A Bridg to Nowhere?

In a world where Amazon seems unstoppable, traditional brick-and-mortar retailers are pinning their hopes on Bridg, a company with thirty employees and one powerful algorithm.

Imagine for a moment if Amazon (NASDAQ: AMZN) offered a more “traditional” shopping experience. While customers could still log in online to order products from the widest array of SKUs ever assembled, imagine if Amazon’s prices were more similar to traditional retailers. Additionally, imagine if customers had to drive to a centralized warehouse where they would sift through aisles of packages to find their own. The customer experience would likely not differ significantly from what Walmart and Target offer today. And yet—Amazon would still dominate the competition for one simple reason: customer data.

“One of the core reasons” behind Amazon’s success, explains Rick Braddock, former CEO of Priceline and FreshDirect, is that “in addition to providing always-on, on-demand convenience, online retailers know so much more about their customers than their offline counterparts do” [1]. Amazon collects enormous amounts of data on its customers in the form of purchase histories, browsing patterns, contact information, geographical locations, and, as of recently, interactions with Alexa [1]. This allows Amazon to maintain a constant dialogue with customers and serve them the most relevant advertisements and promotions. After all, Amazon’s guiding principle of “Customer Obsession” hinges on knowing their customer [2]. Traditional retailers, on the other hand, cannot distinguish one customer who walks in the door from another, and—even if they were able to—they lack the ability to reach them (customers do not need to create an account and supply their email addresses and phone numbers to simply walk into a Macy’s).

Enter Bridg

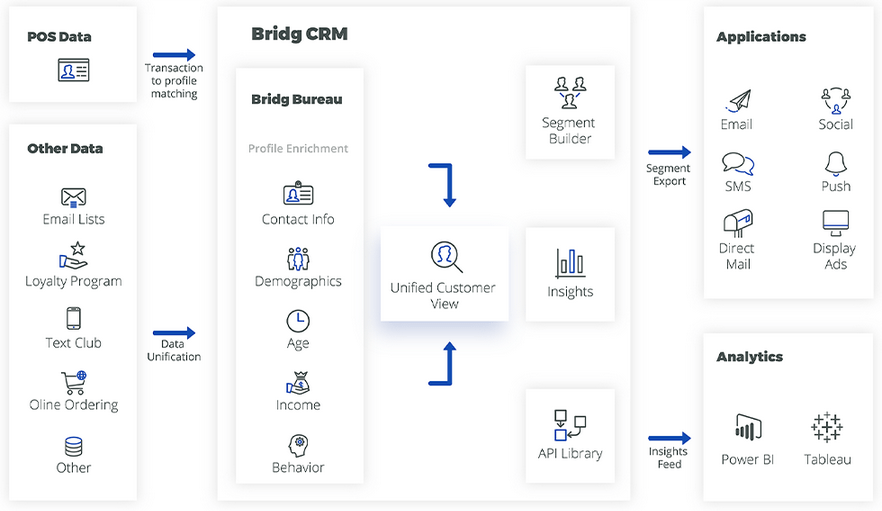

One Santa Monica-based company hopes to change that. Bridg, founded in 2012 by Google alumnus Amit Jain, uses machine learning and deep data science to pair retailers’ point-of-sale (“POS”) data with customer contact information to drive precision-marketing campaigns [3]. Bridg’s core offering incorporates disparate data sources from retailers (including purchase histories based on credit card information and existing loyalty programs) and matches it to a proprietary database of over 200 million consumers in the United States (see Exhibit 1 for details) [4]. According to Jain, “the average brick-and-mortar business today is, at best, able to identify 15-20% of their consumers via a loyalty or other opt-in marketing program. The Bridg Customer Data Platform gives operators access to an entirely new revenue opportunity—the other 80% of their guests existing in their historical POS data” [4]. This dataset includes demographic data and share-of-wallet information, and allows retailers to target customers via email, text, and social media, in addition to a wide a variety of other channels with high precision (including customers’ favorite brands, colors, and patterns) [4]. Bridg’s machine learning algorithm also allows it to measure the efficacy of various targeted promotions and adapt future programs accordingly.

Exhibit 1:

Bridg’s most successful case study to date actually occurred outside the retail space. Following a series of food safety scandals in late 2015, Chipotle Mexican Grill (NYSE: CMG) was reeling: same store sales were down 20% and net income was down 95% the following year [5]. Under intense pressure from investors to turn around their performance, Chipotle partnered with Bridg to identify Existing, New, and Lapsed customers and target them with specific promotions in order to drive traffic. This partnership helped the company achieve double-digit same store sales growth in 2017 and greatly enhanced Bridg’s public profile.

