A Bigger Piece of Pie: Converging Content Creation and Delivery at AT&T-Time Warner

As slowing market growth drove fierce competition between telecom companies, AT&T announced its purchase of Time Warner to capture value created by the content flowing through its networks

AT&T’s historical role in the media industry

Telecom companies are the invisible highways that enabled digital transformation of media in the last decade. Without AT&T, Verizon, Sprint, Comcast, Time Warner, and other players providing the LTE and high-speed copper or fiber technologies that deliver our content, the smart phone’s value proposition would be zero, there would be no “Netflix and chill,” and studios’ content distribution would be limited to movie theaters and DVD sales or rentals. Telecom and media thus have a distinctly symbiotic relationship.

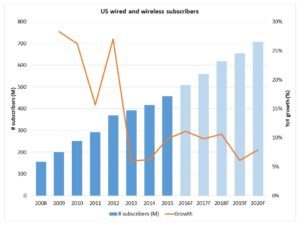

As the smartphone revolution neared saturation ~2012, telecom companies faced a period of significant decline in subscriber growth1 (Exhibit 1). Intense competition between operators ensued, but it was difficult to convince consumers what “better coverage” or “faster speed” really meant. Having largely captured the value of “wave 1” of the digital revolution, the telecom industry needed a new way to capture value.

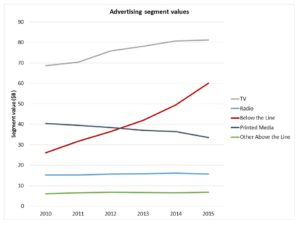

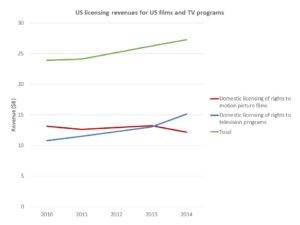

Looking externally, telecom companies saw that advertising spend had increased nearly 25% 2010-20152 (Exhibit 2) driven by digital methods, and that the content licensing revenues paid to studios (costs to telecom P&Ls) increased 14% in the same period3 (Exhibit 3). For studios, a stream of mergers had not cracked the question of how to make media production profitable in the digital age. Convergence was at hand.

Time Warner acquisition: a business and operating model transition for AT&T

AT&T’s acquisition of Time Warner is still recent news and the merger will not close until 20174, but initial statements indicate that significant changes to both AT&T’s business and operating models are at hand.

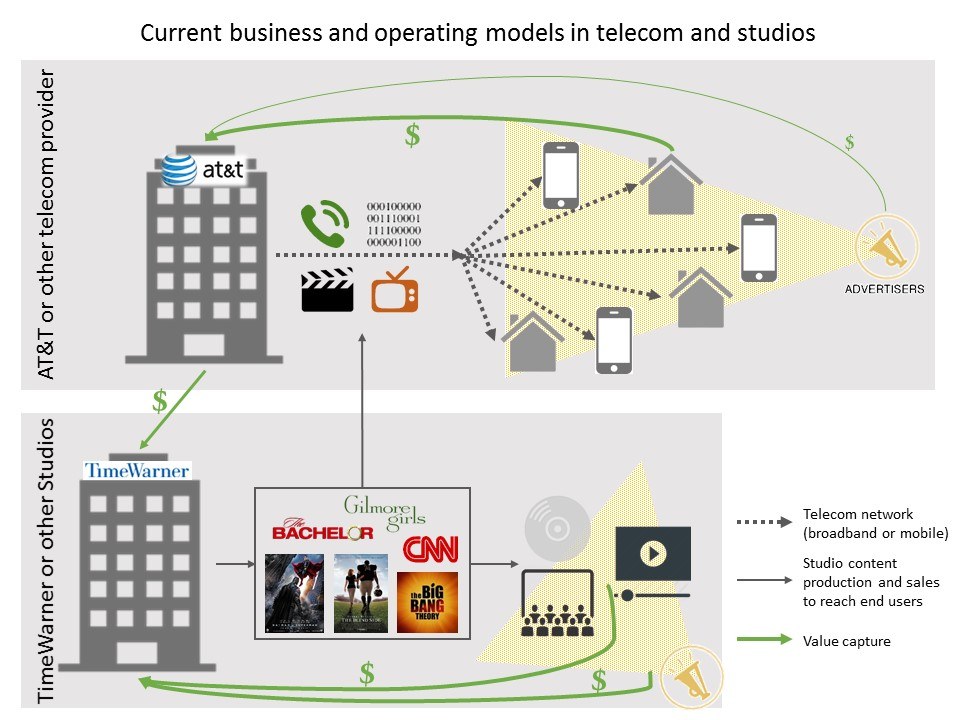

AT&T’s business model in the first wave of digital revolution was to provide users high-speed, vast coverage on mobile and broadband networks for telephone service, data access, and video content5. Network engineers and technicians built data highways to carry the expensive content that buyers licensed from studios6. AT&T captured the content delivery value they created through monthly fees charged to mobile and broadband customers. Studios produced TV and film content, the value of which they captured by distributing directly to end users via theater or DVDs or indirectly to end users via TV and internet licensing agreements with telecom companies7. Telecom companies captured some but the studios captured most of the value from selling advertisers access to the content subscriber base.

