Beware the Trump Trade: Why Trump’s Attack on NAFTA is a Call to Arms for General Motors.

Donald Trump has publicly called for significant changes to NAFTA and for the auto industry to shift operations away from Mexico and into the United States. This would greatly disrupt General Motors, its employees, and its shareholders.

When Donald Trump recently called NAFTA the “worst trade deal ever made,” General Motors paid close attention to the President’s attacks on the agreement, and with good reason. [1] Over the 23 years since the North American Free Trade Agreement (NAFTA) was signed, General Motors has relied on NAFTA to relegate labor-intensive production to its four Mexican factories and develop a supply chain highly contingent on Mexican-produced parts (a Chevy Silverado built in Indiana today, for example, has 51% of its parts from Mexico). [2] [3] Over the same period, Mexico’s total light vehicle production has more than tripled, from 1.1 million units in 1994 to approximately 3.5 million units in 2016, in large part due to NAFTA. [4]

Figure 1: Donald Trump tweet on NAFTA from August 27, 2017 (Twitter)

This free trade between the U.S. and its neighbors to the South has also helped Detroit-based manufacturer General Motors achieve financial success: with GM driving to record profitability and all-time high share prices in 2017. [5] Thus, President Trump’s recent NAFTA call for renegotiation, which could impose high tariffs on Mexican-made automobiles and mandate that 50% of parts in U.S. vehicles come from the U.S., comes at a time where the spotlight on GM’s financial performance is high. [6] As an August piece for the Harvard Business Review noted, eliminating NAFTA would end the uninterrupted access between North American markets for General Motors, prompting the “need to radically rethink its localization and sourcing strategy” and likely leading “to closing factories, seeking new sources for inputs, and raising prices to mitigate higher production cuts.” [7] Understandably, this would be very expensive to both GM and its employees: the Motor and Equipment Manufacturers Association and American Automotive Policy Council recently estimated these moves could cost Americans 24,000 jobs and auto manufacturer’s $10 billion in costs (Bain estimated the total profit impact to be $4.4 billion; General Motors holds a ~17% U.S. market share). [8] [9] [10]

Figure 2: Bain Study on Impact of NAFTA Withdrawal on U.S. Profits (Bain)

Figure 2: Bain Study on Impact of NAFTA Withdrawal on U.S. Profits (Bain)

How has GM reacted to this potential political and financial hailstorm?

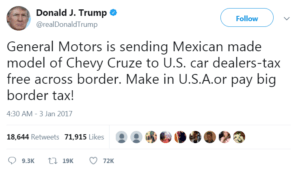

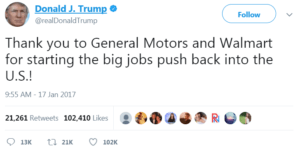

Since Trump’s election in November of 2016, General Motors has pursued public, short-term appeasement to the President’s January 2017 call for GM to “make [cars] in the U.S.” [11] Just two weeks after Trump’s tweet, the company announced an additional $1 billion investment in U.S. manufacturing operations, pointing out in the same press release that the investment followed “$21 billion GM has invested in its U.S. operations since 2009.” [12]

Figure 3: Trump tweet criticizing General Motors Mexican manufacturing operations (Twitter)

Figure 3: Trump tweet criticizing General Motors Mexican manufacturing operations (Twitter)

However, GM has not wholeheartedly relented to the President’s demands to bring operations back to the U.S., recently fighting the potentially damaging effects of a NAFTA renegotiation as trade talks have ramped up over the past few months. Chief Financial Officer Chuck Stevens recently acknowledging “some risks” to GM from NAFTA negotiations, prompting a partnership with Ford and Fiat-Chrysler through the American Automotive Policy Council to openly lobby against NAFTA changes in Washington. [13] [14] The company is hoping to capture the sympathy of Republican and Democratic congress members alike, reminding them that added supply chain costs and tariffs ultimately lead to fewer U.S. jobs.

What are GM’s plans for the long-term in Mexico?

