Acciona Energy: Saving the world, a risky affair?

At the forefront of global efforts against climate change, Acciona Energy must not turn a blind eye to its own resilience to the intensifying effects of global warming.

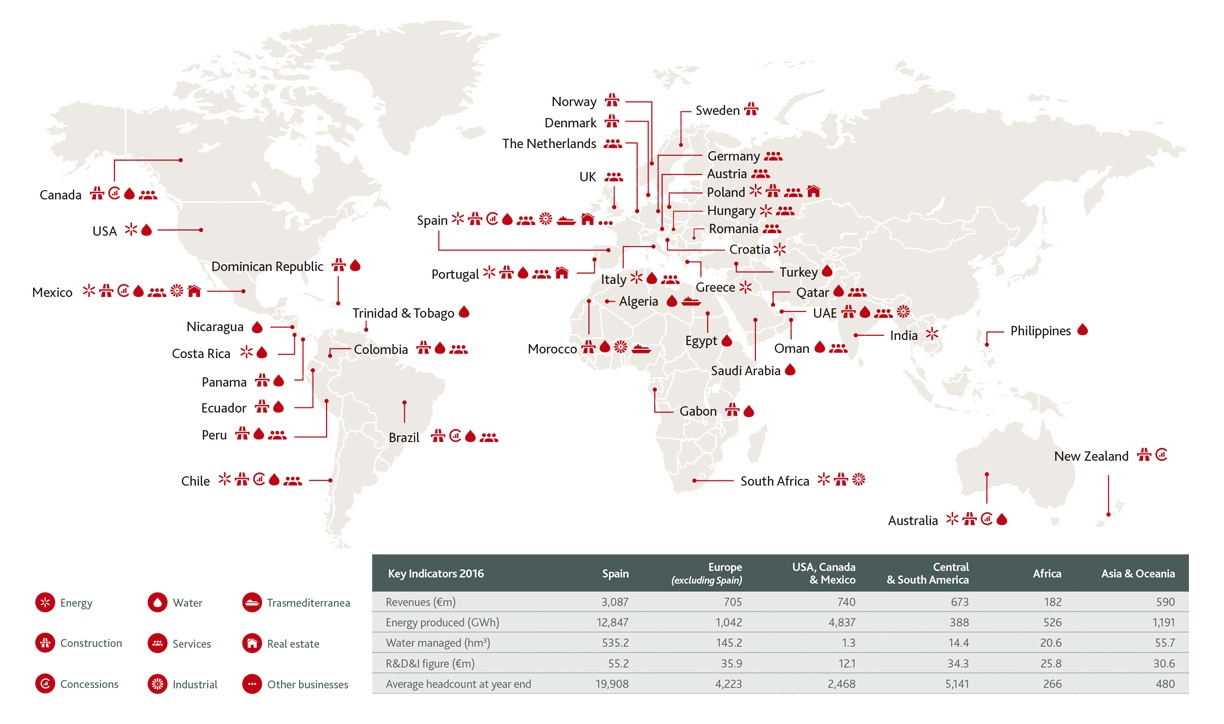

As the largest global company operating exclusively in the renewable space, Acciona Energy is a key player determining how the world’s energy demand is met [1]. It is active in both development and generation across five major technologies: wind, solar photovoltaic, solar thermal, hydroelectricity and biomass. Its assets span the globe, with a strong presence in Spain, Australia, Mexico, South Africa and the USA. Acciona is now seemingly well placed to succeed given its alignment with global sustainability goals, favourable policies and improvements in renewable technologies. Has Acciona done enough, however, to ensure its own operations are safeguarded against the inevitable multifaceted effects of climate change?

Exhibit 1: Acciona’s global operational footprint by type of asset [2]

Renewable energy: Solutions to climate change that come at a price

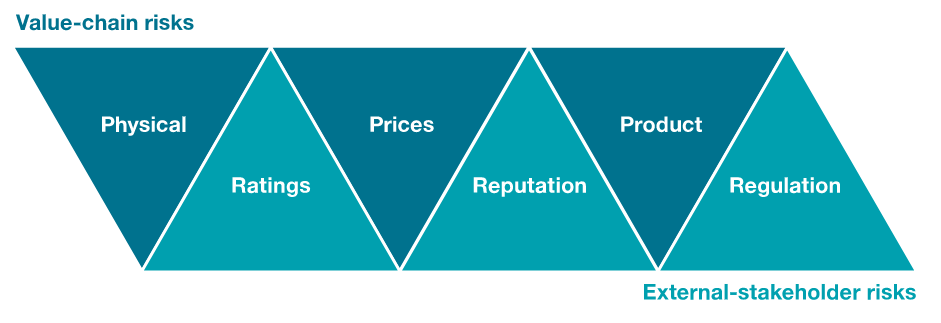

Although renewable energy is the main weapon against human-induced climate change, it is itself highly vulnerable to climate related risks. A framework proposed by McKinsey & Co. [3] categorizes these types of risk:

