Anglo American Platinum: A South African miner’s bet on fuel cell vehicles

“I don’t want Anglo American Platinum, or any of our partners or customers, to be a Kodak,” – Anglo American Platinum, Chief Executive Chris Griffith [*1]

Early this year, Anglo American Platinum (Amplats) – the world’s leading primary producer of Platinum Group Metals (PGMs) accounting for about 38% of the world’s annual supply- announced that it was investing $4 million in United Hydrogen Group, a hydrogen production and distribution business in the U.S., in an effort to bolster the demand for platinum, which is used in fuel cell electric vehicles (FCEVs). Amplats also has strategic investments in three global fuel cell companies, Ballard Power Systems, Altergy Systems, and Johnson Matthey Fuel Cells, which are all a part of their PGM Investment Program, which provides growth capital to companies that can demonstrate the commercial viability of products or technologies that use or enable the use of the company’s metals.[*2]

Platinum’s top consumer is the auto industry, as they are used in autocatalysts, which converts pollutants from the combustion of fuel into harmless gasses. As auto emissions regulations around the world get tighter, the platinum industry benefits as more cars in more countries will need to be fitted with more of these catalytic converters.

However, mining is a long term business with significant upfront capital requirements. That is why, it is essential for the miners to be able to accurately forecast the viability of their long term demand, to verify their investment decisions. For the platinum producers, in the midst of a seemingly positive trend in the tightening emissions regulations, they are extremely worried about the one thing – the wide adoption of pure electric vehicles (EVs), which pose as an extreme threat as they don’t use any platinum.

This is why, with a careful eye on the evolution of next generation vehicles around the world, the platinum industry, such as this recent investment by Amplats, is on a mission to try and steer the world in the direction of FCEVs, since fuel cells requires platinum, as the next generation’s dominant drivetrain.

Platinum

Platinum is a highly valuable metal (roughly $30/gram), as you may have noticed when shopping for a ring or necklace. It is pricey because its existence is extremely rare – a mere 5 parts per billion in weight in the earth’s crust. It is also unevenly dispersed, as more than 70% of primary platinum is mined by South Africa. The mining operation is also complex, as platinum deposits can be found up to 2,000 meters underground and require intensive labor, water, and electricity to operate. However, its sheer beauty (used to be called white gold), and extreme resistance to corrosion and tarnishing even under high temperatures, makes it a key resource for many industrial sectors. [*3]

Autocatalysts

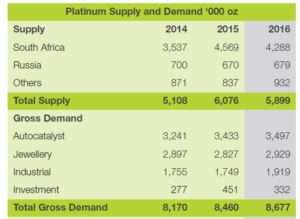

Contrary to most people’s intuitions, the jewelry sector is not platinum’s biggest consumer. Autocatalysts and other industrial applications in the oil refining, petrochemical and glass industries make up over 60% of platinum demand.[*4]

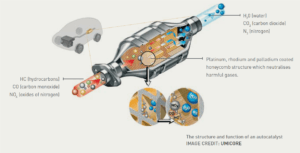

Autocatalysts, which make up 41% of total platinum demand, are used in internal combustion engine car exhausts that convert over 90 per cent of hydrocarbons, carbon monoxide and oxides of nitrogen from gasoline engines into less harmful carbon dioxide, nitrogen and water vapor. [*5] It is estimated that about 2-8 grams of platinum group metals are used in single autocatalyst, depending on the size and type of engine (gasoline or diesel). [*6]

Going Forward

Amplats, as the industry leader in platinum production, is doing what it can to realize a sustainable future for its business, by actively promoting the diffusion of FCEVs, and I think they are right in doing so.

Personally, although there is a lot of buzz around Tesla and the seemingly growing popularity of EVs, I still believe the powertrain of the future lies in FCEVs. This is because the general public is still far from overcoming “range anxiety”, which describes the state of fear drivers experience from knowing that their battery could run out of charge and strand them far from a recharging station. Also, there is the practical drawback of requiring at least 30 mins to charge your car, which can have a major impact on your driving experience. [*7]

However, FCEVs have their own share of challenges, with infrastructure being its biggest. Although FCEVs have a much longer range than EVs, there is still a long way to go to in terms of putting in place hydrogen stations.

