AbbVie: Improving Life in a Digital World (734 Words)

What will digital success in the pharmaceutical industry look like 10 years from now? What are the right initiatives to capture the digital opportunity? How well will a giant pharmaceutical company implement changes in the digital landscape? One Chicago pharmaceutical company AbbVie, is currently in a unique position to lead the sluggish pharma industry’s transformation into the digital age. (734 words)

What will digital success in the pharmaceutical industry look like 10 years from now? What are the right initiatives to capture the digital opportunity? How well will a giant pharmaceutical company implement changes in the digital landscape? One Chicago pharmaceutical company AbbVie, is currently in a unique position to lead the sluggish pharma industry’s transformation into the digital age.

AbbVie mission statement on its website states “Our life’s work is to improve lives.” However, to accomplish this mission, AbbVie must adapt to innovations in advanced analytics, cloud computing, mobile communications, and the Internet of Things. It’s estimated by 2020, there will 50 billion objects connected to the internet with a global population at 7.6 billion people. To improve these 7.6 billion lives AbbVie must develop the capability to connect with its patients for the duration of their lifetime, to include: healthy living, prevention, diagnosis, treatment, recovery and home care.

One way AbbVie is moving forward is by acknowledging that consumers are prioritizing “outcomes-based care” compared to the status-quo of blindly accepting the results of the clinical trials and their doctor’s recommendation. Per a 2013 study by the Pew Research Center, “more than 70 percent of patients who are online in the United States use the Internet to find healthcare information, and more than 40 percent of people who diagnosed their condition through online research had it confirmed by a physician.” Due to the increasing transparency of information, patients are increasingly likely to be proactive of their diagnosis and challenge their doctor’s recommendations. Furthermore, AbbVie will have more pressure to validate premium pricing to of its drugs to keep customer loyalty. With sales of $22.8B in 2015, AbbVie must justify premium pricing to cover its $17.0B of expenditures and $29.2B in long-term debt to fuel further life-saving innovations (Capital IQ). Companies that fail to control the controversy of pharmaceutical pricing will be pressured to lower their prices, resulting in lower margins and less capital invested in long-term research and development.

AbbVie proactively addresses this issue via transparency on its website: its current drugs are listed with active ingredients along with drug’s benefits. AbbVie’s research and development process is displayed in full detail- to include an ‘open innovation program’ to help spur innovations from outside the agency. Finally, AbbVie lists the details of all current drugs in the pipeline in phases 1-3 of the United States Food & Drug Administration (FDA) approval process. This level of transparency helps convince critics of the life-saving implications of AbbVie’s breakthroughs in oncology, immunology, neuroscience, and virology. Moreover, AbbVie launched a digital custom manufacturing business to encourage entrepreneurs in biopharma R&D to use AbbVie’s facilities to deliver scale and capital-intensive resources to include lab equipment and raw materials. This is an aggressive hedge to counter the Big Pharma status quo of secrecy.

