Artificial Intelligence at Berg: Just another biotech or industry changing company?

Assessment of Berg's (Boston based biotech) strategy in the short and medium term with respect to its AI, Interrogative Biology and drug development.

According to its website, “BERG, LLC, is a clinical-stage company disrupting and re-defining the approach to drug discovery, research and development through its Interrogative Biology® platform.”1. It claims that by using AI, in addition to traditional research methods, it can “develop a robust pipeline of first-in-class product candidates and diagnostics that advance bold innovations that have the potential to improve patient lives.”2. Berg’s differentiating factor, its customer value proposition and competitive edge, lie in its analytical engine that change the way the company develops and commercializes drugs.

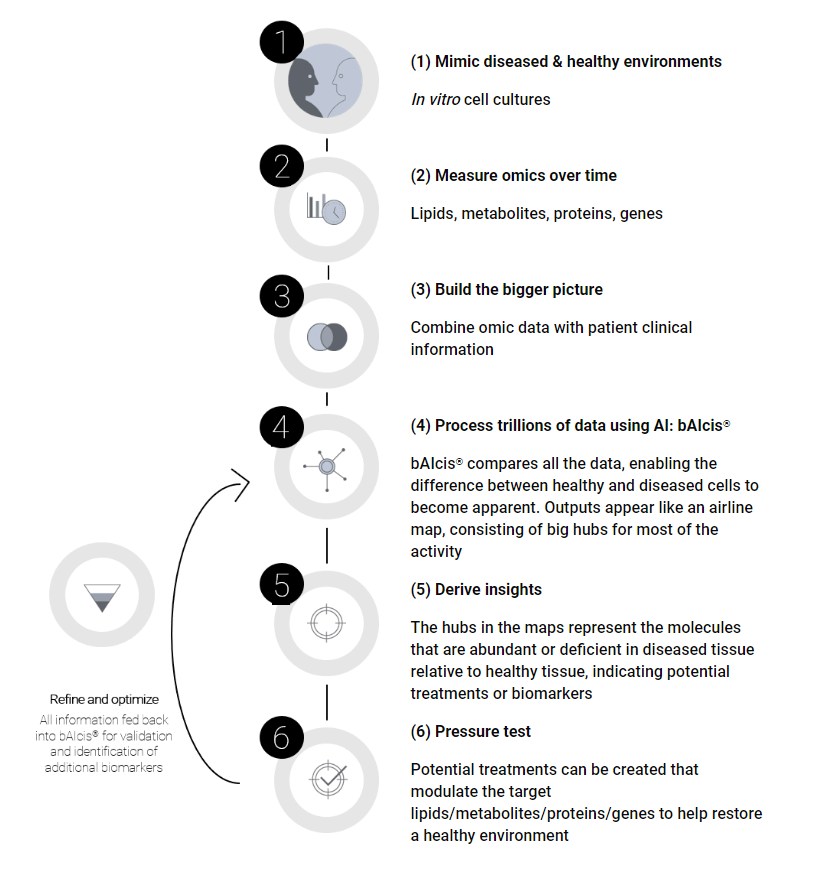

Their core product, other than the drugs in their pipeline, is called Interrogative Biology, which is powered by bAIcis. bAIcis is a “state of the art Bayesian artificial intelligence learning software used for patient stratification, precision medicine, target identification, and lead optimization of novel drug candidates.”3. The main value driver of bAIcis is to identify ‘hubs’ in the collected clinical trial data. The hubs are connections between molecules and clusters of abundant healthy cells or deficient diseased cells. From here, the software can identify which molecules target which biomarkers, which creates gives feedback to the development teams and the algorithm.  To date, it appears to drive most of their product development decisions, in terms of the selected populations of their two molecules in clinical trials, BPM31510 and BPM31543.

To date, it appears to drive most of their product development decisions, in terms of the selected populations of their two molecules in clinical trials, BPM31510 and BPM31543.