Therefore, in order to accelerate the adoption of fuel cell technology, the platinum industry needs something far beyond an Amplats effort. They need to collaborate more within industry to get other mining companies to join in, as well as collaborate with other industries, whether its BP or Shell in Oil and Gas, car companies such as Toyota and Hyundai, retailers and governments. This collaboration will be key in driving the industry changing technology, and whether the platinum mining industry can be sustained.

[790 words]

Sources:

[*1] Reuters and News, B. (2015) Platinum hopes for a catalyst as electric cars start to take charge. Available at: http://www.thenational.ae/business/markets/platinum-hopes-for-a-catalyst-as-electric-cars-start-to-take-charge

[*2] 2016, A.A. (2016) Anglo American platinum invests $4 million into fuel cell electric vehicle value chain. Available at: http://www.angloamericanplatinum.com/media/press-releases/2016/29-01-2016.aspx

[*3] Harper, D., platinum and Dictionary, O.E. (2016) ‘Platinum’, in Wikipedia. Available at: https://en.wikipedia.org/wiki/Platinum#Applications

[*4] Johnson Matthey, PGM Market Report May 2016. Available at: http://www.platinum.matthey.com/documents/new-item/pgm%20market%20reports/pgm-market-report-may-2016.pdf

[*5] Autocatalyst – PMM (2015) Available at: http://www.platinum.matthey.com/about-pgm/applications/autocatalyst

[*6] Autocatalysts and Platinum Group Metals, IPA. Available at: http://ipa-news.com/assets/sustainability/Autocatalyst%20Fact%20Sheet_LR.pdf?PHPSESSID=8f924aa0e30f81ba7fe97c7449665b58

[*7] Schaal, E. (2016) A simple guide to electric vehicle charging. Available at: http://www.fleetcarma.com/electric-vehicle-charging-guide/

[Featured image] Patterson, S. and Miller, J.W. (2015) Mining companies slash jobs as commodities prices slide. Available at: http://www.wsj.com/articles/miners-shed-thousands-of-jobs-as-commodities-prices-slide-1437740084

Mr. Fujii makes a great point about the limitations of electric vehicles versus fuel cell vehicles, in that they require too much time to charge when consumers may need them most. Instead of waiting for their Tesla to charge, a consumer may instead choose a car sharing service in order to get to their destination. I certainly understand the challenges of providing infrastructure; while Tesla can install supercharging stations anywhere that has a consistent amount of sunlight, fuel cell charging stations are limited by the access to underground lines that provide the fuel needed for these specific types of cars. I saw fuel cell stations for the first time while living in Irvine, California, and they were few and far in between. It may take an entire generation to make this transition to FCEVs, but at the same time there is a significant demand for them. With the right partnerships and implementation, the future of FCEVs may be here before we know it.

I don’t agree that EV’s current charging and range issues will keep it from becoming tomorrow’s leading standard for vehicles. First, range has constantly been a criticism of EV’s. However, recent advances in the development of batteries have significantly increased the range of EV’s. Second, the practical drawback of having to charge your car for at least 30 minutes will be reduced by a longer range. Finally, the reduced availability of platinum could well cause car manufacturers to look for a technology that doesn’t rely on such a scarce resources.

Hide, this is a great article! I never knew how mining companies are beginning to strategically invest in the technologies of the future, but outside the domain of mining itself. I feel this is a very unique move to preserve Amplats own business.

I would love to learn how such moves have played out in the past. In my limited knowledge, the last strategically successive move which pivoted a mining companies was probably De Beers’ “A Diamond is Forever” marketing campaign. I hope it really plays out well and moves the mining industry one step towards being, albeit indirectly, environmentally successful.

Hide, thanks for sharing this post. It’s exciting to hear about the many ways companies around the world, like Tesla and Anglo American, are trying to combat the climate change issue. While I agree that there is a market for FCEVs, I would encourage you to explore what the size of that market opportunity really is, especially relative to the price point for FCEV. Since platinum is such a rare metal, I would be curious to know how its potentially volatile commodity price translates into the price to the consumer for an FCEV. Consumers are extremely price sensitive with car purchases so platinum prices will matter – how will the FCEV producers lock in or hedge the platinum price, if possible?

I would also think about whether or not the market demand for FCEVs will be in the future in the context of our world’s shift to a more “shared’ economy, in which existing assets like vehicles become increasingly utilized and shared. If our world shifts to more ubers/lyfts and more self-driving cars and more car sharing through companies like Getaround, our future total vehicle demand will be lower, causing higher priced options to fall out of the supply curve.