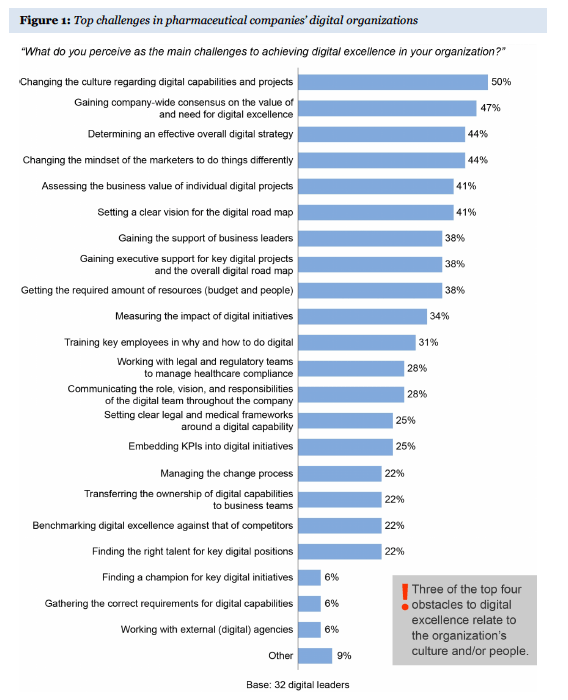

Furthermore, AbbVie’s competitors are going to have a tougher time leveraging the digital transformation. AbbVie is a four-year-old company and much more flexible than its giant competitors such as Gilead ($112B), Amgen ($109B), Abbott ($59B), Johnson & Johnson ($317B), Pfizer ($192B), Merck ($172B) and Novartis ($167B). These larger companies will be much slower to adapt to the cultural shift that digitization requires. For example, a 2014 DT Associates study of 14 pharmaceutical companies resulted in employees voicing concern that their companies are blocked from reaching digital excellence because they struggle to 1) lead a culture shift 2) set a mission and 3) gain support of key stakeholders (See below figure for survey results). Incumbent pharmaceutical companies must move quickly or else face the risk that innovative competitors steal a larger share of benefits and stronger customer loyalty.

Another key player in the pharma space is the Government, who has been moving into digital surprisingly quickly. The 2010 Health Data Initiative spearheaded by Chief Technology Officer of the US Department of Health & Human Services (HHS) made a huge push into transparency of health data. If the government wins the push into the digital age, they will control how the data is used and which data is made available to the public, which is a key advantage in controlling the argument of pricing and future innovation.

In conclusion, AbbVie is a young company which is leveraging digital innovation to personalize its products and services, engage patients and stakeholders, shape decisions of key stakeholders competing in a data-driven environment, as well as deliver its business commitments in a more immediate fashion.

Sources:

20, 2015 Oct. “Quality Management in the Digital Age.” Pharma Manufacturing. N.p., n.d. Web. 18 Nov. 2016.

Tradewell, By David S. “How Can Pharma Organize for Agility in the Digital Age?” Econsultancy. N.p., 15 July 1970. Web. 18 Nov. 2016.

“AbbVie Inc.” S&P Capital IQ. McGraw Hill Financial, n.d. Web. 18 Nov. 2016.

“Overcoming Obstacles To Digital Transformation Success In The Pharmaceutical Industry.” DT Associates. N.p., n.d. Web. 18 Nov. 2016. <http://dt-associates.com/research-overcoming-obstacles-to-digital-transformation-success-in-the-pharmaceutical-industry/>.

Futty, Robert. “Leveraging Digital Content to Go Beyond Face-to-Face Engagement at AbbVie.” MM&M. N.p., 09 June 2016. Web. 18 Nov. 2016.

By David Champagne, Amy Hung, and Olivier Leclerc. “The Road to Digital Success in Pharma.” McKinsey & Company. N.p., n.d. Web. 18 Nov. 2016.

By Sastry Chilukuri, Rena Rosenberg, and Steve Van Kuiken. “A Digital Prescription for Pharma Companies.” McKinsey & Company. N.p., n.d. Web. 18 Nov. 2016.

By Stefan Biesdorf and Florian Niedermann. “Healthcare’s Digital Future.” McKinsey & Company. N.p., n.d. Web. 18 Nov. 2016.

“OUR PASSION HELPS PATIENTS.” AbbVie | Pharmaceutical Research & Innovation. N.p., n.d. Web. 18 Nov. 2016.

Oh my gawd Sarah Yu, I didn’t know you were a big Cubs fan.

Nah, she’s really a Tigers fan through and through.

Go Cubs! -Sarah Yu

Sarah, this is an interesting article! While I agree with you that AbbVie could potential disrupt the pharmaceutical industry, I would be cautious about saying that larger companies would have a tough time jumping on the digital transformation wave. Big pharmaceutical companies are just so massive in terms of its resources that they could easily counter AbbVie’s efforts by creating a new digital division or acquire an up and coming company in the digital space. Furthermore, the size of the big companies allows it have more wiggle room to resort to aggressive prices wars to gain market share. Abbvie has very little margin for error while fighting against competition since it has an enormous amount of debt – Debt to Equity ratio of 687% compared to major pharmaceutical companies’ debt to equity value of 84%. Some of its current major drugs (such as Humira) are going to go off-patent as well. So it is heavily dependent on it’s new product pipeline to yield some blockbuster drug.

