Alibaba and Singles’ Day Sales

Alibaba just announced 18 billion USD sales on Nov 11, the so-called Singles' Day in China. What's the secret behind this tremendous success?

Background

Symbolized by four 1s, Nov 11 is the so called “Singles’ Day” in China, a festival created to celebrate singleton. In 2009, Alibaba decided to use this day to promote online shopping. Similar to Black Friday in US, Singles’ Day Sales involves millions of shops offering huge discounts to consumers. The biggest difference is: all the participating retailers are online.

The impact has proved to be phenomenal. At the beginning everyone considered Singles’ Day Sales as a pure marketing ploy that will not be taken seriously. Yet now it has actually become the world’s largest online shopping event. Even retailers in North America has started to use similar strategy to promote Singles’ Day sales, just a few weeks before the traditional Black Friday. This year Alibaba reported a record 120.7 billion RMB (ca. $18 billion) worth of sales, a 30 percent growth from last year. [1]

Why Alibaba succeeded

Technology development

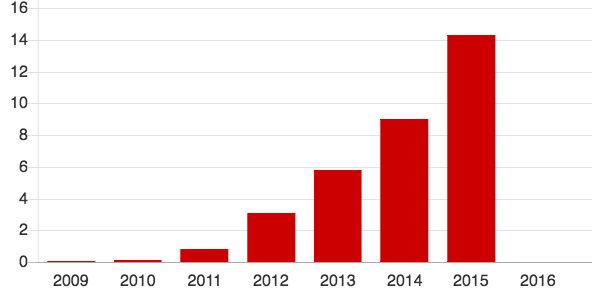

Dealing with an average of 750 million USD sales per hour is not an easy job. It is estimated that Alibaba receives more than 140 thousand orders per second during the peak time on Singles’ Day. In contrast, VISA and MasterCard handle no more than 40 thousand orders per second. Alibaba used several mechanisms to deal with the challenge posed by this huge transaction volume. First, Alibaba used its “Ali Cloud” resources to share part of the traffic. Ali Cloud is a cloud computing service platform with operations across the different geographic locations, including Hangzhou, Beijing, Silicon Valley, etc. By utilizing Ali Cloud’s spare capacities and making different merchants share the same system resources, Alibaba is able to handle this huge transaction volume. Second, Alibaba developed its own database called “OceanBase”. In 2014 OceanBase carries out only 10% of all transactions and since 2015 OceanBase has been carrying out 100% of transaction without any omission. Behind this rapid growth is Alibaba’s constant investment in technology development. [2]

Mobile shopping

During its IPO Roadshow, Alibaba claimed that it would increase its mobile monetization rate to surpass its PC monetization rate. Now it has at least partially achieved this goal. When Alibaba went public, its mobile monetization rate was just about 1.87%. With several quarters of growth, in Q2 2016 its mobile monetization rate has achieved 2.8%, higher than its PC monetization rate of 2.78%. In this year’s singles’ day sales, 85% of orders were sent from mobile phones. As consumers becoming increasingly accustomed to shopping through smart phone, I expect that this trend will continue in the future. [3]

Relentless efforts fighting counterfeiters

The issue of counterfeits has haunted Alibaba for many years. Early this year, Alibaba has launched an online platform aimed at countering fakes. The system will allow Alibaba to monitor suspicious listings and notify retailers that they need to provide independent proof of its authenticity. Retailers can also report whether their products have violated Alibaba’s rules and anti-counterfeit laws. [4]

Challenges going forward

Logistics

With Alibaba’s sales volume, logistics is never a simple issue, especially in a country as big as China. In 2013 Alibaba formed Cainiao, a Fedex type affiliate, providing logistics solutions to millions of merchants online. The expansion of Cainiao has been phenomenal. Now it has 128 warehouses and 180,000 express delivery stations in China, providing same day delivery in tier 1 cities and next day delivery in tier 2 and part of tier 3 cities. And this is just the beginning of Alibaba’s ambitious plan in logistics. In 2015 Cainiao announced that it would invest another 16 billion USD in the coming five to eight years to “ deliver everywhere”. [5]

