Burden of Arabia

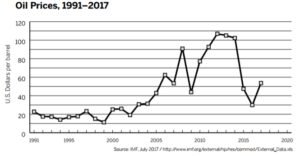

With low oil prices and continued technological shifts towards renewable energy on the horizon, Saudi Aramco confronts a monumental struggle to evolve into more than an Oil Company

Saudi Aramco (“Aramco”), the state-owned oil company of Saudi Arabia, is the 2nd largest producer of crude oil in the world[1]. Aramco’s daily production of 10.5 million barrels (2016) is 1.2x the production of the entire United States and drives ~50% of Saudi Arabia’s Gross Domestic Product[2]. With annual revenues exceeding $300B[3] and an estimated market cap between $1-2 trillion[4], Aramco is widely considered the world’s most valuable company. However, Aramco now faces a significant threat to its future as the concern for the effects of greenhouse gases on the environment has driven governments worldwide to seek out methods (e.g., renewable energy, fuel efficient vehicles) to reduce oil consumption and greenhouse gas emissions. To this end, Saudi Arabia and 195 other nations signed the Paris Climate Accord, a pact reflecting a commitment from each government to reduce greenhouse gas emissions and limit the rise of global temperatures[5]. Aramco (and by extension, Saudi Arabia), the historically slow-moving oil giant, must now adapt quickly if it is to secure its future.

Saudi Arabia has appointed its crown prince, Mohammad Bin Salman, to lead the effort to diversify the country’s economy. He has put forth a “Vision 2030” plan[6] that outlines the steps necessary to transform Saudi Arabia into, among other things, an investment powerhouse. In many ways, the fate of Vision 2030 rests on the ability of Aramco to evolve. To that end, Aramco is exploring several initiatives, each with unique challenges, to prepare for a future with less reliance on oil. Key initiatives include: (i) an Initial Public Offering (“IPO”) (ii) investments in renewable energy infrastructure and (iii) clean energy acquisitions.

- Aramco has indicated a willingness to raise $50-100B[7] via an IPO in 2018, which would be the largest IPO in history. The benefits of this IPO would be two-fold as it would raise funds for further diversifying the company/country and encourage foreign investment in an economy that has welcomed limited international involvement in years past. However, the ability to raise $50-100B is contingent upon the valuation that the market ascribes to Aramco and in today’s environment of low oil prices and world-wide aversion to greenhouse gases, global investors may not look fondly upon a company so heavily exposed to a commodity with an indeterminate future.

- Aramco has also indicated plans to invest $30-50B[8] in renewable energy infrastructure over the next 5-6 years with the goal to deliver 10 gigawatts of solar and wind power by 2023. For a company that ranked 2nd in the world in greenhouse gas emissions from 1988-2015[9], the investments in renewable energy infrastructure should help curtail future emissions.

- In addition, Aramco is considering ~$5B of investments in renewable energy acquisitions/partnerships as p

art of its plans to diversify away from crude production. The company is seeking to bring foreign expertise in renewable energy into the business and has engaged several investment banks to identify potential acquisition targets[10].

art of its plans to diversify away from crude production. The company is seeking to bring foreign expertise in renewable energy into the business and has engaged several investment banks to identify potential acquisition targets[10].

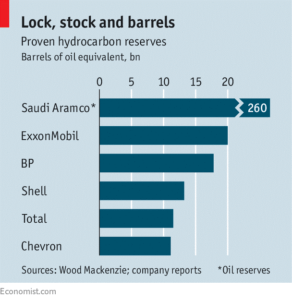

Though these initiatives are focused on developing a competence beyond oil, Aramco must continue to invest in alternative methods to utilize its 260 billion barrels in crude reserves[11]. One such method is utilizing crude as an input to manufacture value-added polymers that can be used for coatings, packaging, and other specialty chemical products. A recent partnership with Dow Chemical[12], facilitating the development of a large-scale production facility to process hydrocarbons into products for a wide array of end-markets, is a step in the right direction. Similar partnerships will be necessary to enable such swift industrial developments.

While Aramco must ensure that it continues to leverage the best of the international community (e.g. investors, partnerships), it must also make better use of internal resources (e.g. inclusion of more women in the workplace) if it is to thrive. In short, Aramco and Saudi Arabia will need to become more modern, nimble, and innovative to succeed – which may run counter to conservative religious constraints in certain instances. While it appears as though Aramco is making progress towards securing a more diversified future, the question remains: is economic necessity enough to mobilize the company (and country) away from the ways of the past and towards the promise of the future, or is it already too late?

