Can the giant Ant replicate its model worldwide?

Is digitalization only disrupting supply chain in traditional manufacturers? It also brought innovative solutions to financial systems in China, changing the supply chain in money.

Fintech (short for “Financial Technology”) in China has boomed in recent years. China leads the world when it comes to total users and market size. China’s digital payments account for nearly half of the global total. It is dominant in online lending, occupying three-quarters of the global market. Fintech is shaking up a stodgy banking system and helping build a more efficient one in China, especially for consumers and small businesses. [1] The largest Chinese fintech company, Ant Financial, affiliated to Alibaba group, brought innovative solutions to financial systems in China, from mobile payment, online lending to wealth management.

How did Ant Financial disrupt financial system in China?

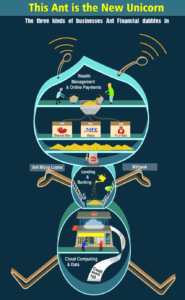

Figure 1: Business Model of Ant Financial (source 5)

A few years ago, in China, people accumulated excessive savings but had few good products for investing. Small business owners were full of entrepreneurial ideas but facing hard time getting startup loans. Consumers had the increasing desire of spending more but needed cash to do so. Starting from Alipay, which controls more than 54% of China’s $5.5 trillion mobile payment in Q1 2017 followed by Wechat from Tencent [2], Ant Financial took the opportunities and evolved into a billion-dollar company that has a finger in almost every pie in China’s Fintech industry.

Mobile payment

Created to build the trust system facilitating C2C transactions in Taobao, an ecommerce platform in Alibaba group, Alipay now accumulated 450 million users worldwide. The competitive advantage of Alipay is its one-stop platform. Many of the payment functions within Alipay exist elsewhere in the world, but in a very disaggregated form: Stripe or PayPal for online shops processing payments; Apple Pay or Android Pay for those using their phones as wallets; Facebook Messenger or Venmo for friends transferring money. [1] In China all these different functions have been combined onto single platforms which include additional features such as payment for utility bill, purchasing of flight or train tickets, donation to NGO.

Online lending

With the mission of “bring the world equal opportunities”, Ant Financial lends out small loans to credit-starved small business left out by the banking systems, who prefer lending to state-owned companies. Established in 2014, the lender now approves more than $15 million in loans to small business owners each day. Each borrower receives a credit line of between $1,500 and $3,000. [4]

Wealth Management

Alipay’s large customer base has fueled the rapid rise of internet finance products developed by Ant Financial. One of the most successful innovation products is Yu’e Bao, which is a money-market fund that offers higher interest rate than commercial banks (Figure 1), has accrued 370 million account holders and $211 billion in assets in just four years. [3]

Figure 2: Treasure Trove (source 1)

Global Footprint

Jack Ma, the tycoon who controls Alibaba and Ant Financial, has a vision for Ant – to create a huge online network of local consumers and merchants in other countries, replicating Ant’s model in China. Over the past two years, Ant Financial has unveiled investments in countries including India, Thailand, South Korea and France, and is currently negotiating to acquire MoneyGram International Inc, a Texas-based money-transfer firm active in over 200 countries. [6]

Ant Financial is building a global network of merchants that accept its payment services, which aimed at the surging number of Chinese tourists who use Alipay mobile-payments application at home. By distributing its technology platform to retailers world-wide, Ant is laying the groundwork for what could eventually be a challenge to Visa Inc. and MasterCard Inc. [7]

The global opportunities for Ant Financial differ in emerging markets and developed markets. In emerging markets, Ant Financial, with the use of the right technology, could replicate the entire business model in China and create new norms in existing financial systems. In developed countries, where the credit system is well-established, the grand consolidation of payments, lending and investment could be the leading trend in the near future.

Challenges ahead

Banking is a tightly regulated industry. How to persuade the government in other countries that its approach is safe, transparent and beneficial to existing system is the challenge that Ant Financial will face. Can they nail it quickly? Well they have to, because they know the rival back home – Tencent, and big tech giants at Silicon Valley are also eyeing the pie.

Word Count: 717

[1] The Economist https://www.economist.com/news/finance-and-economics/21717393-advanced-technology-backward-banks-and-soaring-wealth-make-china-leader

[2] Forbes https://www.forbes.com/sites/quora/2017/06/20/is-wechat-pay-taking-over-alipay/#66ad54f33a0b

[4] Caixin https://www.caixinglobal.com/2017-10-25/101161042.html

[5] China-focused leadership and business analysis http://knowledge.ckgsb.edu.cn/2015/08/05/finance-and-investment/can-alibabas-ant-financial-disrupt-chinas-financial-industry/

[6] Bloomberg https://www.bloomberg.com/news/articles/2017-05-18/jack-ma-s-ant-financial-eyes-more-deals-in-global-expansion

[7] WSJ https://www.wsj.com/articles/alipay-mobilizes-for-world-wide-expansion-1477930366

Phenomenal article Zoe! As noted, Chinese consumers have welcomed the FinTech sector, embracing the use of technology to transfer funds, make loans, and manage wealth anywhere with the tips of their fingertips. Determining a global expansion strategy that addresses regional regulation, consumer technology trends, and fierce competition will not be easy though!

