Are partisan politics and crony capitalism to blame for the decline of the coal industry?

The coal industry has been devastated over the last 6 years while coal executives have clung to the past. Refusing to accept the facts of climate change, they have stuck to their core business, blamed partisan politics and fallen into bankruptcy one by one. Murray Energy has managed to hang on by establishing a dominant cost position and becoming one of the few surviving American coal miners. Can CEO Robert Murray shift his mindset to capture new opportunities in the energy industry? Or will Murray go down with its peers, too blinded by partisan anger to accept the facts of climate change and invest for a sustainable future?

______________________________________________________________________________________________________________________________

Coal Industry Collapse

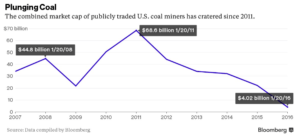

Since 2011, the market cap of publicly traded coal companies has dropped 94% (1). During this time more than three dozen coal companies have filed for bankruptcy protection (2). In a recent interview with Fox Business, Robert Murray, blamed “crony capitalism” and politics for the “virtual destruction” of his beloved industry (3).

There are three major factors that have contributed to this decline; climate change regulation may have been the final stroke.

1.) Lack of demand for Metallurgical coal exports to developing economies

In 2010-2011, many coal companies took on debt burdens to scale up operations for a bet that Chinese demand for steel would continue to drive coal prices higher. The demand never materialized and metallurgical coal prices have fallen precipitously leaving many of these companies unable to service their debt (1). This bet went badly for many industry players, but they may have survived the shock if not for two other headwinds.

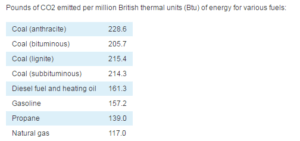

2.) Coal is the heaviest CO2 emitter per unit of energy and the consensus around climate change is strong

The intergovernmental panel on climate change has published six assessment reports since 1990 which conclude that human caused carbon emissions contribute to global warming. Broad acceptance of these reports is signaled in several recent agreements and legislative actions. In April 2016 representatives from 200 countries met in Paris and reached agreement to reduce GHGs (4), Obama endorsed the EPA clean power plan, and to date 29 states have signed renewable portfolio standards which require a reduction in GHG intensity on their grids.

The pressure on CO2 is mounting and coal, the highest emitting energy source, is the low hanging fruit. This is not a partisan argument, it is a practical one.

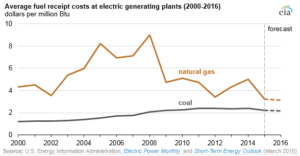

3.) Natural gas is cheap, clean(er) and is rapidly replacing coal for baseload generation

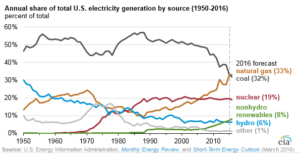

Coal has long been the dominant source of electricity on the US grid, it is cheap and plentiful, so its position as 50-60% of generation, has been safe for 60 yrs. With the advent of hydraulic fracturing and the development of US natural gas resources, coal’s position is being challenged. Pressure on CO2 and falling gas prices make Natural Gas an obvious choice.

The coal industry has blamed democrats and the renewable energy industry as the source of the coal industry’s problems, but these claims are not supported by fact. Investment in renewables has been meaningful, however even though a majority of new generating capacity added last year was renewables, the increase of Natural gas generation on the grid was nearly 21x that of renewables. 2016 is predicted to be the first year in history where Natural Gas will replace coal as the dominant provider of electricity on the American grid.

Murray Coal has survived for now

Murray coal has survived while many of its competitors have filed for bankruptcy protection. The key to their success is the leadership of CEO Robert Murray who understands that “the only way to get out ahead is to watch every penny and be the low-cost producer” (5).

Return to Growth?

The industry has already laid-off 140k people and is unlikely to see a return to a grid dominated by coal (3). However, there may be interesting opportunities for Murray to grow, deliver value to shareholders and re-employ many of the “family” he has had to lay off.

A study from the journal of energy economics shows that the “growth of solar-related employment could benefit coal workers, by easily absorbing the coal-industry layoffs over the next 15 years and offering full-time careers” (6). Perhaps Murray could invest in worker training and add an energy services business?

Black hills energy, a diversified energy company, recognized the regulatory / environmental risk in coal and augmented their portfolio with a natural gas acquisition in 2008. Perhaps Murray could diversify by acquiring other commodities such as natural gas resources before its too late?

Will the coal industry and CEO’s like Robert Murray move past their ideological anger and prepare their businesses for the next 50 years?

______________________________________________________________________________________________________________________________

Sources Cited:

(1) Klein, Jodi Xu. “The Coal Miner `On Everybody’s List’ as Next Bankruptcy Victim.” Bloomberg.com. Bloomberg, 20 Jan. 2016. Web. 04 Nov. 2016.

(2) Kuykendall, By Taylor. “SNL: Roster of US Coal Companies Turning to Bankruptcy Continues to Swell.” SNL: Roster of US Coal Companies Turning to Bankruptcy Continues to Swell | SNL. S&P Global Market Intelligence, 6 June 2015. Web. 04 Nov. 2016.