Exhibit 2: Categorization of climate change risks [3]

Value-chain risks are particularly salient in the renewable energy industry, given its capital intensity, commoditized offering and context dependencies. (In fact, rating, reputational and regulatory aspects of Acciona’s operations may evolve favourably as the impact of climate change becomes more apparent.) Due to the interconnected nature of power networks, vulnerabilities in one region or generation system will cascade negative effects.

Physical asset risks

One asset risk to be mitigated is the vulnerability of coastal infrastructure to rising sea levels; Acciona is particulary exposed to this in the Western Americas and Northern Europe. Increasing extreme weather events including storms, surges and hurricanes will also jeopardize assets and render their supply of energy more intermittent. Coupled with the shift in energy mix to more renewables, which are less consistent than conventional sources by nature, this will further exacerbate the issue of supply reliability.

As temperatures of water bodies increase, solar installations can suffer from a reduced cooling capacity, which may result in outages [4]. A study for European solar generation has shown capacity may decrease by as much as 14% [5]. Variation in precipitation volume may also lead to a reduced utilization of Acciona’s large hydroelectric plants. [6]

Price related risks

Raw materials used in the manufacturing of Acciona’s core assets, like rare earth metals for wind turbines and photovoltaic systems, will experience price volatility affecting the upstream supply chain [3]. Regional droughts can also raise the price of water used in cooling.

Product risks

Demand side fluctuations are expected to become more unpredictable in the future: higher air temperatures and occasional heat waves will increase peak power demand, requiring more redundancy and back-up systems to be built into the grid. Reliability will suffer; climate-related outages are already being observed, for example in Northern India’s 2012 blackouts. [7]

Acciona’s climate risk mitigation

Acciona has a strong track record of committing to sustainability in its operations, but only partially acted on the negative externalities of climate change so far. Its treatment of climate change as an area of social responsibility, rather than a tangible business risk, does not reflect the magnitude of the company’s exposure to it.

Building resilient infrastructure is the main pillar through which the company is attempting to pre-empt the climate risks it faces. [8] In the short term, it is aiming to utilize new solutions and materials in its construction processes to build more robust assets that are less affected by upstream supply chain risks, like new generation solar panels and turbine blades. In the medium to long term, it is trying to identify new types of projects to further diversify its portfolio and mitigate risks.

Acciona’s end-to-end water management process will also help alleviate some of the impact of droughts and floods in the regions in which it operates; the attainment of scale will be crucial.

Looking ahead: The urgency of planning around climate change

A thorough assessment of climate related risks for Acciona is paramount going forward. In the short term, climate forecasting must be used to assess which existing assets are most at risk, and what to do to protect them; this may include divestment, higher decommissioning provisions or introduction of redundancy in the case of outages.

Looking ahead, investment decisions for future project development must take into account their impact on the overall portfolio and promote asset diversification. Coastal areas with existing assets should be avoided, favouring geographic variability. To assess the business’ resilience to climate risks, scenario testing should be used similarly to the insurance industry. Innovation in the distribution network will help avoid reliability issues; this could include smart metering, microgrid provisions and power sharing technologies.

As Acciona attempts to navigate the changing energy landscape in light of climate risks, the broader context remains uncertain. Should Acciona consider investing in some natural gas assets in certain geographies? Would the company benefit from reducing its sustainability impact commitments to selfishly secure its own future?

(800 words)

References

[1] Acciona company information, https://www.acciona.com/business-divisions/energy/

[2] Accional Annual Report 2016, http://annualreport2016.acciona.com

[3] How Companies can adapt to climate change, McKinsey & Co, https://www.mckinsey.com/business-functions/sustainability-and-resource-productivity/our-insights/how-companies-can-adapt-to-climate-change

[4] Energy Sector Vulnerabilities Report, US Department of Energy, https://energy.gov/sites/prod/files/2013/07/f2/20130716-Energy%20Sector%20Vulnerabilities%20Report.pdf

[5] The impact of climate change on photovoltaic power generation in Europe, Nature Magazine, https://www.nature.com/articles/ncomms10014

[6] Effects of Climate Change on Energy Production and Use in the United States, U.S. Climate Change Science Program, https://science.energy.gov/~/media/ber/pdf/Sap_4_5_final_all.pdf