General Motors appears to be staying put in Mexico, with no publicly-announced changes to its long-term strategy. Early this year, Chief Executive Officer Mary Barra told reporters that the company’s small-car Mexico production would stay, citing the difficulty of making changes to plant investments and the “long-lead” and “highly capital-intensive” nature of automotive manufacturing with decisions being made with years-long time horizons. [15] Barra has backed up this rhetoric with action, as well, recently prompting the September strike of 2,750 employees at GM’s Ingersoll, Ontario plant when GM announced that 600 jobs would shift from Canada to Mexico. [16] While President Trump may continue to lament this U.S. manufacturer utilizing labor and manufacturing capabilities across the border, General Motors appears to be betting that his bark is bigger than his bite.

While I believe General Motors has treaded nicely between placating President Trump’s U.S.-made public relations agenda and its obligation to its shareholders and employees to maximize profits through a NAFTA-enabled supply chain, management would be wise to continue publicly trumpeting continued investments in the United States and the aforementioned negative impacts changes to NAFTA would have on jobs and profitability. The January 2017 $1 billion U.S. investment by General Motors largely silenced President Trump (he has not tweeted directly at General Motors since) and educating the public on the somewhat counterintuitive, net negative effect of NAFTA on the U.S. auto industry’s employees appears necessary to help build public pressure to avoid wholesale changes to the trade agreement’s automotive components.

Some important questions linger for General Motors: if NAFTA dissolves, is the right answer for General Motors to dissolve Mexican operations or simply burden itself with incremental tariff costs that shareholders and consumers would ultimately bear? Can General Motors compete with Japanese and European manufacturers in a post-NAFTA world?

(791 Words)

References

[1] “Donald J. Trump On Twitter”. 2017. Twitter. https://twitter.com/realdonaldtrump/status/901804388649500672?lang=en

[2] “General Motors Manufacturing Plants”. 2017. GM Authority. http://gmauthority.com/blog/gm/gm-manufacturing/.

[3] “NHTSA.Gov”. 2017. Nhtsa.Gov. https://www.nhtsa.gov/sites/nhtsa.dot.gov/files/documents/2016_aala_alpha_02012017.pdf.

[4] Welch, David, and Kristine Owram. 2017. “GM Hit With First Canada Strike In Decades On NAFTA Losses”. San Antonio Express-News. http://www.expressnews.com/business/national/article/GM-hit-with-first-Canada-strike-in-decades-on-12206951.php.

[5] Capital IQ. S&P Capital IQ. (2017). General Motors Inc.: Public company profile. Retrieved November 14, 2017, from S&P Capital IQ database.

[6] Shepardson, David. 2017. “Auto Industry Tells Trump ‘We’re Winning With NAFTA'”. U.S.. https://www.reuters.com/article/us-trade-nafta-autos/auto-industry-tells-trump-were-winning-with-nafta-idUSKBN1CT1FJ.

[7] Martinez, Antonio. 2017. “What A Changing NAFTA Could Mean For Doing Business In Mexico”. Harvard Business Review. https://hbr.org/2017/06/what-a-changing-nafta-could-mean-for-doing-business-in-mexico.

[8] “A World Without Nafta”. 2017. Mema.Org. https://www.mema.org/sites/default/files/A_World_Without_NAFTA_0.pdf.

[9] “Is Your Supply Chain Ready For A Nafta Overhaul? – Bain Brief”. 2017. Bain.Com. http://www.bain.com/publications/articles/is-your-supply-chain-ready-for-a-nafta-overhaul.aspx.

[10] “General Motors US Sales Information | GM.Com”. 2017. Gm.Com. http://www.gm.com/investors/sales/us-sales-production.html.

[11] “Donald J. Trump On Twitter”. 2017. Twitter. https://twitter.com/realdonaldtrump/status/816260343391514624?lang=en.

[12] “GM Announces 7,000 U.S. Jobs, Builds Off Strong Track Record”. 2017. Media.Gm.Com. http://media.gm.com/media/us/en/gm/home.detail.html/content/Pages/news/us/en/2017/jan/0117-investment.html.

[13] Shepardson, David. 2017. “Auto Industry Tells Trump ‘We’re Winning With NAFTA'”. U.S.. https://www.reuters.com/article/us-trade-nafta-autos/auto-industry-tells-trump-were-winning-with-nafta-idUSKBN1CT1FJ.

[14] Kitroeff, Ana. 2017. “‘Army’ Of Lobbyists Hits Capitol Hill To Preserve Nafta”. Nytimes.Com. https://www.nytimes.com/2017/10/24/us/politics/nafta-lobby-congress.html.

