AccorHotels: Battling against Online Travel Agents

“There are many new participants in the value chain and every one of them is trying to eat some of the cake” — Sebastien Bazin, CEO of Accor Hotels (2)

Digital technology is changing the hospitality industry

With the advent of digital technologies, global hotel management companies face increasing competitions in every step of the value chain. At every customer touch point, digital technology has allowed various companies to enter the value chain, disrupting the entire hospitality industry and undermining major value propositions that traditional hotel management companies offer. In order to maintain their market shares in this highly competitive industry, hotel management companies were forced to redefine their digital strategies.

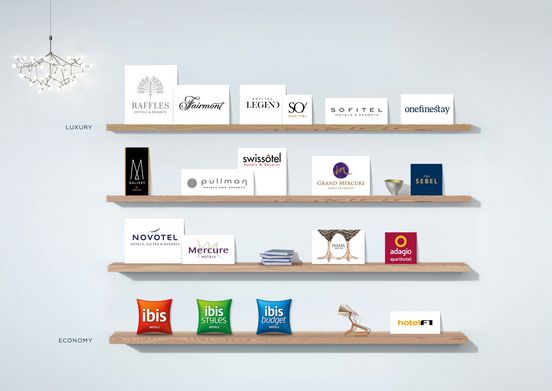

AccorHotels has taken the lead in aggressively reshaping its business models in order to effectively compete with many new entrants that threaten its profitability. A leading French hotel operator with portfolio of brands spanning across different segments, Accor has 3,942 hotels or 524,955 rooms around the world as of June 2016 (1).

Redefining customer experience:

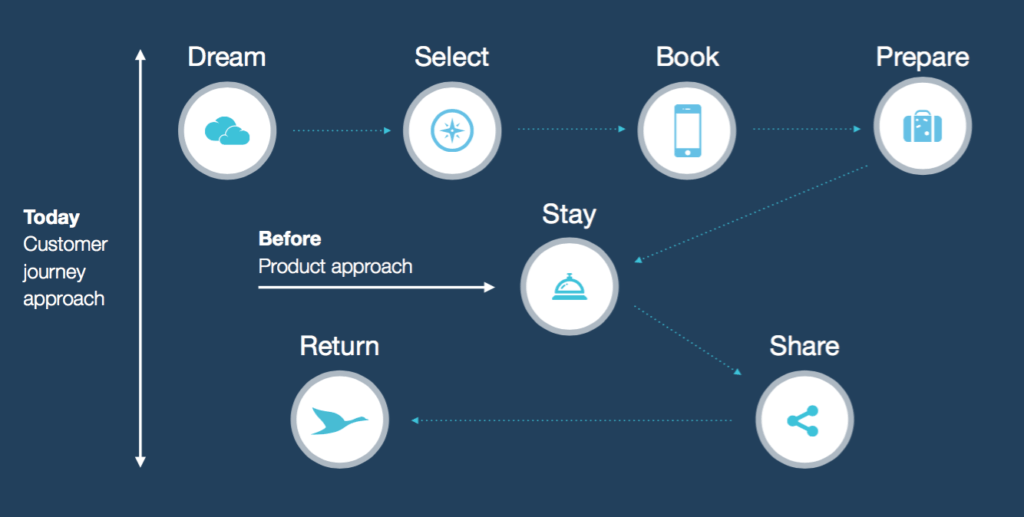

To better understand challenges and opportunities that digital technologies pose on Accor’s business models and the hospitality industry, it is helpful to examine a customer journey (3).

- Dream: Traditionally, customers relied mainly on tour operators and travel agents for information about hotel properties. Social media becomes a new channel in which guests can discover new destinations and hotels.

