Can you do your taxes faster than you prepare for a FIN 1 case?

The answer to this question for many first year Harvard MBA students, myself included, is yes!

Turbo Tax, and its competitors, drastically changed the way many American taxpayers do their taxes. April 15th is no longer a day to be dreaded as it was in the past because of the digitization of the tax filing business.

Benjamin Franklin is famously known for many things, but a common quote of his in regards to taxes was in a letter he wrote to Jean-Baptiste Leroy in November 1789, “Our new Constitution is now established, everything seems to promise it will be durable; but in this world, nothing is certain except death and taxes [1].” Taxes no longer have to be a burdensome process for the majority of American taxpayers now that Turbo Tax exists. From 2001 to 2014 the percentage of e-filed tax returns submitted to the Internal Revenue Service (IRS) increased from 31% to 86% respectively [2].

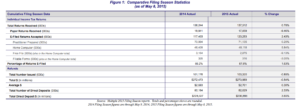

Three and a half months into the 2014 tax season more than 27 million taxpayers had used home computers to file their taxes, this was an increase of about 6% compared to the previous year [3]. By the end of the 2014 tax filing season the IRS had accepted 117,403,000 e-filed returns, and that number increased in 2015 by 2.43% (see Figure 1) [4].

Turbo Tax’s promise to their customers is to help them complete their taxes quickly, easily, and to maximize their refund [5]. Turbo tax has eliminated much of the anxiety and unknown when it comes to filing taxes. They are able to do this at a low price point, and provide their customers the ability to complete their taxes at their convenience. Tax payers no longer have to pay large sums of money and schedule an appointment at a brick and mortar tax professional service.

Turbo Tax’s operating model delivers on their promise by offering four main products provided through one of two platforms so that a customer can pick the best product to fit their needs. An individual looking to complete their taxes can either sign up for one of the four packages online or order the CD/Download version. The four CD/Download product features are Basic, Deluxe, Premier, and Home & Business which range in prices from $39.99 to $109.99 [6]. One significant way Turbo Tax simplified the tax filing process is that they partnered with over 1 million companies and financial institutions to allow customers to securely import multiple W-2s, 1099-INTs and 1099-DIVs automatically [7]. This can eliminate time and the possibility of errors when manually inputting information. Additionally, Turbo Tax saves personal information which makes filing taxes in future years easier, this encourages customers to continue to return to Turbo Tax year after year.

There are two ways Turbo Tax could improve their business and attract more customers. The first improvement opportunity is to target first time tax filers, or young adults. They could provide these potential customers with a heavily discounted service to attract them to the website through social media platforms. It is important to capture these younger customers early, because they have an incentive to use the same online platform if their data is saved to provide simplicity in future years. Over time Turbo Tax can increase the price on these users as their taxes become more complicated as they get married, have children, buy a home, start investing, or become small business owners.

Turbo Tax could also improve their customer base by targeting individuals older than the millennial generation who may not trust online platforms. These potential customers may be comfortable with paying higher costs to their local and long time accountants. Turbo Tax could offer this market a free service after they file their taxes in a given year, and have them submit their tax information into the website to show what their cost savings could have been had they filed online with Turbo Tax. This gives the customer an opportunity to get familiar with the platform in a stress free environment by removing any time constraints, because their taxes have already been completed for that year. Turbo Tax could send these potential customers an email the following tax season and offer them a discount. An additional benefit to this program is that a lot of their personal information will be in the system, and the process will take less time and be less stressful than a normal first time user.

Turbo Tax and the digitization of the tax filing industry has made filing taxes much more simple, reduced errors, and saved tax payers time and money. As the millennial generation gets older and begins to file taxes for themselves, Turbo Tax’s potential customer base will continue to grow. As Turbo Tax evolves to the ever changing tax laws, they can continue to offer American taxpayers an affordable and simple way to complete their taxes.

Word Count (without citations): 786

References:

[1] National Constitution Center Staff. “Benjamin Franklin’s last great quote and the Constitution”. Yahoo News, November 13, 2016. Web. Nov. 2016. <https://www.yahoo.com/ news/benjamin-franklin-last-great-quote-constitution-100220284.html>.

[2] “U.S. Taxpayers efiled More Than 128 Million Returns in 2016.” Web. Nov. 2016. <http:// www.efile.com/efile-tax-return-direct-deposit-statistics/>.

[3] IRS. “More Taxpayers Filing from Home Computers in 2014, Many Taxpayers Eligible to Use Free File.” March 13, 2014. Web. Nov. 2016. <https://www.irs.gov/uac/newsroom/more-taxpayers-filing-from-home-computers-in-2014-many-taxpayers-eligible-to-use-free-file>.

