Can Allstate be the ‘Hail Mary’ to the Climate Change Debate?

In this post, I analyze how Allstate is relevant and influential in the climate change debate.

Although for many companies the risks of global warming seem to be an issue of the future, insurance companies are directly impacted by climate change given their business model. The Allstate Corporation is the largest publicly held personal lines property and casualty insurer in America, with nearly $105 billion in total assets, and has recognized the prevalence of climate change.

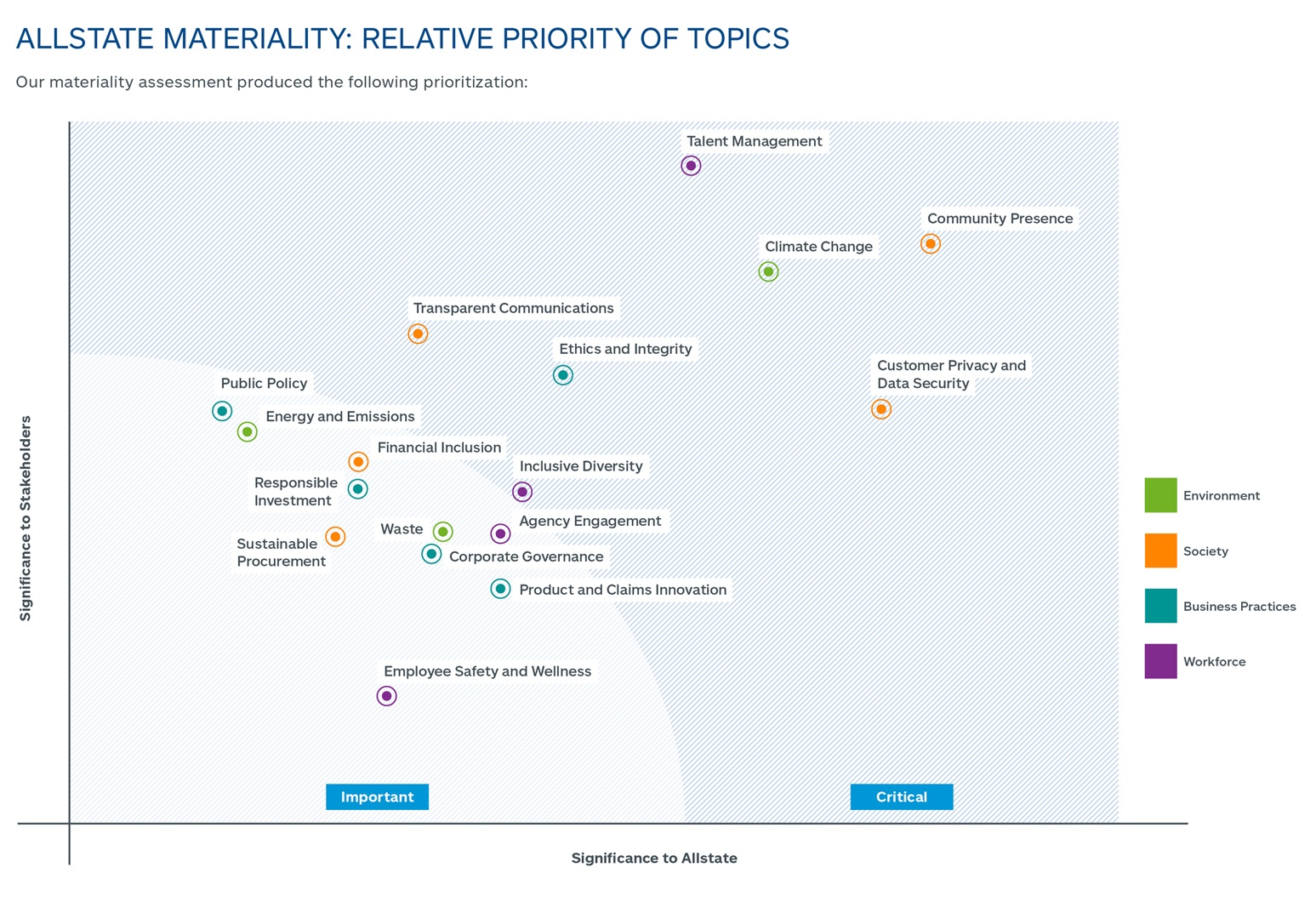

Exhibit 1: Allstate’s Relative Materiality

Climate change is projected to increase the frequency and severity of extreme weather events. As  a consequence, economic losses caused by natural catastrophes could increase significantly. [1] Given its operating model, increased frequency and severity of natural catastrophes and weather events impact not only the short-term profitability of Allstate, as claims increase for floods, hurricanes and fires, but also the long-term profitability, as historical risk models become obsolete. Allstate’s success depends on their ability to properly price, model, and underwrite climate-related risks, and thus climate change is a critical and timely issue for Allstate and its stakeholders.

a consequence, economic losses caused by natural catastrophes could increase significantly. [1] Given its operating model, increased frequency and severity of natural catastrophes and weather events impact not only the short-term profitability of Allstate, as claims increase for floods, hurricanes and fires, but also the long-term profitability, as historical risk models become obsolete. Allstate’s success depends on their ability to properly price, model, and underwrite climate-related risks, and thus climate change is a critical and timely issue for Allstate and its stakeholders.

Source: Allstate Corporate Responsibility. http://corporateresponsibility.allstate.com/corporate-responsibility-strategy/materiality-and-stakeholder-engagement.