- Select: Digital revolution has reshaped the way customers select their hotels. Before adoption of internet, traditional hotel operators, such as Marriott, Hilton, and Accor, benefited from information asymmetry between customers and hotel properties. By leveraging years spent establishing brands’ credibility and operational track records, these operators were able to attract customers to their hotels by delivering guests customer experience based on a brand’s promise (4). The internet significantly improves the information flow among customers, hotel operators, and hotel properties, increasing transparency within the system whereby customers can easily obtain details, reviews, and pictures of hotel properties. Metasearch companies, such as Trivago, aggregate information on prices of hotels from different online travel agents and serve as price comparison platforms for consumers. It is estimated that 66% of travelers use different online sites to compare prices before making reservation (5). As a result of increased transparency, customers become less loyal to a hotel brand or a hotel company as they tend to select hotel that provides the best value.

- Book: Although online travel agents (OTAs) increase distribution and reach for hotel properties, they charge very high commissions as much as 15% to 28%, squeezing profit margins from hotel properties and hotel operators (6), (10).

- Prepare: New mobile applications allow hotel operators to combine digital technologies and human elements to enhance guest experience (7).

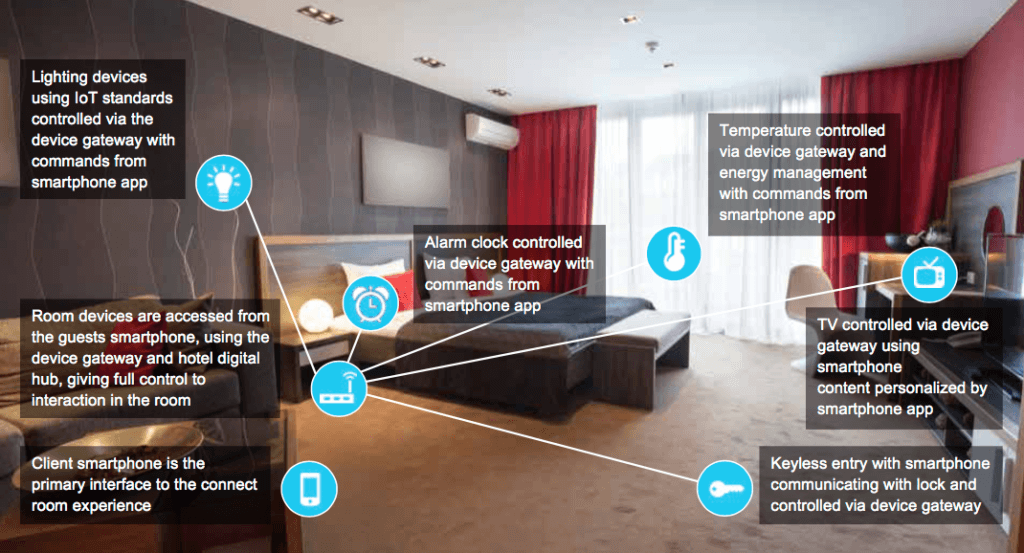

- Stay: Digital technologies provide opportunities for hotels to make customer experience more seamless, such as online check-in and cutting edge in-room technologies (5).

- Share & Return: Peer review sites, such as Tripadvisor, and social media allow guests to share their customer experience, increasing information flow between customers and hotel properties. These platforms provide hotels with data on customer satisfaction and allow hotels to respond to negative reviews to regain customer loyalty (3).

