AK Steel: Casualty of a Protectionist War with No Winner in Sight

An industry that has historically relied on operating leverage to generate profits now finds itself struggling to plan production amidst the uncertainty caused by competing protectionist policies.

China’s ascendance to the newest low-cost industrial epicenter fueled a demand for commodities required in construction and manufacturing such as copper, coal, and steel. China began investing heavily in capacity to endogenously supply itself. There were two options for steel – 1) blast-furnaces (“BOF”s): large plants using iron ore and coal, with attractive economics at capacity but high breakevens at low utilizations; and 2) electric-arc furnaces (“EAF”s): smaller, modern plants that used iron ore and recycled steel, with less scale but flexible production. China built almost exclusively BOFs. [1]

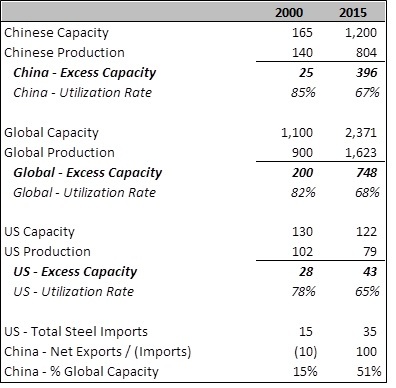

Initially, capacity expanded in-line with consumption. Eventually however, the financial crisis stunted demand, but new facilities kept opening. By 2015, China had more capacity than the rest of the world and began exporting its surplus, creating a supply/demand imbalance. [2]

Source: Compiled by author from Bloomberg LP and World Steel Association Data, November 2017.

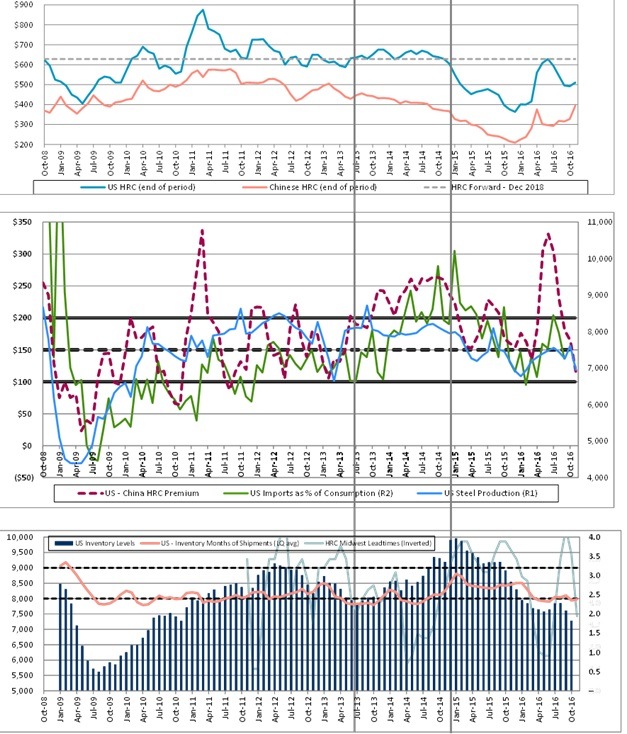

AK Steel (“AKS”) is one of four major US producers and operates both BOFs and EAFs (the others focus on one). Pre-2008, the four jostled for market share while attempting to maintain stability. Thus, steel prices generally reacted to demand and feedstock costs. [3] However, the influx of Chinese exports created a new paradigm. A customer now had a choice between a Chinese and US supplier, and would juxtapose (A) the US price versus (B) (i) the Chinese price + (ii) incremental shipping costs + (iii) a premium for longer lead times –in equilibrium, US prices would be higher than China’s by a spread of (ii) + (iii). [4]

Source: Compiled by author from Bloomberg LP and Woodmac Mackenzie data, November 2017.

For years, this spread oscillated around ~$150: if the US charged a higher premium, imports rose, driving prices down; conversely, if the US charged less, exports fell until prices recovered. However, in mid-2013, the US OEMs refused to cede price, but since they could not lower production, inventory began to build. In Jan 2015, the OEMs caved as imports reached 40% of consumption, and prices remained depressed until the accumulated inventory could normalize. The combination of low prices and low production during the subsequent destocking led to a painful year, prompting both countries to turn to their governments.

