7-Eleven in China: How Should Chinese’ Choice of Convenience Store Respond to Digitalization?

Given the digitalization wave and intensified competitions from e-commerce players, Chinese’ Choice of Convenience Store —— 7-Eleven is reevaluating its strategy and relevant implications on supply chain.

Background: 7-Eleven and the digitalization trend in China

7-Eleven, a well-known American-Japanese international chain of convenience stores, operates in franchises and licenses more than 63,000 stores in 18 countries. With the first store opened in 1992, 7-Eleven has more than 2,300 stores in China as of Jun 30, 2017, and has become a famous brand with premium services and high accessibility. 7-Eleven has maintained a solid operation track record for years.

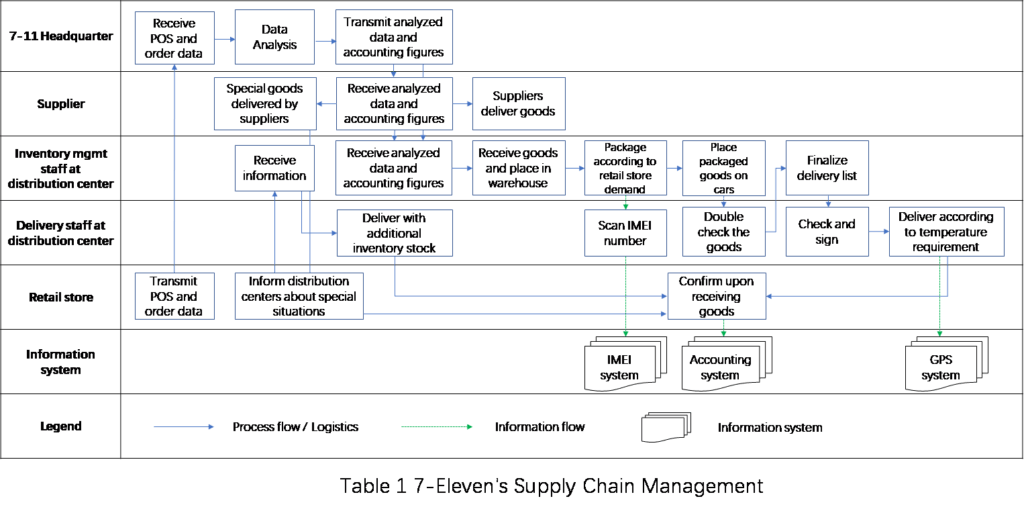

One of the secret sauces contributed to 7-Eleven’s success is its supply chain management, including dynamic customer demand management, real-time and integrated supplier management IT system, and efficient logistic and delivery services. However, digitalization has posed new threats and challenges to 7-Eleven. Along with the increase in internet penetration rate and rapid development of mobile internet in China, e-commerce has been the major growth driver for China’s retail industry. In 2016, total gross merchandising volume of e-commerce has reached RMB5.16 trn (US$744 mm), representing 26.2% y-o-y increase and 12.6% of total retail volume. In terms of supply chain, e-commerce companies cut the middlemen, enhance the information flow and accumulate massive customer data which lead to more efficient and advanced supply chain management. The development of technology, such as big data, artificial intelligence and cloud computing in retail sector, have been transforming the supply chain as well.

Recently, there is an increasing trend in China that leading e-commerce players such as Alibaba and JD.com begin to open or acquire offline retail or convenience stores to compete for offline traffic. For example, the “Amazon Go” type of automated stores has emerged and brought disruptive changes on the conventional convenience store model.

Short term and medium term steps 7-Eleven has taken

7-Eleven China has taken short term steps to respond to the industry trend. On one hand, 7-Eleven started to engage in O2O business by cooperating with Meituan, one of the largest online and on-demand delivery platform. The customers can order 7-Eleven labeled food from Meituan’s app and receive them from Meituan’s delivery service within 20 to 30 minutes. The online orders and customer preference will be integrated into the IT system and central database for future SKU selection and supply chain management. On the other hand, 7-Eleven is setting up more regional distribution centers to enhance inventory management and shorten the lead time to better compete with peers.

In medium term, 7-Eleven will focus on three key areas: supply chain, consumer data and operation management system. It believes the three aspects are interlinked with one another and it can further enhance its technology strength and optimize its operation management decisions by big data analysis. 7-Eleven believes it has an edge in supply chain management while its internet peers are better at data breadth and delivery services. In the short term, 7-Eleven chose to cooperate due to complementary advantages from each party, whereas in the long term, 7-Eleven will be evaluating its strategy in terms of data acquisition and delivery.