[4] Treasury Inspector General for Tax Administration. “Results of the 2015 Filing Season.” August 31, 2015. Web. Nov. 2016. <https://www.treasury.gov/tigta/auditreports/2015reports/ 201540080fr.html>.

[5] “Intuit Turbo Tax.” Web. Nov. 2016. <https://turbotax.intuit.com>.

[6] “Which Turbo Tax CD/Download product is right for you?” Web. Nov. 2016. <https: //turbotax.intuit.com/personal-taxes/cd-download/>.

[7] “Intuit Turbo Tax.” Web. Nov. 2016. <https://turbotax.intuit.com>.

Featured Image 1: Digital image. “Benjamin Franklin Quote.” Web. Nov. 2016. < http://izquotes. com/quote/301559>.

Figure 1: Treasury Inspector General for Tax Administration. “Results of the 2015 Filing Season.” August 31, 2015. Web. Nov. 2016. <https://www.treasury.gov/tigta/auditreports/ 2015reports/ 201540080fr.html>.

Thanks Ken, for a great post! I take Turbo Tax for granted now and often forget those years when I did do most of my taxes on paper. It’s mind-blowing to think that American taxpayers spend an average of 13 hours preparing their taxes and pay about $200 for tax preparation services (1). I’m curious to hear your thoughts on Elizabeth Warren’s Tax Filing Simplification Act of 2016 (1) and how Turbo Tax can survive if it’s passed, and if not, what other business models it could consider going into. In the Act, she proposes that IRS develop its own free, online tax filing service that would allow taxpayers to file directly with the government (vs. being forced to share private info with external parties) and would prohibit the IRS from entering into agreements with third parties that restrict their ability to provide free online tax services (2). What’s the future of private tax software companies, if this legislation is passed?

(1) https://www.warren.senate.gov/taxday/https://www.warren.senate.gov/taxday/

(2) http://www.warren.senate.gov/files/documents/Tax_Filing_Simplification_Act_Fact_Sheet.pdf

Great insights, Ken. Aside from changing the way that citizens interact with the IRS, Turbo Tax (and similar online tax prep companies) have also forced the IRS to evolve the way they interact with the customer. From direct deposit options to online tracking of your refund status, the private sector has been a first mover with innovation, making it less costly for the IRS to follow. While the above mentioned legislation by Senator Warren would allow the IRS to build its own ‘free’ interface, the worry is how much it would cost to do so and the loss in efficiency by transferring something from the private sector to the public sector.

Another menacing threat to Turbo Tax is a massive simplification of the the tax code. [1] While unlikely, the impact would be drastic. If I can do my taxes on a postcard, why do I need to pay $200?

[1] http://www.economist.com/news/finance-and-economics/21701759-californias-tax-system-needs-reform-it-unlikely-get-it-stop-dreamin

Hello Ken,

Excellent post, thank you for sharing. This is an excellent example of automation, where algorithms can now do many of the tasks previously performed by a tax accountant. It would be interesting to know what will be happen to the profession.

On the long term, as demand drops, there will probably be less tax professionals on the market. They might also start using software like Turbotax themselves, in order to improve their own efficiency and serve more clients, while dropping their prices to remain competitive. I actually wonder if today Turbotax markets itself to professionals in addition to private customers.

At the same time, it is likely that the nature of their job will change, and their role will move from being mere accountants to advisors, hence focusing on helping people improve their tax situation. Differences might not be huge for many people, but for some in special situations the delta might be worth the higher fees.

Yet, even this might not be enough to protect the profession from automation: Artificial Intelligence might soon be capable of replacing a good part of professional service providers, including tax advisory [1]. Simultaneously, tax authorities are also considering using AI to identify tax evasion [2]. Will this lead us to a battle between machines, where each side will try to outsmart the other?

Mr. Franklin was certainly correct on death. Taxes, on the other hand, seem as uncertain as ever.

[1] http://www.smh.com.au/business/the-economy/artificial-intelligence-to-help-prepare-tax-returns-report-20160822-gqykq6.html

[2] http://www.nytimes.com/2015/10/10/business/computer-scientists-wield-artificial-intelligence-to-battle-tax-evasion.html?_r=0

Ken, thank you for writing about this. In the software tax space, there are a number of competitive players. I think about how one of these providers can have an advantage over the others. Will this ultimately become a commoditized space or is there a way to have an advantage. Everything you’ve described any competitor could do. I wonder they can use the data that they have from countless tax returns to provide advise in what they can do to reduce their taxable income over the course of a year. If they were able to do something along those lines, they might be able to incorporate themselves into the lives of the tax payers in a way that bought them some brand loyalty.

