AXA “Redefining Standards” Strategy: Leading Insurance Industry to Face Climate Change

How is climate change impacting AXA, leader of the insurance industry?

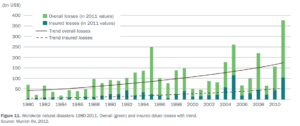

The insurance industry shows growing concerns in the face of Climate Change future challenges. Insurance companies are the main businesses impacted by the three financial risks associated with Climate Change: Physical risk, Transition risk, and Liability risk [1]. The Physical risk is observed through the increase in climate-related damages such as storms, floods or even tsunamis that have dramatically increased insured losses since 1980 (Figure 1) [2]. In particular, in 2017 alone in the US, Hurricanes Harvey, Irma and Maria caused nearly $300 billions in losses and damages, more than twice the amount of all damages caused by hurricanes in the last 10 years [3]. The Transition risk to a low-carbon economy directly impacts insurance companies which hold large investments in coal, oil, and gas companies. The Liability risk comes from the fact that some people or institutions that have suffered from climate damages will try to hold accountable other people and organizations that will see these losses covered by insurers.

Figure 1 – Worldwide natural disasters 1980-2011

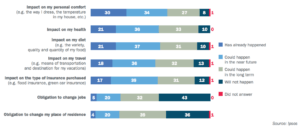

Moreover, populations face greater concerns of both climate change reality and the limited ability of governments to address it, and increasingly seek initiatives to collectively address the problem, up until their daily lives, including the type of insurance purchased promoted by 87% (Figure 2) [4]. Therefore, climate change represents both a challenge and an opportunity for insurance companies.

Figure 2 – Personal situation regarding possible consequences of climate risks

2012 Survey among 13,000 people across 13 countries led by AXA in partnership with the research institute IPSOS

Going forward: between Commitment and Research

Insurance companies face a double activity. One is to offer insurances services and advice to clients, another is to invest the funds they receive for greater returns. Both are correlated and impact AXA’s strategy to cope with climate change.

AXA undertook a series of short-term commitments to address this new reality:

- They signed the UN Principles for Sustainable Insurance, committing to embed environmental issues in their decision-making, raise awareness, work with governments and regulators to promote widespread actions, and finally being accountable and transparent towards these principles. [5]

- They committed in 2015 to triple ‘green’ investments by 2020. [6]

- They financially endorsed political initiatives such as the COP21 in Paris in 2015.

AXA also invested in medium and long-term projects to both prevent and monitor climate-related risks. First, they initiated through the AXA Research Fund 5 projects with professors from various university to:

- Reduce the impact of climate change to secure feeding and water supply in South Africa.

- Develop new strategies to adapt and reduce human’s vulnerability to climate change.

- Improve coastal cities resistance to floods in the South China Sea.

- Foster new ways to predict the increase in sea-level.

- Create agricultural strategies to meet growing food supply. [7]

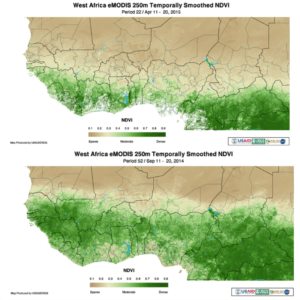

Second, they invested in parametric insurance to increase their time and cost efficiency. [7] One of their first projects was with West African countries facing increasing risk of droughts in the region. By offering them insurances that could capture real-time satellite pictures of their greening level, AXA could anticipate the drought up to 6 months before and take immediate actions without having to send experts in locations difficult to access (Figure 3) [8]. The main effect is the possibility for AXA to cover the insurance upstream in order to avoid famine or worse, political crisis.

Figure 3 – Satellite picture to assess greening level in West Africa

Meet commitments, Expand achievements, and Highlight need for action

First, AXA was recently pressured for not reducing its investment in companies that generate 50% or less of their revenue from coal. [9] To address long-term goals without putting their investment strategy at risk, AXA should stop all investments in companies that invest in new coal-fired power stations, thereby ensuring their progressive withdrawal from any investment in coal.