The Chinese government did not care about profitability; their goal was to avoid social unrest caused by unemployment. Thus, “protectionism” came in the form of social financing –capital that allowed unprofitable firms to avoid closing, thus preventing the global supply glut from equilibrating. [5] Conversely, American desired protectionism was import duties. OEMs filed an anti-dumping case with the ITC, but after the election they pushed President Trump to enact duties under executive order. [6] [7] While both governments placated the local businesses, they simultaneously attempted to appease international trade principles: China committed to a capacity reduction schedule, while the US ensured duties would only follow evidence of dumping. [8] The result has been immense volatility: US steel prices have moved between $365 and $650 since 2016, and could swing $30 following a Trump comment. [9]

This uncertainty creates material production issues for AKS. Since BOF’s cannot operate at partial capacity, AKS must decide whether to operate at the beginning of each year; assuming a BOF has breakeven costs of ~$575, AKS doesn’t know if it will lose $200 or make $100/ton. [10] The decision is complicated by the high cost of idling and re-starting a plant (unions, maintenance, etc.). Additional uncertainty exists since, unlike some other OEMs, AKS imports some feedstocks, which themselves could be affected by tariffs. [11]

In response to this new archetype, AKS idled its Kentucky BOF (moved orders to its other two BOFs). [12] Next, it has attempted to move its facilities away from the production of commodity HRC steel towards more specialized “up-stream” value-add services that customize HRC for an end-user. These products have higher margins, quality-focused customers, less import competition, and lower price volatility. Additionally, AKS has been spending R&D with goal to shift certain products from their BOFs to their EAFs, which have more production flexibility. [13]

While I agree with these steps, I believe AKS must go further. While difficult to admit, I believe BOFs are no longer economically viable given the US’s relative access to feedstocks and high labor costs. These plants are over 100 years old with structural disadvantages versus modern facilities, and AKS should not rely on protectionism to achieve profitability. Rather than keeping the Kentucky BOF idled with the hopes of eventually restarting it, I would permanently shutter all facilities that cannot be converted to downstream. I would then move as much production as possible to the remaining EAFs, with the hopes of consolidating into one BOF, downstream facilities, and EAFs. With this portfolio, AKS could actually benefit from cheap HRC imports, which could be used as feedstocks into the EAF and value-add processes.

While outstanding questions need to be addressed – such as evaluating the viability / social impact of closing the BOFs and ensuring customers will purchase EAF products – the bottom line is AKS must transition to the new reality before it is too late.

(800 words)

Sources:

[1] Keith Walker, Steel Folk Co., “The Basics of Iron and Steelmaking,” (word file) downloaded from Steel Times Intl. website, [www.steeltimesint.com/contentimages/features/Basics_of_Iron_and_Steel_Making.doc], accessed November 2017.

[2] World Steel Association, “Steel Statistical Yearbook 2016” (PDF file), downloaded from World Steel Association website, [https://www.worldsteel.org/en/dam/jcr:37ad1117-fefc-4df3-b84f-6295478ae460/Steel+Statistical+Yearbook+2016.pdf], accessed November 2017.

[3] Heather Long, “China, not President Trump, is suddenly helping American steel.” The Washington Post, August 7, 2017, [https://www.washingtonpost.com/news/wonk/wp/2017/08/07/china-not-trump-is-suddenly-helping-american-steel], accessed November 2017.

[4] Author’s phone interview with Evan L. Kurtz (Morgan Stanley Equity Research), New York, NY, November 8, 2017.

[5] Zhiyao Lu, “State of Play in the Chinese Steel Industry,” Peterson Institute for International Economics, July 5, 2016, [https://piie.com/blogs/china-economic-watch/state-play-chinese-steel-industry], accessed November 2017.

[6] “U.S. Department of Commerce Issues Affirmative Final Antidumping Duty Determination on Steel Concrete Reinforcing Bar From Taiwan,” US Government, Department of Commerce press release (Washington D.C., July 21, 2017).

[7] Found Egbaria, “No Resolution For Section 232s, Yet, As Trump Administration Mulls Options.” Metal Miner, August 2, 2017, [https://agmetalminer.com/2017/08/02/section-232-president-donald-trump-china], accessed November 2017.

[8] The Economist, “Making sense of capacity Cuts in China.” September 9, 2017, [https://www.economist.com/news/leaders/21728640-investors-have-been-cheered-sweeping-cutbacks-they-should-look-more-closely-making-sense], accessed November 2017.