(3) Wisner, Matthew. “Murray Energy CEO: Coal Industry Is Virtually Destroyed.” Fox Business News. Fox Business, 20 July 2016. Web. 4 Nov. 2016.

(4) Briggs, Helen. “Global Climate Deal: In Summary.” BBC News. BBC News, 12 Dec. 2015. Web. 04 Nov. 2016.

(5) Puko, Timothy. “Robert Murray: The Last Man Betting on U.S. Coal.” WSJ. Wsj.com, 17 Mar. 2015. Web. 04 Nov. 2016.

(6) Pearce, Joshua M. “What If All U.S. Coal Workers Were Retrained to Work in Solar?” Harvard Business Review. Harvard Business Review, 08 Aug. 2016. Web. 04 Nov. 2016.

Danny-

Thanks for sharing this perspective on the coal industry and the impact of climate change regulation and sentiment on the field- I think it’s a really interesting case. It seems like there is a lot of room for action with Murray Energy, as they’ve been largely lackadaisical in their response to climate change. The opportunity you point to at the end – the opportunity for diversification of Murray’s business – makes a lot of sense to me. In particular, beyond natural gas, if Murray were able to look into sources of clean and/or renewable energy (solar, wind, hydroelectric), this would seem to make business sense. These sectors are growing rapidly and will (hopefully) shape the future of energy.

One fact that I found interesting as I looked for additional reading on the topic was that the coal industry uses an amount of fresh water that is so high, it would meet the needs of one billion people. Moreover, pollution from coal extraction contaminates waterways and ground water, further straining the world’s fresh water supply. Not only is coal an atmospheric polluter, the industry is also heavily using many of our precious natural resources. This makes the need to move away from coal even more dire.

I think it’s imperative that Murray consider responses to either reduce the impact of climate change (finding safer, more environmentally-friendly methods of coal extraction – if possible?) or adapt their business by diversifying the areas they play in.

Thanks again for sharing Danny- it’s a very well-written article!

Very thoughtful post, Danny! It’s certainly troubling times ahead for the U.S. coal industry and Robert Murray undoubtedly has some difficult questions awaiting him. Your post reminded me of a Scientific American article that I read earlier this year titled “Inside a Western Town that Refuses to Quit Coal.” The article explores the fight of a small, historically coal-producing town, Colstrip, Montana, against the anti-coal movement sweeping the U.S. Colstrip is home to one of the nation’s largest coal power plants and its residents feel betrayed and abandoned by a government which so readily depended on them not long ago. It can be easy to forget that there are still many in the U.S. who rely on coal for their livelihood and, if companies like Murray don’t soon evolve, there will be devastating implications for many. It is critical that coal firms become more open-minded and less stubborn about where the future is heading and start making the necessary adjustments to survive. As both you and Ronnie mentioned, renewable energy sources and natural gas seem like pretty good places to start!

Very interesting post. It is crazy how little regard many reputable leaders have for actual truth…or does Murray truly believe that this is a Democratic “crony capitalism” conspiracy? If he does, that would speak to the power of human self-rationalization. I guess the line between the two gets blurry as you peddle certain talking points long enough.

Danny, thank you for sharing. I totally agree with your perspective here that energy companies, especially those in coal, need to start diversifying their portfolios. While coal may certainly be on the decline domestically, it is unfortunate that on a global level, consumption is estimated to be largely flat through 2040 (per Exxon global demand projections). Murray Coal would undoubtedly benefit from diversifying into natural gas as did Black Hills, however, that in theory is a shorter term solution than foraying directly into renewable sources like solar, as you alluded to. Given the recent explosion of investment behind natural gas fracking, it has become relatively crowded and competitive. I’d argue that it would actually be more prudent for Murray to start investing directly in renewable energy from the outset and be one of the first traditional energy producers to foray into that space aggressively. Murray Coal generated $200M of operating cash flow in 2015 and paid out $152M in dividends. While this may be great for short term investor returns, if the Company wants to survive in the new world of energy, perhaps those dividends should be cut and re-invested in new sources of energy.

Coal has an interesting trait in that it can be turned into other types of carbohydrates through chemical reactions (used to be synthetic diesel through coal liquefaction, but increasingly in synthetic natural gas through methanation). These processes require an additional energy input, which can be easily achieved by burning some of the coal, but the much more interesting opportunity is using this as a way to store renewable energy.

A basic example could be a way to monetize a coal mining region (especially a remote one, removed from the major population and industrial centers) by colocating a massive solar or wind “farm” with it. The renewable energy that is generated is used to convert coal into LNG, which is

a) Much more eco-friendly than coal

b) Substantially easier to transport

c) Can be used as fuel for ships/aircrafts/other vehicles (syndiesel can produced instead of LNG if necessary)

d) Stores not just the coal energy, but also part of the solar/renewable energy.

e) Unlike the solar/wind energy that helped create it, can be stored and used to produce energy when it is needed (helps mitigate the variability in renewable energy output)

Danny, thank you for sharing this post. It will be interesting to see how the global economy weans off of non-renewable energy sources in the coming future. Companies and investors will eventually face challenges in choosing between creating shareholder value and taking those tough climate change decisions for their companies and it all comes down to deciding whether these companies and investors evolve and survive or chose to not adapt and eventually close down. Its an interesting read.