Source: http://www.fool.com/investing/2016/06/04/is-abbvies-stock-too-risky.aspx).

Very interesting! thanks for the source & info!

A very thought provoking article! I’ve never really thought about the relationship between digitization and the pharmaceutical industry, but when you look into the back end of things and how big pharma actually operates, the origins of all of the new drugs that come onto market is through R&D and knowledge sharing. A digital age allows information dissemination and research changes to happen almost instantaneously, and that’s where I see the true value of using technology as a pharma company. Instead of waiting weeks or months to receive results, share with other medical experts, and decide on how to tweak a formulation or take the next step of clinical trials, a digitized world can allow for all of this communication to happen remotely. I do agree that culture is a big hurdle to making this change, as the flow of information is only as good as the holder who is willing to pass it on through this new means of communication.

The other thing that got me thinking was how much more pharmaceutical companies need to invest in their marketing efforts and carefully monitor their online presence now that patients can easily access efficacy and reviews on any type of prescription online. We live in an age where reviews can significantly sway our consumption, and when talking about side effects and efficacy of drugs, customers have much more information to assess their next best alternative.

Interesting. It is very common for pharma companies to least active ingredients, stages of pipeline product development, and benefits. However I agree that their approach to open sourcing R&D is relatively rare in the biopharma space. I think AbbVie should also focus on using technology via remote monitoring/wearables to provide evidence that their drugs actually deliver on their value proposition. Drug companies generally can use the gains in 24/7 monitoring to improve R&D processes, streamline the process for identifying patients for clinical trials, and better identify which patients can benefit from a drug

Thanks Pavithra! I actually read the remote monitoring/wearables being a huge opportunity in healthcare, particularly pharma. I’ll keep my eyes open for those opportunities @ AbbVie.

Sarah, this is indeed an interesting situation that AbbVie is in. Do you believe that digitization is pushing AV and other pharmaceuticals to broaden their mission statements (“improve lives”)? While I agree that reaching broader will certainly help cement AV’s ability to place themselves along key parts of the healthcare value chain, I am much more interested in how Abbvie is going to more effectively use digitization to amplify its core competency and question whether these current transparency initiatives will be enough to justify their premiums. Instead, I would assume that digitization would be more impactful by complementing the drugs themselves to ensure proper adherence and better outcomes with AbbVie drugs.

Sarah, that’s a great point. I think I was more focused in ‘controlling the narrative’ with the public/government rather than what digitization can do to boost their products and complement their consumers (patients).

-Sarah

Thank you for the article, it was quite interesting. Although I agree that pharmaceutical companies must do far more than what they’re doing today to address nowaday’s consumer trends considering digitalization and knowledge proliferation, it is unclear how AbbVie is doing exceptionally more than the big pharma companies. I did a quick search in one of the big pharma companies (Merck) and they have as well the pipeline of upcoming research, detailed prescription and contraception in all of their drugs, etc. Whether if this is because they caught up with AbbVie, still leaves the question of what they’re going to do next to maintain their so-called transparency advantage. What I would like to see from AbbVie and the other pharma companies to address today’s opportunity is to be more focused on their approach with mobile and devices, perhaps developing apps that communicate their products and their benefits, partnering with social media companies to create awareness and communities impacted by certain diseases, and motivating real debate between patients and doctors.

Thanks for sharing Sarah (and also great alias). It is great to see that AbbVie is adopting transparency and displaying their drug pipeline to the market. One thing I would caution is that while AbbVie is new, it is really just a recent spin off from Abbott. As such, I wonder how much of Abbott’s culture has remained intact at AbbVie. Abbott is a historically slow but steady growth company that divested AbbVie in order to differentiate their investment profiles. AbbVie is free to focus on big ticket drugs with more volatile earnings and the result is that they need to invest heavily in costly R&D that enables those few blockbuster drugs to get to market. In this environment I wonder how much they will be able to lower the final cost of their drugs without compromising the drug pipeline that enabled them.