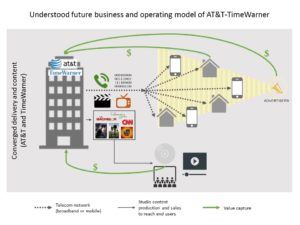

In the new AT&T-Time Warner company, both AT&T and Time Warner will still perform their fundamental tasks of operating networks and producing content. But, AT&T’s business has fundamentally changed from being a network operator to additionally being a content producer. AT&T’s strategy and key stakeholders thus both broaden in scope. Financially, both businesses have significant up front capital investment requirements with long payout periods and the allocation method for investment dollars will need to be defined. Hopes are that revenue will increase from 1) new subscribers seeking access to AT&T’s premium content and 2) from advertisers’ willingness to pay more for access to a larger subscriber base.

Operationally, Time Warner is now a partner, rather than a supplier, for AT&T, changing the nature of the two companies’ relationship. The companies will also have to redefine decision rights for major choices such as strategic company direction, performance metrics and incentives, and investment distribution between networks and new content. Tactically, AT&T and Time Warner can combine back-office functions such as HR, Finance, and IT to realize cost savings.

Opportunities and challenges ahead

AT&T has the opportunity to define what good looks like in a converged media world. Major mergers such as Comcast-NBC Universal and Verizon-AOL8 have produced moderate to unsuccessful results9 but AT&T has the advantage of learning from them. Using that knowledge, AT&T has potential to successfully merge content creation and delivery mechanisms in a “wave 2” digital revolution to increase existing subscriber bundling and attract new subscribers to their services.

AT&T will also now hold immense amounts of media consumption data on its users – could it be further monetized? Initial studies indicate that significant value could lie in surgically targeting consumers rather than broadly targeting a region as is done today10. For example, AT&T could learn from mobile payments that Joe Subscriber is a dog owner and show him dog food ads during a TV commercial break rather than cat food ads. Consumer satisfaction increases and AT&T is able to charge advertisers more for highly targeted views.

We cannot forget that AT&T is also a significant player in the commercial network sphere, with ~50% of its revenue coming from business connectivity and data solutions5. IoT promises even greater use of commercial networks and AT&T must be careful not to downgrade its enterprise image by aligning with a content creation studio. AT&T’s new monolithic size will also demand that its executives find the right balance between consumer and commercial focus.

The Time Warner acquisition is a significant moment in AT&T’s 100+ year history and with the right decisions made about how to adapt their business and operating models, AT&T can create significant value for both their customers and their shareholders in its second wave of digital revolution.

796 words

Exhibit 1

1US – Broadband services and 3G services

Exhibit 2

Note: Below the Line includes internet, direct, viral, exhibitions, and in-store promotions.

2US – Advertising

Exhibit 3

3Estimated domestic licensing revenue

Sources

1“US – Broadband services and 3G services,” Federal Communications Commission and Organization for Economic, http://marketsizes.mintel.com.ezp-prod1.hul.harvard.edu/snapshots/USA/47/performance/single, accessed November 2016 via Mintel Market Sizes.

2“US – Advertising,” Interactive Advertising Bureau, Kantar, Media, Zenith Optimedia, and eMarketer, http://marketsizes.mintel.com.ezp-prod1.hul.harvard.edu/snapshots/USA/84/performance/single, accessed November 2016 via Mintel Market Sizes.

3“Estimated domestic licensing revenue of the motion picture and video industry in the United States from 2010-2014,” US Census Bureau, January 2016, https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/185112/domestic-licensing-revenue-of-the-motion-picture-and-video-industry-since-2005/, accessed November 2016 via Statista.

4AT&T, “AT&T to acquire Time Warner,” October 22, 2016, http://about.att.com/story/att_to_acquire_time_warner.html, accessed November 2016.

5AT&T 2015 Annual Report, February 12, 2016, http://www.att.com/Investor/ATT_Annual/2015/downloads/att_ar2015_completeannualreport.pdf, accessed November 2016.

