A Growing Issue: Cargill’s Climate Change Push

Cargill has made bold strategic bets to position itself for a changing climate but ‘hidden’ impact of livestock still looms.

“So here’s the question for all of us in agriculture: are we in a situation where increasing levels of global CO2 are loading the dice?” – Greg Page, Executive Chairman, Cargill1

After spending four days on the road a week as a consultant, I was inspired to celebrate the lack of regular travel during business school by buying a live plant at the local market.

A first-time live plant owner, I surprised myself by keeping the plant alive past the one month milestone. But then things changed. I got busy. I forgot to water the plant. I inadvertently placed the plant next to our heating duct. You may have guessed how this story ends – I no longer have a live plant. And while this story may seem trivial, Mother Nature is moving around heating ducts and changing her watering patterns as we speak, and perhaps no business is more exposed to those changes than Cargill.

As the climate changes, so does Cargill’s business. The largest private company in the United States, Cargill’s influence spans across the food supply chain, including agricultural trading and processing, food ingredients and products, meat, poultry, and eggs, farmer services, and animal feed.2 That is why changes in climate that affect crop yield and livestock conditions require serious and diligent strategic consideration from the Minnesota-based company.

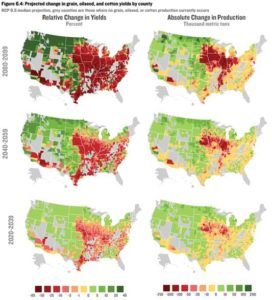

In the agricultural belt of America, there is likely to be quite a bit of change in temperature, precipitation, and consequently crop yield. Across middle America, which accounts for most the nation’s crop yield, average summer temperatures are anticipated to rise by 10°F+ by the end of the century. Over the same duration, grain, oilseed and cotton yields are projected to decrease by more than 50% in parts of the Midwest.3 This fundamental change in agricultural suitability is not localized to America. Cargill’s 150,000 employees across 70 countries will all need to adapt as agricultural circumstances change across the globe.4

To that end, Cargill is not waiting for Mother Nature. They’ve seen enough of her hand to start placing bets to prepare them for the future. The bets have taken two primary forms to-date: capital investment to shift their geographic footprint and advocacy efforts to raise awareness and create a fact base about climate change. Cargill’s largest single-site capital investment in 2015 was a canola processing plant in Camrose, Alberta, shifting their North American grain infrastructure north.5 On the awareness front, they’ve served in an advisory capacity for several organizations researching the impact of climate change on America, including The Risky Business Project, which was co-chaired by Michael Bloomberg, Henry Paulson, and Tom Steyer.6

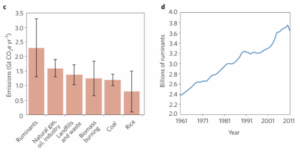

But while Cargill has invested time and capital to be ready to adapt to climate change on the crop front, it’s less clear what they are doing on to prevent climate change in their livestock business. Worldwide, livestock accounts for 14.5% of all annual greenhouse gas emissions. In fact, it is a larger source of greenhouse gas emissions than natural gas, landfills, and coal.7 As one of the world’s largest animal feed and nutrition providers and one of North America’s largest beef processors, Cargill is a key contributor to these emissions.

Ripple et. al, “Ruminants, climate change and climate policy,” Nature Climate Change. January 2014, vol 4.

Changes to the beef business will require strong will. Beef demand is forecasted to almost double by 2050, driven by an increasing global population and more people coming out of poverty.8 This will increase direct greenhouse emissions, as more cattle release more methane into the air. But it will also have second and third order effects, as more land will be needed to house livestock (which account for 70% of agricultural land today) and crops that could feed humans will be used to feed cattle.9

Cargill should consider taking the lead on livestock and climate change as it has in farming. While this will require much bolder decisions, such as funding potentially disruptive research and pushing for policy changes related to livestock consumption, the diversified nature of their business (a market leader in agriculture and livestock) positions them well to capture a shift away meat consumption.

————————

1 Greg Page, “Climate Change: Can we afford to play with loaded dice?” speech given at Indiana Governor’s Agriculture Conference, Indianapolis, Indiana, January 16, 2015.

2 Cargill. “Our Businesses.” http://www.cargill.com/company/businesses/index.jsp, accessed November 2016.

3 Rhodium Group. “American Climate Prospectus: Economic Risks in the United States.” October 2014. http://climateprospectus.org/assets/publications/AmericanClimateProspectus_v1.2.pdf, accessed November 2016.

4 Cargill, 2016 Annual Report.

5 Greg Page, “Climate Change: Can we afford to play with loaded dice?” speech given at Indiana Governor’s Agriculture Conference, Indianapolis, Indiana, January 16, 2015.

6 Burt Helm, “Climate Change’s Bottom Line,” New York Times. January 31, 2015, http://www.nytimes.com/2015/02/01/business/energy-environment/climate-changes-bottom-line.html, accessed November 2016.

7 Ripple et. al, “Ruminants, climate change and climate policy,” Nature Climate Change. January 2014, vol 4.

8 Nikos Alexandratos and Jelle Bruinsma, “World Agriculture towards 2030/2050,” ESA Food and Agriculture Organization of the United Nations Working Paper No. 12-03, June 2012.

9 Ripple et. al, “Ruminants, climate change and climate policy,” Nature Climate Change. January 2014, vol 4.

Cargill is a very powerful example of how a company can and must leverage its leadership position to become a benchmark in addressing and reducing the effects of climate change. I read an interesting article by Mark R. Tercek, CEO of The Nature Conservancy, that considers that one of the transformative approaches to save the planet is to find common ground between diverse parties, more specifically the private and public sector, and all stakeholders involved. He also states that “the bigger a company’s environmental footprint, the bigger the opportunity to benefit nature by helping the company reduce its impact,” [1] which puts on companies as Cargill a great responsibility for the future!

PD. I too bought a plant as soon as I moved in to SFP and found out I had a big enough balcony! Sadly it had the same fate as yours, and did not make it past its first month 🙁

[1] http://assets1b.milkeninstitute.org/assets/PillarPage/POI/MarkTercek.pdf

Great read, Bottle Neck. It’s very interesting how Cargill is dealing with the changes in the Midwest and is even going so far as to cross the border and move into Canada. I wonder how many others are also taking this approach.

Re: the cattle piece, I’m sure it will be a tough solve as they require more space and Cargill will need to house them in an ethical way. I agree with your points around Cargill leading the way on climate change, but I question how far they’d want to push away from meat consumption. I’m not sure how their business splits out, but I’d imagine it will be tough to walk away from what are likely higher margins on the livestock side.