Celgene Corporation – Diversifying Bets in Research & Development to Ensure Success in the Biopharmaceutical Industry

By investing in in-house drug research and development, partnering with world class research institutes, and acquiring high potential compounds, Celgene has achieved massive success so far and is positioned to continue to do so.

A Clear Winner

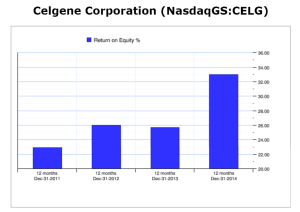

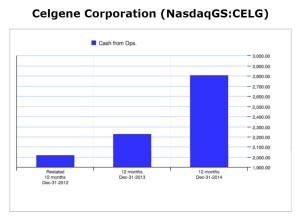

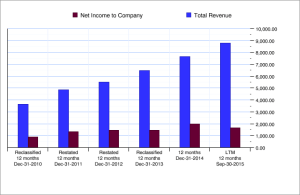

Celgene Corporation (NasdaqGS:CELG) boasts impressive statistics: with only 6000 employees, the company was able to generate almost 2 billion dollars in net income in 2014, has more than doubled its revenue between 2010 and the twelve month period leading up to September 2015, produced more than 2 billion in operating cash flow during each of the last three years, returned more than 20% on equity for each of the last four years, and is currently valued by the market at almost 90 billion dollars.

The Vision

According to the company’s website, Celgene’s “vision as a company is to build a major global biopharmaceutical corporation while focusing on the discovery, the development, and the commercialization of products for the treatment of cancer and other severe, immune, inflammatory conditions”.

How is Celgene’s Massive Success Possible?

In the words of Chairman and CEO Robert Hugin, the company’s alignment between its business model and its operating model is completely natural: “it’s not hard to set bold goals—you don’t need to meet many cancer patients to understand the urgency.” Furthemore, Joel Beetsch, vice president of Patient Advocacy, describes Celgene’s as “a make-it-happen culture.” These are some of the key factors that align Celgene’s operating model with its business objectives:

- Focus: Celgene focuses on hematology and oncology, and is pushing to strengthen its immune-inflamatory diseases business.

- Market Diversification: While today Celgene is still highly reliant on blockbuster multiple myeloma drug REVLIMID, which generated sales of nearly $5 billion in 2014, it is aggressively pursuing diversification into other markets, primarily those of oncology and immune-inflamatory diseases.

- Sources of New Drugs: Unlike other pharmaceutical companies, which rely heavily on either internal development of new compounds, acquisitions, or partnerships, Celgene takes a balanced approach by pursuing attainment of new compounds via all of these three streams. For example, in 2014 alone, they “strengthened (their) I&I pipeline through the acquisition of GED-0301, a potential paradigm changing approach to treating Crohn’s disease”**, “established more than 10 innovative collaborations with some of the best emerging science companies in the world”**, in addition to continuing with their in-house efforts. For the years 2010-2014, Celgene has invested on average 32.29% of total revenue in Research & Development and, in 2014, almost 35% of Celgene’s workforce devoted itself to R&D.**

- Commercialization: Celgene’s products are typically sold to government owned or controlled hospitals.* Since its customer base is not highly fragmented, Celgene can operate with a relatively lean salesforce. Celgene generated 2014 total revenue of $7,670 million with a sales division that employs 2,161 people — equating to sales per sales employee of $3.5 million!

As far as operating-business model alignment goes, Celgene is a great example of a company that has managed to balance huge growth with a sustainable long term model.

—

Sources

*http://www.celgene.com/wp-content/uploads/celgene-corporate-brochure.pdf

**http://files.shareholder.com/downloads/AMDA-262QUJ/1144250326x0x825208/A1003DD5-7CDE-4073-AF4F-ED7EB1D28E73/Celgene_2014_Annual_Report.pdf

Thanks Gome for the introduction on Celgene’s business model.

I think one common practice among leading biopharmaceutical companies is specialization, be it Celgene, Biogen or Regeneron. As you mentioned, such specialization will make it easier to maintain the leading position in technology and minimize salesforce investment. Meanwhile, the dominance in certain field can also improve the companies’ pricing power, in this case, Gilead’s Sovaldi has been a good example.

My only concern about this strategy is how they are prepared for potential impacts on revenue from competing new drugs in the future, since the chunk of which are from narrow markets.