Growth slowing down

This year’s 30% growth is significantly lower than last year’s 60%, showing that consumers are becoming more reasonable and that Alibaba is facing more serious competition. Even though Alibaba is driving the whole Singles’ Day Sales, its competitors have quickly catch up by offering deep discount in their respective areas. For instance, JD.com, Alibaba’s local competitor that is more focused on consumer electronics, has seen 130% growth in its sales in 2015 Singles’ Day and 60% growth in 2016. JD.com also made significant investment in its own logistics system. Therefore, Alibaba needs to do more in order to differentiate itself from other competitors.

What US retailers can learn from Alibaba

Admittedly situation in US is very different from in China. It is very hard to imagine Amazon tell its merchants that they can only post things with at least 50% discount. Yet US retailers do can learn from Alibaba’s theme-building tactics. Now in China Singles’ Day is no longer about single people but rather everyone’s carnival. Perhaps US retailers may consider creating similar momentum to create topics and boost their sales.

Word Count: 783

Reference:

[1] http://www.bbc.com/news/37946470

[2] https://www.infoq.com/news/2012/12/interview-taobao-tmall

[3] http://www.businessinsider.com/alibaba-is-effectively-monetizing-mobile-2016-8

The growth of Singles Day is definitely astounding. I wonder how much of the slowing growth in sales on Singles Day from 60% to 30% is due to saturation of the market, as opposed to an inevitable result of the slowing of China’s economy growth as a whole.

I think Alibaba should take a page out of Amazon’s book, and explore drone delivery in order to augment their existing Cainiao logistics services. This could save costs greatly when implemented at scale in a country like China.

Insightful article, Long! The stats surrounding Single’s Day in China are incredible – especially the $18 billion in sales and the handling of 140,000 orders per second during peak times of 11/11. Alibaba’s logistical network must be constantly evolving in order to handle this vast amount of sales volume in a country almost as large in land area and 4x as large population compared with the United States. I agree with Jimmy’s comment in that Alibaba will need to continue to innovate and evolve to make use of new technology such as drones or self-driving vehicles. Besides being able to support the world’s largest one-day shopping event, Alibaba must also reliably support the daily usage of its services. I am curious to see the evolution of sales levels on Single’s Day; will another company be able to compete seriously with Alibaba? It does not seem that way due to the sheer scale of Alibaba.

Thanks for this Long. I am interested to know how many of the Singles Day discounts are real discounts i.e. for how long the products that are on discount traded at the non-discounted price for. Also, in considering whether the West cold adopt Singles Day in to it’s retail calendar, I wonder if Western cultures could support such a large retail day so close to Thanksgiving or Christmas. I think that it would be a push for consumers to spend a lot of money on two dates which are so close to one another in terms of affordability and also guilt!

Long, the amounts of sales and orders Alibaba is capable of handling is truly incredible. Thanks for sharing! I’m curious how sustainable this 30% growth really is? As Alibaba looks to scale outside of China, how will its logistical network and infrastructure need to develop. I agree that new technology like drones can help, but perhaps Alibaba can leverage existing transportation infrastructure to deliver its products.

Interesting post, Long! I agree with you that it’s eye opening to see the volume of transactions that is processed on such a big shopping day. In your article, you discuss how Visa and Mastercard help play a big role in ensuring Alibaba can actually keep its systems up and process so many orders. While I agree, I think that AliPay is also critical here and is what is truly making the operations behind a day like this happen. I would think that a good amount of the transaction volume is conducted through AliPay given how popular it is in China and key markets for Alibaba.

Without AliPay, I don’t think that Alibaba could conduct such a massive selling day at scale. However, this new payments platform allows them to do exactly that. Given how integral AliPay’s success is to Alibaba, I’m curious to see if Alibaba looks to expand further through other acquisitions in the payments space. While they are an online marketplace, online payments capabilities becomes critical to a marketplace’s success (as proven by AliPay). As they look to scale, this could become a key point of investment for the company since payments will continue to be a key focus.