Can MTN Keep Shreddin’ the Gnar in the Face of Climate Change?

Global warming isn't snow's best friend. Vail Resorts provides insights on how to enable year-round powder days.

We often hear about the impacts of climate change at low altitude: rising sea levels, melting of the polar ice caps, bigger hurricanes… but what about in the mountains? The U.S. snowsport industry ($3.2Bn of resort sales in 2015[i]) is also at significant risk of global warming. Vail Resorts, Inc. (NYSE: MTN; $1.6Bn FY2016 net revenue), a premier ski resort in the U.S., has been taking steps to mitigate the impact of climate change on its businesses in the face of historically declining trends in snowfall[ii], but is it enough?

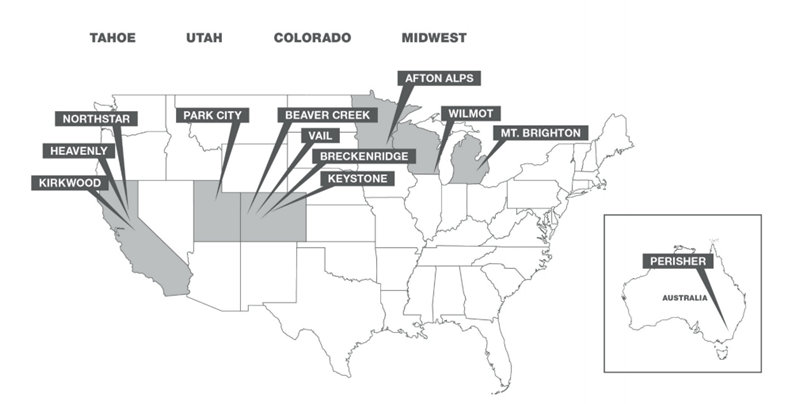

Current Portfolio of Gregor Clegane, a.k.a. the MTN

MTN operates in three main segments, including Mountain (82% of FY16 revenue), Lodging (17%) and Real Estate Development (1%)[iii]. Weather is one of the largest risk factors for MTN[iv], to the point where the company is typically valued by investors at a discount due to this downside[v]. Given the concentration of earnings during the winter months[vi], changes in weather patterns can have a significant impact on the company’s profitability.

Lower Beta Through Diversification

MTN is already taking steps to diversify its operations. In 2015, the company closed its acquisition of Perisher Ski Resort, the largest and most visited ski resort in the Southern Hemisphere[vii]. In 2016, MTN acquired a majority stake in Whistler, which boasts one of the longest ski seasons in North America[viii]. As a result, customers are still able to ski at a MTN resort, even if their preferred location is negatively impacted by local weather.

Vail Resorts, Inc. portfolio of mountain resorts and ski areas as of FYE2016 (excl. Whistler)[ix].

A second mitigation technique is to artificially create snow. MTN utilizes the most popular option of snow machines, allowing more frequent skiing despite the increase in average temperatures (88% of ski resorts rely on snowmaking[x]). Vail also uses cloud seeding technology, which pumps silver iodide into the atmosphere to generate additional snow (~5-15% increase in precipitation)[xi].

Finally, Vail is focusing on increasing topline contribution from summer activities by attracting off-season customers. In 2016 the company opened its initial Epic Discovery programs, which are comprised of summer activities, at both Vail Mountain and Heavenly. The company has announced plans to open a Breckenridge Epic Discovery in 2017[xii], and could continue this trend at other resorts.

But How to Find More Alpha?

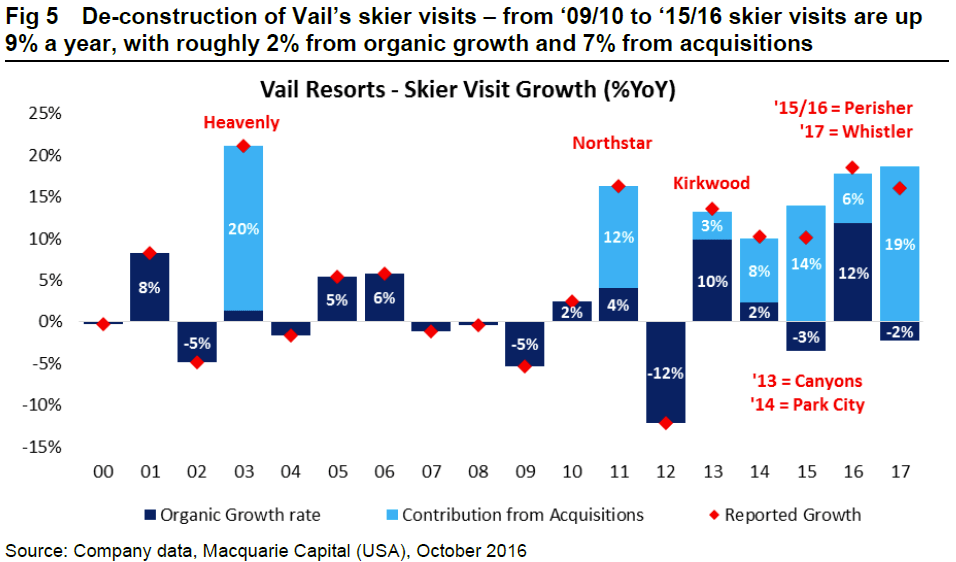

In the short-term, MTN should maintain focus on growth by acquisitions, as growth would likely be more weather-driven if deals stopped[xiii]. This (i) increases its total customer base given lackluster ~2% organic growth (see table below), and (ii) further diversifies its geographic footprint. Specifically, MTN should consider acquiring resorts in Europe and in the southern hemisphere. Diversification to Europe increases the probability of a strong snow season somewhere in the MTN network when weather in the U.S. is poor. Acquiring a resort in South America diversifies southern hemisphere weather risk away from Australia during its peak season.