In the short term and medium term, Interrogative Biology® drives product and development decisions. In the pre-commercial state, as BPM31510 and BPM31543 are in the midst of Phase II clinical trials and into the foreseebale future, Berg will use bAIcis to continue to identify molecules-biomarker pairs. In the future, it is reasonable to assume that Berg will use its AI to impact the rest of the commercialization process from clinical trial site selection to marketing strategies to patients side effect management. Since the company is founded on the priciples of using data to drive their decisions in an iterative manner, they will likely leverage bAIcis in the commercial setting as mentioned previously, although this is speculative due to the lack of an on-the-market product.

In the longer term, Berg might be able to commercialize the Patient Intelligence offering as a compliment to its drug (assuming BPM31510 or BPM31543 is successfully commercialized). The trained AI could be valuable to other companies as they try to interpret sales force call data, doctor prescribing habits and patient side effect data into the most effective way to assess customer potential and segment the market, and develop a marketing strategy for doctors, payors and patients (despite the ethical concerns here, this is standard in the US). However, there are inherent risks to this strategy for bAIcis. It’s a saturated (and quasi-successful) space with companies such as IBM Watson and Optum. Additionally, they are at a disadvantage compared to the aforementioned companies, since their system would not have access to the same breadth and depth of data. Since AI and ML rely on large quantities of data, this puts their Patient Intelligence product as a significant disadvantage. On the other hand, linking the commercial strategy back to clinical data, offers a potentially robust product that is not currently seen on the AI market.

One key caveat in this process is that Berg might simply be using ‘AI’ as part of their company marketing to drive buzz, but not actually driving value for the company in a meaningful way. Because Berg is a privately held company, the public is unsure of its performance to date, although it laid off about a third of its workforce in August 2018, spun off its manufacturing arm in Tennessee and has partnered with large organizations such as NIH and Sanofi Pasteur.4 Only time will tell, but the public should keep an eye out for the future performance of companies, such as Berg, that claim to be driving additional value and creating superior drugs. Is this true innovation or simply riding the bandwagon of trendy jargon?

Overall, Berg has the potential to be a large disruptor to the healthcare space, if they can use their AI to truly improve their own drug development process and streamline their operations. Can companies have both machine learning and drug development as core competencies? Will Berg be well positioned to commercialize Interrogative Biology® or should they focus on leveraging AI, but remain a drug development company? Which is a better strategy for the future of Berg? For the future of healthcare? (730 words)

- https://www.berghealth.com/berg-showcases-new-clinical-data-on-bpm-31510-at-asco-2018/. Accessed 09Nov2018.

- http://www.berghealth.com/about/. Accessed 09Nov2018.

- http://www.berghealth.com/research/healthcare-professionals/. Accessed 09Nov2018.

- https://www.bizjournals.com/boston/news/2018/08/05/framingham-biotech-berg-lays-off-third-of-staff.html. Accessed 09Nov2018.

It’s not clear to me how bAIcis drives drug production discovery decision from your article. To your layman readers, it might help to give an example of how AI powers specific use case. Also, it’s opaque what ” identify target patients, biomarkers and other cell-based phenotypic data” means. It would be great to illustrate more how the software interact with patients as I assume it introduces more complex variable to the AI algorithm. What I like about the article is that you also talk about the company other than the AI software. You emphasize on its product marketing and commercialization strategy which are as important as the technology that is advancing the company itself.

What’s interesting about this is that their algorithm picks a group of patients that would be suitable for the molecule, not the molecule that will treat a group of patients (at least that’s how I understood it – possibly wrong). Not sure whether that’s turning the model of pharma upside down or is actually a novel approach (aka personalized healthcare?). Given this company has only been working with two molecules and for ML to be effective, it needs vast amount of data (which in this case this company doesn’t have), its strategy would probably be better served if they focused on drug development. If the tool they developed helps them get there faster, it’s only better both for the patients and for them, but it’s unlikely they’d be able to replicate it if they offered this tool to another pharma player.

Thanks for a great read. I think that the two things do not contradict each other. The contrary – Medicine can leverage an in-house machine learning capabilities.