[9] U.S Midwest Domestic Hot-Rolled Coil Steel Index Futures (HRC1 Comdty), Bloomberg LP, accessed November 2017.

[10] Author’s phone interview with Sean Wondrack (Deutsche Bank Credit Research), New York, NY, November 8, 2017.

[11] AK Steel Holdings Corporation, December 31, 2017 Form 10-K (filed February 17, 2017), via Bloomberg LP, accessed November 2017.

[12] David E. Malloy, “Awaiting improved market, AK Steel plant still idle.” The Herald Dispatch, December 22, 2016, [http://www.herald-dispatch.com/news/awaiting-improved-market-ak-steel-plant-still-idle/article_417781e2-1f72-5f79-b5de-42fb9ca5840e.html], accessed November 2017.

[13] Roger Newport, Chief Executive Officer; Kirk Reich, President and Chief Operating Officer, remarks made on AK Steel Holdings Corporation 2017 3rd Quarter Earnings Call, December 31, 2017. From transcript provided by Bloomberg LP, accessed November 2017.

Very succinct and thorough analysis of the effects of supply and demand on the steel market, and the potential impacts of protectionism. I think your comment that “AKS should not rely on protectionism to achieve profitability” hits a key point – it seems that several companies who have recently claimed damages from illegal subsidization are doing so primarily to avoid facing long term economic realities, rather than compensate for actual damages from malign intent.

I think the recommendation to shutter the BOF plants is worthwhile. There is already a broader industry trend of moving away from BOFs towards electric arc furnaces, and this could also free up capital to invest in newer steel production technology like twin-roll or single belt casting. Interesting article on those here: https://www.economist.com/news/business/21718545-150-year-old-idea-finally-looks-working-new-technologies-could-slash-cost-steel

I think both of those options are in line with AKS’ desire to move upstream in the production process and provide increased value for customers. Ultimately, as you alluded to, this environment could force AKS to make good long term decisions rather than rely on what has worked in the past.

This is certainly an interesting dilemma for the companies involved, and a clear case of the startup and winddown time fuelling a significant decrease in profitability in the face of market uncertainty. I would be very interested in learning more about the cost-benefit analysis that led to your conclusion that BOF’s are no longer economically viable. Based on the dynamics you describe, I would expect this to be strongly driven by expectations for future developments in protectionist policy. Given the uncertainty of the political climate, I wonder at your recommending such a drastic and hard-to-reverse step.

Hello “vlookup90,” thank you for this thoroughly-researched article. We often have the impression in America that China’s protectionist policies have been only a boon to the economy, and I appreciate that your article demonstrates some of the drawbacks of protectionism in China.

I disagree that AKS should abandon BOF. BOF steelmaking still accounts for 71% of all global production and the barrier to entry for EAFs is much lower diminishing AKS’s long-term competitive edge. Furthermore, 75% of costs for EAF are raw materials versus 50% of costs for BOF, and I’m concerned about volatility in raw material prices [1].

I also found myself wondering why your exhibits stopped at October 2016 – what’s happened in inventories since then?

[1] http://econ243.academic.wlu.edu/2016/03/07/bof-and-eaf-steels-what-are-the-differences/

Hi vlookup90,

Thanks for the research you put into this article! I found it very interesting to see how both countries implemented protectionist policies that have resulted in so much price volatility in the US.

As mentioned in the comments above, would be very interesting to actually evaluate the economics of BOF vs. EOF, from my reading, it seemed like while scrap steel is more expensive, the costs largely even out eventually. The key decision making factor, seems to be low capex and ability to customize and the differential volatility in raw material prices of scrap steel and iron ore.

To make the BOF shutdown decision I would consider the following:

1) What do customers want:

As in the connectors case we studied today, there is value in moving upstream that could justify shutting down the BOFs – but we need to understand the market demand for customization. Is there a large enough demand for this? Do our current customers want this? Are we going to have to completely change our target customer?

2) What are we good at?

While we currently do EOF, is customization and innovation our core competency for us to completely divest our BOF business?

3) Impact of shrinking capacity:

How will this impact our supplier relations? Raw material prices? Investor perceptions?

[1] http://www.steelonthenet.com/cost-eaf.html

[2] http://www.steelonthenet.com/cost-bof.html