Other recommended short term and medium term steps

From my perspective, 7-Eleven should also consider other short term and long term initiatives. In the short term, first and foremost, 7-Eleven should develop its own mobile app and loyalty program in China. Through years of development, 7-Eleven has built up strong brand awareness and customer loyalty, which could potentially convert to online traffic. By promoting its proprietary mobile app and loyalty program, 7-Eleven can enhance customer stickiness and service breadth, and acquire real-time, accurate data, which is valuable for inventory management, SKU selection and new store location selection. Moreover, 7-Eleven should consider building automated convenience stores that can offer better customer experience and achieve cost savings. Given 7-Eleven’s store density is quite high within a certain area, supply chain and delivery will not be bottlenecks as inter transportation between stores is instant and convenient.

In the medium term, 7-Eleven should also target to increase scale and continuously improve the information flow. By opening more stores and increasing density in core regions, 7-Eleven can be more accessible and visible to end consumers. It can further strengthen 7-Eleven’s bargain power to its suppliers and improve the utilization rate of its regional distribution centers. Information flow among its proprietary, franchise and future automated stores is another significant aspect 7-Eleven should enhance as it scales up. By adoption of the latest technology, 7-Eleven can capture the benefits from innovations and continue to optimize its supply chain management.

Road to advanced retail technology

An issue that is worth debating is how 7-Eleven should develop its retail technology. Should it focus on internal R&D or external acquisition? Or should it consider partner with internet companies to leverage the expertise and ecosystem that the internet companies already built up?

(794 words)

Reference:

[1] 7-Eleven China’s official website, http://www.7-11bj.com.cn/?app.html

[2] “The Distribution Strategies of Convenience Stores Chain in China from Japan 7-Eleven”, Ting Huang and Chunxiong Liu, https://www.matec-conferences.org/articles/matecconf/pdf/2017/14/matecconf_gcmm2017_05045.pdf, 2017

[3] “Solution to Chinese Convenience Chain Stores —— 7-11 Japan’s Supply Chain Management Model”, Ting Zhou, Runqing Ding, 2016

[4] “7-Eleven’s Development Strategy in Mainlan China —— Comparative Analysis Based on Taiwan Market”, Cheng Chun, 2016

[5] “From 7-Eleven Japan to Chinese Convenience Store”, Economic Observer Online, http://www.eeo.com.cn/2017/0307/299640.shtml, March 2017

[6] “7-Eleven on New Retail: Way out of Franchisee”, Gao Yang, http://www.ebrun.com/20170802/240673.shtml, October 2017

[7] “Secret Sauce of 7-Eleven Japan: Platform, Supply Chain Integration, Energization, Common Destiny”, Netease, http://mp.163.com/v2/article/detail/CTLECOPS0511LBHO.html, September 2017

[8] “Convenience Store is the New Growth? How did 7-Eleven Succeed in China”, 36Kr, https://36kr.com/p/5065785.html, March 2017

[9] “What’s 7-Eleven’s Lesson on New Retail?”, Iyiou, http://www.iyiou.com/p/39833, February 2017

[10] 2016 China E-commerce GMV Increased by 26%, B2C Model GMV represented more than 50%, Caixin, http://companies.caixin.com/2017-02-09/101053476.html, February 2017

Note: 1 US dolloar = 6.94 RMB, as of end of 2016

This is a very interesting topic and one which is in an extremely competitive space. In the US, it’s a fairly organized and mature market and i’m unclear about it being the same in China. Though, in light of that, in my opinion, it is critical for 7-Eleven to use their own internal resources to grow technologically. The benefit with internal R&D is that the risk is much lower. The process could be slower but it would be deliberate and calculated. When acquiring a company to do this, there is less flexibility as the acquired company will have a core competence and 7-Eleven would be acquiring them for that capability. But if the R&D is done internally, 7-Eleven can steer the process in the desired direction and would be able to adapt to rapidly changing technology.

Interesting article, this is an exciting opportunity for 7-Eleven. I agree with you and Nirav that 7-Eleven should develop their app in house. They can tailor their app completely to the desired customer experience. If they were not such an international powerhouse, I would recommend they outsource, but given the scale of the 7-Eleven brand, building the app themselves makes sense. I don’t think the process necessarily needs to be that slow. They can get an early version out quickly to test in limited markets which features will have the desired effects on customer behavior. They can experiment with coupons, gamification, etc. The sooner they have access to the data set of purchases by customers, the better they can plan inventory, promotions, and more! Because the learnings will be core to 7-Eleven’s business

On the other hand, outsourcing delivery seems like a wise move. Setting up the logistics and infrastructure to do that well would be a huge headache and best left to an external group.