Climate Change as a Competitive Advantage for an Oil Major

Can Shell stay relevant as the energy mix evolves to address market implications of climate change?

Royal Dutch Shell is fundamentally an energy company with significant hydrocarbon resources and believes oil and gas will be important for many decades to come (1). Shell Scenarios are widely regarded as insightful forecasting of macro-energy trends for the past 40 years and a way to challenge the existing business environment: “society will need to grow its renewable energy share to around 80% of an energy system much larger than today’s if the world is to complete an energy transition and achieve a long-term goal of near net-zero emissions by 2100.”(2)

Shell expects the global economy to slowly shift from reliance on oil to increased use of natural gas and ultimately a more balanced mix of renewables. Leveraging hydrocarbons and renewable energy sources will be important to meet base and peak load energy demand with a growing world population.

Level of Risk Exposure (3)

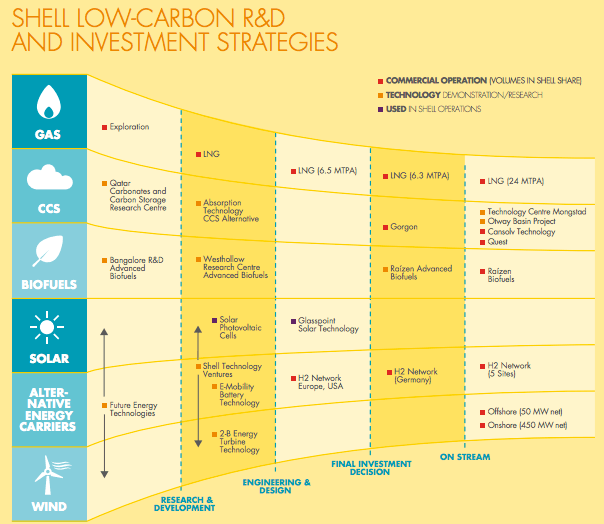

While Shell cites research and development and regional efforts in low-carbon biofuel, hydrogen fuel distribution, wind power, and solar, their only globally-scaled portfolio include oil, natural gas, and downstream hydrocarbons (see Figure 1). A traditional oil company pivoting to stay relevant in a future of 80+% renewables seems drastic and nearly impossible, but there’s significant opportunity to take early action given the lack of enforceable carbon regulation.

Figure 1

Shell must consider their level of exposure and carbon footprint of direct and indirect emissions. In 2015, Shell produced 72 million tonnes of direct CO2e, a 5% reduction from 2014 that includes one-time divestments as well as the startup on the Quest Carbon Capture and Storage (CCS) project used to offset the carbon footprint of Canadian oil sands (4).

Strategic Action

Operational Improvements of Direct Emissions

On a more granular scale, many existing assets need to be considered. Since for many assets the local and regional regulations do not guide emission performance standards or required technology, Shell has developed its own internal best practices and reporting requirements. Shell “direct GHG emissions have fallen by 40 million tonnes of CO2 equivalent or 35% since their peak in 2003” (5). Specifically:

- Bukom refinery installed a new cogeneration unit that took waste heat from the gas turbine’s exhaust and generated steam, increasing their site’s energy efficiency significantly (6)

- Between 2009 and 2015, the energy intensity of Shell refineries decreased by about 6%.” (7)

Long-term Strategic Implications on Portfolio

Internal R&D in biofuels, CCS, less energy-intensive chemical processes etc. as well as Shell Technology Ventures investment in external companies will be very important to close the gap between Shell’s current and future portfolios. Shells’ current strength in CCS and liquefied natural gas (LNG) technology should help them expand in these areas.

Carbon capture and storage is an especially interesting technology. CCS allows carbon emissions to be captured and stored in the ground. Shell has the talent, research, and years of field experience to understand the subsurface environment needed to implement CCS, while also implementing the appropriate monitoring to avoid unintended consequences. CCS is one of the very few impactful mitigation technologies available (Quest reduced 1 million tonnes of CO2 in its first year of operation) (8), but it has not been seen as economically viable in many circumstances.

What is economically viable?

