Amazon: The Cycle of Victory

Amazon leverages its superior warehousing and product innovation to drive prices down and purchases up.

Amazon is highly effective in aligning its business model and operating model. Amazon sells a broad range of goods and services, both physical and digital. Although Amazon Web Services (AWS), which enables companies to outsource components of their IT infrastructure and services, represents a significant portion of its business, this post will focus on the consumer e-commerce side of the business.

The Business

Amazon sells goods that it procures from manufacturers/distributors. As would be expected, it makes money by sells those goods to end customers at a (sometimes thin) markup to wholesale prices.

Amazon also provides a marketplace for external vendors to sell their goods alongside Amazon’s own goods. Approximately 40% of items sold on Amazon come from external vendors [1]. Amazon retains a percentage of sales ranging from 6-50% of the sales price based on the product category. It collects several other fees from vendors including either a $39.99 monthly subscription fee for “professional” sellers or a $0.99 per item fee for “individual” sellers [2]. Amazon’s complete fee schedule can be found here.

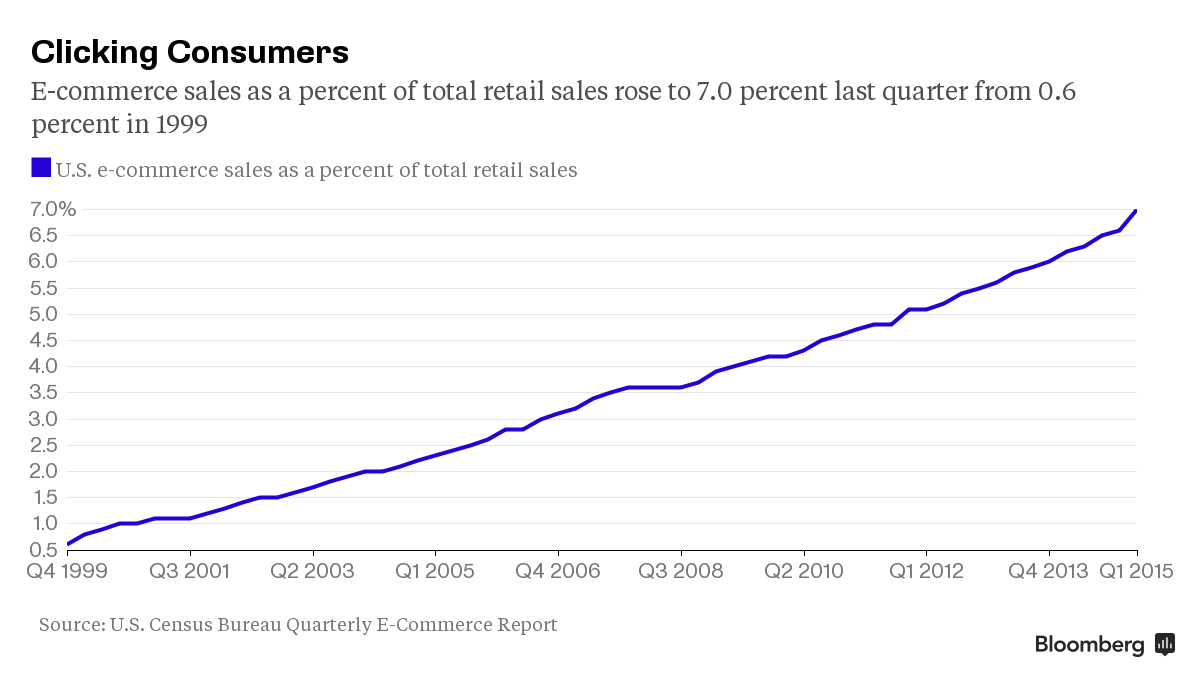

Amazon also places little emphasis on short-term earnings. With e-commerce quickly growing yet representing just 7% of total U.S. retail sales in Q1 2015 (see Figure 1), Amazon sees tremendous upside potential to its business and reinvests heavily into growth.

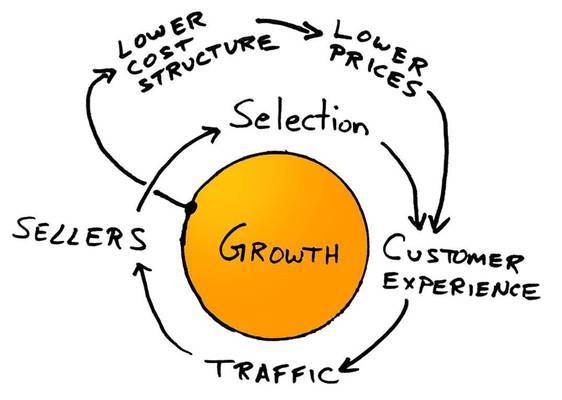

As shown in Figure 2, growth is core to Amazon’s strategy. Amazon creates a virtuous cycle whereby transaction volume provides leverage to negotiate favorable pricing from its manufacturers/distributors. It also justifies broader product selection from Amazon and external vendors.

