail Resorts and Whistler Blackcomb Complete Strategic Combination. N.p., 17 Oct. 2016. Web. 3 Nov. 2016. <http://investors.vailresorts.com/releasedetail.cfm?ReleaseID=993851>.

[3] Alvarez, A. (2016). IBISWorld Industry Report 71392. Ski and Snowboard Resorts in the US. Retrieved November 3, 2016 from IBISWorld database.

[4] Vail Resorts, Inc. (Nov 2016). 2016 Form 10-K. Retrieved from www.capitaliq.com

[5] Samenow, Jason. “Much of the U.S. Seeing More Rain and Less Snow Due to Climate Change.” The Washington Post. 5 Apr. 2016. <https://www.washingtonpost.com/news/capital-weather-gang/wp/2016/04/05/report-much-of-the-u-s-seeing-more-rain-and-less-snow-due-to-climate-change/>.

[6] Bebb, Donna. Climate Exposure Impact on Equity Valuation: Case Study of Vail Resorts, Inc. Steyer-Taylor Center for Energy Policy and Finance. Stanford, Web. <http://media.law.stanford.edu/organizations/programs-and-centers/steyer-taylor/Vail_Final.pdf>.

[7] Ibid.

[8] Ward, Bob. “Vail: Bigger Company, Smaller Footprint.” The Aspen Times. 18 Dec. 2013. Web. <http://www.aspentimes.com/news/vail-bigger-company-smaller-footprint/>.

[9] Bebb, Donna. Climate Exposure Impact on Equity Valuation: Case Study of Vail Resorts, Inc. Steyer-Taylor Center for Energy Policy and Finance. Stanford, Web. <http://media.law.stanford.edu/organizations/programs-and-centers/steyer-taylor/Vail_Final.pdf>.

[10] Ward, Bob. “Vail: Bigger Company, Smaller Footprint.” The Aspen Times. 18 Dec. 2013. Web. <http://www.aspentimes.com/news/vail-bigger-company-smaller-footprint/>.

[11] Ibid.

[12] Ibid.

[13] Vail Resorts, Inc. (Nov 2016). 2016 Form 10-K. Retrieved from www.capitaliq.com

[14] Samenow, Jason. “Much of the U.S. Seeing More Rain and Less Snow Due to Climate Change.” The Washington Post. 5 Apr. 2016. <https://www.washingtonpost.com/news/capital-weather-gang/wp/2016/04/05/report-much-of-the-u-s-seeing-more-rain-and-less-snow-due-to-climate-change/>.

[15] Ibid.

[16] Bebb, Donna. Climate Exposure Impact on Equity Valuation: Case Study of Vail Resorts, Inc. Steyer-Taylor Center for Energy Policy and Finance. Stanford, Web. <http://media.law.stanford.edu/organizations/programs-and-centers/steyer-taylor/Vail_Final.pdf>.

Ethan, it’s really interesting to me that MTN’s consolidation of the industry also seems to have environmental benefits. As the company continues to acquire smaller competitors and increase their share do you expect the company to maintain it’s best-in-class environmental practices? Are you concerned that the company might get complacent as it’s market share grows?

I like your point of how they are reacting against climate change effects by diversifying in areas where there is less or none effect of climate change. So, in order to do this, do you think it would be interesting to expand the brand to the southern hemisphere? In some point they have done this buy acquiring Perisher in Australia, but maybe it could be a good opportunity to grow even more aggressively and acquire ski resorts in Chile, Argentina or New Zealand. They could certainly replicate their business model in those resorts, improving and expanding them, but with regards the climate change context, I can imagine many benefits: having a drought season in the Northern Hemisphere could be an opportunity for MTN to offer a new market to their North American and European consumers and vice-versa, exposing their customers to new resorts in a counter-seasonal manner and obtaining more benefits of their “Epic Pass”.

This seems simplistic, but I wonder if another potential solution could be to transition its portfolio further north. I’m no expert on ski mountains, but I assume there are many in Canada that Vail could begin to target and invest in. This could come in the form of building out a new mountain or buying one, and preferably before demand moves to those more ideal snowfall areas and raises the potential acquisition price. As you mention, among any resort operator, given its scale and resources Vail would seem best equipped to execute this sort of portfolio transition. Clearly it would not solve the root of the climate change problem, as warmer weather would impact these more northern resorts as well, but at least they can begin the process of getting away from Colorado and Utah before the ski season shortens to 6 weeks.

What a slippery slope MTN finds itself on! Or not, if snowfall continues to decline… Ethan, loved this post – and not just because MTN operates Australia’s only worthy ski resort. The measures taken to mitigate the effects of climate change are impressive, from consolidation of the industry, to doubling down on its summer offerings. Though I can’t help but feel there’s more they can do. For example, how else can they maximize earnings from their winter offering given demonstrably shorter ski seasons, other than marketing their ‘Epic Pass’? Perhaps recycling water could help stave off some of the exorbitant costs of artificial snow production. Also, how are they planning to account for year to year variability?