I do appreciate the network effects they have built up in having both the W2 providers and the customers on the same platform, but I wonder if there is a way they can work with the data providers to get information throughout the year to provide insights along the way. Something like this would enable them to provide a value added service in a very unique way. They have started down this path with Mint, so they have some idea that they can do this, but other synergies can they offer between Mint and TurboTax.

Great post Ken!

I have been using Turbo Tax for many years, and I have seen improvements to the platform and the user experience over the years. While many have mentioned above the risk to Turbo Tax of the legislation, both pricing and customer service have not been mentioned. I agree with you that Turbo Tax, to not only acquire new customers but also retain existing customers, should offer discounts for students or for people who have below a certain income level. Currently I find that while pricing is cheaper than going into a brick and mortar accountant or tax filing service, I still perceive the price to be high considering I am not getting 1:1 attention or a 100% guarantee that I am completing it all correctly.

Regarding customer service, I find Turbo tax to be lacking in a major way when it comes to digitizing CRM. They only have a “chat with a specialist” function through a messenger service online, and you often have to wait a very long time to be contacted or get a response. I believe there are many other new and innovative ways to interact with customers than a slightly antiquated messenger system. For example, there are chatbots now which could be loaded with specific information by topic. They should also have an option of integrating chat with phone options so that you can actually speak with the person you began the conversation with online, versus having to start all over again when you call in.

Great post Ken! As a happy turbotax customer, I agree that Turbotax provides important tech-driven innovation to simplify the arcane tax process. My main concern as a customer is privacy and security of my personal information. I was happy that earlier commenters highlighted Elizabeth Warren’s proposal for a government-led online tax preparation system, but even government systems, as we saw with the Chinese hacking of the federal Office of Personnel Management [1], are not hack-proof, and perhaps the private sector can provide a more-secure online tax prep service cheaper and with greater marketing reach. In this regard, I wonder if instead of Turbo tax only acting as filer-facing interface platform to input and submit data to the IRS through the IRS’ predefined forms, Turbotax could instead be an outsourcing agent of some of the IRS core functions such as return processing and auditing. This shift is especially important as the IRS operates in a period of declining funding with the IRS budget declining 17% since 2010 [2] and congressional scrutiny of its operations. Interestingly, the IRS has reduced the amount of money it must spend to process taxes even with budget cuts and smaller staff. According to the Fiscal Times, the IRS’ tax collection efficiencies, assumed to be due to electronic filing, has brought “the cost of collecting $100 in taxes [down] to 35 cents, down from 53 cents in 2010 and the lowest level since 1980.” [3]

[1] https://www.washingtonpost.com/world/national-security/chinese-hackers-breach-federal-governments-personnel-office/2015/06/04/889c0e52-0af7-11e5-95fd-d580f1c5d44e_story.html

[2] http://www.cbpp.org/research/federal-tax/irs-funding-cuts-continue-to-compromise-taxpayer-service-and-weaken-enforcement

[3] http://www.thefiscaltimes.com/2016/04/01/Here-s-How-Budget-Cuts-Have-Hammered-IRS

I LOVE Turbotax! I think they have done a great time integrating digital technology into the tax filing process for many Americans. I have never done my taxes on paper, and this is the only way I know to do my taxes. I think the way they introduce the product to users makes it very accessible because you can start with the free version and upgrade as needed. However, as I have gotten older and had to incorporate more complexity into my tax filing, I have considered moving to a tax advisor. You can use their SmartLook or AnswerXchange services for one off technical questions, but I wonder if they can implement a services that provides a dedicated supplemental support advisor [1]. Although it would probably be complex, they could potentially transition from a human advisory workforce to bots once they develop the technology. It will be exciting to see how Turbotax integrates technology to help their customers in the future, and make tax filing even easier!