[15] Farber, Madeline. 2017. “General Motors CEO Says Trump’S Threats Won’T Change The Company’S Plans”. Fortune. http://fortune.com/2017/01/09/donald-trump-general-motors-mary-barra/.

[16] Austen, Ian. 2017. “G.M. Workers Strike In Canada As Mexico Jobs Raise Tension”. Nytimes.Com. https://www.nytimes.com/2017/09/18/business/general-motors-strike-canada.html.

Figure 4: Trump applauding General Motors following the announcement of its $1 billion investment into U.S. operations (Twitter)

Figure 4: Trump applauding General Motors following the announcement of its $1 billion investment into U.S. operations (Twitter)

Despite its longer-term ambitions, automakers such as GM must still confront today’s nationalist movements and determine where to invest its capital. GM’s management must assume that the risks in producing in North America will continue to persist. Both political parties in the US are led by individuals who champion anti-free trade rhetoric. Andres Obrador, a populist leftist who has been critical of Mexico’s free-market policies, is a contender in next year’s presidential election. Political movements across Europe and Asia share the same sentiment and suggest that GM should optimize for political security rather than current favorable conditions.

I like GM’s move to partner with Ford and Fiat-Chrysler to lobby against NAFTA changes. Washington needs to understand that eliminating NAFTA would actually lead to American jobs being lost in the long term by making the American automotive companies uncompetitive, even if investments create jobs in the short term. Despite President Trump’s stance, lawmakers in Washington on both sides of the aisle can rationally arrive at the same conclusion.

To your question of whether GM should continue to operate in Mexico in the event that NAFTA dissolves, I say yes. GM should bear the costs of the incremental tariffs in the short term. As quickly as NAFTA can dissolve, a future administration in Washington can just as easily re-embrace the notion of free trade, and I believe that to be a likely scenario in the long term.

This post does a great job of outlining the negative implications for the US that can stem from nationalistic policies. All too often, in my opinion, calls to bring back jobs to the US ignore the fact that many US companies’ ability to outsource certain pieces of their manufacturing actually generates a net gain in US jobs. When faced with nuanced arguments like the impact of nationalist policies on automakers, it is vital to actually understand the financial implications of doing so versus focusing merely on the politically expedient soundbite. It is my hope that GM continues to strike the fine balance between appeasing the current administration while making savvy business decisions. And in the event that the pressure becomes too great domestically to continue their operations this way, I would push GM management to make it abundantly clear the negative consequences US GM employees experienced as a result.

This is an interesting essay and puts out some good thoughts regarding NAFTA and GM, but much of the data provided feels incomplete. On the face of it I can see where the data provided shows potential negative impact. However, there is no mention of the potential positive impacts of a growing economy in the US, tax reform, the ability for companies to repatriate monies held overseas at a one time small charge. Much of this part of the current administration’s plan is designed to help mitigate issues described in the article, and provide strong long term growth and desire to be more “American Made.” Whether this happens or not remains to be seen, but on the surface the plans sound solid, and would have a positive impact on GM and the US, while a seeming negative impact on Mexico.

An additional factor that is also linked to this issue is the trend towards automating production. I wonder how much political uncertainty the auto manufacturers are willing deal with before they more aggressively pursue automated factories (even more so than they already are). I’m sure there are still many technical barriers to full automation in some processes, but I imagine there are also processes that are technically feasible to automate that the manufacturers have not pursued due to financial limitations. If protectionism continues to be a major risk or even begins materializing as significant added cost, GM will eventually hit a tipping point where the investment in automation now makes financial sense and those jobs are simply eliminated. In that case, the result is higher prices to consumers without any additional job growth – an outcome I’m sure nobody wants.

GM faces some bleak trade negotiations ahead. Famous brands that are traditionally considered a symbol of national pride are directly under fire – General Motors included. The high public nature of the company means that Trump will have a very firm stance on this point. The tweets referenced above illustrate how much Trump’s “make America great” campaign hinges on that. I think GM should do everything it can to negotiate with Trump – to come to some kind of compromise: If GM creates x jobs in the US or produces x cars on US soil, they would be permitted to keep x operations in Mexico. I don’t think this is a situation where GM can net a direct win, nor do I think it’s one where GM has to take 100% of the losses (cut all ties to Mexico/take on all the tariffs and additional costs). GM has political power as a high-profile brand that can help push Trump’s approval ratings up/down. They should capitalize on this as I am sure they already are.