You mentioned that Ant Financial is a one-stop-shop compared to the fragmented FinTech market of the United States, for example, including PayPal, Apple Pay, Venmo, and the list goes on. How best do you think Ant Financial can go about integrating all these previously siloed technologies? Venmo is cute and fun – the little emojis to playfully pay friends after a dinner out on the town. But, is the Venmo consumer ready to manage their stock portfolio and saving bonds within an application they previously were sending witty payment one-liners? It will require a consumer mindset shift.

Another question I have, is what role does brick-and-mortar banking have in the future? I do believe, there will always be a traditional consumer who wants to walk into a bank to discuss getting a car loan or home mortgage (call me old-fashioned!). Banking is a product for many that is complicated and time confusing, and therefore consumers desire the convenience and service elements of a physical banking institution. Is it possible Ant Financial could leverage brick-and-mortar locations to drive adoption and increase speed on penetration in new markets?

I think the final challenges Ant Financial will face is to successfully build trusts with consumers regarding privacy and security and the idea one-offering can deliver competitiveness across so many unique bank product offerings.

As you perfectly explained it in your essay, regulation is a big hurdle for Ant Financial to quickly expand. First of all, it usually takes time to comply with the different regulation requirements. Moreover some Western countries might be suspicious about having Ant Financial, a Chinese company, as a new entrant in their financial system. I believe that Ant Financial can bypass the regulation and speed up its expansion by partnering with local providers in different countries. For example, Ant Financial has recently partnered with payment processor firm First Data in the US. In this partnership, First Data allows Ant Financial’s services to be used at point-of-sales with its US retail partners [1].

Another way Ant Financial can quickly increase the adoption of its services in a new market is to partner with local telecom companies. For example, Ant Financial has recently launched a JV with Hong Kong’s largest mobile operator, CK Hutchison. The JV will leverage CK Hutchison’s extensive market presence and combine its commercial experience with Ant Financial’s technology expertise in order to bring Ant Financial’s full range of services to many customers.

In conclusion, I believe that Ant Financial should leverage partnerships in order to expand aggressively abroad instead of resorting to large scale acquisitions or starting from scratch.

1. https://techcrunch.com/2017/05/09/alipay-first-data-us-point-of-sale-expansion/

2. https://techcrunch.com/2017/09/26/ant-financial-partners-with-hutchison-alipay-hong-kong/

I think another thing Ant Financial needs to consider as it expands globally is the amount of consumer data and capital they will have access to. While I agree that having a one-stop shop for all your personal finance needs is highly efficient and convenient for the consumer, I do think there is a reason this type of monopoly doesn’t exist in the U.S. Any one firm with access to all facets of a consumers payment cycle would have immense control over the consumer themselves, and would essentially be operating as a monopoly. Not only would this type of monopoly benefit from the synergies across its interrelated business units, but it would also get access to massive amounts of consumer data. From what a consumer is spending on to how much the consumer has in his investment portfolio, Ant Financial knows all. One can see the issues that can arise with allowing a private sector entity access to such large amounts of precious data, especially one headquartered in China. Winning over consumer trust in foreign markets, already a difficult and daunting task, will not be Ant Financials only problem: I can imagine interference from governments and anti-trust regulators too. To draw from Alexandre’s comment above, one way to protect against the image of Ant Financial trying to establish itself as a monopoly is to adopt a partnership approach and continue fostering partnerships with incumbents as it expands. In addition to consumer data, we should also remember that as Ant Financial expands it will continue to have access to consumer capital too, at least if it plans to continue operating its existing business lines. I believe this will add another layer of complication and scrutiny from regulators seeking to encourage competition. As someone who has experienced the ease of Alipay and its huge network of compatible offerings, I do hope we one day have a global, ubiquitous platform. At the same time, the capitalist in me questions whether allowing one company such dominance should be allowed.

Thank you sharing Zoe. Ant Financial is indeed a role model for any fintech ecosystem, particularly compared to the slower western worl din this respect. I wonder how Any Financial views its relationship and perhaps competition, with Tencent and WeChat? While Ant Financial controls the Merchant World and many B2C transactions, the WeChat ecosystem as a well-rounded platform is a clear competition to Ant. the ability of a consumer to browse through one app, the equivalents of Whatsapp, Opentable, Uber, TaskRabbit, Amazon and more is quite a feat.

The next generation of fintech ecosystems like Ant will house all financial transactions for customers including eInsurance, eMortgage, eInvesting and many more. I am excited for the future and Ant is leading the way with Jack Ma and Ali Baba