[7] Power outages hit 600 million in India, New York Times, http://www.nytimes.com/2012/08/01/world/asia/power-outages-hit-600-million-in-india.html

[8] Acciona sustainable development goals, Acciona Energy https://www.acciona.com/news/acciona-contribution-sustainable-development-goals

Charis, this was a great read. Acciona is clearly a vision-oriented energy company, and I applaud their efforts in bringing affordable renewable energy to many parts of the world that need it. That said, a few things came to mind when I was reading about their rapid expansion:

(1) I’m not sure if Acciona has seriously considered the decommissioning and deconstruction (D&D) of some of their renewable assets. For example, per a recent news article [1], their wind turbine blades “are a high-tech wonder of composite material, which most experts agree cannot be separated into its component materials and is thus worthless for recycling”. “The landfills are going to be filled with blades in a matter of no time.” The article goes on to talk about the costs of maintaining these wind turbines, especially as technology rapidly advances in the space of wind energy. There could be a future where it simply doesn’t make sense economically to maintain, upgrade, or take down these old wind turbines.

(2) Many of these renewable energy solutions are unable to maintain 100% up-time, and some may be significantly affected by natural factors such as wind speed, sunshine, cloud cover, etc. You mentioned this briefly at the end of your article, but the amount of redundancy required might make the entire renewable solution uneconomical. Should Acciona then partner with traditional coal producers for redundancy then?

Footnotes:

[1] http://www.valleymorningstar.com/news/local_news/retiring-worn-out-wind-turbines-could-cost-billions-that-nobody/article_3a81176e-f65d-11e6-b1bb-b70957ccb19f.html

I thought you brought up a very relevant topic – the effect of climate change on providers of renewable energy. You show how Acciona Energy is a key player in the modern world that is effected by climate change and in a world where there seems to be great consensus regarding the need to find alternative sources of energy. You make a great point however, that Acciona is not immune to the same risks that more traditional providers of energy are facing due to climate change, specifically the impact on their generation capacity, availability and intermittency.

I thought you gave a thorough analysis of the effect that climate change would have on the physical asset, the prices and the product and how that will have a great impact on the supply chain, and Acciona’s ability to accurately predict future demand and operations. I also thought your point about Acciona’s failure to treat climate change as a tangible business risk, rather than just a part of the social responsibility, casts serious warning to Acciona and the severity of the issue. I read up a little more on the impacts of climate change on renewable energy sources and came across this article that highlights exactly what you are saying. The risks to Acciona could actually be greater than what they might currently believe, and your article certainly opens up that conversation and highlights the urgency of planning around climate change, even to a company that works in the renewable space.

It would be worth questioning whether Acciona has many alternatives in the renewable space moving forward, whether they simply need to adjust to these changes or whether they may even consider moving towards other sources of energy in the future in order to remain relevant in the energy market as they begin to experience more efficiencies. Is there a way for them to prepare better for what is to come?

Charis, I enjoyed your analysis on how a company thats business is centered on capturing a shift in energy consumption could also be affected by the very thing they are attempting to combat. Several things I noticed is a lack of diversification geographically – Acciona is barely present in the BRIC region, for example. They do, however, have a global presence in other markets, besides energy which begs the question: is Acciona leveraging its global reach to minimize construction and labor costs for its larger projects. Another consideration is government regulation and how Acciona is adjusting to the changing global appetite and demand for alternative energy projects that are incentivized through tax credits, etc.

Thanks Charis, this is a problem that I’ve never considered. It’s both interesting and a bit disheartening that the problem we are trying to solve could potentially hurt our efforts in doing so. It essentially implies that as climate change gets worse, there is a possibility that we become even more dependent on fossil fuels (if indeed it’s true that those are not as exposed to weather volatility issues), leading to an acceleration in climate change damage.

Regarding your second question, “Would the company benefit from reducing its sustainability impact commitments to selfishly secure its own future?”, I think in many ways the ends justify the means here. If needed, I wouldn’t be overly upset if the Company did what it needed to survive as long as its core mission stays intact. A better outcome, however, would be if the government decided to further the climate change cause by offering additional incentives to companies like Acciona such that the private sector is more incentivized to work on this critically important problem.

Hm — interesting quandary, Charis. I’ll add one thought to the comments above. I can think of one additional climate-change-lens through which I think it makes sense for Acciona to view its investment (and divestment) decisions moving forward: political uncertainty. If ‘long-tail’ scenarios of climate change impacts come to fruition it seems possible that there will be socio-political changes that take place across the world as populations and governments adjust to new environmental realities. I think its entirely possible that these new realities add even more risk on top of what you mentioned for a multinational energy producer.