AccorHotels: Leading Digital Hospitality

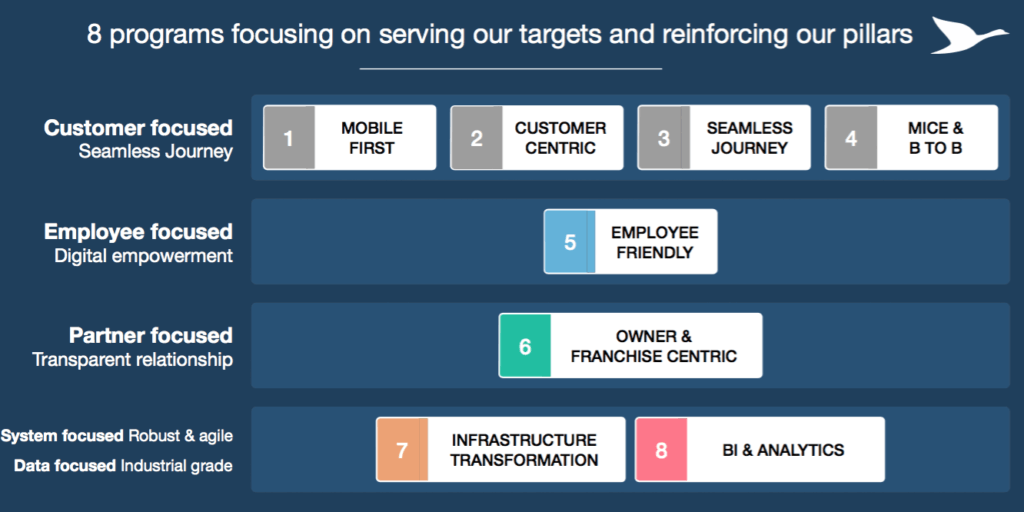

In 2014, Accor Hotels announced a five-year €225-million investment plan in digital strategy to reinvent customer experience. The plan has 3 targets (Exhibit 2):

- Customer: providing guests with seamless journey

- In 2014, Accor acquired a French-start up, Wipolo, to enhance its comprehensive mobile application and further with customer throughout the entire journey—before, during, and after guest’s stay (2).

- Employee: use online platform to provide training and facilitate communications

- Owner and Franchise: use technology to provide dynamic pricing and revenue management strategies

Welcoming Independent Hotels

The biggest move was when Accor announced in 2015 that it will allow independent hotels to be listed on its website AccorHotels.com. Accor offers these hotels lower commissions than the rates demanded by Online Travel Agents, serving as a distribution channel in an effort to reduce OTAs’ bargaining power and encouraging more direct bookings (8). The digital platform is facilitated by Accor’s recent acquisition of Fastbooking, a European-based digital services provider for the hospitality industry (9). In addition, these independent hotels will also have access to Accor’s loyalty program. While this move certainly provides travelers with more options (from 3,800 to 10,000 hotels) and benefits, it is questionable whether Accor’s new digital platform can gain traction and justify the immense amount of investments.

Finding the right balance

As the effectiveness of AccorHotels.com depends on getting as many independent hotels to join, Accor should invest heavily in marketing this platform to attract independent hotels. In particular, it should focus on geographic regions, such as Europe and Asia, where there is a higher percentage of independent hotels in the markets. Nonetheless, in doing so, it is important that Accor continue to foster its relationships with major OTAs in parallel as these OTAs provide market exposure and attract first-time client to hotel properties.

Word count: 797

Source:

- Accor Hotels. http://www.hotelnewsnow.com/Articles/26387/Accor-brings-independents-into-distribution. Accessed 17 November 2016.

- Jill Avery, Chekitan S. Dev, Peter O’ Connor. “Accor: Strengthening the Brand with Digital Marketing. Harvard Business School. 22 October 2015.

- Accor Hotels. Digital Technology presentation. http://www.accorhotels-group.com/fileadmin/user_upload/Contenus_Accor/Finance/PDF/2014/UK/20141030_accor_leading_digital_hospitality_presentation.pdf. Accessed 17 November 2016.

- “The Value of Brand promise.” https://www2.deloitte.com/us/en/pages/consumer-business/articles/hotel-branding-promise.html. Accessed 17 November 2016.

- “Five big ideas to master digital in hospitality”. https://www.accenture.com/us-en/insight-trends-travel-hospitality-digital. Accessed 17 November 2016.

- “Focus on Distribution: Hotels”. http://www.travelmarketreport.com/articles/Focus-on-Distribution-Hotels-Value-Agents-But-OTAs-Rule. Accessed 17 November 2016.

- “Accor Hotels Acquires Mobile Developer Wipolo in Strategy Revamp”. https://skift.com/2014/10/30/accor-hotels-acquires-mobile-developer-wipolo-in-strategy-revamp/. Accessed 17 November 2016.