Shell implements an internal carbon Net Present Value of $40/tonne CO2e. This value is used to evaluate project economics. Including carbon sensitivity analysis allows project teams to discover energy efficiency measures that reduce cost and footprint, as well as economically viable reduction strategies. In some cases, this also means considering CCS-readiness for assets with a long-life. If future costs of CCS are reduced or the technology is mandated by regulation, it could be added much more easily.

Gaining a “Seat at the Table”

Given the “systemic, regulatory, legal, physical, and reputational risk” (9) Shell faces, they have advocated for climate change policy since 1999. In 2015, Shell CEO Ben van Beurden publicly emphasized that climate change would need to be addressed by carbon pricing (10). A carbon price would increase cost of goods sold and force innovation and investment to improve existing operating models. Whether Shell’s strong public stance is selfishly or altruistically motivated, it is still a huge risk given Shell’s portfolio of hydrocarbons.

Overall, I believe Shell has taken calculated risks to position themselves as a first mover amongst their direct competitors in the context of climate change. Their largest hurdle will be influencing policy and assuring that a carbon price is embedded in the competitive landscape. In my experience working with regulators, there was apprehension of developing carbon performance standards if there wasn’t agreed guidance on how the performance standards could be achieved (through emission reduction technology). While early efforts may be used to demonstrate proof of concept to regulators, pricing carbon is necessary to make innovations (CCS, LNG) viable at a global scale.

(798 words)

(1) Royal Dutch Shell, “Who We Are,” http://www.shell.com/about-us/who-we-are.html, accessed November 2016.

(2) Royal Dutch Shell, “Energy Transitions & Portfolio Resilience,” http://www.shell.com/promos/investors-promo/set-report/_jcr_content.stream/1464169346892/f26a997fc9a8ca5f6117e9f44866f5114a0c424de7b16a05e37f0f74ee4af506/shell-energy-transitions-and-portfolio-resilience.pdf, accessed November 2016.

(3) Andrew J. Hoffman and John G. Woody, Climate Change: What’s Your Business Strategy? (Boston: Harvard Business Review Press, 2008), p. 10.

(4) Royal Dutch Shell, “Climate and Energy Transitions,” http://www.shell.com/sustainability/environment/climate-change.html, accessed November 2016.

(5) Royal Dutch Shell, “Energy Transitions & Portfolio Resilience.”

(6) Ibid.

(7) Ibid.

(8) Royal Dutch Shell, “Climate and Energy Transitions.”

(9) Hoffman and Woody, pg 11-12.

(10) Terry Macalister and Damian Carrington, “Shell Boss Endorses Warnings About Fossil Fuels and Climate Change”, The Guardian, May 22, 2015, https://www.theguardian.com/business/2015/may/22/shell-boss-endorses-warnings-about-fossil-fuels-and-climate-change, accessed November 2016.

Very interesting read on a major O&G producer’s view on the changing role of hydrocarbons in the future of energy generation. I think you are right that Shell is in a unique position to be on the leading edge of renewable and lower-emission energy innovation, given the company’s strong financial position and huge talent base. I find it interesting that Shell has publicly stated its desire for a carbon tax, which will hurt the company’s margins and bottom line in the short- and medium-term, but the carbon tax will make the company stronger in the long-term as it instills discipline to produce cleaner energy that will allow Shell to compete in the future. Regardless of the carbon tax, hopefully Shell has the internal discipline to pursue cleaner and more efficient energy practices.

Great post! It’s refreshing to see how forward Shell has been in pushing forward not only carbon regulation, but the entire industry. It definitely reminds me of the Ikea case where we debated whether the motives were truly centered around profit or more altruistic concerns. You touched on it briefly in your post, but I didn’t get the sense of which way you fall. Do you believe Shell is doing this purely from a competitive standpoint, or a moral one?

With only surface level knowledge, it seems like the risks of pushing carbon legislation far outweigh the competitive advantage Shell would have by being a “first mover” in a sense. Also, I’m pessimistic to their ability to successfully make this pivot given their seize, even on a long enough time scale. The Solar, Wind, and Nuclear industries are SO different than Oil & Gas, I would be surprised that they would be considering accelerating the pressure on themselves for any other reason than morality. I wish them the best of luck!