Allstate’s first response to climate change risks has been to limit their exposure to high-risk areas. As part of their catastrophe management plan, Allstate has decreased their exposure of personal homeowners and landlord package policy in coastal areas. For example, Allstate ceased writing new homeowner and landlord package policy business in California in 2007, and in Florida in 2011. [2] Allstate’s CEO Tom Wilson predicted losses from natural disasters such as Hurricane Mathew, will likely be lower than its competitors, given its prior decision to lower marker share in Florida, thus reducing exposure. [3] This is an undesirable solution, since it merely limits Allstate’s’ insurance availability and shifts risk to households.

Therefore, Allstate has decided to go beyond risk-management and take a a more active stance against climate change through three initiatives: (1) Improve, (2) Innovate, and (3) Influence.

Can Allstate, which touches 16 million households nationwide, be the advocate and role model for climate-reducing tactics we’ve been hoping for?

Improve: Reduce Emissions Through Business Operations

Exhibit 2: Allstate’s Energy Reduction

Allstate created a Sustainability Council, composed of senior leaders from across the company, which meet 3 times a year, to guide environmental efforts and to provide opportunities for its employees to engage in sustainability strategies. In 2010, Allstate pledge to reduce its energy use by 20%, and the company surpassed this goal in 2014, six-years ahead of scheduled. [4]

Allstate created a Sustainability Council, composed of senior leaders from across the company, which meet 3 times a year, to guide environmental efforts and to provide opportunities for its employees to engage in sustainability strategies. In 2010, Allstate pledge to reduce its energy use by 20%, and the company surpassed this goal in 2014, six-years ahead of scheduled. [4]

Source: Allstate Corporate Responsibility | Energy, Emissions and Waste. http://corporateresponsibility.allstate.com/environment/energy-emissions-and-waste.