Part of the issue for General Motors is consumer sentiment. Should NAFTA end and GM’s costs rise (whether they stay in Mexico and pay the tariffs or relocate to the US and pay higher wages and operating costs), these costs will flow through to the consumer. Assuming both scenarios produce similar cost increases, the next question GM must ask is, “Will consumers care whether we are operating out of Mexico or the US?” And despite abundant rhetoric in the media, evidence shows that American consumers prioritize lower price far above American manufacturing origins.

All of this to say: if GM evaluates the two scenarios and finds that the costs are even slightly lower to stay in Mexico and pay the tariff, they should do that. And as Zeya pointed out, the world trends towards free trade. Even as America considers dropping out of NAFTA, Canada and Mexico are holding talks to continue their own free trade agreement. How long until that coalition strikes a deal with the EU? In the end, the inertia of the world’s top powers playing nice with each other leaves me believing that we will eventually make our way back into the fold.

Interesting article about the implications of NAFTA on the automobile industry. Clearly, recent threats from the current administration about dissolving / renegotiating NAFTA can be concerning and GM is in my opinion reacting wisely. However, I personally think that dissolving / renegotiating NAFTA could take a fair amount of time to concretise. If NAFTA happens to dissolve during the next 3 years, I would adivse GM to keep Mexican operations and pay higher tariffs. First, because as fast as NAFTA can dissolve a future administration can easily reestablish a similar agreement and (2) because I would not fear competition from Japanese or European manufacturer given that foreign manufacturers will also be subjected to import tariffs.

I wonder if you’ve overlooked, or haven’t given enough weight, to the thought that President Trump may care about the rhetoric far more than he cares about actually moving manufacturing back into the US. GM may be too far gone for Trump to control and he may understand that. But by getting them to trumpet their US manufacturing, he effects many of the smaller manufacturers who look to GM to understand the macro environment. He effects the businesses yet to be started by making them believe that they will ultimately need to manufacture in the US because even big players like GM have been forced to. He’ll also effect his voters by showing them that he’s kept campaign promises, which will allow his reelection and do work on issues that he finds more important. For now, GM management seems to be threading the needle nicely. They should continue.

Great article–and I love the tweet quotes. In looking at GM through the lens of a post-NAFTA world, I do think it’s important to realize that a post-NAFTA world would include some sort of trade agreement. Would there be a reason to believe that GM would be worse off under the terms of a new agreement? I think that, if anything, they would benefit locally, but the implications (possible backlash) globally might be hard to stomach.

Going forward, I think it will be tough for GM to optimally distribute the sourcing of its supplies between the US and Mexico, given that the specifics of the NAFTA renegotiation are still in the works. Additionally, the optimal distribution could change in just a few years if the agreement were subsequently renegotiated again. I agree with the author that GM is treading a fine line between appeasing the public (that demands more domestic jobs) and GM shareholders (who want to maximize profits and minimize costs).

However, I strongly recommend that GM spend some time scoping the level of effort to shift some of its supply bases out of Mexico. If GM were forced to shift the sourcing of some of its automotive parts because of changes to NAFTA, the company would need to: 1) determine which parts are easiest to transfer to the US (i.e. which parts require minimal time to decommission the Mexican operations and start up the American operations), and 2) evaluate the difference in costs on a per unit basis (i.e. are there parts for which the difference in variable costs between Mexico vs. US is minimal?). GM should have an action plan in place in case the proposed “50% US content” mandate for duty-free imports is finalized.

Shooter, you raise some hair raising points as to the fate of the U.S. automotive industry in light of the rhetoric (or lick-worthy tweets) coming from the White House these days. It feels prudent for GM to be all over the administration with lobbying efforts to avoid such a NAFTA shake-up — the costs borne by the manufacturer would seemingly make it unable to compete with European and Asian automakers. However, GM seems to be taking the bait, investing some $5Bn over the last two years, $1Bn of which came on the heels of Trump’s win. You highlighted the positive PR this drove, started by Trump’s twitter account. For now, I believe this continues to be a publicity win for GM and would question the economics of a wholesale change to on-shoring more capacity. I would be standing pat and hoping for a better 2020 if I were GM. See you on the course, Jane.