(Word Count: 706)

Sources

[1] U.S. Energy Information Administration, “Production of Crude Oil including Lease Condensate 2016 (CVS download),” accessed May 27, 2017.

[2] “Best Countries For Business,” www.forbes.com/places/saudi-arabia, December 2016, [URL], accessed November 12, 2017.

[3] Crooks, E., & Raval, A., “Saudi Aramco’s value at risk from climate change policies,” www.ft.com/content/2115e218-802e-11e7-94e2-c5b903247afd, August 13, 2017, [URL], accessed November 09, 2017.

[4] Hertenstein, A., “Saudi Aramco’s Green Energy Push Seen Widening Appeal of IPO,” www.bloomberg.com/news/articles/2017-03-06/saudi-aramco-s-green-energy-push-seen-widening-appeal-of-ipo, March 5, 2017, [URL], accessed November 10, 2017.

[5] Paris Agreement, treaties.un.org/pages/ViewDetails.aspx?src=TREATY&mtdsg_no=XXVII-7-d&chapter=27&clang=_en, December 12 2015, [URL], accessed November 12, 2017.

[6] Bin Salman bin Abdulaziz Al-Saud, M. (n.d.), “Our Vision: Saudi Arabia – the heart of the Arab and Islamic worlds, the investment powerhouse, and the hub connecting three continents,” http://vision2030.gov.sa, [URL], accessed November 13, 2017.

[7] Hertenstein, A., “Saudi Aramco’s Green Energy Push Seen Widening Appeal of IPO,” www.bloomberg.com/news/articles/2017-03-06/saudi-aramco-s-green-energy-push-seen-widening-appeal-of-ipo, March 5, 2017, [URL], accessed November 10, 2017.

[8] Doherty, Patrick, “Behind Saudi Arabia’s $2 trillion bet on a sustainable future,” www.greenbiz.com/article/behind-saudi-arabias-2-trillion-bet-sustainable-future, March 24 2017, [URL], accessed November 14, 2017.

[9] Riley, T., “Just 100 companies responsible for 71% of global emissions,” www.theguardian.com/sustainable-business/2017/jul/10/100-fossil-fuel-companies-investors-responsible-71-global-emissions-cdp-study-climate-change, July 10, 2017, [URL], accessed August 13, 2017.

[10] Martin, M., “Saudi Aramco Said to Weigh Up to $5 Billion of Renewable Deals,” www.bloomberg.com/news/articles/2017-01-29/saudi-aramco-said-to-weigh-up-to-5-billion-of-renewable-deals, January 29, 2017, [URL], accessed November 13, 2017.

[11] OPEC, Annual Statistical Bulletin 2016

[12] Schikorra , R., “Dow and Saudi Aramco Sign MOU for Potential Equity Ownership Restructure in Sadara Joint Venture,” www.dow.com/en-us/news/press-releases/dow-and-saudi-aramco-sign-mou-for-potential-equity-ownership-restructure-in-sadara-joint-venture, August 28, 2017, [URL], accessed November 13, 2017.

Thanks for the post, Samson! Aramco is both adapting to global warming through diversification, as well as mitigating it by supporting the development of renewable energy. I agree that these methods will ultimately help Aramco survive, but I wonder how sustainable Aramco’s action will be – Aramco’s strategy seem purely motivated by it’s stock price, and if the market begins to favor renewable energy less, I imagine Aramco would revert away from mitigating global warming. Aramco’s stock price is highly dependent on global climate change policies (Source: https://www.ft.com/content/2115e218-802e-11e7-94e2-c5b903247afd) and thus Aramco’s commitment to mitigating climate change may not be sustainable.

One additional promising move toward mitigating greenhouse gas emissions is that Aramco, Shell and other major oil companies set up a fund that focuses on carbon capture and storage technology, which captures carbon dioxide emissions from burning fossil fuels and stores them underground. (Source: http://business.financialpost.com/commodities/energy/saudi-aramco-and-shell-join-other-oil-majors-to-set-up-clean-energy-fund-to-fight-climate-change)

Thank you, Samson, for the great post – it’s fascinating to see how large the effect of Climate Change is on entire nations. I agree with the points you outlined and it seems that Aramco is indeed on the right track towards navigating a world favoring renewables. Taking a set back, however, I notice that most of the major actions that Aramco plans to take are external to it – IPO, investments in renewable energy infrastructure, and investments in renewable energy acquisitions/partnerships. As such, what actions is Aramco currently taking to improve its current oil drilling/lifting operations and reduce their carbon footprint? Moreover, how sizable is this opportunity?

In other words, if Aramco improves its operational efficiency, will the reduced carbon footprint of its operations be comparable to the reduced carbon footprint through its planned investments?