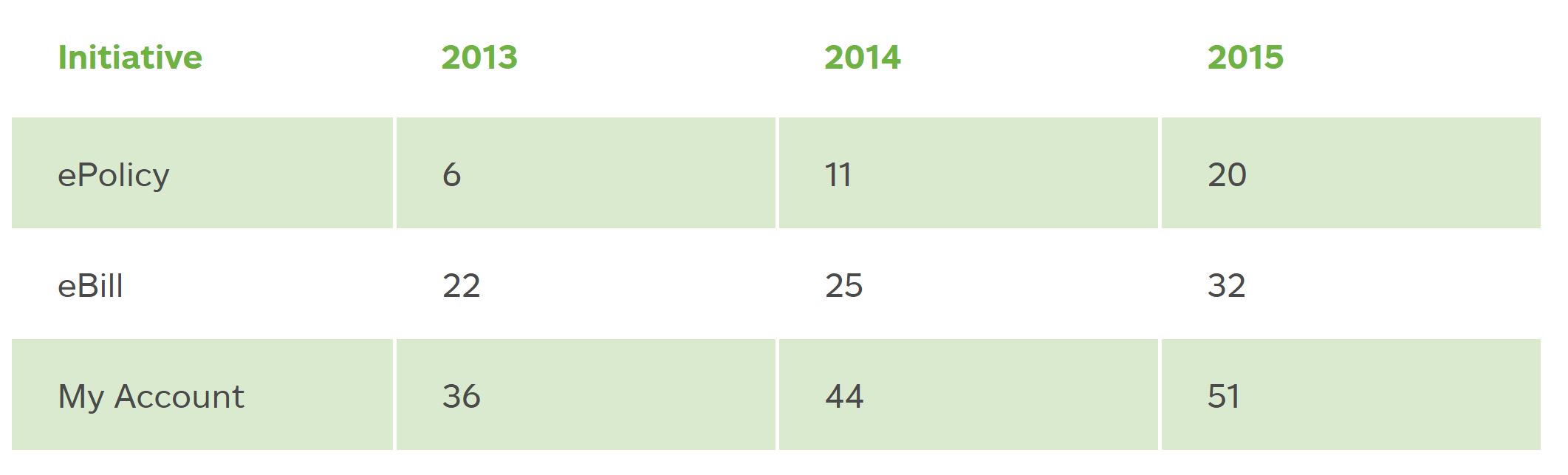

Exhibit 3: Allstate’s Customer Paperless Initiative (% of Usage)

In addition to energy conservation, Allstate identified paper as its largest source of potential waste and thus has focused o n significantly reducing paper usage. It’s reduced internal paper use through awareness campaigns and tracking mechanism. It has also reduced customers’ use through three paperless initiatives (ePolicy, eBill, My Account). All of these initiatives not only reduce Allstate’s environmental footprint and its costs, but also incentivizes consumers to reduce their own footprint. [4]

n significantly reducing paper usage. It’s reduced internal paper use through awareness campaigns and tracking mechanism. It has also reduced customers’ use through three paperless initiatives (ePolicy, eBill, My Account). All of these initiatives not only reduce Allstate’s environmental footprint and its costs, but also incentivizes consumers to reduce their own footprint. [4]

Source: Allstate Corporate Responsibility | Energy, Emissions and Waste. http://corporateresponsibility.allstate.com/environment/energy-emissions-and-waste.

In 2015, Newsweek magazine named Allstate one of the World’s Greenest Companies (#81) for the sixth time. Allstate was also recognized as a leader among S&P 500 companies for their disclosure of climate change data by CDP, the world’s only global environmental disclosure system. They scored 97 out of 100 in 2014 report, the highest score the company has received since it started reporting in 2007.

Innovate: Products and Services

A unique opportunity arises for insurance companies to become more than just low-emission companies. Allstate has begun developing creative insurance products that will further incentivize clients to reduce emissions, while benefiting from the product sales.

Milewise: It’s a new kind of insurance. You pay a rate per mile when you drive plus a low rate per day. It’s easy to pay as you go with automatic replenishment via your credit card. Whatever you spend in a day is deducted from your account so you can see real-time costs and budget better.

Milewise: It’s a new kind of insurance. You pay a rate per mile when you drive plus a low rate per day. It’s easy to pay as you go with automatic replenishment via your credit card. Whatever you spend in a day is deducted from your account so you can see real-time costs and budget better.

Homeowners Policy Green Improvement Reimbursement: A type of insurance coverage that can help pay you back for the

additional cost of replacing damaged or destroyed covered items with more energy-efficient items after a loss.

Pay-as-you-drive insurance products, such as Milewise, recognize that smaller distances reduces accidents, while decreasing carbon emission, therefore providing win-win opportunities for Allstate. Reimbursement programs like the Green Improvement remove the consumer’s switching costs associated with moving to energy-efficient products, thus encouraging consumers to become more “green”.