- Accor Hotels. “AccorHotels accelerates its transformation”. http://www.accorhotels-group.com/fileadmin/user_upload/Contenus_Accor/Finance/Pressreleases/2015/UK/accorhotels_pr_pdm_20150603_en.pdf. Accessed 17 November 2016

- “Accor accelerates its digital strategy by taking over FASTBOOKING”. http://www.fastbooking.com/newsfeeds/accor-accelerates-digital-strategy-taking-fastbooking/. Accessed 17 November 2016.

- Hotel News Now. “Accor owners welcome independents”. http://www.hotelnewsnow.com/Articles/26446/Accor-owners-welcome-independents. Accessed 17 November 2016.

- “AccorHotels CEO to the Hotel Industry: “You Have an Obligation to Be Bold””. https://skift.com/2016/08/05/accorhotels-ceo-to-the-hotel-industry-you-have-an-obligation-to-be-bold/. Accessed 17 November 2016.

Piriya- great blog, and great exhibits showcasing the ways in which the hotel industry uses both mobile apps to ease the guest’s journey, and digital technologies to make the hotel room more comfortable.

I would argue that OTAs and hotels have a more symbiotic relationship. OTAs provide hotels with exposure, and a platform for customers to advertise them through word-of-mouth. Hotels provide OTAs with rooms to earn commission on.

I imagine before the world wide web and OTAs, hotel sales people would have had to maintain good relationships with travel agencies to motivate them to influence customers to book rooms with those particular hotels. In today’s world, an OTA cannot influence how much visibility a hotel on their website gets, even if the relationship between the OTA and the hotel turns sour. Hotels show up on the website according to popularity among customers, and number of bookings made in the recent past.

Additionally, Accor hotels owns many hotels and so many rooms, and therefore, it is more likely that a customer will find an Accor Hotel room on an OTA website and book it, thereby leading to a commission for the OTA.

If this is the case, how do OTAs still manage to squeeze margins for hotels? I would have thought large hotels such as Accor would have had more negotiating power.

I’m surprised by the size of the commissions OTAs can command. Given the amount of revenue lost, it seems reasonable for hotels to push into this area. As a consumer, my value is derived almost entirely from the hotel- it’s easy enough for me to find something I will like. Because of this, I want to see my money get to the hotel and contribute to my experience. I worry that, as hotels get squeezed, they will turn into airlines charging fees left and right and cutting amenities at the same time.

Separately, I disagree with MC that “an OTA cannot influence how much visibility a hotel on their website gets”. OTAs can absolutely influence the order of results on their websites. Recommended, or featured, is usually the default sort order, which is another way of saying “whatever we, the OTA, want to show you”. Even if consumers choose to sort by another criterion, star ratings for example, the order within the group of results ranked equally is probably determined by benefit to the OTA. If an OTA is large enough, I imagine even getting listed might require hefty concessions on the part of the hotel.

Piriya, thanks for your insights on Accor Hotels. I really appreciated the background information on how Accor and other companies within the hospitality industry are dissecting the “customer journey” and attempting to use digital technology to influence them along the way. I previously envisioned it in more of a retroactive manner–new technology being introduced and then companies looking to incorporate it into its business model to add value. Accor’s proactive approach of breaking down the process and looking for technology to transform the customer experience seems far more innovative and efficient.

Though I appreciate their strategy, I am concerned about Accor’s tactical decision of allowing independent hotels to list on their website. Customers will certainly appreciate the added value of lower prices, but Accor will still find itself in low margin pricing wars with these other independent hotels. In addition, I am afraid that Accor will never be compete with the network effect these OTA’s are already benefiting from. Perhaps, this investment would have been better spent investing in innovative methods to create additional value other than lower prices. It reminded me of Marriot’s work with their Courtyard brand. They added a bistro across all of their Courtyard hotels, which added a unique, affordable, and consistent experience that I myself have found worth the additional value.

http://courtyard.marriott.com/amenities

Another interesting discussing is how this new strategy of allowing independent hotels to be listed on its website will affect Accor’s margins. Inevitably, the more the company provides travelers with more options, the more visits to its website Accor can expect. However, there is a risk of cannibalization, since Accor’s existing customers will be more incentivized to book hotels from outside the chain.