[1] https://turbotax.intuit.com/best-tax-software/personalized-tax-services/

Hey Ken,

Great topic– thanks for writing about it! It is definitely true that TurboTax has played an important role in simplifying tax preparation through digital means in the context of the current tax system, but interestingly, TurboTax has also played a role in lobbying to keep taxes as complicated as they currently are. TurboTax spent billions of dollars lobbying to prevent common sense reforms to tax filings that would improve the process for taxpayers dramatically. (1) In some sense, you could see this as a smart investment by TurboTax to preserve its competitive advantage (no one will need to pay for TurboTax if taxes are made simpler to file). But there’s also a downside. As media groups got wind of this lobbying, there has been a movement to boycott TurboTax. Who knows how impactful it will be, but it’s worth looking at TurboTax with some skepticism and caution. (2)

Beyond this challenging PR, I think TurboTax does have some really interesting projects and opportunities on the horizon. There’s been a lot of policy conversation about the evolving “gig economy” sector of people who work in contract work rather than traditional W2 employment. Platforms like Uber, Airbnb, and TaskRabbit are shifting how people earn, and gig economy workers are treated differently under the tax code. There taxes are complex and hard to navigate, but due to regulatory and social scrutiny, platform companies are increasingly looking to support their workers in filing taxes. In response, TurboTax/Intuit have created a new tool to help gig economy workers track earnings and file their taxes (3). Uber has even partnered with Intuit to create a new tax dashboard for its drivers (4). TurboTax should be thoughtful to keep responding to evolving trends in workforce participation so that it can deliver value to emerging segments of tax payers.

1. https://www.propublica.org/article/how-the-maker-of-turbotax-fought-free-simple-tax-filing

2. http://www.vox.com/2016/3/29/11320386/turbotax-boycott-lobbying

3. https://turbotax.intuit.com/tax-tools/tax-tips/Self-Employment-Taxes/Tax-Tips-for-Uber–Lyft–Sidecar-and-other-Car-Sharing-Drivers/INF28820.html

4. https://techcrunch.com/2015/01/28/uber-intuit/

Correction: lobbying budget in the millions, not billions! Sorry for error!

Wonderful topic and marvelously written article Ken. I agree with you with much of the opportunity still left to be captured by Turbo Tax (acquiring younger consumers, proving to older consumers the value and credibility of the product) but also have fears akin to those of Daniel (what barriers to entry, if any, exist in this space – will margins ultimately degrade to nothing?) and Reilly (is it morose that it may be in Turbo Tax’s best interests to keep taxes as complicated a system as possible?).

With both of these I wonder about the true necessity of complex tax systems in America. If we come to the conclusion that complex systems typically benefit those at scale with capabilities to best traverse and advantage (typically the wealthy and large corporations), how do we move away from a system buttressed by the interest of so many parties on America?

The sentiment expressed in many of the above comments read so true to me; what did tax payers do prior to services like TurboTax? As I looked up research on the origins of TurboTax and other computer tax services, I started to wonder how standard accountants were still employed. I came to the conclusion that possibly TurboTax was not actually saving tax payers the maximum return possible. An investigation by CBS News sought to investigate the same hypothesis.

The investigation found that for one particular individual (not clear how scale-able the results are) Turbo Tax identified a tax refund of $3,941 for a cost of $111.90, for a total savings of $3,379.10. An accountant for the same set of tax information found a tax refund of $3,831 for a cost of $400.00, for a total savings of $3,431.00. [1] In total, while the accountant won the competition, the financial differential is almost negligible. The investigator did, however, identify that the accountant had recommended several additional actions that the customer could take in the next year to produce significantly more savings. This seems to be the only competitive advantage that humans seem to have at this point of the field, and it will be very interesting to see at what point computer services begin to be as valuable for future recommendations as well.

[1] Ashford, Kate.March 15, 2010.http://www.cbsnews.com/news/turbotax-vs-human-best-way-to-save-on-your-tax-return/,Accessed November 2016.

This is a very fascinating topic and I love how you compared the function of preparing a tax return to preparing for a case, something we can all understand and have context around. Our generation has mostly only experienced the online and digital tax returns as opposed to the traditional paper returns, thus it is hard for me to imagine other methods. I have personally used Turbo Tax on multiple occasions and while it was quick, I’m not sure that it’s quicker than preparing for a case study. I believe that they have ingeniously made the upfront investments around SaaS technologies and the like to secure a leading position as a innovator in the space and I believe that this investment will pay off huge dividends in the long term

Great post, Ken! I HATE tax season – even when being helped by TurboTax. I have found TurboTax to be very useful and intuitive, but only for when filing simple filings. I had the pleasure of filing many different state returns because of my time in consulting. I think this just about broke TurboTax, making my life very difficult. If tax codes continue to become more complex and as millennials redefine working norms (e.g., contract work) I wonder how TurboTax will keep up. Is there a certain point where it becomes too complicated for an untrained citizen to file their taxes? Will we all have to use a tax professional at some point?