Influence: Public Advocacy

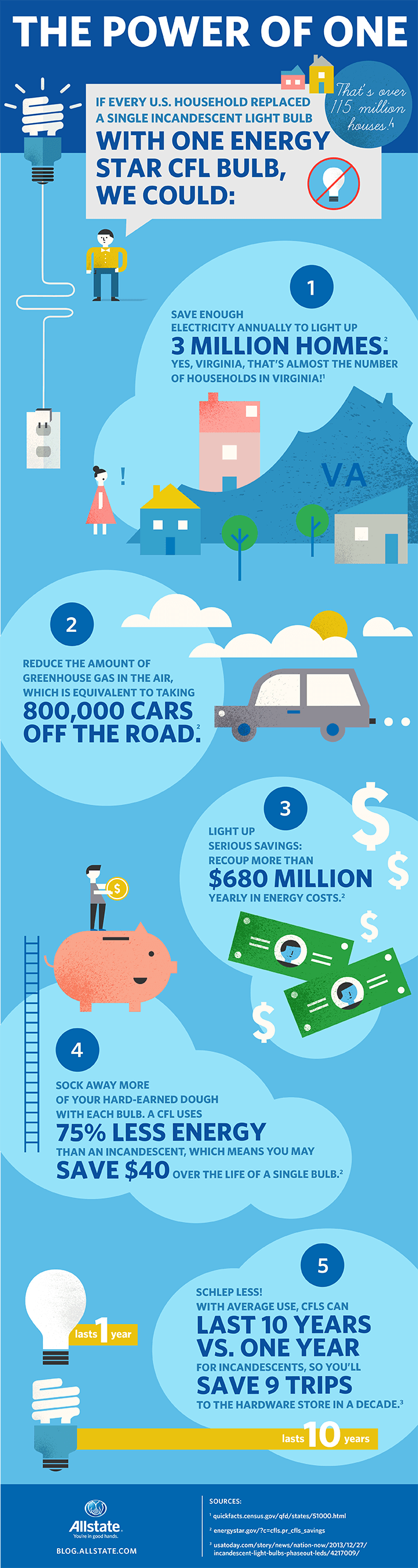

In addition to indirectly nudging consumers to make better choices through their products, Allstate has taken upon themselves to become a strong advocate for the importance of decreasing climate change effects. Through blog posts and campaigns, they are educating and encouraging consumers to make energy-efficient decisions.

Exhibit 4: Infographic from Allstate Blog

Source: The Allstate Blog. 2016. The Power of Switching One Light Bulb. https://blog.allstate.com/infographic-light-bulbs/.

The faster other insurance companies acknowledge that the climate change not only poses challenges for the industry, but also provides new business opportunities, the more impact the industry can have. Allstate’s model to go beyond risk-management and focus on: improving, innovating and influence, should be seen as a road map to other insurance companies.

I wrote about Allstate too! Great minds and all… Such an interesting topic, since they’re literally insuring against the damages of climate change, so every move they make to decrease emissions should theoretically increase their bottom line. I didn’t know about Milewise, which is such a cool and innovative program. Since Allstate is clearly on top of the issue, it was a real thought exercise to come up with additional initiatives they could implement! I wondered whether their advocacy could be stronger, in terms of writing and enforcing stronger building codes, which they could also incentivize in their policy-writing. Additionally, I wonder if they’ve considered special programs for low-emission vehicles – they likely get into accidents with the same frequency, are likely more expensive to repair, but also help decrease emissions!

Wow – I had no idea that Allstate stopped writing homeowners policies in California and Florida – have any other insurance companies followed suit? I wonder if this has had an impact on the real-estate markets in those areas. I’m also very impressed by the idea of ‘Milewise’, though I assume that the primary motivator behind the introduction of this product was not its impact on the environment, it makes me wonder what kind of other products can be introduced which incentivize behaviors that are ultimately beneficial for energy consumption or environmental impact.