Additionally, I think we should discuss about breakthrough innovation aimed at optimizing the hotels physical space. For example, the interior space of hotels, particularly in high-density urban centers around the world, has become too expensive to be static and unresponsive. Within this context, some companies are designing dynamic environments that act and feel as though they are substantially larger. By doing this, hotels can significantly reducing their costs and as a consequence, provide customers a great experience at lower prices.

My concern with this model is that there is an inherent conflict of interest. Accor is incentivised to give priority to its own hotels over the independent listings. In such marketplaces, having premium “real estate” makes all the difference. Therefore, the team managing this site must be completely impartial. This could be achieved with the right organisational structure and a compensation scheme that fosters objectivity.

This was really interesting to read – thanks for writing, Piriya! I’ve done a little work in the travel and tourism space, and the issue of how to deal with online platforms that provide valuable information for the customer but take a cut of the profits for the provider is something that all of the traditional players are trying to deal with. Metasearch companies and OTAs offer a perceived level of impartiality, which drives travelers to consult them before booking anywhere. I like the idea of what Accor Hotels is trying to do with its website to offer more of a one-stop-shop across hotel chains and independents, but I worry that it still will have trouble competing with sites that consumers view as more unbiased/impartial. In the airline industry, Southwest has held off on listing on most of the OTAs, and its value proposition is strong enough to still drive consumers to its independent site. It’s interesting to think about whether or not the same thing is possible with hotels – I think it’d be much more challenging to retain a competitive position without listing on OTAs, which makes it seem like hotels need to find a way to get back more margin from the OTAs.

Such an interesting read about an industry that has so much going on. I am interested in understanding how providers like AirBnB and Homeaway affect the behaviors of these large hotel providers. As more consumers see a growing market of substitutes to staying in a hotel does that make the urgency to be more tech savvy higher? AirBnB as most know is a very tech heavy platform that does most of it’s business from individuals coming direct to their site actually. Additionally, it was interesting to see that Expedia saw the writing on the wall and decided to purchase HomeAway for ~$4 Billion (https://skift.com/2015/11/04/expedia-acquires-homeaway-for-3-9-billion/) in order to start capturing that portion of the market.

Very interesting read. I also found Accord to be trying to deal with the sharing economy by taking a pretty large stake in http://www.OasisCollections.com, an Airbnb parallel for the higher-end market with a strong focus on service & hospitality. To Edmundo’s point, while I applaud Accor’s efforts to not get disrupted, I wonder just how they will be able to fight over their inherent conflict of interest.

Piriya, what an interesting post! It had never occurred to me to think of the customer journey of a hotel occupant. It seems that AccorHotels has begun to “crack the nut” with respect to digitizing its methods for monetizing various parts of the hotel value chain. If Accor and similar corporations are to survive the onslaught of AirBnB and similar upstarts, they are going to have to continue to innovate along these lines. I too, however, question whether allowing the independents access to the Accor platform will prove to be worth the massive investment that Accor has had to make.

This is an amazing example of how the hotel industry is using technology to manage its operating processes and business models. There is clearly a great benefit to technology in the space, as is evidenced by the rise of hotel startups. One example is Hotel Tonight, a San Francisco-based company that allows patrons to book hotel rooms via an app from one-day to one-week in advance. Here, technology allows Hotels to get rid of stale inventory that may not be sold in other scenarios. In addition, there is a robust technology platform that allows the hotels to understand pricing dynamics and demand trends. It will be interesting to see how companies like Hotel Tonight fare versus actual hotel groups as both use technology to compete in a crowded space.