6 “Convergence of Content and Distribution in the US,” October 31, 2016, http://techpp.com/2016/10/31/convergence-content-distribution-us/, accessed November 2016.

7Time Warner 2015 Annual Report, April 29, 2016, http://ir.timewarner.com/phoenix.zhtml?c=70972&p=irol-reportsannual, accessed November 2016.

8Alina Selyukh, “AT&T’s Merger with Time Warner Follows Decades of Industry Deals,” NPR, October 22, 2016, http://www.npr.org/sections/thetwo-way/2016/10/22/498996253/timeline-at-ts-merger-with-time-warner-follows-decades-of-industry-deals, accessed November 2016.

9Emily Steel, “How Comcast and NBCUniversal Used Minions to Fuse an Empire,” New York Times, November 6, 2016, http://www.nytimes.com/2016/11/07/business/media/media-merger-success-comcast-and-nbcuniversal-say-yes.html?_r=0, accessed November 2016.

10John Osborn, “The Next Business Model for Ad-Supported TV?”, AdAge, http://adage.com/article/media/business-model-advertising-supported-tv/134746/, accessed November 2016.

This was a very interesting post that offered a compelling synopsis of how an AT&T/Time Warner merger would create value, while substantially altering the business and operating models of both pieces of the new combined company. Yet, there seem to be huge question-marks regarding the regulatory landscape and the chances that the deal will be scuttled on anti-trust grounds; in fact, it’s precisely because of the ability for AT&T to capture value as a result of its size that can worry regulators. This raised a few questions in my mind that I think would be interesting to explore in more depth.

(1) How may AT&T alter its public comments surrounding the deal to perhaps assuage these anti-trust concerns? Is it possible that some of the value creation you pinpoint will be better left unsaid to shareholders?

(2) How might the recent election results impact the regulatory risk? Both candidates came out with highly negative commentary surrounding the announced merger; it seems like a risk that absolutely cannot be ignored. For example, back in October, Donald Trump condemned the deal saying he would block it because it would result in “too much concentration of power in the hands of too few.” [1]

[1] http://www.nytimes.com/2016/10/23/business/dealbook/regulatory-microscope-lies-ahead-for-att-and-time-warner.html?_r=0

I also agree that the regulatory risks of the merger are real. However, I do think AT&T is working to calm the concerns of anti-trust problems. In many ways, AT&T will increase the competitiveness within the current media distribution landscape. Most people have limited choices for their cable provider, and AT&T could disrupt the status quo of companies like Comcast. Additionally, communicating value of the merger to shareholders seems important to me. I would look to frame the gain as value creation from new advertising revenue and new customers drawn to AT&T for fast, interesting, and innovative mobile content. Overall, I think it will be interesting to see how this merger plays out in the next year.

Great post and a very interesting perspective, Elise. We looked at a lot of examples in class of companies that are changing their business models entirely to stay competitive in a digital world and many of the posts for this assignment also focus on internal business or operational initiatives but vertical integration is certainly an important strategy that many companies pursue to respond to the rapid technological changes.

The impact of digital innovation and IoT has pushed large incumbents, such as AT&T, to entirely re-think their business strategy and has led to major consolidation in the telecom space. Furthermore, the price that AT&T is paying for Time Warner is very high and begs the question – will the benefits from vertical integration justify an $86bn purchase price?

Vertical integration of distribution and content programming would enable the combined AT&T/Time Warner to have control over content rights. Presumably, AT&T would have a competitive advantage over the other telecom players if it maintains exclusive content rights to Warner Bros and HBO content. However, will the content produced by Warner Bros and HBO lose its value if it is available only to AT&T/DirecTV customers? [1] And will FCC’s network neutrality mandate make it impossible for AT&T to execute its vertical integration strategy?

[1] Jon Lafayette, “AT&T-Time Warner: Wall Street Not Buying Vertical Integration”, Broadcasting and Cable, http://www.broadcastingcable.com/news/currency/att-time-warner-wall-street-not-buying-vertical-integration/160587, accessed November 2016.

Great post, Elise. When the deal was announced, I had read a bit about it and found the Moody’s review (https://www.moodys.com/research/Moodys-places-ATTs-ratings-on-review-for-downgrade-following-Time–PR_356948) pretty interesting. One piece that stood out to me was that despite all the benefits of AT&T’s recent acquisitions (DirecTV and now Time Warner) that you also enumerated, it is buying businesses that are being threatened by disruptors like Netflix and Amazon Video who are also producing their own content, which makes me question whether AT&T believes they can move into that space and compete against the online streaming services as well as the traditional cable content providers.