Warehousing provides a key operating advantage for Amazon and the company invests heavily to optimize performance in this area. As of the end of 2014, Amazon owned 109 warehouses, called fulfillment centers, globally to store both its own inventory and optionally that of external vendors [1]. The efficiency and strategic geographic placement of Amazon’s fulfillment centers allow Amazon to deliver on the low prices and positive customer experiences that are core to executing its business model. Consequently, product selection and transaction volume also indirectly benefit. By being able to efficiently select a customer’s items from the shelves of the fulfillment center and get it to the customer’s door, the customer can receive his/her purchases sooner. Amazon accomplishes this in part through proprietary software to determine warehouse layout and optimal routes for its warehouse staff [5]. The global distribution of fulfillment centers allows Amazon to cut down on shipping time and costs, which it can pass on to the customer to fulfill its goal of low prices.

Amazon continues to drive towards logistics improvements. It recently launched Amazon Flex, which leverages non-institutional drivers to make deliveries, similar in concept to UberX. Amazon also has ambitions to one day deliver packages via drones. These initiatives have the opportunity to further reduce cost and shipping time. The fulfillment centers also represent a large capital investment, both in PP&E and IP, creating a significant competitive advantage.

Product Innovation

Amazon has made significant efforts to increase sales through the products and user experience it creates.

Amazon has gone to great lengths to minimize friction in the purchasing process. It famously holds a patent for one-click purchasing, making it incredibly easy (and impulsive) for customers to buy through the site. It also offers the Dash button, which allows customers to purchase consumables with the single press of a button even without their laptop or mobile device.

Amazon Prime is a subscription service ($99 per year) that offers free two-day shipping among other benefits. By making shipping a fixed cost for customers rather than a variable cost, Amazon incents its customers to make frequent purchases on its site.

Amazon’s line of e-readers, tablets and phones are also intended to drive sales. The devices tend to be priced inexpensively and feature prominent entry points into Amazon’s shopping experience. Amazon’s strategy is to use its devices as a means to make the Amazon shopping experience front and center.

In summary, through its superior fulfillment centers and product offerings, Amazon is able to provide a wide selection of products at low prices with a strong customer experience, which drives sales. The high sales volumes allow Amazon to negotiate lower prices and invest further in its warehouses and product offerings.

Sources:

[1] Amazon 2014 Annual Report (10-K)

[2] Selling on Amazon Fee Schedule

[3] E-Commerce Sales Are Surging, Jordan Yadoo, May 15, 2015.

[4] Why Amazon Has No Profits (And Why It Works), Benedict Evans, September 5, 2014.

[5] The Everything Store, Brad Stone, 2013.

Thanks Liam. Amazon is truly a virtuous cycle and I’m increasingly fascinated by their story. I am really surprised to hear that they are able to effectively cover the globe with just 109 fulfillment centers! My key questions about this business that remain are two-fold. A) I know Amazon would like to paint this as a total win for everyone and it certainly is for them and their consumers, however what about the sellers? Are they truly winning as Amazon is able to increasingly able negotiate tougher and tougher deals given their place in the value chain? I know that we can claim they have higher sales volumes but what happens when this is not necessarily the case. And B) which is kind of related, of course this is a virtuous cycle when things are going well and the economy is headed towards new peaks once again, but what happens the next time the orange circle in Figure 2 changes into “Decline?” Does this then reverse and turn into a vicious cycle? And if not, which piece of the puzzle is the key that stops it from doing so? This is well written, I’m glad someone in our section did Amazon. Thank you.

Adam

Adam, thanks for commenting. I think you raise two really good points.

I definitely think you could make an argument that Amazon’s suppliers could suffer. It’s very similar to the power Walmart has had on its suppliers. I don’t know enough about these dynamics to know whether this power will drive those suppliers into the ground or whether they’re better off net-net due to the large market Amazon exposes them to. The optimist in me would say that the Internet provides fairly low barriers for e-commerce stores and price discovery is fairly easily achieved so there will be alternatives to turn to if Amazon turns the screws too hard on them. That said, Amazon’s scale and efficiency may prove too large a barrier to overcome.

Regarding your second point, from the speculation I’ve read, Amazon has some quite profitable verticals and essentially uses the cash generated from those verticals to expand to others. I suspect that were growth to stagnate, they could fall back to their core businesses and sustain themselves by putting expansion on hold. That said, if their volumes do actually start to decline, not just slowed growth, I do think that Amazon would run into significant issues as fixed costs start to erode margins.

Overall, I think you’ve identified some significant issues worth further consideration. Thanks!

Liam, thanks for writing this and agree with Adam above that Amazon is an interesting company to consider. You allude to it in here, but I think the key to Amazon’s success is that they have foregone profitability in order to become both low cost and premium service (in terms of breadth of goods offered, shipping times, and user experience). The enabler of this strategy is that the market is growing so fast and the online retailing opportunity is so large that they (and their investors) are willing to sacrifice short term profits for growth. The biggest decisions Amazon has to make now are around scope, and specifically, whether or not they should enter the shipping / delivery logistics business. That decision is somewhat analogous to Google’s decision to build or partner on self-driving car manufacturing that we discussed today in class. On one hand, the control of the value chain will allow them to innovate more; on the other, delivery is not Amazon’s core competency right now. It will be interesting to see where they decide to go.