An Uncertain Future

Looking forward, however, Bridg faces a number of potential issues. The quality of the output of a machine learning algorithm relies on the size of the dataset available and the quality. Like any business that thrives on network effects, Bridg must focus its near term efforts on customer acquisition. One issue the company currently faces is that the retail analytics space is becoming increasingly crowded, and much of Bridg’s data can be harvested from public sources. Should management taper its sales and data mining efforts, a competitor could copy Bridg’s model, rendering their once-proprietary dataset obsolete.

In order to grow its competitive moat in the medium term, Bridg should attempt to enter the predictive analytics space. Given that Bridg measures SKU-level sales, it should be able to offer a complementary product that helps retailers manage inventories more efficiently. Bridg’s algorithm should be able to help retailers predict fluctuations in demand for various products, thereby reducing inventory carrying costs while simultaneously minimizing out-of-stock issues.

Finally, the specter of the doomsday scenario still looms. Contrary to the counterfactual presented above, Amazon’s competitive advantage comes not only from customer data, but also from superior logistics that allow it to win on both convenience and price as well. Can Bridg’s $11M in Series B funding [6] compete with Amazon’s annual cash flow from operations of $18B+ [7]? Or is Bridg selling to a dying market?

Word Count: 783

Bibliography

[1] Braddock, R. (2018). To Compete with Amazon, Big-Name Consumer Brands Have to Become More Like It. [online] Harvard Business Review. Available at: https://hbr.org/2018/06/to-compete-with-amazon-big-name-consumer-brands-have-to-become-more-like-it [Accessed 13 Nov. 2018].

[2] Amazon.jobs. (2018). Amazon’s global career site. [online] Available at: https://www.amazon.jobs/en/principles [Accessed 13 Nov. 2018].

[3] Bridg.com. (2018). Restaurant & Retail Customer Data Platform + CRM — Bridg — Join the data revolution. [online] Available at: https://bridg.com/ [Accessed 13 Nov. 2018].

[4] CRM Magazine. (2018). Bridg to Launch Customer Data Platform with CRM for Restaurants and Offline Retailers. [online] Available at: https://www.destinationcrm.com/Articles/ReadArticle.aspx?ArticleID=126643 [Accessed 13 Nov. 2018].

[5] Maze, J. (2018). Chipotle earnings plummet in fiscal 2016. [online] Nation’s Restaurant News. Available at: https://www.nrn.com/sales-trends/chipotle-earnings-plummet-fiscal-2016 [Accessed 13 Nov. 2018].

[6] Vcnewsdaily.com. (2018). Bridg Pulls In $11M Series B Funding. [online] Available at: https://vcnewsdaily.com/bridg/venture-capital-funding/qlsrqwzwwt [Accessed 13 Nov. 2018].

[7] Amazon.com, Inc. Form 10-K, 2017. Page 37.

Very interesting article. Brick and motar stores are certainly struggling with the problem of correctly identifying their customer base and then marketing specifically to them, something that online retailers can do relatively easily. However, I believe this is fairly difficult thing to do in practice and a lot hinges on how accurately their algorithm can identify these customers. Another interesting aspect of this ML software you mentioned is the ability to measure to the efficacy of a marketing campaign. This coupled with customer-level data visibility can certainly help brick and motar stores with a lot of problems they are facing in this environment.

This is an interesting piece. Ironically, it seems to me like the only way Bridg can truly maintain a competitive edge is to expand it’s human-based consulting services. It’s one thing for the algorithm to generate useful customer insights. Making decisions on those insights is another and this is where such consulting services may come in. As to the question of whether or not they are selling to a dying market, I don’t believe they are. Not all Brick and Mortar stores are bowing out to Amazon. Restaurants and fast food chains, for example, are certainly not. Seeing what they were able to achieve with Chipotle, I’m guessing there’s still more than enough opportunity for them to serve this current target market.

Thanks for the read! This is my first time hearing of Bridg and I found this very interesting. I do not think Bridg is selling to a dying market. I think there will always be a strong brick and mortar retail space and it sounds like Bridg can help bring this space into the digital future. One concern I do have is Amazon Go and similar solutions existing in Asia. In addition to going cashier-less, Amazon Go and others are working on this exact problem of connecting physical shoppers to digital data. Through a combination of computer vision and machine learning, they are able to identify customers when they walk in the store, connect them to their Prime account, track what they purchase, and charge them on the way out without any friction. I see this as a risk to Bridg as similar technology will likely be purchasable in the future.