Source: Macquarie[xiv].

In the long-term, MTN should look into diversifying its operations away from ski resorts. MTN already has expertise in the leisure industry, and should look to leverage this by focusing on hotels, beach resorts and sport facilities (e.g,. Chelsea Piers in New York or the Wide World of Sports complex in Orlando). These business models are still relatively similar to MTN’s, and a focus on spring/summer-related activities would help mitigate a decrease in revenues from its ski-related businesses.

Conclusion: Just Buy the Market

MTN has been actively making decisions to protect itself against climate change, but their exposure to winter activity is still significant. Geographic and operational diversification would allow it to decrease its exposure to global warming, while keeping it firmly within the spectrum of its current business model.

(800 words)

[i] IBISWorld, http://clients1.ibisworld.com/reports/us/industry/keystatistics.aspx?entid=1653, accessed November 2016

[ii] Donna Bebb, “Climate Exposure Impact on Equity Valuation: Case Study of Vail Resorts, Inc.” http://media.law.stanford.edu/organizations/programs-and-centers/steyer-taylor/Vail_Final.pdf, accessed November 2016

[iii] Vail Resorts, Inc. 2016 Annual Report, page 3, https://www.sec.gov/Archives/edgar/data/812011/000081201116000115/mtn2016073110-kforq4.htm, accessed November 2016

[iv] Felicia R. Hendrix, “Season Pass Momentum Builds” Barclays Capital Inc., September 26, 2016.

[v] Felicia R. Hendrix, “Season Pass Momentum Builds” Barclays Capital Inc., September 26, 2016.

[vi] Donna Bebb, “Climate Exposure Impact on Equity Valuation: Case Study of Vail Resorts, Inc.” http://media.law.stanford.edu/organizations/programs-and-centers/steyer-taylor/Vail_Final.pdf, accessed November 2016

[vii] Vail Resorts, Inc. 2016 Annual Report, page 5, https://www.sec.gov/Archives/edgar/data/812011/000081201116000115/mtn2016073110-kforq4.htm, accessed November 2016

[viii] Whistler Blackcomb, https://www.whistlerblackcomb.com/about-us/media/oct-31-2016, accessed November 2016

[ix] Vail Resorts, Inc. 2016 Annual Report, page 4, https://www.sec.gov/Archives/edgar/data/812011/000081201116000115/mtn2016073110-kforq4.htm, accessed November 2016

[x] Vice News, https://news.vice.com/article/climate-change-could-decimate-the-american-ski-industry, accessed November 2016

[xi] Vice News, https://news.vice.com/article/climate-change-could-decimate-the-american-ski-industry, accessed November 2016

[xii] Vail Resorts, Inc. 2016 Annual Report, page 6, https://www.sec.gov/Archives/edgar/data/812011/000081201116000115/mtn2016073110-kforq4.htm, accessed November 2016

[xiii] Matthew Brooks, “Vail Resorts” Macquarie Capital (USA), October 20, 2016.

[xiv] Matthew Brooks, “Vail Resorts” Macquarie Capital (USA), October 20, 2016.

Banner image: Vail Valley Real Estate Incorporated, http://vailrealestatesearch.com/vail-and-beaver-creek-named-best-ski-resort-town-real-estate-investments/, accessed November 2016

Interesting post – and as a long-time fan of Park City I was interested in seeing your recommendations. Another possibility is to weather hedge. This acts similarly to insurance, but is based on weather outcomes rather than specific losses of property, etc. Generic weather hedging products are available on the CME, but have historically been limited to rainfall measures, and thus have been of more use to agricultural producers. A few private investment firms are starting to offer weather hedging clients in a variety of structures. For instance, MTN could pay premiums, and then get paid off if it fails to snow or if temperatures are above a pre-set level above a certain number of days in the season. Alternatively, there could be no premiums – the investment firm could pay MTN if it was too warm or failed to snow, and MTN could pay the investment firm if it was cold and did snow. This would be a particularly good hedge for MTN. Now, whether investment firms will continue to offer a product as the planet gets warmer, I do not know.

What I would like to learn more is how ski resorts themselves can reduce their impact on the environment. In many ways it seems like a vicious cycle: Winter’s become warmer, less snow falls, the need for artificial snow arises and ultimately energy consumption increases, which again contributes to the environment. What are the ways MTN has addressed this issue?

On another note, how do you see the potential of replacing winter tourism with summer tourism? The numbers I found were pretty disappointing in the way that potential is very limited with over 90% of revenues generated during the colder months. Nonetheless, it might be tricky to diversify into beach destinations given that they themselves will face many struggles with climate change.

I believe that a key challenge would be to look more closely into how and at what level, ski resorts can preserve the customer experience they currently offer. What are the improvements necessary to make artificial snow a full substitute and would it even be possible for it to melt only at higher temperatures. What can science do to mitigate the effects of climate change on the skiers’ experience?

Nice article, Pierre. I think this scheme of diversification that MTN is currently pursuing is the correct one. I disagree with the above commenter that MTN should begin hedging with financial instruments available in the market. Running ski resorts is their core competency and they should continue to do that. The expansion of business into increased summer activities is clearly paying dividends already as Vail had a 14% increase in bookings last summer compared to the year before (http://www.vaildaily.com/news/vail-lodging-headed-for-another-record-summer/). I also think that MTN has a corporate responsibility to do what it can to reduce its carbon footprint. MTN has already reduced their energy usage by 10% over the last five years and are targeting another 10% reduction by 2020 (http://www.epicpromise.com/our-epicpromise/what-we-do/). Hopefully this trend of conservation and sustainability can continue so we can have many more seasons of great skiing ahead of us.