Second, parametric insurances have proven their efficiency, especially in areas where large portions of lands face high climate-related risks. Therefore, AXA should expand parametric insurances to countries in Asia and South America. During this process, AXA should also increase their investments or acquisitions in big-data and insurance start-ups focused on climate risks, like their recent investment on ClimateSecure.

Third, AXA and insurance companies, in general, must seek greater support from governments. To do so, they should pressure governments to meet their commitments made in international conferences and increase awareness among populations on real-time events to boost pressure on their governments.

What other concerns for AXA?

Recent years have shown an increasing dominance of the GAFA. They own more data than any other companies and have therefore the ability to predict, forecast and address the same issues related to climate change as an insurer. In this context, how should an insurance company anticipate or react the possible entry in the market of a potential big competitor?

The second question I have is how far the scope of insurance companies should cover in the face of climate change damages?

(word count: 783)

Endnotes

[1] Underwriting climate chaos

http://unfriendcoal.com/wp-content/uploads/2017/04/Coal-insurance-briefing-paper-0417.pdf

[2] AXA Papers Risk Education & Research N4 Climate Risks https://group.axa.com/en/newsroom/publications/climate-risks-ipsos

[3] https://feu-us.org/press-releases/

[4] Individual Perceptions Of Climate Change Risks Survey AXA/IPSOS 2012

[5] http://www.unepfi.org/psi/the-principles/

[7] https://gallery.axa-research.org/fr/webdocs/preparer-changement-climatique.htm

This is a very interesting topic. I agree with you that insurance companies like AXA should work more closely with governments, though I struggle with how that will actually work in practice. Hurricanes and other natural disasters, the incidence of which appears to be correlated with climate change, are having a tremendous impact on developing nations around the world. Yet, both governments and individuals in these countries are likely to have a much lower ability to pay for things like flood insurance than their counterparts in developed countries. An added challenge is that awareness of climate change in developing countries is rather low –a recent study showed that 65% of adults in developing countries have never heard of climate change (http://climatecommunication.yale.edu/publications/analysis-of-a-119-country-survey-predicts-global-climatechange-awareness). However, of those who are aware, most people in developing countries perceive climate change to be a much greater threat than do those in developed countries. Perhaps partnering with governments in developing countries to explain the specific risks to their communities – especially using the predictive data capabilities you described – will increase the impact they can have.

I found your essay extremely interesting and the questions you raised very pertinent. Regarding the first one, I believe insurance companies are in big danger. The two key elements to this industry are forecasting (based, as you said, on data), and cash to support your potential payments. Unfortunately, GAFA dominates in both aspects (look at Apple’s 300 billion in cash: https://blogs.wsj.com/moneybeat/2017/11/20/apples-cash-pile-is-approaching-300-billion/) and it is just a matter of time until they diversify and enter this business. As a defense strategy, AXA can try to diversify into other services in order to great a platform to clients. In addition, it could lobby for legislation that would prevent new entrants. Abut the second questions, the solution seems quite simple. With higher risks of environmental damages due to global warming, prices of insurances will simply go up. The risk here, however, once again goes back to the entrance of new competitors, which would pressure prices down from a supply point of view.

Interesting article – I like your point about GAFA, but am not particularly worried about the threat those companies represent for insurers. I agree that their cash piles and data strengths are formidable, but insurance is so far outside of their core business that I don’t think they can be successful in the industry. Companies that extend outside their core generally don’t succeed. For example, the HBR article linked below notes that three-fourth of expansion efforts outside a core competency failed. Additionally, the GAFA companies enjoy considerable brand power, and entering the insurance business puts the brand at risk, since people consistently hate their insurance provider.

HBR Article: https://hbr.org/2003/12/growth-outside-the-core

Bain Article on insurance loyalty – see figure 3 on net promoter scores and how low they are: http://www.bain.com/publications/articles/customer-behavior-loyalty-in-insurance-global-2017.aspx